agEUR - Angle Protocol

We take a look at ANGLE Protocol's agEUR and attempt to understand it from a risk standpoint - fiddy.

Useful links:

Abstract

Angle Protocol is a novel stablecoin framework that achieves price stability and collateralisation while maximising capital efficiency. The protocol achieves stability by transferring collateral volatility to third party users seeking leveraged long exposure with no funding rates. Their current stablecoin is agEUR, showing resilient price stability compared to its EURO stablecoin counterparts.

Critical points for a quick summary:

Angle is a stablecoin protocol that aims to collateralise and stabilise minted stablecoins while maximising capital efficiency.

Protocol incentivises 3rd parties to collateralise minted stablecoins.

Long perpetual with zero funding rates hedges the protocol against the collateral’s volatility, thus neutralising the collateral’s price action.

Prominent VCs and market markers back angle Protocol.

ChainSecurity has audited the protocol.

agEUR is relatively stable.

The protocol uses well-researched logic for front-running proof pricing by employing multiple oracles.

veANGLE decentralises the DAO, but the top 3 holders control >51% of all veANGLE. But this may be excusable as the protocol is barely a few months old.

We recommend that agEUR gets a gauge.

Introduction

Capital efficiency in stablecoins

A stablecoin backed by more collateral (over-collateralisation) can absorb more of its collateral’s market volatility. For example, if a synthetic stablecoin is minted at a 250% C-ratio and the value of the collateral drops by 50%, the system is still solvent. Following this, one could even imagine a stablecoin that is supremely over collateralised, say backed by a 400% C-ratio. Such collateralisation would make it relatively stable against extreme levels of market volatility, but at the cost of capital doing not much else (thus, low capital efficiency). Most stablecoin protocols aim to maximise the capital efficiency of the collateralisation.

There are a few directions one could go into (this is not an exhaustive list):

Lower collateralisation ratio such that you need less collateral to mint a stablecoin, and

Maximise yield on the collateral such that yield-bearing collateral effectively re-collateralises the stablecoin it backs.

In general, increasing capital efficiency involves the protocol taking on more risk, which has implications for its adoption: riskier stablecoins may only be adopted if the market is coaxed/incentivised to do so (i.e. Terra UST). Unfortunately, when it comes to stablecoins, it is pretty challenging for stablecoin issuers to have their cake (pile on risk to maximise capital efficiency) and eat it too (mass adoption). With their first foray into the Euro via their agEUR stablecoin, Angle attempts to capture a large slice of the proverbial pie.

Why Euro?

Stablecoins pegged to the USD are pretty popular in the current DeFi landscape, which has implications for users, such as

the exposure to regulatory risk that comes with USD stablecoins, and

the influence of the US Federal Reserve’s inflationary monetary policies.

There is a rising need for stablecoins outside of the USD paradigm. Enter Angle Protocol’s agEUR.

agEUR as an asset - it is more about the Angle Protocol

agEUR (Angle Euro) applies ANGLE Protocol’s methodology of minting and maintaining stablecoins.

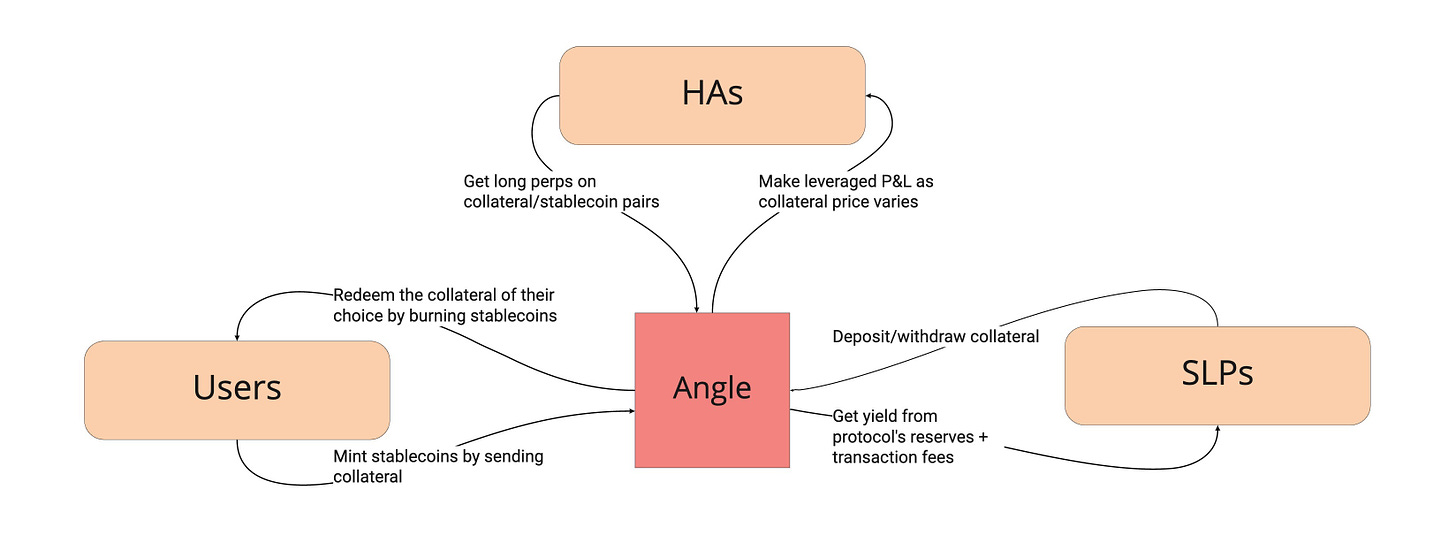

The method involves three stakeholders that bring stability to the minted stablecoins:

Stable Seekers: These are the primary stablecoin minters, providing collateral to mint stablecoins or burn stablecoins to redeem their collateral at an oracle price.

Hedging Agents: These users want to make speculative leveraged bets on the stablecoin’s collateral by bringing in their own collateral, thus over collateralising the minted stablecoin.

Standard Liquidity Providers: These users provide collateralisation when the protocol is closer to being under-collateralised and hedging agents do not bring in enough collateral to back the stablecoin. In some sense, the liquidity provided by SLPs acts as backstop protection to re-collateralise the system in dire conditions.

Stable Seekers and Oracles

Useful links

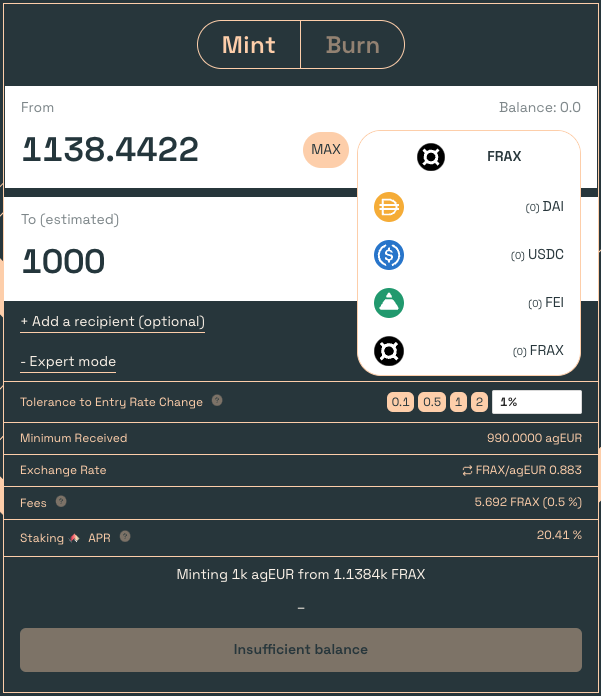

Currently, interested parties may mint agEUR by depositing the following collateral:

USDC

DAI

FRAX

FEI

The cost of minting is set around 0.3%, a part of which goes to SLPs. This process does not involve slippage. The price feed used for this transaction involves two sets of oracles: 1. Chainlink oracles, and 2. 10-minute Uniswap TWAP oracles. They mention a few reasons for choosing an aggregation of two oracles instead of one.

Chainlink is a widely accepted, decentralised solution and is at the heart of modern-day DeFi. With a single oracle update potentially costing upwards of $150 on Ethereum, updating Chainlink feeds is expensive. Oracle update costs limit a feed’s update frequency at lower time intervals or significant market price changes.

An oracle with a limited update frequency reports prices that lag from the market, which incentivises oracle front-running. Users may mint agEUR at prices unfavourable for the protocol (e.g. minting more stablecoins in between feed updates at a price higher than the upcoming feed price).

TWAPs (or time-weighted average prices) may offer more recent market information into their price feeds but only for a specific token pair in a particular DEX pool. As a result, they may lag against Chainlink oracle prices.

The general idea is to use a price between the feeds mentioned above that benefits the protocol the most:

For minting stables, the protocol uses the lower of the two prices.

For burning stables, the protocol uses the higher of the two prices.

Opening a long perpetuals position occurs at the higher of the two prices.

Closing a long perpetual position occurs at the lowest of the two prices.

This article from the Angle Protocol offers more information on their choice of oracles. It is a recommended read for people interested in oracles and oracle manipulations. As a risk reviewer, seeing a protocol take economic security seriously is quite positive.

Hedging agents as insurers of the protocol

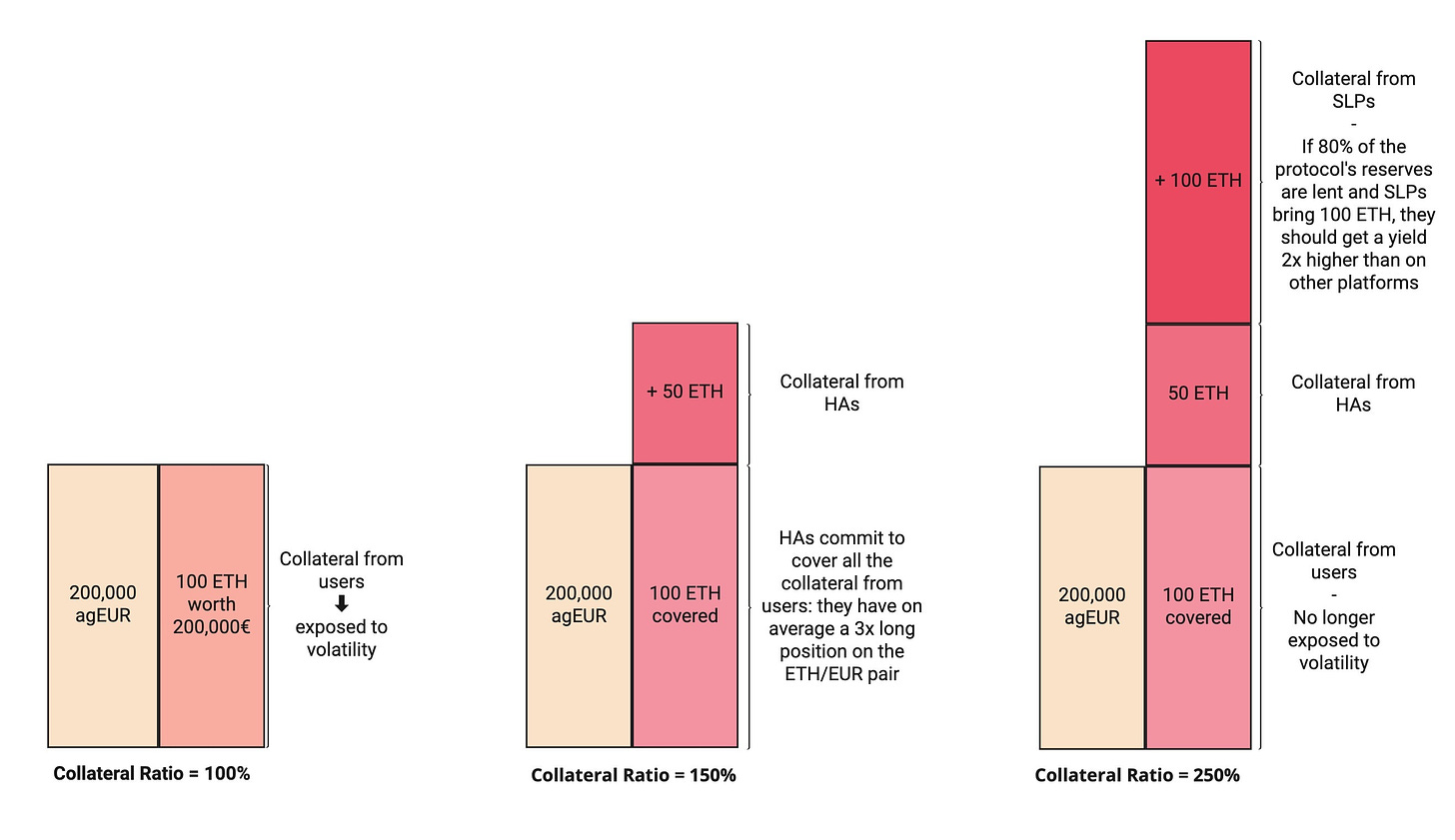

Hedging agents are vital in increasing Angle Protocol’s capital efficiency and allow the protocol to transfer the collateral’s volatility to external third parties looking for leveraged exposure. Combined with liquidity from SLPs acting as a backstop, this leveraged exposure allows the system to maintain a 1:1 stablecoin to collateral parity.

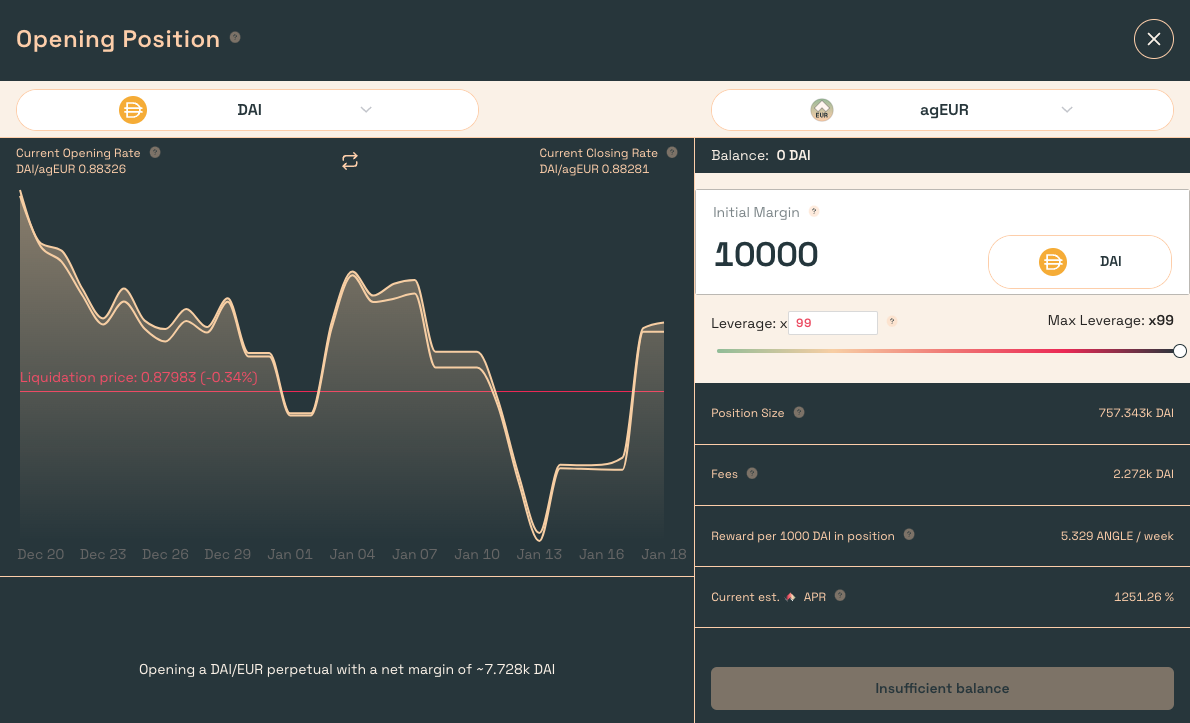

A stable seeker wants to mint agEUR by depositing any whitelisted collateral options. The protocol now has a certain amount of collateral (say, DAI) that backs the minted agEUR. The protocol’s lack of funding rates attracts users who want to be long volatility between DAI/agEUR using excessive leverage by just paying a single transaction fee. Say a hedging agent brings in their collateral and leverages their DAI/agEUR position by a certain amount (within limits such that the protocol is solvent),

If the value of DAI goes up, the hedging agent now earns the profits, paid out from the reserves, as long as the agEUR minted is collateralised.

If the value of DAI goes down, the hedging agent’s loss is taken from their collateral and added to the reserves.

In this way, the collateral in the system acts as a trade counterparty to the user seeking leverage, and the user’s collateral effectively provides insurance to the protocol against volatility, thereby ensuring a stable collateral:agASSET parity.

The protocol employs the services of Keepers to ensure that Hedging Agents cannot take positions greater than what’s allowed. Keepers also perform liquidations should a hedging agent’s collateral value falls below the liquidation threshold.

SLP Backstop Protection Mechanism

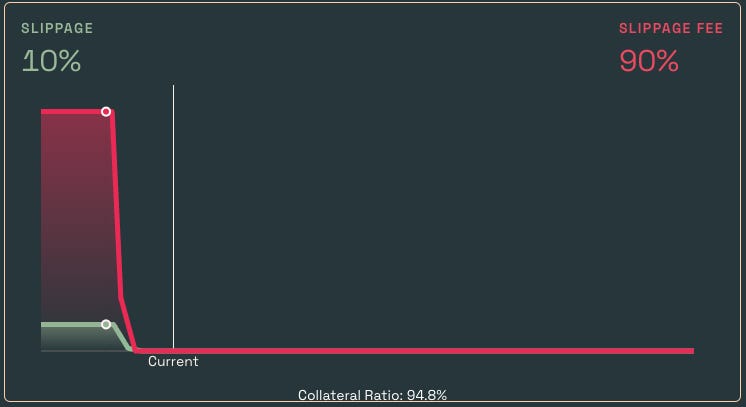

In the case of the protocol reaching under-collateralisation, the liquidity provided by an SLP ensures 1:1 redeemability. Should an SLP choose to remove their liquidity in such circumstances, they would incur a slippage. The protocol’s C-ratio governs the slippage parameter:

Above 120% C-ratio, the slippage is zero.

Slippage increases with decreasing C-ratio.

SLPs are rewarded by yields earned from the collateral, mint and burn transaction fees, and yields on collateral deposited by Hedging Agents. This incentive structure provider yields liquidity providers.

In the case of under-collateralisation, there exist re-collateralisation incentives:

If under-collateralised, progressively put aside agASSET mint and burn tx fees.

Once the protocol re-collateralises, reward SLPs that re-collateralised the protocol with pent up tx fees.

These mechanisms allow the protocol a large collateralisation ratio with high capital efficiency.

Yield strategies on collateral reserves and the yield multiplier effect - adding on another layer of capital efficiency

Inspired by Yearn’s yield farming strategies, the Angle Protocol optimises its collateral’s efficiency by mobilising the liquidity into blue-chip DeFi protocols such as Yearn, Curve, Aave, Compound, Uniswap, and so on. Such yield farming strategies improve the capital efficiency of the collateral, allowing the cake-having (cap. efficiency) and cake-eating (adoption: attracting more SLPs, thereby buffering the system, which makes agEUR more stable and hence more attractive).

The debt-ratio parameter controls the various strategies, lending out a certain amount of collateral to earn yield for the protocol.

An exciting characteristic of this setup is that SLPs generate income from their liquidity and liquidity provided by hedging agents and stable seekers, causing a multiplier effect on the SLP’s yields.

To stabilise and over-collateralise the system, the protocol

incentivises hedging agents to place long bets on the collateral at zero-funding rates, thereby transferring the collateral’s volatility away from the protocol, and

incentivises standard liquidity providers to act as a backstop mechanism by providing multiplied yields or yields on assets beyond what the SLPs provide.

Knowing this, let us look at agEUR’s price stability.

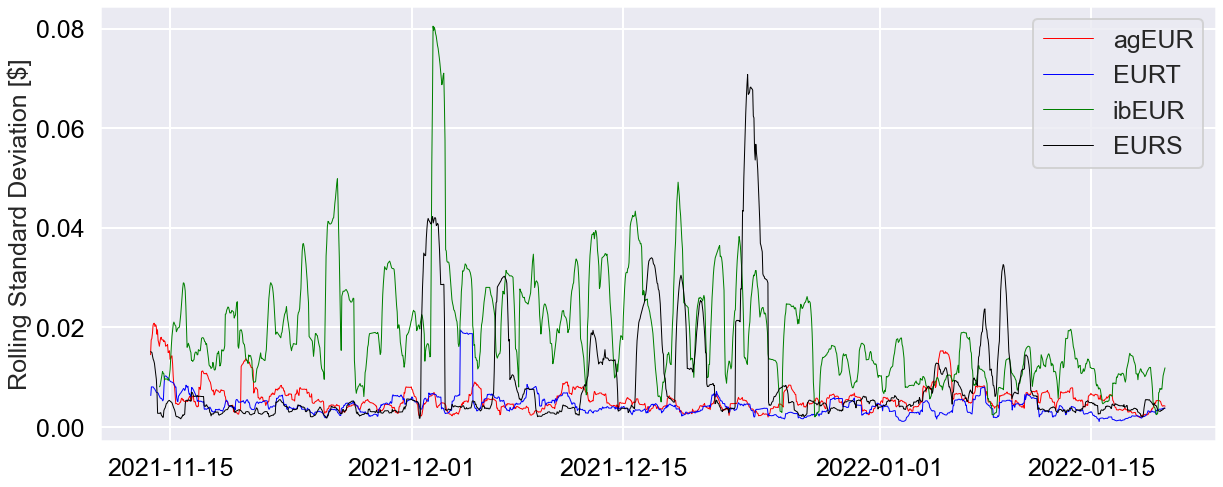

agEUR Price Stability

Prices derived from Coingecko suggest agEUR to have a more stable price than its counterparts.

As usual, the price stability of pegged assets is handled by arbitrageurs. The general logic is: if agEUR deviates beyond €0.997 or €1.003 (considering a 0.3% swap fee), arbitrageurs are incentivised to mint or burn 1:1 collateral to agEUR and sell or buy agEUR from or to the market. The swap fee introduces a price spread around €1 but is necessary to prevent front-running attacks that rely on flash-mints by increasing the economic cost of an oracle attack.

These mint and burn costs are variable and aligned with the protocol’s best. For example, if the amount of collateral available in the protocol is high, the protocol would lower swap fees for minting agEUR. These values introduce a price spread where arbitrage does not provide profit and hence are an essential variable in assessing price stability.

agEUR has seen quite some stability: this shows that their idea works and provides a very reliable Euro stablecoin. A part of this stability comes from the low volatility of their collateral: USD stablecoins. Studying their price stability will get interesting once the protocol onboards more volatile collateral such as ETH.

Security Audits

Useful links:

The auditors involved in the security audit of Angle Protocol’s smart contracts are cream of the crop, with their reputation preceding their names. Both auditors found high-to-critical risk vulnerabilities, which the Angle protocol devs have sufficiently resolved. As it stands right now, the Angle Protocol’s smart contracts have been de-risked significantly after implementing changes recommended by the auditors.

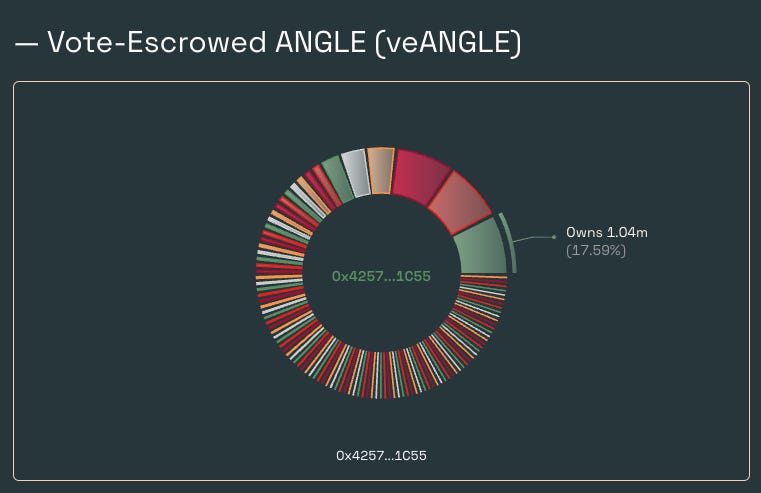

The Angle Protocol DAO: veANGLE is born!

Useful links:

Taking lessons from Curve’s book, the Angle Protocol has decided to adopt veANGLE as their governance token, with a locking mechanism very similar to Curve’s veCRV:

Users may lock ANGLE for one week to four years to receive non-transferrable veANGLE tokens.

veANGLE balances linearly decay to 0, after which ANGLE becomes claimable.

Governance proposals are on Snapshot (Gasless; Starknet in the future) rather than on-chain (more expensive).

veANGLE holders direct ANGLE rewards to all kinds of liquidity pools on the protocol.

The Angle Protocol DAO can incentivise economic activity to any part of their protocol with a liquidity pool incentivisation mechanism. For instance, if the protocol needs more backstop protection, the DAO could incentivise SLPs. Such a mechanism may introduce a more hands-on approach to stabilise and re-collateralise the issued stablecoins.

On Multisigs

Useful links:

The Angle protocol employs a Guardian Role to different addresses that protect the protocol against time-sensitive issues. The general abilities of a Guardian are:

Pausing and unpausing contracts.

Rapidly changing minting and burning fees.

Changing debt ratio (amount of collateral lent out to earn yield) employed for different yield farming strategies.

What the Guardian cannot do:

Change references to an oracle or modify prices in any negative way to the protocol.

Influence ANGLE’s inflation rate.

The issue with such a governance methodology is that whales often have a more significant say in how a proposal evolves. For instance, the top 3 veANGLE holders as of the writing of this article hold 51.51% of all veANGLE. Should they choose to be malicious and vote against the protocol’s interests, governance may become quite challenging. This is not a new problem: most protocols tend to be controlled by whales.

Considering that veANGLE holders can incentivise economic activity within the protocol, the top three veANGLE holders may introduce attack vectors by vetoing against the protocol’s best interests. Alas, one can only hope that they are aligned with the protocol’s well-being.

Conclusions

Angle Protocol looks very well thought out and has thus far executed its development roadmap with finesse. The agEUR stablecoin has commendable stability, owing to the low volatility of the collateral that backs it. Introducing funding-rate free long exposure to its collateral is an exciting and attractive product, which will be well received by the market, thereby allowing over-collateralisation of agEUR. It remains to be seen how the protocol handles volatile assets, as thus far, its methodology has been tested on more straightforward assets.

Security audits were conducted by very reputable auditors and revealed no signs of concern. The only issue is the lack of decentralisation, as the top three governance token holders have over 51% of influence in the protocol. This is, however, nothing new in DeFi and may be excusable for a protocol a few months old. We are still a ways away from achieving true decentralisation for a trustless and decentralised ecosystem.

Does the asset meet minimum requirements?

Is it possible for a single entity to rug its users? No single entity can rug Angle Protocol’s users.

If the team vanishes, can the project continue? Currently, this is not possible as the protocol is only a few months old.

Do audits reveal any concerning signs? The audits do not show any concerning signs.

We recommend that agEUR get a gauge on Curve pools, subject to the asset it is paired against.

Great article. I would love to see a risk assessment for stables under the Iron Bank/Fixed Forex system (e.g. ibEUR). Thanks.

Can you pls update the report? The Angle approach to agEUR has changed quite a lot post Euler hack ...