Asset Risk Assessment: Spiral DAO (COIL)

Analyzing Spiral DAO: A Novel Approach to Yield Farming, Bribe Markets, and veTokenomics

Links

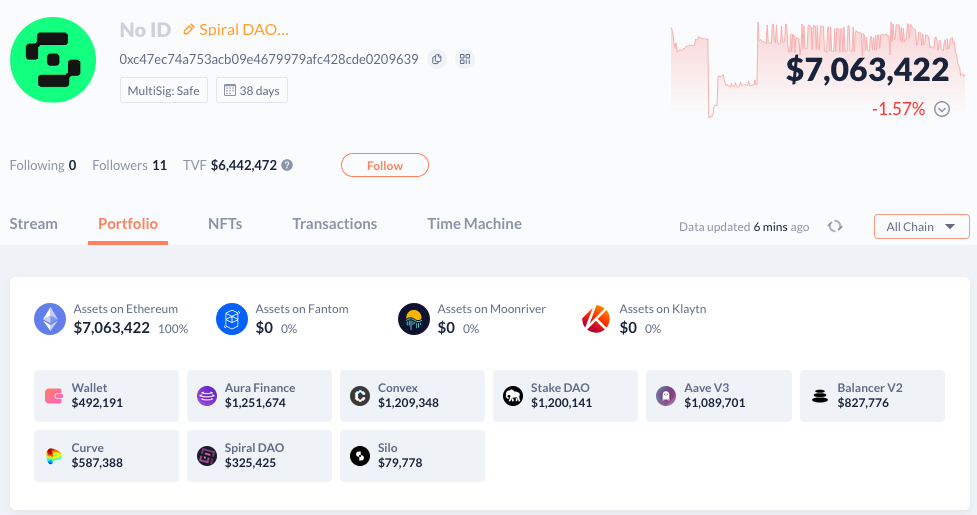

Spiral DAO Treasury (DeBank)

Relation to Curve

On April 5th, Spiral DAO introduced a COIL/FRAXBP V2 factory pool on Curve, which includes COIL, FRAX, and USDC. The pool currently holds approximately $1.8 million in assets and was initially bootstrapped by the Spiral DAO Treasury. A gauge proposal was submitted on April 13th. An on-chain vote concluded on April 23rd in favor of the proposal.

Approximately 25% of the Treasury TVL is presently allocated to providing liquidity to the Curve COIL/FRAXBP pool. Spiral DAO remains the primary liquidity provider of this pool and earns over 100% APY by staking their LP token into the COILFRAX-f Gauge. Spiral DAO also participates in Curve Governance, currently holding 1,415,869 sdCRV (Stake DAO).

This report aims to investigate the inner workings of Spiral DAO, review its design trade-offs, and examine the potential implications in the ongoing curve wars and global DeFi bribes ecosystem.

Key Findings

Access controls for most system contracts are with the 4-of-7 protocol multi-sig. This multi-sig controls critical functionality and is responsible for user deposits in its yield bonding strategy and protecting against an infinite mint of COIL and SPR tokens.

The COIL/FraxBP pool is almost entirely POL, as the COIL tokenomics incentivize users to stake their COIL for SPR. Spiral DAO uses bribes and its own governance power to increase CRV emissions to its pool, which is currently earning >100% CRV APY on $1.8M of liquidity.

The protocol borrows many mechanics from Olympus DAO, a well-proven codebase with numerous forks.

There is no cap on COIL and SPR tokens; while Spiral DAO aims to grow its treasury backing quickly enough to offset emissions for stability and sustainability, caution should be exercised due to the model’s reliance on momentum that carries the risk of failure.

COIL and SPR holders depend on the performance of Spiral DAO’s Treasury, which is exposed to smart contract risk from several different protocols (Aura, StakeDAO, Convex, Balancer, Curve, Silo, etc.) and is managed by the 3-of-6 Treasury multi-sig.

SpiralDAO is composed of primarily anonymous contributors who are seasoned DeFi natives and have attracted significant demand through their Initial Treasury Offering (ITO) and have partnered with StakeDAO.

The governance is reasonably decentralized for an early-stage project but leaves much to be improved. SPR is used in Snapshot voting, multi-sigs are set with reasonable thresholds, and owners of the multi-sigs are all disclosed (though many are pseudonymous). However, several contracts have EOAs in privileged roles, and timelocks are not used.

Introduction to Spiral DAO

Spiral DAO is a capital-efficient yield aggregator designed to optimize yield farming and bribe markets across applications that employ veTokenomics (ie. Curve and Balancer). Unlike traditional aggregators such as Yearn and Beefy, SpiralDAO retains reward tokens from third-party protocols within the DAO Treasury, reducing sell pressure and circulating supply. While the protocol borrows much of its smart contract design from Olympus DAO, it introduces a novel concept of "Yield Bonding". The protocol accepts LP token deposits to farm rewards to its Treasury and issues an excess value of its native token to depositors as compensation.

The two-token model of Spiral DAO consists of the COIL and SPR tokens. COIL is an inflationary token primarily useful for staking as SPR. The vast majority of unstaked COIL supply is protocol-owned liquidity (POL) in the Curve and Balancer pools. The rebasing SPR token is a governance token that incentivizes liquidity providers to contribute their yields to the Spiral DAO Treasury through Yield Bonding. This structure enables users to obtain SPR governance rights while safeguarding them from COIL’s inflationary nature. By distributing a greater yield in SPR tokens than the rewards attainable via existing protocols, Spiral DAO incentivizes user engagement. It aims to grow its Treasury backing fast enough to offset emissions, ensuring the stability and sustainability of the protocol.

Spiral DAO claims to support the DeFi ecosystem by reducing sell pressure on farming tokens such as CRV and BAL, offering improved risk-adjusted yields for farmers, and optimizing the bribe market.

The Launch of Spiral DAO

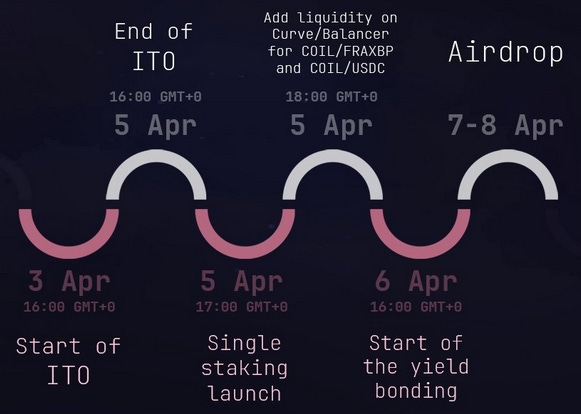

Spiral DAO was launched in March 2023 through an Initial Treasury Offering (ITO), aiming to accumulate a large share of USDC, CRV, BAL, FXS, and SDT tokens. The protocol was bootstrapped by an initial oversubscription auction for 2.6m COIL tokens between April 3rd and 5th.

The initial timeline for the Spiral DAO launch:

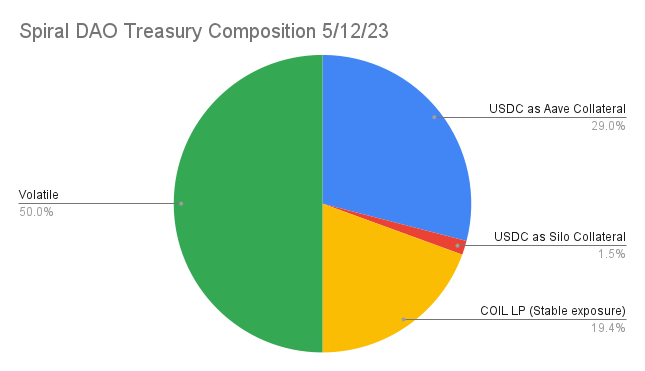

The ITO resulted from the Treasury holding the following position:

Unpurchased COIL from the auction was burned and initial liquidity was seeded to the COIL/FraxBP Curve pool with 730,360 USDC and 235,600 COIL.

The protocol then deployed its POL to various other protocols, including Aura Finance, Convex, Conic, Aave V3, Balancer V2, and Silo Finance. It acquired an initial stake of 955,854 sdCRV to participate in Curve gauge voting. It has since increased its stake to 1,415,869 sdCRV as of this writing.

A quick overview of the current Treasury exposure to various protocols can be found on DeBank.

Airdrop

To encourage adoption, Spiral DAO planned a two-phase Airdrop:

Phase 1 was initially planned right after the Initial Auction. It was postponed by a few weeks (via snapshot vote) to allow sufficient time to prepare the marketing campaign and distribute the tokens over a broader user base. Phase one started on April 29th, with 3% of the initial token supply distributed towards Curve/Convex, Balancer/Aura Finance, FRAX Finance/StakeDAO, and 1,000 DeBank users as DegenScore Beacon NFT owners.

Phase 2 will be distributed among the most active community participators.

Protocol Mechanics

Spiral DAO uses several mechanisms first introduced and popularised by Olympus DAO (OHM), such as the two-token model, rebasing, treasury management, and bonding. Spiral DAO addresses issues from OHM-like protocols by tackling a key concern: the possibility that the executive team could "slow-rug" by passively underperforming against token emissions and restricting treasury redemption, ultimately putting the token value below the Treasury backing.

The Dual COIL/SPR Token Model

1- COIL Token: A share of the Treasury Assets

The COIL token is an 18-decimal ERC-20 token representing a user's share in the growing DAO Treasury. Newly issued COIL is dispensed at preferential rates as a reward that attracts users to deposit their yield-bearing LP tokens with Spiral DAO (e.g. B-auraBAL-STABLE, pax-usdp3CRV-f, etc.). COIL can be redeemed directly for a share of the Treasury's USDC with the protocol's SpiralRedeem contract (with a penalty) or via the SpiralSwap liquidity aggregator that swaps COIL for USDC at the best rate.

COIL can be staked to receive SPR, which grows periodically via a "share price" logic, meaning that the exchange rate is ever-increasing based on the value of the underlying treasury assets. Current data on staking APY is viewable on the Staking page or directly on the SpiralStaking contract. COIL has an unlimited supply and is highly inflationary. The tokenomics of Spiral DAO addresses dilutionary pressure via wrapped COIL (SPR tokens). This structure protects users from COIL's inflation while offering a derivative that is intended to outperform staked and non-staked veTokens. As a result, virtually all unstaked circulating COIL is POL in the Curve and Balancer pools.

2- SPR Token: The Rebasing Asset

SPR tokens are obtained by staking COIL. It is used for governance over the Spiral DAO system and Treasury. The token is distributed as rewards to users that stake their LP tokens on Spiral DAO. SPR can be unwrapped to the native COIL asset via the SpiralStaking smart contract at an exchange rate (index variable). Spiral DAO plans on having the option to lock SPR in the future to allow boosted yields in the manner popularized by veTokens.

Adjustments to staking APR are governable parameters via the changeAPR() and changeLength() functions in the SpiralStaking contract with execution done by the contract owner (currently the 4-of-7 protocol multi-sig is composed of core contributors). A Twitter post on May 2nd promoted an update to the APR from 100% to 271.828% and was a decision that went through a Snapshot governance process.

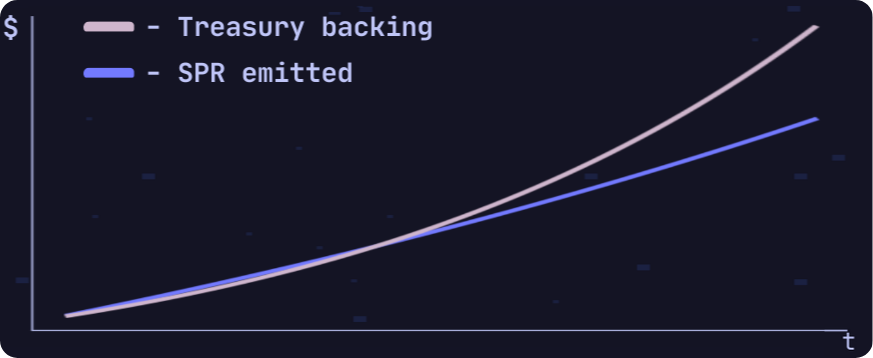

With time, treasury gains are intended to outpace the SPR emitted:

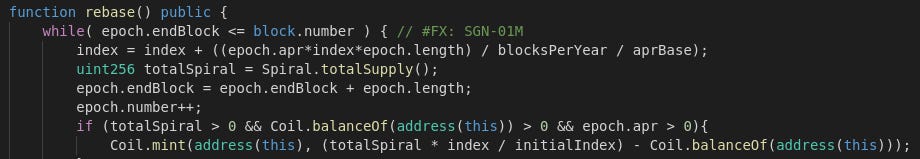

Rebase

Rebasing is the process of minting new COIL tokens paid to stakers. For Spiral DAO, this is done via Rebase, a permissionless function in the SpiralStaking contract called automatically at each staking/unstaking event without relying on off-chain scripts. This differs from other protocols that may require permissioned actions or off-chain scripts to perform rebases.

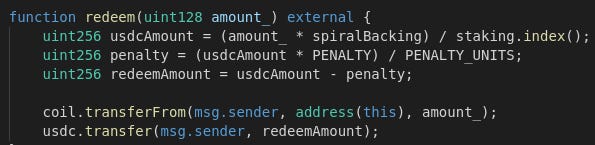

Redemption and Exit Liquidity

Both COIL and SPR tokens are inflationary, but the Treasury backing creates some assurance of a price floor via Treasury redemptions. Spiral DAO aims to offer an additional exit strategy for users through its redemption page; this page uses the USDC treasury reserve and provides users with the option to exit the DAO by redeeming the Treasury backing with a 10% penalty (this penalty is configurable by the SpiralRedeem contract owner, currently set to a team-controlled EOA).

SpiralRedeem is seeded with an arbitrary amount of Spiral DAO Treasury's USDC (simply transferred at the discretion of the Treasury management multi-sig). When writing this report, the contract held 312,000 USDC against a total supply of 4,091,200 COIL, worth approximately $9,8m.

Although it is typically irrational for users to redeem (since it's more advantageous to sell via Curve's COIL/FRAXBP Factory pool), the redemption page serves as an ultimate price floor in specific situations, ensuring users have a secure exit strategy.

The Treasury composition of Spiral DAO is said to ensure ample exit liquidity for every user should they choose to leave the protocol, even if the COIL price trades below its backing. The Spiral DAO Treasury is structured to allocate a portion of its reserves to prevent the COIL price from falling more than 10% below its actual backing, enabling the protocol to arbitrage Spiral tokens when their value dips below the fair value.

Protocol Revenue Model

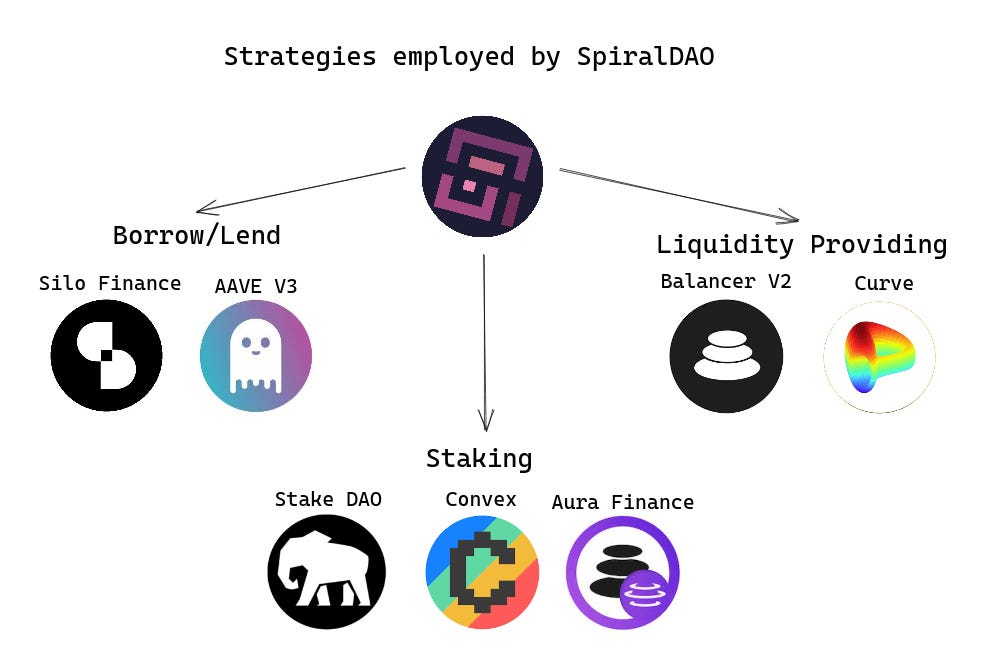

Spiral DAO's revenue model employs several strategies to generate income. The primary source is yield farming through staking treasury assets like CRV, BAL, CVX, and AURA. The protocol also uses a Yield Bonding strategy to accumulate these assets from user deposits. Additionally, the protocol takes advantage of arbitrage opportunities in bribe markets to acquire discounted tokens.

Spiral DAO also plans to participate in other protocols' Initial Liquidity Offerings to diversify its revenue sources and expand into aggregating veCRV boosts. The Treasury receives a 10% fee upon redemption and charges 0.5 per COIL emitted, contributing to the overall revenue.

By exploiting inefficiencies in bribe markets and deploying a sizeable portion of its Protocol-Owned Liquidity (POL), Spiral DAO aims to maximize its revenue streams, benefiting its users. The protocol plans to develop a Dune dashboard to track the efficiency of bribe markets and make informed decisions.

Protocol Owned Liquidity (POL) and Treasury Management

Spiral DAO's Treasury deploys liquidity across various diversified strategies, using multiple governance tokens and stablecoins to support host protocols and optimize yields for token holders and users. The unique treasury rebalancing mechanism and tokenomics enable Spiral DAO to exploit bribe market inefficiencies, enhancing both bribe yields and liquidity depth.

The treasury management in Spiral DAO pursues three primary objectives:

Sustaining market share

Ensuring balanced Treasury exposure

Providing fair exit opportunities for users

Spiral DAO strives to increase the market share of relevant tokens continually. For instance, if the DAO attains a 10% market share of a token, it aims to raise its share and prevent it from dropping below 10% unless decided otherwise by the community.

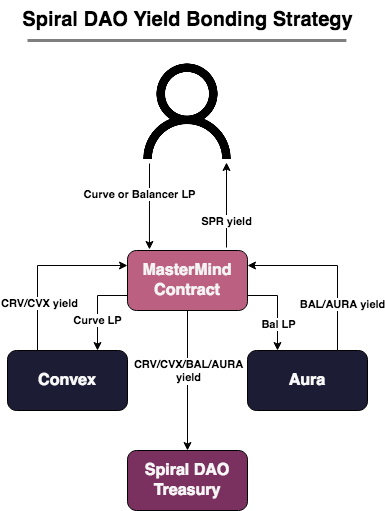

Yield Bonding Strategy

Yield Bonding is a spin on the bonding concept popularized by OHM. Instead of a user selling their token to the protocol in exchange for the discounted protocol token, Spiral DAO does not require users to relinquish ownership of their principle. Instead, users exchange the yield farming rewards they would have earned from their Curve/Balancer LP token, and in return, the protocol distributes outsized yield in the native token SPR. The additional yield rates are adjusted daily based on the COIL market cap and the Treasury value. Users are free to withdraw their LP tokens at any time.

Yield Bonding only works when the COIL market cap is significantly larger than the Treasury value, making it a deflationary measure. Spiral DAO's Treasury grows exponentially, outpacing the natural inflation of the token and corresponding reward tokens. Spiral DAO aims to resolve issues faced by competitors, such as inflation, cannibalization, lack of steady supply, poor fund utilization, and overexposure to one token.

The current composition of LP tokens deposited into Spiral DAO's Yield Bonding scheme can be seen on DeBank. As of this writing, $1.6M of value is being farmed for the benefit of the Treasury’s benefit.

Emissions and Yield Bonding

Spiral DAO's protocol is designed to incentivize users to maintain their investment by ensuring that, under normal conditions, the value of emitted SPR tokens surpasses the Treasury backing. The protocol undergoes periodic weight updates for new SPR token emissions, adjusting them to achieve an emission value equal to 100% of the underlying yields plus 40% of the "additional overValue" parameter. This approach aims to attract more yield farmers by offering a higher APR than a mere 5% discount on SPR tokens.

The selection of the 40% proportion is grounded in achieving a balanced dynamic between the Treasury, which secures approximately 60% of the overvalued COIL market cap, and individual yield stakers, who benefit from 40% of this via additional yield. While this percentage is not immutable and could be altered based on community proposals, the protocol intends to introduce pools without this mechanism. Consequently, the yield boost will only apply to select, reliable assets such as those in the Curve-Bal ecosystem.

To better accommodate emissions across all pools, weight updates for SPR emissions transpire every few days. The calculation of SPR rewards is based on 1 ETH of LP, which bolsters the protocol's robustness amidst TVL fluctuations.

Spiral DAO has implemented various mechanisms to safeguard against potential faulty or malicious behavior during weight updates and intends to introduce additional measures. One such mechanism involves limiting the overall amount of SPR rewards distributed, effectively limiting potential funds misappropriation to approximately $100k worth of SPR.

Occasionally, emissions may exceed the Treasury backing. This scenario may materialize if, for instance, the price increases during the day between weight updates while the protocol remains below the Treasury backing and emits an equivalent amount in value. It is worth noting that this disproportionality operates bidirectionally, resulting in users receiving reduced dollar value rewards, negating negative impacts.

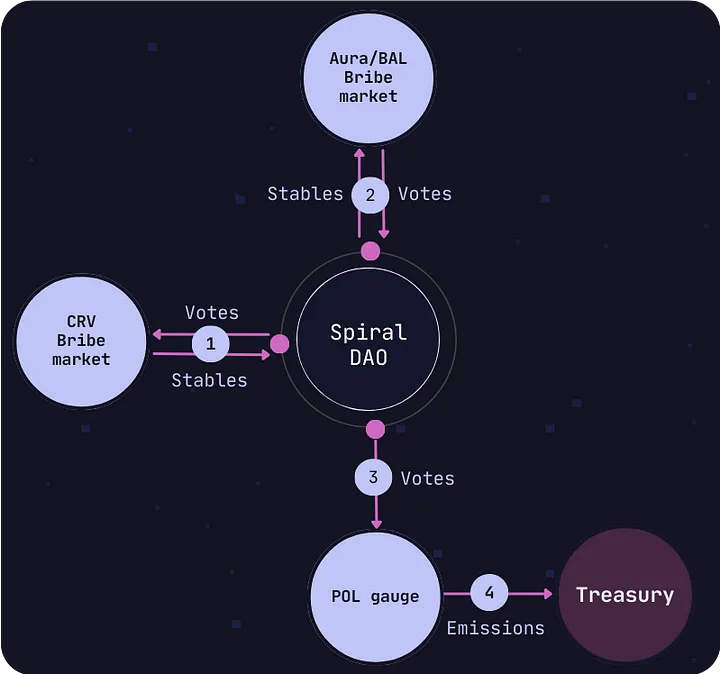

Rebalancing Mechanism: Bribe Strategy

Spiral DAO's Treasury rebalancing mechanism plays a crucial role in maintaining a balanced Treasury exposure by taking advantage of bribe markets for arbitrage purposes.

For example, if the DAO intends to increase the BAL weighting in the Treasury in relation to CRV, it proceeds as follows:

Sell CRV votes in the bribe market to acquire stablecoins

Use those stablecoins to buy votes in the Aura/BAL bribe market

Allocate the acquired votes to the POL gauge

Receive additional BAL/AURA emissions

The rebalancing mechanism is designed to adjust the Treasury's holdings according to market dynamics and the Spiral community's preferred risk profile. Specifically, it increases the exposure to BAL-AURA tokens, thereby relatively increasing their weighting in the Treasury. This process does not reduce the exposure to CRV tokens but instead adjusts the balance in favor of BAL-AURA. This ensures liquidity for Spiral tokens while adapting to changing market conditions.

In practice, we observe that Spiral DAO has been bribing 33.2K USDC per week on the StakeDAO VoteMarket to incentivize liquidity in the COIL/FraxBP pool. A total of 144K USDC has been deposited for bribes in total from the Spiral DAO Treasury here and here.

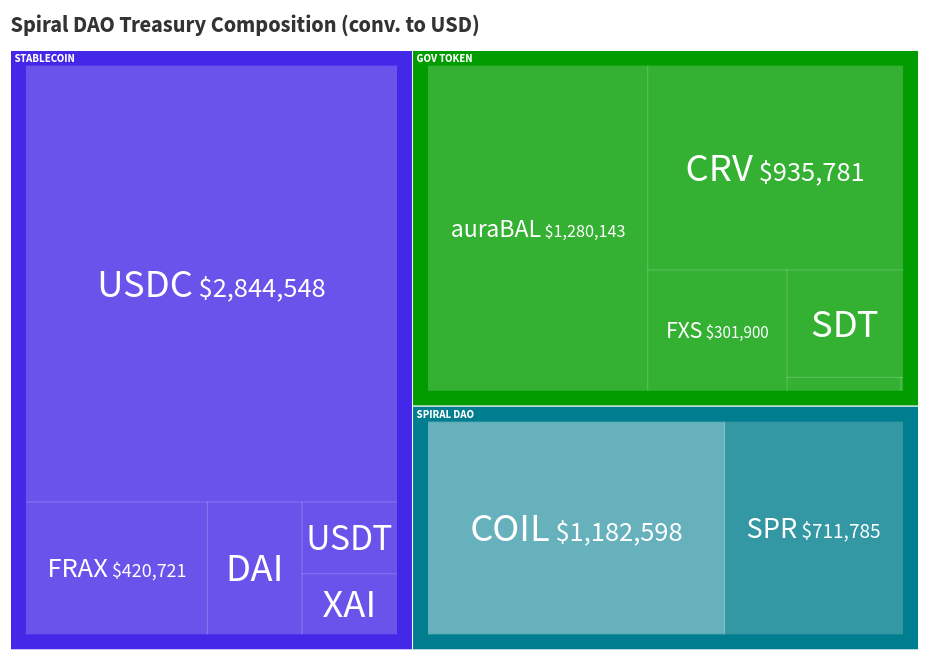

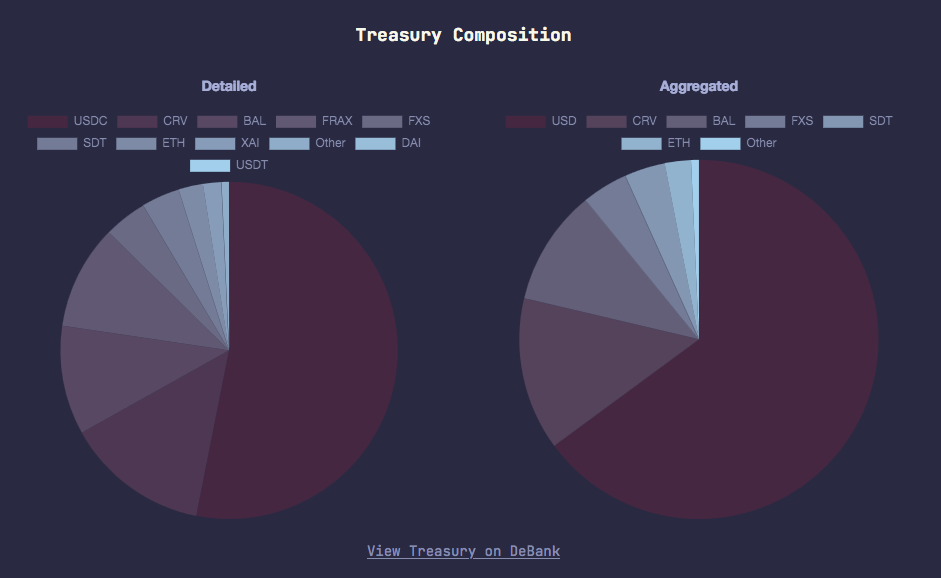

Treasury Composition

An overview of the current Treasury composition along with projections of revenue and expenses can be found on this Google Sheet. After accounting for interest and bribe expenses, Spiral DAO projects to earn a 28% APY on its Treasury investment activities (of course, yields in crypto can change rapidly, so this constitutes a very rough estimation).

Guidelines for future Treasury composition were proposed and voted on via a snapshot vote. A core contributor presented a plan addressing future token weights in the DAO, focusing on two main aspects: 1) setting a target Treasury composition to enable rebalancing using various methods, and 2) determining the handling of byproducts and additional rewards, such as GEAR tokens.

The proposal suggests modifying the existing Treasury composition over the coming months to increase exposure to CRV/BAL and potentially cultivate external partnerships. Furthermore, the proposal advises adopting a default practice of retaining, rather than selling, other tokens until they account for less than 1% of the Treasury. At this point, a reevaluation would occur. This strategy aims to prevent protocol cannibalization while maximizing potential yields.

The Treasury composition (including Redeem contract), as of early May 2023, is as follows:

The target asset mix to be achieved in the next few months is as follows:

45% Stables/USDC

20% CRV/CVX

15% BAL/AURA

6% FXS

4% SDT

10% Other (ETH + BTC + Partnership assets)

The DAO plans to submit any significant changes to a snapshot vote, whether it involves increasing, decreasing, or maintaining a specific asset exposure. Concerning Spiral's risk framework, they intend to have the following ratios: ~10-15% for potentially risky assets, 20-30% for medium-level risks, and 50-70% for a safe risk profile. Proactive measures are taken, and continuous monitoring is conducted; for instance, Spiral eliminated Conic finance exposure due to its excessive size and experimental nature.

Governance

Contributors

While most contributors are anonymous, the team behind the project possesses diverse backgrounds in the crypto industry, including market making on CEXs, quantitative analysis, angel investing, arbitrage, and yield farming. Several contributors have been involved in the space since 2012-2013. The project also benefits from the advice and guidance of notable figures in the DeFi space, such as the founder of cp0x (validators in multiple DeFi applications) and Sami (Redacted Cartel founder). A core contributor was also involved in a white hat attack in 2021, where over $1m of assets were returned.

We asked Spiral DAO for more information about contributors' roles. We were told that the DAO plans to make its structure more transparent at a later stage. Below is a partial list of contributors based on the latest information obtained:

Contributors:

VaeVictis

Cuttlefish

Ivan

Advisors:

Farmer Brown - Advisor

SuperChad - Advisor

CIA Officer - Security researcher

Sami - Founder of Redacted Cartel

Valentin Mihov - Co-founder of Daedalus

Gov Process and Voting

Governance proposals can be made on the Governance channel of the Spiral DAO Discord server. According to guidelines in the docs, a proposal should be active for at least 24 hours before going to a vote. Voting is done via Snapshot with votes being recognized based on SPR holdings.

As Snapshot votes are non-binding, in most cases, the protocol or Treasury multi-sig will be responsible for executing the outcome of the vote.

Multi-sigs

Treasury (3/6)

The Treasury multi-sig manages the protocol Treasury:

GnosisSafeProxy.sol: Treasury Multisig - 3-of-6 Gnosis Safe 1.3.0 (behind proxy)Cuttlefish - 0xC541A7b893eFD384d3E0013DfCb3e563a777fDBC

SuperChad - 0xDD9bF0A45452a4F22cfd2C963c15B191D97Ce106

Protocol (4/7)

The Protocol owner multi-sig has ownership privileges for the majority of protocol contracts including MasterMind, SpiralStaking, and the token contracts:

GnosisSafeProxy.sol: Protocol Multisig - 4-of-7 Gnosis Safe 1.3.0 (behind proxy)

Smart Contracts Overview

Contract Architecture Overview

Spiral DAO's smart contract architecture is designed to incentivize users to stake in selected yield bonding pools while maintaining necessary relative inflation.

The MasterMind contract is an upgradeable proxy yield aggregator central to the yield bonding system and comprises three roles: Service, Drainers, and Owner. The Service role handles lower-level threats and non-impactful activities, while the Drainers can take corresponding rewards (CRV/BAL/other) to the DAO/Treasury address. The Owner role, Spiral DAO's multi-sig, can add pools, change delegate-call adapters, and increase withdrawal fees (in addiiton to privileges of other roles).

MasterMind features two types of "Adapters": XXXAdapter.sol, consisting of hardcoded routes for zaps and view information of reward tokens for drains, and XXDelegate.sol, which holds the code MasterMind used for delegate calls of different protocols. The latter is crucial for security reasons. The MasterMind contract owner can set the Rewarder contract address, which determines the token distribution for each user based on the allocated rewards per 1 LP token per pool. Reward rates are updated by the admin role, guided by off-chain scripts that calculate the price of Coil, collateral protocol yield, and the required APR to sustain per 1 LP for the target pool in COIL.

The architecture also includes a SpiralStaking contract based on Olympus DAO that mints COIL and SPR tokens through vaults, a Router used to efficiently swap between COIL/SPR and USDC, and a SpiralRedeem contract that lets users redeem COIL for Treasury USDC.

Deployed Contracts

The protocol has two tokens and a staking contract for the tokens:

SPR.sol: Protocol wrap token (ERC20), 18 decimals

COIL.sol: Reward token (ERC20), 18 decimals

SpiralStaking.sol: Deposit COIL to get SPR (similar to OHM staking with rebase, but no forfeit functionality)

The following contracts are related to the MasterMind contract, responsible for managing AMM farming pools and user deposits into those pools:

UpgradableProxy.sol: MasterMind Proxy (OpenZeppelin fork)

MasterMind.sol: Current implementation

ProxyAdmin.sol: Proxy Admin (OpenZeppelin fork) of MasterMind proxy contract

Rewarder.sol: Multi-pool rewarder contract that sets fees and reward rates for depositors. This contract is set by MasterMind.

RewarderVault.sol: Executes mints for Rewarder with SPR reward token.

Additional functionality includes the SpiralSwap router and the SpiralRedeem contract:

Router.sol: SpiralSwap router is a COIL liquidity aggregator that allows swaps between COIL/SPR and USDC.

SpiralRedeem: Redeem contract allows users to redeem COIL for Treasury USDC with a configurable penalty. The penalty is currently 10%

Access Control

We have reviewed the access control for Spiral DAO's deployed contracts. You can find the details here. Below are the key points:

The majority of contracts are owned by the 4-of-7 protocol multi-sig, which has extensive privileges to upgrade contracts, add and remove privileged addresses, and is generally responsible for critical system functionality.

It is possible to infinite mint COIL and/or SPR in case of irresponsible or malicious action taken by the owner multi-sig. The protocol multi-sig must ensure that the vault address is not set to an exploitable address. It can call

setVault()to set an arbitrary address as a designated vault, which then has the power to callmint()to the token contract. Currently theSpiralStakingandRewarderVaultcontracts are set as vaults, and these have protected conditions for minting.The Rewarder contract is controlled by an EOA. It is responsible for setting pool parameters cataloged within the

MasterMindcontract and distributing fees from theRewarderVault.The

SpiralRedeemcontract is owned by an EOA, which can set parameters for redeeming COIL for USDC. It can also withdraw all USDC deposited in the contract (The contract is periodically topped up by the protocol Treasury as seen here).All Spiral farming pool deposits are through the

MasterMindcontract, which is upgradeable by the 4-of-7 multi-sig. Depositors in the Spiral pools must trust the contract owner to responsibly custody funds in the Spiral farming pools.

Timelock

Spiral DAO opts not to use a Timelock for crucial protocol-related matters. Instead, the project employs a 4-of-7 multi-sig approach involving only two contributors. This decision stems from the challenges associated with gathering all signers for approval and the desire for signers to maintain control and cross-verification of all activities. While this approach may increase efficiency, it is essential to ensure adequate security measures and checks are in place to prevent potential risks.

Risk Analysis

Given that Spiral DAO introduces novel mechanics on top of the Olympus DAO model, it is essential to analyze its potential risks.

Underlying Treasury Assets

The COIL & SPR tokens represent a share of all Spiral DAO's Treasury assets. As such, we've examined the risks to which token holders are exposed. These tokens carry the associated risks of every asset the Treasury holds, including the potential fluctuations in the value of these assets, exposure to market volatility, and any other risks inherent to the individual assets themselves.

The Treasury composition can be audited here and is currently exposed to 7 additional protocols (Aura, StakeDAO, Convex, Aave, Balancer, Curve, and Silo). Each protocol has different risk profiles, and COIL/SPR holders are exposed to them all. The potential for de-pegging in DeFi liquidity lockers, such as AuraBal and sdCRV, presents a risk that stakeholders must be aware of, as it can disrupt Spiral DAO's underlying holdings. Users should consider the mechanics specific to each asset and understand the implications of a de-pegging event on the Treasury's value.

Although Spiral DAO attests to a Treasury target of 45% stablecoin as of this Snapshot vote, users should be aware of market risk to the underlying strategies. Currently, only 30% of the Treasury is in stables without exposure to market risk (eg. USDC as collateral in Aave). Nearly 40% of the stablecoin portion of the Treasury is deployed as Curve and Balancer LPs paired with COIL. This greatly increases the market risk of the stable portion of the portfolio and isn't adequately conveyed in Spiral DAO's own dashboard.

In addition to smart contract risk and economic risks associated with each underlying protocol, there is a reliance on the 3-of-6 Treasury multi-sig to responsibly manage the investment strategies.

Smart Contract Risks

An audit report from Pessimistic was made public in January 2023. The audit of Spiral DAO's smart contracts revealed one critical issue concerning deleting a logic contract via delegatecall. Several medium-severity issues were identified, such as outdated addresses, overpowered roles, test issues, incorrect variable values, skipped operators, and inaccurate reward calculations. Additionally, multiple low-severity issues were found.

Spiral Dao confirmed that all findings had been addressed. Some changes and additions (e.g., the SpiralRedeem contract) appear to have been made after the audit. Smart contract vulnerabilities pose risks for Spiral DAO, especially since it is unclear which contracts were changed post-audit.

To counter potential threats, the project offers a bug bounty program with rewards up to $250k or 15% of the affected funds for critical findings. Furthermore, Spiral DAO has recently voted to launch a bounty program with Hats.finance with the goal to incentivize responsible vulnerability disclosure for Spiral DAO. As per the Snapshot vote, the protocol Treasury sent 30K SPR, currently valued at ~$77k at this tx.

Potential Bank Run and Redeem limitations

While Spiral DAO has implemented a backstop mechanism for redemption, there remains a risk of COIL becoming illiquid. The USDC balance in the SpiralRedeem contract is overseen by the Treasury multi-sig. The majority of the Treasury's assets are liquid, with the exception of approximately $50k in locked SDT. Although COIL's market cap could decline below the Treasury's value, the redemption smart contract serves as a safeguard by ensuring the drop does not exceed 10% of the total.

However, there are certain limitations to the redemption mechanism that should be taken into consideration. First, if a large number of users choose to redeem their COIL tokens simultaneously, the USDC reserve in the SpiralRedeem contract could be depleted, resulting in reduced exit liquidity for remaining users. This scenario could potentially trigger a bank run-like event, where users rush to redeem their tokens before the reserve is exhausted.

Second, the redemption penalty rate, which can range from 0 to 100%, is controlled by a team-owned EOA. While this flexibility allows the protocol to adapt to varying market conditions, it also introduces uncertainty for users regarding the actual redemption rate they will receive upon exit.

To mitigate these risks, it is essential for Spiral DAO to maintain a sufficiently sized USDC reserve in the SpiralRedeem contract, as well as implement clear guidelines on how the redemption penalty rate will be determined and adjusted. Ideally, the EOA owner should be replaced with the 4-of-7 protocol multi-sig for greater user assurance.

Llama Risk Gauge Criteria

Centralization Factors

1. Is it possible for a single entity to rug its users?

User funds in the Treasury are custodied by the 3-of-6 Treasury multi-sig and other system funds (including COIL/SPR token security) are custodied by the 4-of-7 protocol multi-sig. Both multi-sigs include core contributors of the protocol in addition to project advisors. The address owners are disclosed, and while the majority are pseudonymous, they include many known actors with a long history working in crypto. It is possible to rug user funds, although appears reasonably secure at this stage.

2. If the team vanishes, can the project continue?

Depends on how "team" is defined. If the 3 core contributors disappeared, the project advisors would still be able to reach the multi-sig threshold required to recover Treasury funds. In case the majority of multi-sig signers disappear, it would no longer be possible to access the Treasury and the project would be unable to continue.

Economic Factors

1. Does the project's viability depend on additional incentives?

A core mechanic of Spiral DAO involves using bribes to expand the Treasury. That includes bribes for the COIL/FraxBP pool, which is almost entirely POL and is earning the Treasury >100% APY on $1.8M of liquidity. The Yield Bonding strategy depends on being able to farm ecosystem reward tokens from a variety of Curve and Balancer pools.

2. If demand falls to 0 tomorrow, can all users be made whole?

Users farming in the Yield Bonding pools can always redeem their LP tokens, regardless of market conditions. On the other hand, COIL holders may not be able to redeem Treasury assets. Only 312K USDC is in the SpiralRedeem contract, in addition to 900K USDC in the Curve pool and 800K USDC in the Balancer pool. Once all USDC is drained, the remaining Treasury funds would need to be distributed by the Treasury multi-sig.

Security Factors

1. Do audits reveal any concerning signs?

An audit report from Pessimistic in January 2023 revealed several issues, including a critical issue. All issues found in the report were fixed or addressed. The project has a bug bounty program of up to $250K for critical findings and recently established a 30K SPR ($77K) bounty program with Hats.Finance.

Conclusion

Spiral DAO offers an innovative approach to yield farming, bribe markets, and veTokenomics in the DeFi ecosystem. With a robust treasury and attractive yields, it distinguishes itself from traditional yield aggregators by retaining third-party protocol rewards within the DAO Treasury. Spiral DAO's unique treasury rebalancing mechanism and tokenomics allow it to capitalize on bribe market inefficiencies, improving bribe yields and liquidity depth.

Although the protocol aims for quick treasury growth to offset emissions and maintain stability, users should consider the risks associated with underlying treasury assets/management, potential bank runs, and smart contract vulnerabilities. While Spiral DAO appears to be formed by DeFi natives with a community-driven ethos, users should be aware there are significant privileges granted to the 3-of-6 Treasury multi-sig and the 4-of-7 protocol multi-sig that give them responsibility over user and protocol funds.

The rebasing tokenomics (currently paying 1410% APY to SPR stakers) disincentivize users from LP-ing in the Curve COIL/FraxBP pool, so practically the entire pool is POL. The pool has a Curve gauge that is paying up to 170% CRV APY currently to the Spiral DAO Tareasury. There have been debates in the past about approving gauges to protocols such as OHM and BTRFLY with similar mechanics. Notably, both of these protocols have Curve gauges and both have transitioned to a low APY rebasing model. Curve DAO voters should consider whether this strategy constitutes a legitimate use of the gauge.