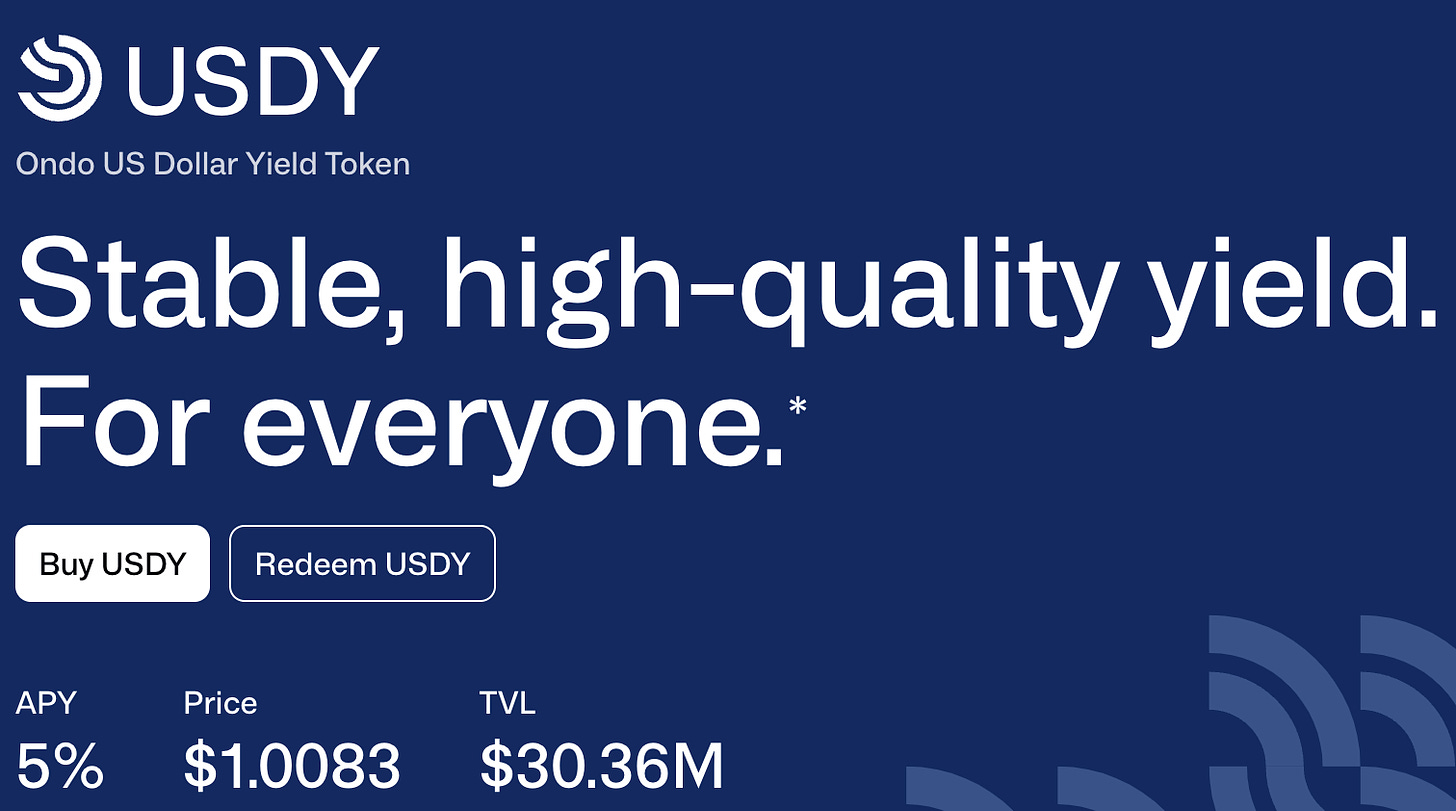

Asset Overview - U.S. Dollar token (USDY)

A look into Ondo Finance's latest offering: U.S. Dollar Yield token (USDY)

This asset coverage looks into the Ondo Finance USDY’s setup and serves as a brief prospectus consolidating independently verified information. This research thread will evolve as more information about the asset is analysed.

Llamarisk has reserved a separate research thread to consolidate risk-related observations.

Asset Overview

USDY, a financial instrument developed by Ondo Finance, is a tokenised note anchored by U.S. Treasuries and bank deposits and is a property of Ondo USDY LLC, a specified subsidiary of Ondo Finance, Inc. An addendum to USDY is Ondo's rUSDY (rebasing USDY). USDY is a rate-oraclised token (the value of USDY goes up over time), and rUSDY is a rebasing token pegged to 1 dollar (user balances go up instead of the value of a token).

USDY is a demarcation from the existing fund products in Ondo's suite of tokenised financial instruments. While OUSG (Ondo Short-Term US. Government Bond) and OMMF (Ondo Money Market Fund) are designed to be exclusively available to accredited investors globally, USDY is a Reg-S US Securities-laws-exempt financial product accessible to all KYC'd non-U.S. users (regardless of the person having a special investor status under U.S. financial regulations).

Structurally, USDY operates within the framework of Ondo USDY LLC, a bankruptcy-remote, US-domiciled specialty purpose vehicle, a wholly-owned subsidiary of Ondo Finance Inc., a Delaware corporation.

Choosing a legal jurisdiction in the U.S. for a relatively innovative financial product issued on the blockchain is bold, especially considering the lack of clarity in U.S. financial regulation of crypto-tokenised traditional finance assets. With backers such as Founders Fund and Coinbase Ventures (among other big names), Ondo is well-capitalised with funding and the knowledgebase to navigate the fog of U.S. Regulations.

USDY Yield

USDY tokenises cash and cash-equivalent deposits, which earn yield through U.S. Treasury bills and bank deposits. Ondo Finance has devised two ways through which holders of the tokenised yield-bearing asset can earn interest:

1. Rate-oraclised token design (USDY).

2. Rebasing token design (rUSDY).

Ondo Finance handles the distribution of this yield through its smart contracts under the watchful eye of trusted custodians and independent attestation service providers (Ankura Trust) acting as redundant checks. Yield Distribution pricing follows a 'face value' pricing system: there are no upfront costs to the user. Two components add to the price:

1. The price of USDY at the first business day of the month, and

2. The monthly yield rate, set by Ondo Finance.

From the example presented by Ondo, if the set interest rate is 4% annualised for the month of June, and the price of USDY is 1.0 USDC (Ondo Finance assumes 1 USDC = 1 USD) on the first business day of the month, the price (P) incrementally increases using the compound interest rate formula:

Here, P is the price of USDY, n is the number of days after the first business day, and APY is the annualised yield in percentage set for the month (say, 4%).

Fee Structure

Although USDY’s smart contracts can charge minting and redemption fees, no upfront minting or redemption costs are enforced on the smart contracts layer. Ondo does charge some redemption costs through off-chain means to pay for wire-transmission costs. For revenue, Ondo Finance skims some yield off the top earned by assets in bank deposits.

Frontend: The permissioned nature of USDY

Minting and redemptions begin at the official USDY product portal.

Minting/Redemptions

Much like USDC or other fiat-redeemable stablecoins, minting USDY involves a standard Know-Your-Customer (KYC) procedure; therefore, minting USDY is permissioned. Depending on the type of user, there are two sets of KYC processes:

1. Onboarding unsophisticated investors involves a third-party service, WithPersona.

2. Sophisticated entities require a more comprehensive onboarding process.

Several geographically blocked locations are disallowed from participating in minting and redeeming USDY, with an exception for U.K. and U.S. citizens: should the user be a non-resident citizen of the U.S. and U.K., they are eligible to mint and redeem USDY.

Transfers

Transferring USDY involves three sets of checks on the addresses involved:

1. Addresses are not on the on-chain Blocklist maintained by Ondo USDY LLC.

2. Addresses are not flagged by the on-chain SanctionsList oracle maintained by Chainalysis.

3. The address used by the user signs a set of on-chain service agreements and is onboarded to the Allowlist, also maintained by Ondo USDY LLC. This procedure may not involve KYC.

As the Allowlist contract is upgradeable, so are the checks for transfers; users who may have been eligible to be on the Allowlist in the past may not be on the upgraded Allowlist. Consequently, users may need to redo on-chain service agreements to be able to transfer their tokens (should the AllowList end-user agreements update).

While this resembles most familiar web services, upgrading AllowList breaks composability. Ondo USDY LLC must maintain an internal list of contract addresses key to their operations and composability with the rest of DeFi.

Minting Delay

Every request for minting USDY requires a 40-50 day waiting period to comply with U.S. regulations. In this period, minters are issued a `token certificate`, a PDF document stating their claim to unminted USDY. In this transfer-restriction period, USDY earns yield.

Backend: USDY Collateral Infrastructure

Underlying Backing: What does USDY tokenise?

USDY's target allocation comprises 65% in bank deposits and 35% in short-term U.S. Treasuries. The collateral earning yield is over-collateralised by 3%.

1. U.S. Treasuries are held in cash-custody accounts at Morgan Stanley and StoneX. These assets cannot be rehypothecated and earn the standard T-bill yields.

2. Bank deposits are custodied in Demand Deposit Accounts at Morgan Stanley (G-SIB, S&P A+ rated) and First Citizens Bank (S&P BBB+ rated), earning yields from these positions.

The choice of a bank with the Global Systemically Important Bank (G-SIB) designation is crucial; failure of G-SIB-designated banks directly threatens the international financial system. These specially designated banks must meet strict capital requirements and risk standards on top of additional regulatory oversight. In the case of Morgan Stanley, it is required to hold at least 1% of capital over the regular capital requirements enforced on banks.

The risk of custodying assets in lower-rated banks can result in exposure to unknown/sub-standard risk practices, resulting in bank failures as observed during the (now infamous) March 2023 bank run of the Silicon Valley Bank and the 'flight to quality'. To that extent, Ondo's choice of higher long-term-rated banks shows their commitment to collateral security.

Is USDY backed by cash and cash-equivalent assets?

1. 35% of the funds are invested in short-term U.S. Treasury bills with a maturity of 3 months; these are considered cash-equivalent.

2. 65% of the funds are custodied in demand-deposit accounts at highly rated banks with good risk practices. Demand-deposit accounts allow the depositor to withdraw funds on demand, thus making them immediately accessible and equivalent to cash.

3. Finally, the 3% first-loss position is cash (over-collateralisation).

All-in-all, USDY is backed by cash and cash-equivalent yield-bearing assets.

Asset Management in the Context of Financial Duress

Ondo Finance has onboarded Ankura Trust, a subsidiary of Ankura, to act as a 'Collateral Agent'. As per Ondo Finance, the Collateral Agent can only step in if:

1. Ondo Finance fails to repay redemptions,

2. USDY is not adequately capitalised (Ondo Finance must maintain a 3% first-loss position or a 103% collateralisation ratio), and

3. Ondo USDY LLC files for bankruptcy.

All actions by the Collateral Agent are subject to USDY token holder approval. Since this has never occurred in practice, how this approval is technically executed is still being determined.

Attestations

Sixty days post USDY launch, Ondo Finance aims to provide daily collateral breakdowns in their web portal. To verify the validity of these data, Ondo Finance has employed the services of Ankura Trust as a 'Verification Agent'. Ankura Trust will essentially attestations these daily reports of the underlying cash and cash-equivalent deposits.

As of October 2023, these attestations have yet to be offered in production. Ondo expects to start the public attestation process by mid-October 2023. The role of the verification agent in the public domain is still to be determined, as these attestations offered by Ondo are not factually checked by the Verification Agent daily.

(Federal Deposit Insurance Corporation) FDIC Coverage

FDIC deposit insurance has specific coverage limits, particularly for institutional or business accounts, and does not cover all current cash deposits. At least 65% of the underlying currently stays uninsured by the FDIC coverage scheme. Ondo Finance LLC is looking into ways to increase the insurance coverage of the underlying collateral over time.

Backend: USDY Legal Infrastructure

USDY is available courtesy of a "Regulation S" exemption granted by the U.S. Securities and Exchange Commission (SEC). Due to the stipulations of this exemption, Ondo is mandated to provide the USDY product exclusively to individuals or entities not based in the United States.

Regulation S allows issuers to sidestep SEC registration when targeting non-US investors; there may exist a tax caveat - an international investor's returns may be subjected to withholding taxes, possibly up to 30%, depending on tax treaties between the U.S. and the current resident country of the U.S. citizen. On the resale frontier, Regulation S is more lenient. With minimal disclosure, securities can enter alternative trading platforms such as DEXes, but one cannot directly sell to a U.S. counterparty within one year of holding the tokenised securities.

Backend: USDY Smart Contracts

Useful Links

The USDY smart contract relies on several components to enable transfers for a user, primarily the AllowList, the BlockList and the SanctionsList. Since the token contract is upgradeable, every upgrade may require the user to go through a redundant AllowList onboarding cycle, without which users cannot transfer tokens.

The process of minting and redemption involves the RWAHub/USDYManager contract. Mints (or subscriptions) and redemptions are not real-time and hence require two transactions: one that assigns a subscription or a redemption I.D. and the other when the user can mint or redeem the asset. Currently, the `RWAHub` enforces floor amounts for mints and redemptions. The same transfer restrictions (checking user addresses against three different oracles) also apply to minting and burning.

Pricer

The Pricer contract connects an `RWAOracle` contract and the `RWAHub` contract and is called once during minting or redemption. An externally owned account sets a `price` for a given `timestamp` via `USDYPricer.addPrice`. The `priceID` for a given `PriceInfo` containing the price and the timestamp combination is incremented in the `addPrice` method. It is important to note that the `PriceInfo` for a `priceId` can be changed later by the trusted EOA via `USDYPricer.updatePrice`.

Minting USDY (Subscription)

Users initiate a subscription by calling `USDYManager.requestSubscription`, which involves a `transferFrom` of the 'collateral' asset USDC to USDY Coinbase Prime address. The collateral asset is an immutable variable set in the RWAHub's constructor, which points to the long-term alignment of Ondo Finance with Circle's USDC.

This process creates a `depositID` index in the smart contract where details about this deposit are stored. Off-chain, the funds are off-ramped by the Coinbase and forwarded to USDY for buying the underlying assets. The price at which the underlying is bought is set on-chain for accounting purposes by a trusted externally owned account (EOA), which calls `USDYManager.setPriceIdForDeposits`; without setting the price for each depositID, `USDYManager.claimMint` reverts and USDY tokens cannot be minted for those depositIDs.

To claim the mint, a user (or anyone) can mint tokens for the user associated with this `depositID` by feeding it to the `USDYManager.claimMint` method.

The process of minting USDY does involve a `mintFee`, which is currently set to 0 but can be changed by the admin of the `USDYManager` contract. The max settable fee is 10000 basis points or 100%.

Should the users wish to avoid granting token spending approvals to smart contracts, there exists an approach of minting USDY tokens by simply sending tokens to a designated smart contract for each onboarded user, with a relayer in the backend handling the mint process by calling `USDYManager.addProof`. In this case, the `depositID` is the transaction hash of the user sending tokens to the relayer.

Burning USDY (Redemption)

The process of burning is not too different from minting, in the sense that a user calls `USDYManager.requestRedemption` and sets a redemptionID, and a `priceID` of 0, which gets processed through `USDY.claimRedemption` after the `priceID` is set to a non-zero value by the trusted EOA for the `redemptionID` via `USDYManager.setPriceIdForRedemptions`. The RWA asset (USDY) is burned immediately upon calling `requestRedemption`, and the user has to wait for the redemption to finalise off-chain.

The `USDYManager.redemptionFee` is set to 0. The maximum redemption fee is 10,000 basis points or 100%. There is an off-chain redemption fee component, which Ondo Finance LLC controls.

Integrations Tooling

Ondo Finance is in the process of developing the RWADynamicRateOracle. This oracle is designed to help bring USDY into DeFi and integrations into other protocols. The oracle is a crucial component of rUSDY, with its primary role being to record USDY price changes.

Audits

So far, Ondo has authorised the following audits in the context of USDY:

2. April 2023 NetherMind Audit

3. January 2023 Code4rena Audit

4. September 2023 RWADynamicRateOracle Audit

LlamaRisk Asset Integration Advisory

USDY is an attempt at creating a yield-bearing stablecoin where assets are custodied by high-integrity independent third-party custodians; other than interactions with Ondo, these custodians cannot issue new USDY and can only facilitate redemptions by the authorised Collateral Agent (Ankura Trust) in exceptional circumstances.

The underlying collateral is deposited in low-risk, cash-equivalent investments, 65% of which is available to the depositor (Ondo Finance) on-demand, and 35% is subject to U.S. Treasury Bill maturity periods. Since the T-bills are short-duration, they are highly liquid in secondary markets, reducing liquidity risk and improving backing.

The tokenised USDY asset can only be integrated into Defi applications if the `RWADynamicRateOracle` is functional, which is currently aimed to be an entirely centralised operation. Integrators can assess the risks of onboarding the oracle as its development progresses.

USDY is a good fit for applications looking for a fiat-redeemable trading counterpart: for crvUSD, Stableswap AMMs with USDY(+RWADynamicRateOracle) or rUSDY are recommended.

In the context of crvUSD pegkeepers, rUSDY could be a good choice, considering that its price is tethered to 1 dollar. The caveat is that the rigorous user-address checks on each USDY token transfer operation increase per-transaction costs significantly (on top of the usual case of rebasing tokens being expensive to transfer). Higher transfer costs in the context of pegkeepers on gas-expensive networks such as Ethereum could make an asset less favourable: liquidations can be less efficient; however, the additional yield from USDY could offset incentivisation costs.

Finally, the AllowList approach can result in denial-of-service (DOS) concerns for integrators; users are offboarded from the AllowList if USDY’s Terms and Conditions are updated. It is important for integrators to be cognizant of any updates to the AllowList, or else suffer risks of DOS and its downstream implications.