Asset Risk Assessment: Origin Ether (OETH)

A look at OETH: Maximizing ETH Liquid Staking Derivatives yield through DeFi incentives

Editorial note 7/17/2023: On July 3rd, 2023, ownership of OETH contracts was transferred to OGV governance and was officially claimed by the DAO via an on-chain vote. The strategist multisig is still in effect.

Editorial note 9/5/2023: Since publishing this report, Origin has added an oracle for frxETH, specifically this one that integrates data from dual on-chain sources: the Curve frxETH/ETH EMA oracle and the Uniswap frxETH/FRAX TWAP oracle.

Editorial note 9/6/2023: Origin has increased its bug bounty program from a max $250k to $1M bounty payout.

Useful Links

Websites: oeth.com | originprotocol.com

Contracts: OETH token, Contracts architecture

Governance: Proposals | OGV token | Timelock | Multisig (admin) | Multisig (strategist)

Curve: OETH/ETH Factory Pool | Gauge Proposal

Dashboard: OETH (Dune)

Relation to Curve

Origin Protocol submitted a proposal to add the OETH-ETH pool to the Curve Gauge Controller, allowing users to assign gauge weight and mint CRV. This proposal aims to enhance liquidity and usage of the pool and boost the yield offered to OETH holders. Profits generated from the gauge represent a substantial part of OETH yield. The proposal successfully passed an on-chain vote on April 22nd, 2023.

TLDR of our findings

In May 2023, the Origin Protocol launched Origin Ether (OETH). This rebasing token dynamically combines ETH Liquid Staking Derivatives (LSDs), specifically Rocket Pool ETH (rETH), Lido Staked ETH (stETH), and Frax Ether (frxETH). Leveraging the OUSD vault codebase, a stablecoin launched in 2020 that reached $300M in TVL at its peak, OETH incorporates yield-generating collateral tokens and uses price oracles from Chainlink.

The system optimizes APYs between LSDs and DeFi liquidity provision strategies. It uses its protocol-owned liquidity (POL) and automated market operations (AMO) to boost yield generation through the OETH/ETH Curve pool. Ultimately, Origin aims to provide OETH holders with diversified risk exposure and optimized returns in the form of trading fees, rewards tokens, and validator rewards from ETH staking.

A summary of our relevant findings:

Yield accrual is done through token rebasing, sourced from LSDs, DeFi strategies, and protocol fees. The allocation of assets between LSDs and strategies is handled manually via permissionned functions.

Origin utilizes an AMO system modeled after Frax to sustain the peg, enhance capital efficiency, and optimize yields for OETH holders. The protocol claims to remain fully collateralized even as the money supply programmatically expands and contracts based on market conditions.

The contracts' access controls are managed by 5-of-8 (admin) and 2-of-8 (strategist) multisigs. The identity of these signers is not disclosed. The multisigs oversee vital functions, including fee setting, contract pausing, asset allocation, and strategy deployment. Origin has plans to transfer many of these responsibilities to governance token holders (OGV) in the future.

OETH is safeguarded by timelock contracts (24h) but retains upgrade capabilities for urgent vulnerabilities through its admin multisig. Other operational functions are controlled by the strategist multisig with no timelock.

Origin draws a significant portion of OETH yield from Curve Gauge incentives, with over 75% of the OETH/ETH pool originating from Origin's POL.

Origin Ether (OETH) Introduction

History

In July 2021, the Origin Protocol introduced the Origin Dollar (OUSD), a yield-bearing stablecoin that did not require staking or asset locking. OUSD has a total market cap of approximately $27m, down from an all-time high of $300m in early 2022 (pre-UST era). This was followed by the Origin Governance Token (OGV), fostering decentralization and inclusive decision-making applied to the OUSD token.

In May 2023, the protocol expanded its offerings with Origin Ether (OETH), an interest-earning token linked to Ethereum's value, in an attempt to capitalize on the Liquid Staking Derivatives (LSDs) trend and to provide a hassle-free yield to its holders.

Team

The core team at Origin Protocol comprises experienced professionals with backgrounds in various industries and companies, including Coinbase, YouTube, Google, Paypal, Dropbox, and Pinterest. The founders and several team members are serial entrepreneurs who have founded and exited successful ventures.

Here are brief profiles of the core team members:

Josh Fraser: Co-founder, co-founded three other venture-backed companies: EventVue, Torbit (acquired by Walmart Labs), and Forage.

Matthew Liu: Co-founder, was the 3rd Product Manager at YouTube (acquired by Google) and VP PM at Qwiki (acquired by Yahoo) and Bonobos (acquired by Walmart).

Franck Chastagnol: Head of Engineering - has led engineering teams at Inktomi, Paypal, YouTube, Google, and Dropbox.

Micah Alcorn: Director of Product, was the technical co-founder of WellAttended, a bootstrapped box office management platform.

Linus Chung: VP of Product, previously worked as Director of Product at Coinbase and lead product at companies like Tesla, Pinterest, and LinkedIn.

Andra Nicolau: Head of BD, OUSD. She was most recently the Head of Growth at 1inch, where she raised over $250M.

Justin Charlton: Head of Finance, Designed budgets for satellite launches and advised tech clients on M&A and strategy for seven years at PwC and KPMG.

The OETH Dapp

OETH can be minted through the Origin Dapp by supplying ETH, WETH, stETH, rETH, frxETH, or sfrxETH. The Dapp integrates several contracts (Curve pool, OETH vault, and OETH zapper) to find the optimal route, factoring in slippage and gas expenses. If OETH is trading below peg, the router acquires OETH already in circulation (from the Curve pool or through Uniswap) rather than minting new OETH tokens from the vault. OETH can be converted back to its composite or individual assets via the Dapp.

OETH Protocol Overview

Contract architecture

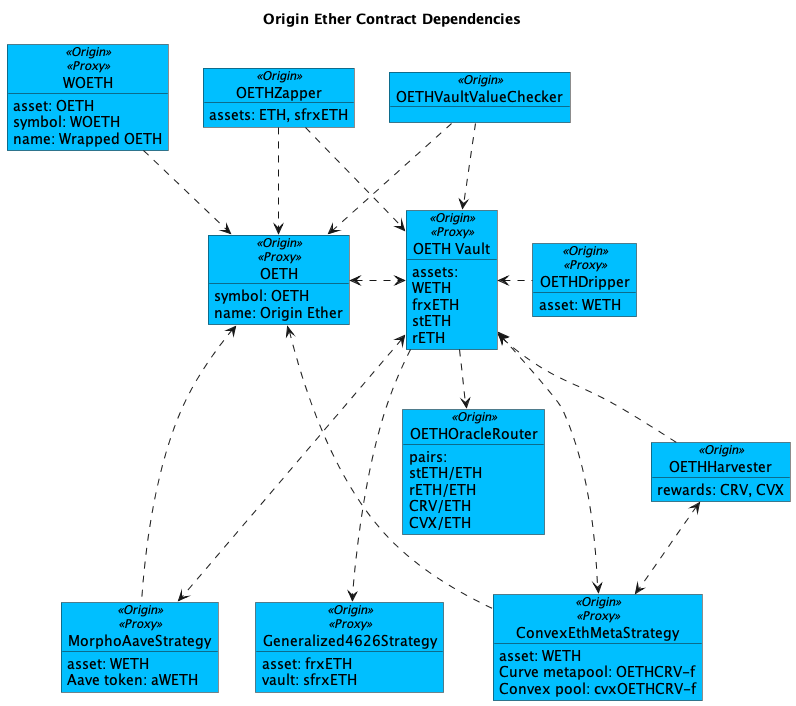

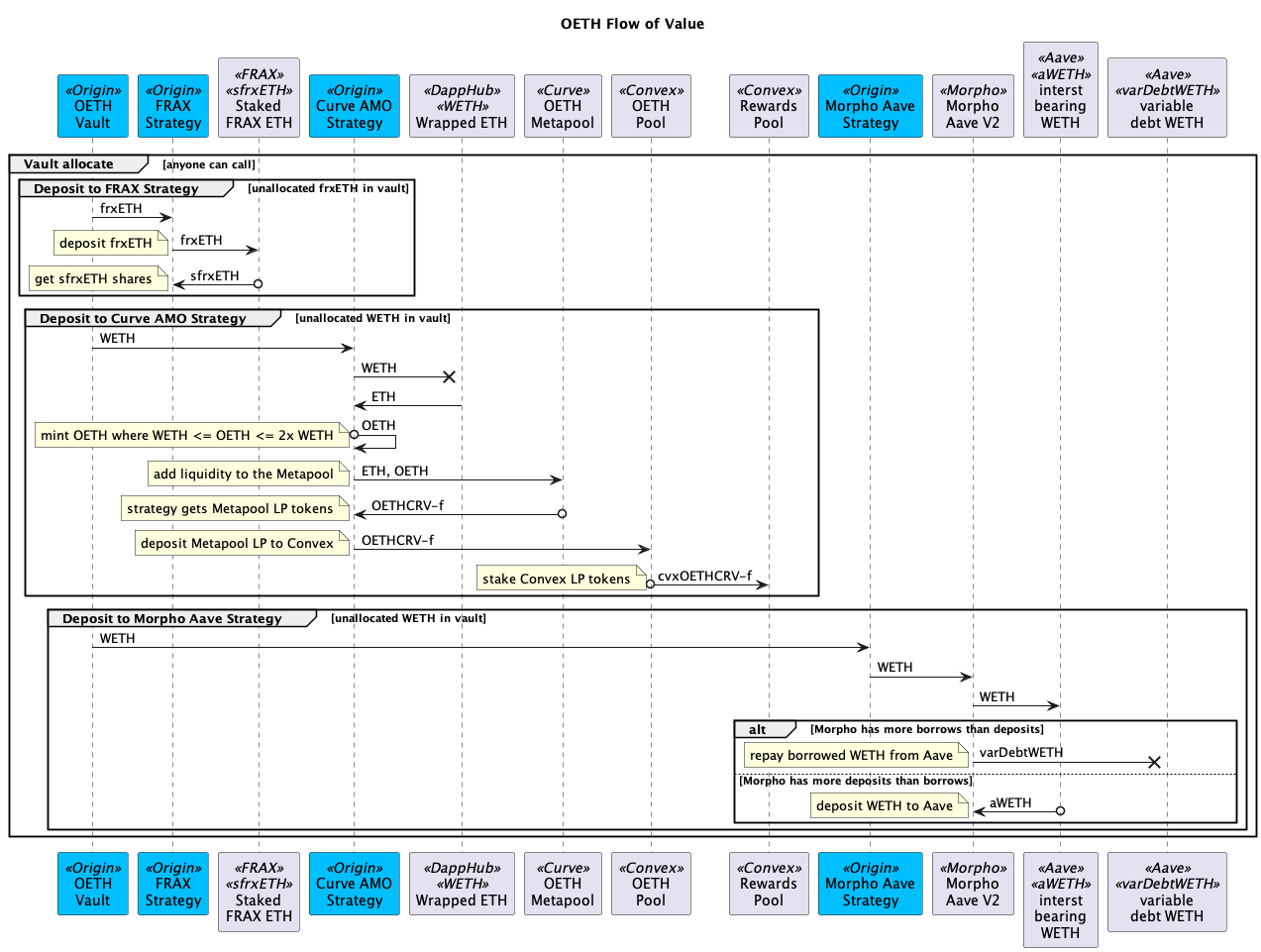

The contract architecture uses a familiar proxy pattern centered around the OETH Vault where assets are custodied and deployed into various strategies approved by governance and managed by authorized strategists.

The Vault

The OETH Vault mints and burns OETH from WETH, frxETH, rETH, and stETH. The supported assets can be queried in getAllAssets. The vault is also a core system contract that custodies the deposited funds and stores various strategies (see: getAllStrategies) where the underlying assets are deployed to earn a yield. It calculates interest earned from the strategies and executes rebases of the OETH supply.

OETH Redemptions from the vault will return an equal value of every supported asset to the user (WETH, frxETH, rETH, stETH). An exit fee of 0.5% is charged on direct redemptions from the vault and is returned to OETH holders. An additional fee is a performance fee assigned to a trusteeAddress, which receives a 20% fee on yield earned whenever the rebase function is called. This address is set to the Origin 2-of-8 strategist multisig. The stated use of this fee is 100% toward accumulating flywheel tokens.

The Zapper

The OETH Zapper is a smart contract designed to assist users in minting OETH using Ether (ETH) and Frax Staked Ether (sfrxETH), as the OETH Vault only supports WETH, frxETH, rETH, and stETH directly. This setup enhances system security and optimizes the gas cost during minting.

The Zapper allows for minting OETH in a single transaction, automatically routing ETH/sfrxETH into the Vault, and sending newly minted OETH to the depositor. It is not possible to withdraw from the Zapper, but users can redeem their OETH through the OETH Vault for a combination of WETH, rETH, stETH, and frxETH, or by simply selling OETH for ETH in the Curve pool.

The Harvester and Dripper

The OETHHarvester collects rewards earned by the strategies, sells them for WETH, and forwards the proceeds to the rewardsProceedsAddress. This address is set to the dripper contract, which is designed to gradually allocate all of the yield produced by the protocol to OETH holders over 3 days (see: dripDuration). This method evens out any abrupt fluctuations in yield and deters potential attacks by eliminating the ability to anticipate significant liquidity events within the protocol. Anyone can call harvest and earn 2% of the proceeds as an incentive.

Oracles

OETH relies on Chainlink oracles to ensure appropriate Liquid Staking Tokens (LSTs) pricing. OETH is intended to always be backed by ETH 1:1, and a calculation of the LSD price during mint/redemption prevents overpayment.

The contract call sets a minimum required amount for minting and redemption. This safeguards transactions from underperformance due to price changes, causing the process to fail if the output of OUSD/OETH or stablecoins/LSTs is insufficient.

The protocol also uses Chainlink oracles when selling reward tokens for additional yield. This helps ensure the sale price slippage remains within acceptable limits, which is also applied to OGV buybacks from protocol earnings.

As of April 2023, Chainlink provides pricing oracles for stETH and rETH, while frxETH is hard coded to a 1:1 ratio. Origin's team plans to implement Curve's time-weighted price oracle for frxETH.

Oracles Addresses:

stETH/ETH: 0x86392dc19c0b719886221c78ab11eb8cf5c52812

Rebasing

OETH generates yield, which is systematically passed on to token holders by rebasing. This process adjusts the total money supply in alignment with the yield earned by the protocol. OETH dynamically modifies its money supply to ensure its value stays equivalent to 1 ETH. In tandem, the token balance in holders' wallets fluctuates in real-time, mirroring the yield the protocol accrues. The rebasing is "up-only". In case of losses due to strategies reallocation (trading fees and slippage), rebasing stops until the yield catches up to pay off the debt. Other lossy events (e.g., a strategy suffering from a hack, or slashing event on an LSD) would result in a drop of OETH price on main liquidity venues.

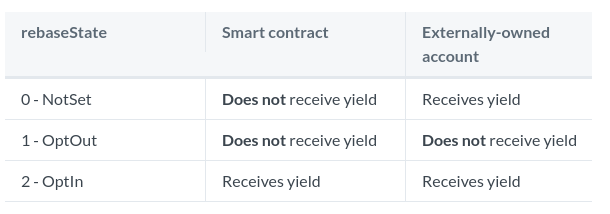

For yield to be earned, smart contracts must proactively opt into the protocol via the rebaseOptIn() function. This enables optimized capital use by the protocol, enhancing the integration with DeFi protocols that weren't originally designed to handle changing balances. Therefore, OETH operates as a conventional ERC-20 token within other DeFi protocols until an explicit request for change is made. Standard EOA wallets, on the other hand, are automatically enrolled in the system, circumventing the need for an explicit opt-in. The OETH managed by the AMO does not rebase.

To verify whether a specific address is configured to receive yield, a public function on the OETH contract can be invoked. This function returns an indicator showing if the address has opted in or out, irrespective of the wallet type.

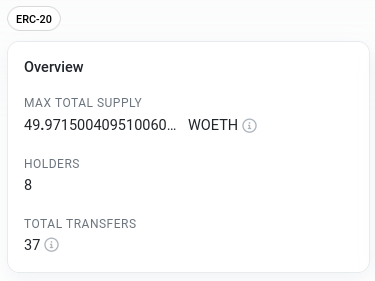

Wrapped OETH

Origin also offers wOETH, a ERC-4626 compliant wrapped version of OETH, which appreciates while maintaining a fixed quantity. This feature makes wOETH compatible with other contracts and may provide tax advantages in certain regions instead of rebasing. Since the user already owns the wrapped version, unwrapping wOETH to OETH involves no approvals or constraints such as minimum term or lock-in period. Despite the static quantity of wOETH tokens, the equivalent OETH that can be unwrapped from wOETH progressively increases. The redeem function allows for the specification of the number of wrapped tokens to be unwrapped, with Etherscan's withdraw function as an alternative for specifying the amount of OETH to be retrieved.

wOETH remains a marginal token with very few holders:

AMO

Origin employs an Automated Market Operations (AMO) design initially pioneered by Frax. The AMO is implemented as the ConvexEthMetaStrategy strategy employed by the OETH Vault. The AMO operates by depositing funds into the Curve pool and allocating liquidity to both sides of the pool (ETH and OETH). Its primary function is maintaining the peg, enhancing capital efficiency, and optimizing yields for OETH holders.

The LP tokens are staked into the Curve Gauge to maximize earned rewards (CRV & CVX). The resulting collateral is added to the vault when these rewards are swapped to ETH. Conversely, the protocol can remove excess OETH from the pool to preserve price stability. Ultimately, the AMO can independently institute monetary policies within a closed system, provided they don't negatively impact the peg. The protocol claims to remain entirely collateralized even as the money supply responsively expands and contracts based on market conditions. This is because the protocol-owned OETH supplied in the Curve pool is not backed by LSDs or other DeFi strategies.

OETH tokens minted by the AMO are unique as they aren't backed by collateral from the vault. One could think of this system as the vault pre-minting some OETH for Curve to sell on its behalf, with those tokens becoming 100% backed when they enter circulation. These tokens are self-backed and are only circulated once collateralized. Users adding or removing OETH from the Curve pool are counterbalanced by the strategy's ability to burn or mint new supply, making the action similar to a minting or redemption process. OETH token can be redeemed at any time for underlying collateral on a 1:1 basis, ensuring the protocol remains 100% collateralized.

Sources of Yield

There are 3 strategies active in the OETH vault. Additionally, an allocation of ETH LSDs are held directly in the OETH Vault, earning interest from staking. A portion of the deposits are unallocated as WETH. The recent allocation of assets on June 7th is as follows:

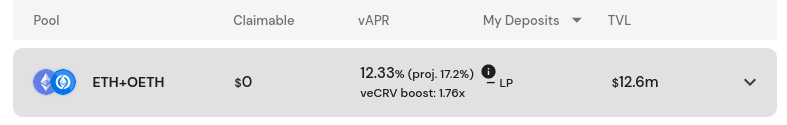

Curve/Convex Yield

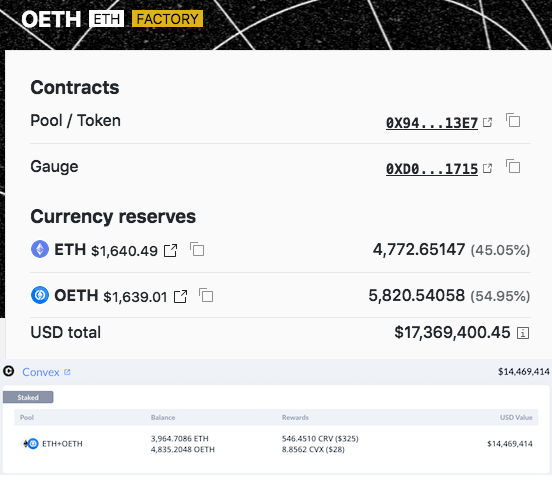

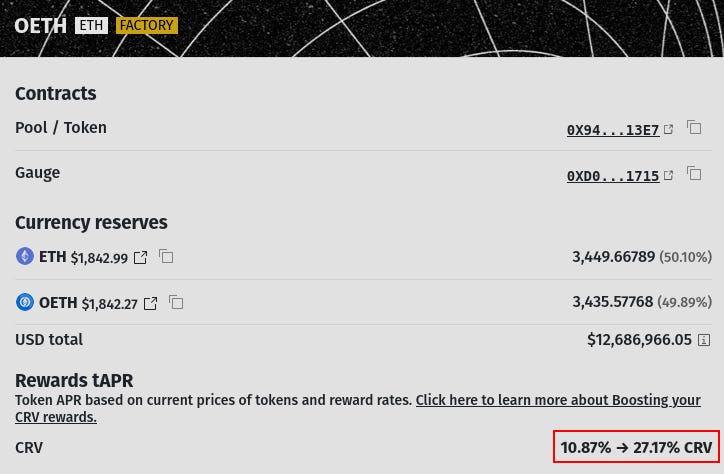

Convex ETH+OETH: Origin predominantly supplies liquidity to the ETH-OETH Curve pool through the ConvexEthMetaStrategy. The LP token is deposited into the gauge, then staked on Convex, enabling Origin to collect trading fees and protocol token rewards (CRV and CVX). This AMO strategy allows OETH to safely boost its deposits to enhance returns and sustain the pool's balance.

Liquid Staking Derivatives (LSDs) Yield

Staked Frax Ether (sfrxETH): Employing a dual-token model, Frax amplifies yields from staking validators. OETH deposits frxETH into the Frax Ether staking contract to magnify this yield further. These funds are managed within the FraxETHStrategy as one of the three OETH vault strategies.

Lido Staked Ether (stETH): As a liquid staking solution for Ethereum, Lido permits ETH staking without locking tokens or maintaining infrastructure. OETH holds stETH, earning staking rewards from the Ethereum network with the added advantage of automatic compounding. The stETH balance is held directly in the OETH Vault.

Rocket Pool Ether (rETH): As a community-owned, decentralized protocol, Rocket Pool mints rETH, an ETH wrapper that accrues interest. OETH holds rETH to earn yield and manages the accounting by distributing additional tokens directly to the users' wallets. The rETH balance is held directly in the OETH Vault.

Yield from DeFi Strategies

Other DeFi strategies, such as the OETHMorphoAAVEStrategy, can power yield generation in the OETH protocol. Morpho augments platforms like Compound and Aave by integrating a peer-to-peer layer that optimizes the pairing of lenders and borrowers, thus offering superior interest rates. If no appropriate pairings exist, the funds are directed straight to the base protocol.

Unallocated Capital

When OETH is minted, collateral is placed into the Origin Vault, where it remains until the allocate function is invoked. This process is automatic for more significant transactions, which aren't as affected by increased gas costs.

Markets

Stablecoin/pegged asset

As of June 7th, the circulating OETH was backed by a total of ~12,000 ETH.

OETH is primarily liquid in Curve's OETH-ETH pool, which boasts over 5,300 ETH worth of liquidity, or around 44% of circulating OETH. On the contrary, the amount of OETH on Uniswap is comparatively small, with approximately 100 ETH in the Uniswap pool 0.05% (v3).

Peg

OETH aims to remain pegged to the price of ETH, allowing holders to have exposure to Ethereum's price movements while earning a stable yield. Since launch, OETH has maintained peg reasonably well.

Chart from Coingecko:

Chart from Curve on-chain data:

In early June, the peg was jeopardized by a large holder (victim of the atomic wallet hack) selling into the Curve pool. The pool balance was restored as other buyers quickly seized the opportunity to buy OETH at a discount, returning the pool to peg.

Risks

Smart Contract Risk

Despite having undergone rigorous audits and being based on the OUSD code base, the OETH protocol encompasses many complex elements, increasing the potential smart contract risk. Additionally, the DeFi strategies employed within the system constantly evolve, with Origin capable of implementing or removing strategies as needed. The dynamic nature of the strategies adds another layer of complexity and potential risk.

OUSD had previously experienced a $7MM exploit in November 2020 due to a previously undetected reentrancy bug. Origin Dollar was relaunched in December after completing multiple audits and security upgrades. You can learn more about the steps taken to secure the protocol in their relaunch announcement. All users were made whole from the Origin community fund.

Audits

A complete list of Orgin audits (including for OUSD) can be found here: https://github.com/OriginProtocol/security/tree/master/audits

Two notable audits were explicitly made on OETH:

Only low-security findings, besides an Oracle issue (date feeds may be outdated), were brought up, which was corrected.

Other audits on protocols systems and related strategies can be found here: https://docs.oeth.com/security-and-risks/audits

Bug Bounties

Bug bounties are granted at the full discretion of Origin Protocol. The rewards range from $100 OUSD for minor issues to $250,000 OUSD for major vulnerabilities. Currently, the bounty program only applies to OUSD and OETH and not other products from Origin. The bounty program is currently administered by Immunefi. As of early June 2023, Origin has paid out $154,850 in bounties and has one of the fastest response times on Immunefi.

More details here: https://immunefi.com/bounty/origindefi/

Risks and tradeoffs with the AMO system

Origin uses the AMO system to provide large amounts of liquidity at a lower cost to the protocol. Yet, it's crucial to remember the risk of bad debt. The system's ability to prevent bad debt largely hinges on the effectiveness of the AMO's interactions with the OETH/ETH Curve pool. If the overall impact of the AMO's transactions with the pool (i.e., deposits and withdrawals) results in positive slippage, they generate a profit and maintain full financial backing. Importantly, while the AMO funnels all yield farming revenue towards OETH, it also has the potential to generate additional profits or suffer losses through arbitrage within the pool.

Liquidity Providers (LPs) also face certain risks within this system. For instance, if a substantial amount of ETH is removed from the pool, as seen in early June, the ensuing imbalance can amplify the profit opportunity for the AMO through arbitrage. Conversely, bad debt can creep into the system if the AMO's transactions lead to an imbalance in the pool, thereby causing negative slippage. In such circumstances, the AMO's best strategy is to let the pool imbalance escalate. Eventually, they can capitalize on this situation by restoring balance to the pool while profiting from the losses sustained by those who withdrew their ETH.

As of June 15, Origin's POL in the Curve ETH/OETH pool amounts to 83% of the pool composition. This can be determined by comparing the value in the ConvexEthMetaStrategy with the OETH pool liquidity.

Since mid-May, Origin has offered vote incentives for the ETH/OETH pool in both Votium and StakeDAO Votemarket. Incentives are paid in the OGV governance token and amount to ~$40k/week in the most recent epoch (week of June 14). The incentives allow Origin to exchange their native token for CRV/CVX emissions, of which the AMO strategy is currently recouping 83%. Emissions are sold for WETH and allocated to the Dripper contract where they increase returns to OETH holders. A significant portion of the yield earned by OETH is therefore dependent on Curve emissions.

Custody Risk

The trust in the OETH system lies with the signers who hold the multisig keys. These signers are responsible for properly handling the assets within the system and must be trusted not to engage in actions such as infinite minting, which could destabilize the system. To provide a layer of security and trust, a 24-hour timelock mechanism is in place. This ensures that significant actions cannot be executed immediately, offering a window of time for potential issues to be identified and addressed.

OETH also leverages DeFi platforms such as Aave, Compound, and Curve, introducing notable smart contract risks. While these collaborations are with platforms managing billions in assets and conducting due diligence regarding their security, there is no absolute certainty of their continued flawless operation. Any malfunction in these underlying strategies could potentially result in a loss for OETH holders.

Governance

The Origin Protocol uses the Origin DeFi Governance Token (OGV) to allow decentralized decision-making within its ecosystem. Like OUSD, Origin Ether is intended ultimately to be governed by veOGV holders, with any upgrades to the contracts being time-delayed by a 48-hour timelock. According to the team, a 5-of-8 multisig will control OETH for the next few weeks if any critical issues are discovered in the early deployment of OETH.

As of this writing, the governor of the OETH Vault is set to the Governor contract. This contract has an admin set to the 5-of-8 admin multisig. The delay time to execute a vote is set to 1 day. Only the admin can queue a proposal and execute a vote. As the OETH Vault is an upgradable proxy contract that contains all underlying assets and is the hub for all strategies, the 5-of-8 multisig effectively has custody of all user funds.

Multisigs can increase security if the key signing process is distributed and diversified across multiple participants. Adding external entities to the list of signers can further amplify this security measure.

Another potential governance risk is the manual allocation of funds. The capability to change the composition of the collateral has yet to be added. Consequently, any deposited ETH either goes into Convex or remains idle.

In terms of future governance, additional strategies are anticipated, but these could introduce new risks. (For instance, a Morpho strategy was recently added, which was promptly halted due to a possible vulnerability being detected.)

Access Control

The contracts' access controls are managed by 5-of-8 (admin) and 2-of-8 (strategist) multisigs. The identity of these signers is not disclosed. Origin claims they are all unique trusted individuals with close ties to Origin.

Signers (same for both):

Admin 5-of-8 multisig: 0xbe2AB3d3d8F6a32b96414ebbd865dBD276d3d899

The admin multisig currently has full ownership over the contracts and the underlying assets, but all contract changes must go through the timelock. This is a temporary situation since OETH is a new protocol, and the team wanted to be able to respond quickly to any unforeseen issues. Full governance will soon be transferred to veOGV stakers like OUSD today. Once that transfer happens, the admin multisig will have no special powers.

Strategist 2-of-8 multisig: 0xF14BBdf064E3F67f51cd9BD646aE3716aD938FDC

Certain features (e.g. adjusting funds among strategies or temporarily stopping deposits) require less time and fewer authorizations, enabling the Origin team to respond swiftly to changes in market circumstances or potential security issues. Strategists can carry out a restricted set of functions with the approval of only 2 of 8 authorized signers. The strategist can only allocate funds between previously approved strategies.

The strategist multisig can do the following actions on the vault:

reallocate- move funds between strategiessetVaultBuffer- adjust the funds held outside strategies for cheaper redeems.setAssetDefaultStrategy- which strategy mints and redeems pull from for a particular strategywithdrawAllFromStrategy- remove funds from a single strategy and send them to the vaultwithdrawAllFromStrategies- remove funds from all active strategies and send them to the vaultpauseRebase- pause all rebasespauseCapital- pause all mints and redeemsunpauseCapital- allow all mints and redeems

Oracle Risk

The OETHOracleRouter contract is set as priceProvider in the OETH Vault. This contract sources Chainlink price feeds for all underlying assets and reward assets (CRV/ETH, CVX/ETH, rETH/ETH, cbETH/ETH, stETH/ETH) with the notable exception that frxETH/ETH is programmed to always be worth 1 ETH.

The purpose of the price feeds is to make sure the protocol does not overpay for LSTs that may be trading below the peg. Since 1 OETH is intended to always be backed by 1 ETH, it may need to adjust the quantity minted or redeemed based on current market data. Additionally, when tokens are sold for additional yield, the protocol uses price feeds to check that price slippage does not exceed a reasonable bound.

A key concern regarding oracles is Origin using a hard-coded 1:1 ratio for frxETH/ETH. The implications are that the Strategist multisig would need to manually pause deposits if frxETH were to experience a major depeg. Losses could be incurred if the multisig takes too long to react or if the depeg perdures. The Origin team says they plan to implement Curve's EMA oracle from the frxETH/ETH pool. This trust assumption and risk to the protocol is clearly disclosed in the Origin Protocol docs.

Depeg Risk

The AMO is designed to restore the peg in ordinary circumstances, and all funds remain secure during this process. Additionally, if the amount of ETH in the pool decreases, it becomes more profitable for the AMO strategy to increase its allocation to restore balance. This serves as a dynamic response mechanism to maintain the stability of the OETH value. As a significant (>80%) amount of the Curve pool consists of protocol-owned liquidity from the AMO, it is unlikely that a depeg could possibly persist except due to an underlying protocol failure (e.g. smart contract exploit resulting in loss of user funds).

There are several scenarios in which OETH could risk depegging from its intended value. These include significant additions or removals from the Curve pool, a strategy becoming loss-inducing, or an exploit related to the Automated Market Maker Operations (AMO). For instance, if a large holder were to sell into the Curve pool, it could temporarily destabilize the peg.

Collateral Risk

OETH holders are exposed to the underlying strategies and LSD tokens (e.g., slashing) deployed within the system, making risk assessment challenging. Given the intricate and evolving nature of these strategies and LSDs, understanding and quantifying the potential risk factors can be complex. Users must closely monitor the underlying assets and remain vigilant to system strategy changes. While the system is designed with robustness and security in mind, the complexity of its elements underscores the importance of cautious engagement and a thorough understanding of its operational mechanics.

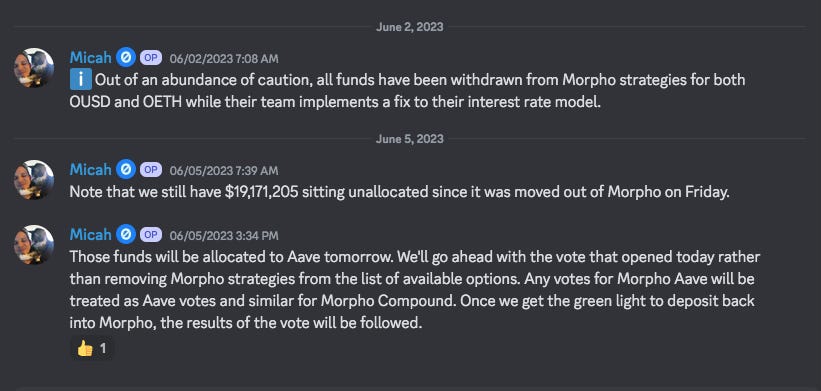

The security of OETH collateral could significantly depend on the multisig's prompt response. For instance, on June 2nd, 2023, the strategist multisig temporarily withdrew funds from the newly launched Morpho strategy back to the OETH Vault by calling withdrawAllFromStrategy (tx) to address a potential issue with their interest rate model. The funds were redeposited on June 14th (tx).

Actions taken by the strategists are communicated in the "Strategy Allocations" thread of the #DeFi-Governance-Forum channel of the Origin Discord server.

Origin also makes risk analyses available for some of their LSDs:

frxeth-sfrxeth:

https://docs.oeth.com/security-and-risks/risk-reports/frxeth-sfrxeth

reth:

https://docs.oeth.com/security-and-risks/risk-reports/reth

LlamaRisk Gauge Criteria

Centralization Factors

Is it possible for a single entity to rug its users?

No, however, the Strategist and Admin multisigs have significant powers. Signers are not publicly known, and users must trust the admin multisig not to perform actions against users’ interests, such as upgrading contracts to divert underlying assets.

If the team vanishes, can the project continue?

No. The project is currently highly dependent on manual operations (e.g., rebalancing) performed by the multisigs. There is a roadmap to transfer control to a DAO governed by veOGV tokenholders, at which point the project will no longer be reliant on the core team.

Economic Factors

Does the project's viability depend on additional incentives?

Somewhat. The outsized yield offered by OETH depends highly on gauge incentives, although a floor APY is established by the yield generated by the LSDs under Origin's custody. The protocol-owned flywheel tokens ensure that there will always be extra rewards as long as the gauge is live and CRV & CVX remain valuable.

If demand falls to 0 tomorrow, can all users be made whole?

Yes. OETH is always backed 1:1 with ETH under normal circumstances. All active strategies (sfrxETH strategy, MorphoAave strategy, Convex AMO strategy) and LSD tokens are readily liquid, allowing all users to exit to ETH in a worst-case scenario when demand drops to 0. Redemptions will attempt to withdraw from the OETH Vault first, and will permissionlessly withdraw from strategies if Vault liquidity has been drained.

Security Factors

Do audits reveal any concerning signs?

No. There were two audits done on OETH, similar in functionality to OUSD, which has also undergone multiple audits. Underlying strategies are also audited before deployment. There is an Immunefi bug bounty program that pays up to $250K in OUSD for responsible disclosure.

Risk Team Recommendation

Although OETH is a new product, Origin Protocol has been integrated with Curve with their OUSD/3CRV pool since August 2021. The design for OETH has much in common with the previous product and leverages the ETH liquid staking trend to create a diversified, yield-generating ETH token.

This initial iteration of OETH has certain centralization vectors that are less than ideal but are understandable given the early stage of the product and the need to respond quickly in case of an emergency. The 5-of-8 admin multisig has a significant amount of control over the system, including custody of user funds. While it is unlikely the team-controlled multisig would become compromised or act maliciously, this does potentially expose the protocol to regulatory risk. There is an intention to pass control over to a DAO of veOGV tokenholders, and users should monitor that the team is actively taking steps to decentralize governance.

Another weakness in the current design is the hardcoded price for frxETH. This makes users dependent on the strategist multisig to protect the protocol in case of a depeg by promptly withdrawing funds from the strategy. The team plans to implement the Curve EMA oracle from the frxETH/ETH pool, so users should monitor that this happens. In general, the performance of OETH is reliant on the responsible management by the strategist multisig, which manages the deployment of funds into strategies and also has the power to pause mints/redemptions and pause rebases.

There is a reasonable pathway to overcome the centralization vectors that exist in OETH today, and the team has a track record of progressively decentralizing the protocol. The system is transparent with clear and thorough documentation. Users are able to independently verify the deployment of assets and determine whether the system suits their own risk profile, although they should remain vigilant as changes are made to the underlying strategies. OETH meets our criteria for a Curve gauge.