Asset Risk Assessment: TrueUSD (TUSD)

TUSD's role and associated risk as a crvUSD Pegkeeper asset

Relevant links:

Chainlink: TUSD Proof of Reserve

Curve: crvUSD/TUSD pool | TUSD Pegkeeper contract | Curve Monitor crvUSD Dash

Relation to Curve

TrueUSD (TUSD) plays an important role in crvUSD as one of the Pegkeeper pools (crvUSD/TUSD), along with USDC, USDT, and USDP. Pegkeepers algorithmically support the crvUSD peg to $1 by minting or burning crvUSD tokens based on market conditions, effectively backing a portion of the outstanding crvUSD supply with its Pegkeeper pair.

Pegkeeper enforces balance in each of the Pegkeeper pools, so if a Pegkeeper asset depegs below $1, it causes excess crvUSD to enter circulation that results in a crvUSD depeg. Curve intends to introduce an improved version of Pegkeeper that checks the token price vs an aggregate of others. This will offer better protection by preventing crvUSD deposits into a depegged Pegkeeper pool. As it stands, crvUSD’s stability depends on strong confidence that its Pegkeeper pairs are sound stablecoins with a low risk of depeg.

There are criticisms regarding TUSD’s transparency policy that are important to highlight in the context of its role as a Pegkeeper asset for crvUSD. Transparency is lacking in a number of categories, including its custodial partners, reserves management, attestations, on-chain operations, and ownership structure. This report will cover the most immediately concerning issues which revolve around the state of TUSD’s reserves and should serve to inform DAO voters if action is required to limit crvUSD’s exposure to TUSD.

TUSD Overview

Issuer and Custodians

On a high level, TUSD operates as a fiat-backed custodial stablecoin. TUSD is designed to maintain a 1:1 peg with the US dollar, offering stability in the volatile crypto market. The issuer of TUSD was initially TrueCoin, LLC (a subsidiary of Archblock, Inc.), although the ownership was transferred to Techteryx on December 15th, 2020.

Techteryx is described by a TUSD representative as an

Asia-based conglomerate with businesses in Hong Kong, Singapore, Guangzhou, Shenzhen, Beijing etc. in the traditional real estate, entertainment, environmental, and information technology industries.

Contrary to self-labeling as an Asian conglomerate, Techteryx Ltd. appears in the registers of the BVI Financial Services Commission. Very little information is publicly available about Techteryx, leading to speculations about its subsidiaries and the ultimate beneficial ownership of TUSD.

As of July 13, 2023, Techteryx has assumed full management of all offshore operations and services related to TUSD, including minting, redemptions, customer onboarding, compliance, and oversight of banking and fiduciary relationships.

TUSD has three custodial partners that are described in attestation reports (which can be downloaded from tusd.io) as a Hong Kong depository institution, a Swiss depository institution, and a Bahamian depository institution.

The reserves portfolio is not specifically disclosed but is described as

USD cash, cash equivalents and short-term, highly liquid investments of sufficient credit quality that are readily convertible to known amounts of cash. The Hong Kong depository institution also invests in other instruments to generate yield. In all cases, cash equivalents and other instruments are recorded at cost.

The main revenue stream generated by TUSD is the interest earned on the fiat reserves held as collateral. The revenue generated from these activities helps cover the operational costs of maintaining the stablecoin infrastructure, compliance with regulations, and supporting the growth and development of TUSD.

Mint/Redeem Process

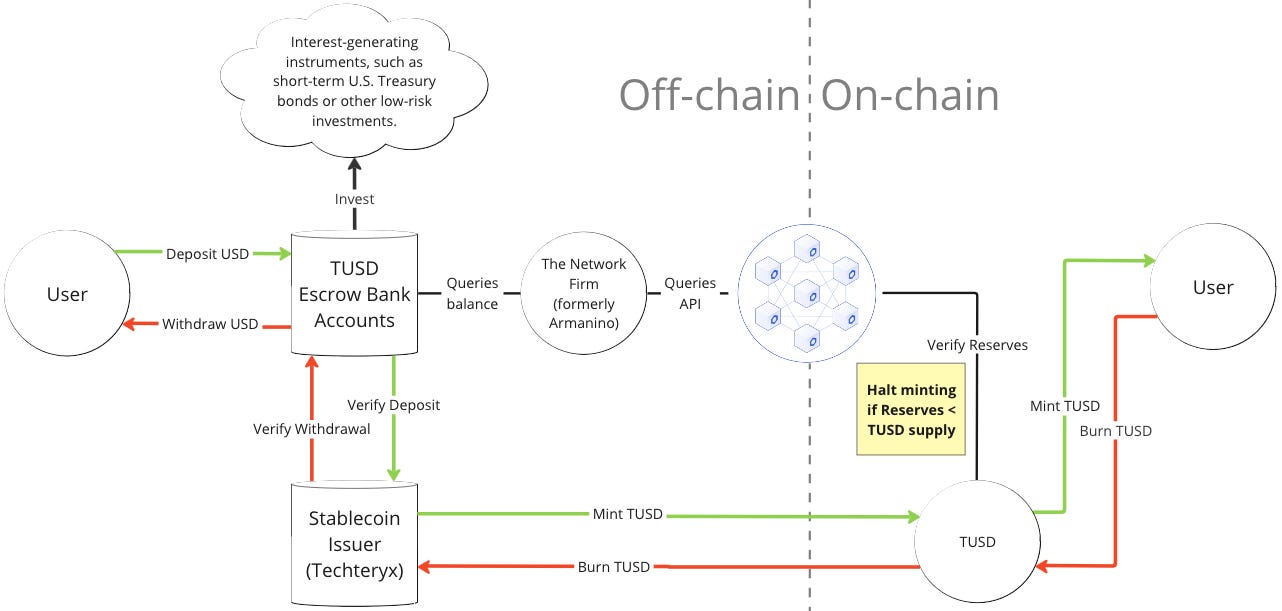

The TUSD system architecture is shown below:

Users wishing to mint TUSD must have an account at https://tusd.io/ and undergo a KYC/AML check. The user then wires US dollars into the designated bank accounts managed by the fiduciary partners. Techteryx emphasizes that funds management is entirely done by its custodians and the issuer never has authority to handle user funds.

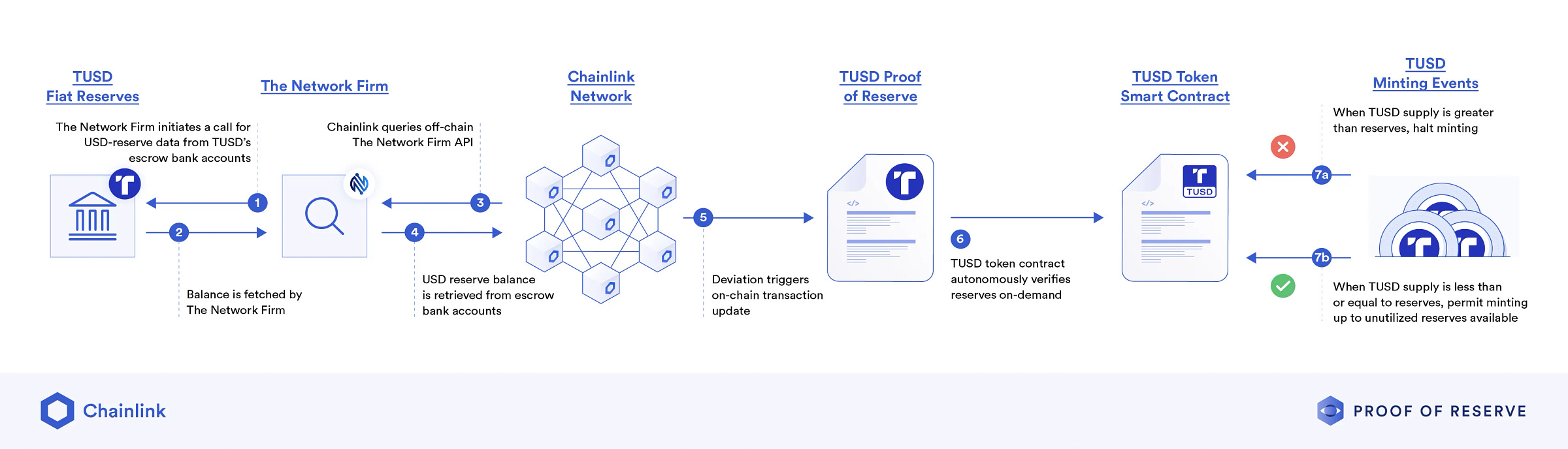

TUSD performs real-time attestations of its reserves through a partnership with The Network Firm LLP and Chainlink Proof of Reserve (PoR). TUSD can only be minted if the total TUSD supply + newly minted TUSD is <= the reserves reported by Chainlink (as provided by The Network Firm). Confirmed deposits that pass the mint check are then tokenized, and the corresponding amount of TUSD is issued to the user’s specified receive wallet.

Conversely, when users wish to redeem their TUSD for US dollars, they initiate a redemption process with the stablecoin issuer by first undergoing a KYC/AML check and specifying their Ethereum and bank wiring addresses. The TUSD tokens are burned by sending to the TUSD smart contract, and the corresponding amount of US dollars is transferred back to the user’s bank account.

TUSD Expansion in March 2023

Until March 2023, TUSD was a minor stablecoin with limited trading activity that captured <1% of the overall stablecoin market share. However, Binance’s decision to adopt TUSD as a successor to BUSD, and the subsequent promotion of a BTC-TUSD trading pair with zero transaction fees, significantly boosted its visibility and trading volume. Its market share rapidly expanded from less than 1% to 19% in a matter of months.

There was a sudden occurrence of two massive transactions, each valued at $1 billion, originating from a single address and being sent directly to Binance. These events occurred on March 12th and June 16th.

The explosive rise in TUSD may be related to Binance’s Zero-Fee Trading promotion and general promotion of TUSD on the exchange. Binance announced the promotion on June 21st. Observers may also notice that the unusual growth trend for TUSD coincided with the period leading up to the shuttering of its Prime Trust custodial partner in mid-June.

Binance had moved to support the TUSD stablecoin after the New York Department of Financial Services (NYDFS) ordered BUSD issuer, Paxos, to halt the issuance of its BUSD stablecoin. This was due to unresolved issues related to Paxos’ oversight of Binance’s Paxos-issued BUSD. This move by Binance appears to be an effort to maintain its market share in the stablecoin space and reduce reliance on a single stablecoin. The move to promote TUSD has resulted in Binance becoming the largest holder of TUSD. Notably, the majority of TUSD’s trading volume is currently concentrated in the Binance BTC-TUSD pair.

Token Distribution

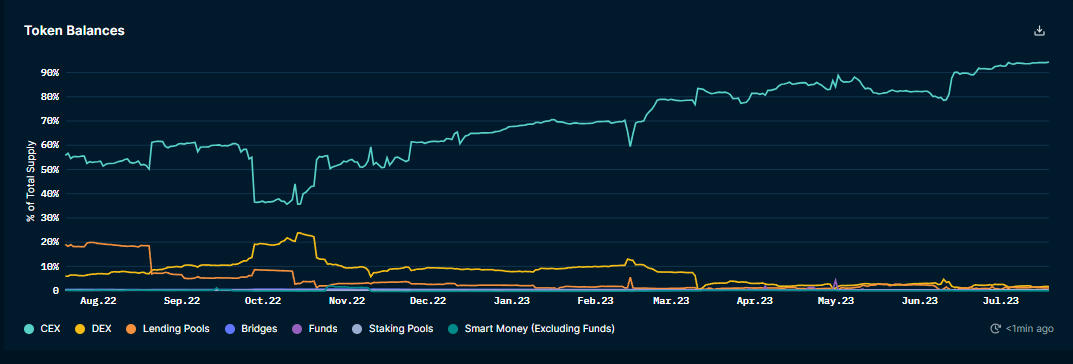

According to Nansen, the majority of the TUSD supply is held on Centralized Exchanges (CEX) with 94% of all Token Supply associated with CEX addresses. As shown below, the vast majority of TUSD is on Binance specifically.

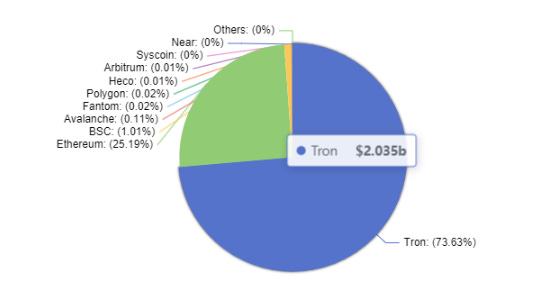

TUSD, at the time of writing, has the majority of its token supply on TRON (73.56%) worth approximately $2.035 Billion. The TUSD website advertises TUSD on Tron, Ethereum, Avalanche, Binance BNB Beacon Chain (BNB), and Binance BNB Smart Chain (BSC). It compiles token supplies from those chains as part of its attestations.

Distribution - TUSD on TRON

The vast majority of TUSD on TRON is held by Binance (94.7%), with a small amount on DeFi lending platform JustLend (3.5%) and Gate.io (1.2%).

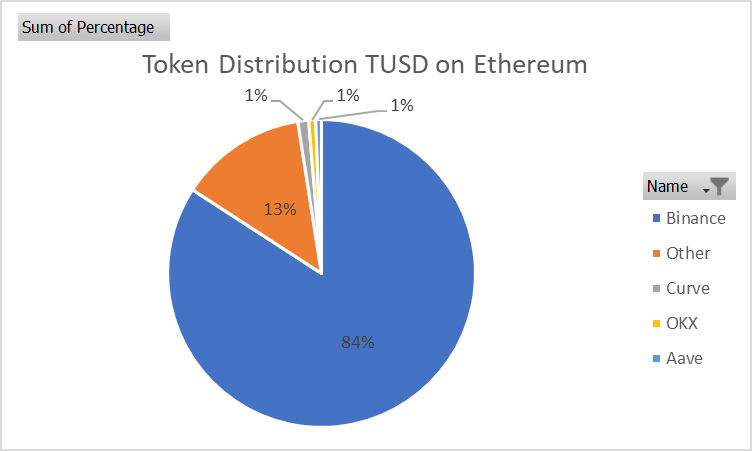

Distribution - TUSD on Ethereum

The TUSD token holder distribution on Ethereum is heavily skewed towards Binance which holds 83.53% of the total tokens. Curve, OKX, and Aave each have a small share with 1.12%, 0.73%, and 0.60% respectively. The Curve crvUSD/TUSD Pegkeeper pool contains the most TUSD of any contract on Ethereum.

crvUSD Pegkeeper and Depeg Risk

Links

TUSD/crvUSD Pool Contract

TUSD Pegkeeper Contract

AggregatorStablePrice Contract

Pegkeeper helps stabilize the crvUSD peg by algorithmically supplying and withdrawing crvUSD to designated Pegkeeper pools. The four pools currently are crvUSD/USDT, crvUSD/USDC, crvUSD/USDP, and crvUSD/TUSD. Each Pegkeeper is allotted a max debt that it can supply to its respective pool. Currently, each Pegkeeper has a 25m crvUSD max debt for a total of 100m crvUSD max Pegkeeper debt.

The AggregatorStablePrice contract is important to Pegkeepers, as it aggregates the price of crvUSD from at least three price sources (currently aggregating the four Pegkeeper pools). Pegkeepers will only supply crvUSD when the Aggregator quotes a crvUSD price > $1.

Using TUSD as an example, the following conditions must be met for Pegkeepers to supply crvUSD:

Over 15 minutes have passed since the last update

The TUSD balance in the pool > the crvUSD balance

The aggregator quotes a crvUSD price > $1

If the conditions are met, supply an amount of crvUSD equal to 1/5 of the difference in balance.

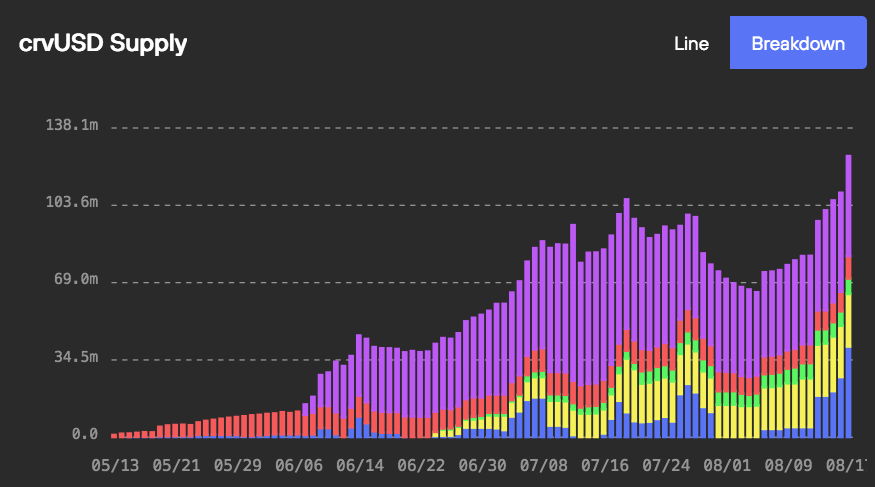

The chart below shows a breakdown of crvUSD supply over time by source. The blue bars indicate crvUSD supplied by Pegkeepers, reaching a max of 40.6m total Pegkeeper crvUSD in mid-August (40.6% utilization). The recent rise in Pegkeeper utilization coincided with a sharp cryptocurrency market downturn which drove up demand for crvUSD. On August 18th, the total crvUSD supply is 125.5m with 85m borrowed from collateral. This equates to a 32.27%/67.73% split between crvUSD minted from Pegkeepers vs from collateral.

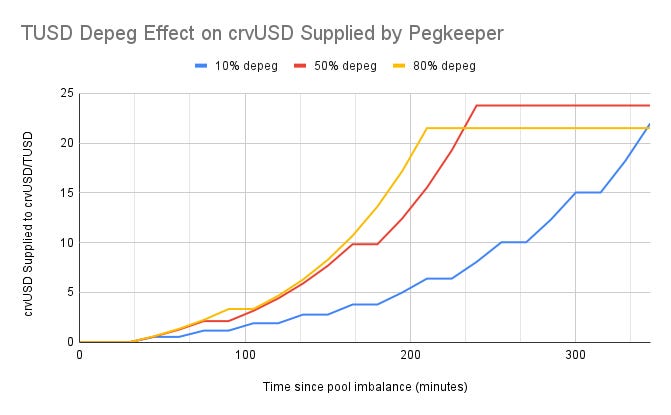

There are undesirable consequences of any Pegkeeper asset (e.g. TUSD) losing its peg, either permanently or for a prolonged period. Because the aggregator checks the pool balance to determine the price of crvUSD, it may incorrectly quote crvUSD as being >$1 during a Pegkeeper asset depeg. This will allow the Pegkeeper to supply crvUSD to the pool up to its max debt. The following chart shows a simulation of how quickly the Pegkeeper may supply crvUSD given several possible depeg severities:

This data was collected by simulating a depeg in Brownie with pool state on August 8th. Regardless of depeg severity, a depeg event lasting 4-5 hours would introduce nearly all available Pegkeeper debt into circulation.

Note that this data is in isolation and in reality would cause LPs in other crvUSD pools to reduce crvUSD exposure, resulting in a depeg proportional to the amount of unbacked crvUSD entering circulation. The depeg would reduce the price quoted by AggregatorStablePrice, limiting additional Pegkeeper crvUSD from entering circulation and allowing the DAO to take mitigating action. crvUSD supplied by the depegged Pegkeeper pool would remain as bad debt to the protocol (assuming the depeg were permanent).

crvUSD depends on its Pegkeeper pools, not only to maintain stability, but to ensure the continued solvency of crvUSD. It is, therefore, crucial to assess the exposure of the protocol to potential Pegkeeper debt (i.e. max debt) proportional to the total crvUSD supply and consider the confidence in the peg of each Pegkeeper asset.

TUSD Transparency Criticisms

Summary

The following criticisms have been levied against TUSD in recent weeks:

Intransparent Reserves Management: TUSD provides notably less transparency about its custodial partners and reserves portfolio than its competitors.

Intransparent Attestations: TUSD provides relatively few details in its attestations, calling into question the effectiveness of its Proof of Reserves system which may give users a false sense of security.

Criticism 1: Intransparent Reserves Management

Obfuscation of Reserves Accounts

Instead of naming its exact depository institutions, TUSD attestations describe generally that its reserves are held in a Hong Kong depository institution (formerly disclosed as First Digital Trust), a Bahamian depository institution (formerly disclosed as Capital Union Bank), and a Swiss depository institution.

As a significant portion of TUSD reserves moved to offshore entities, the escrow account structure has become further obfuscated. TokenInsight reported on March 16, 2023, that Archblock, the prior operator of TrueUSD, has transferred $1 billion of the token’s reserves to Capital Union Bank in the Bahamas due to worsening banking conditions for crypto businesses in the United States. Capital Union Bank, located in Lyford Cay, Nassau, is an independent banking institution offering private banking services and is regulated by the Central Bank and Securities Commission of the Bahamas.

In addition, the recent addition of a note to the attestation indicates that Techteryx opened a corporate account with a Swiss depository institution on April 21st. The attestations disclose that the terms of the account do not explicitly provide important protections to TUSD holders, namely:

Funds in the account are escrowed on behalf of TUSD token holders

Agents are not entitled to funds in the account at any time

No amount deposited in the account shall become the property of Techteryx, the agents, or any other entity

No amount deposited in the account shall be subject to debts, liens, or encumbrances of any kind of Techteryx, the agents, or any other entity.

The relevant excerpt from the attestations is shown below:

The recent addition of this account further highlights the lack of clarity about the reserves held by Techeryx’s partners and the separation between the issuer and user funds. Such a setup is highly susceptible to commingling customer deposits or misappropriation of the corporate account.

In terms of the assets held with the unnamed custodians, the portfolio backing TUSD is disclosed in general terms as containing:

USD cash, cash equivalents and short-term, highly liquid investments of sufficient credit quality that are readily convertible to known amounts of cash. The Hong Kong depository institution also invests in other instruments to generate yield.

Source: TUSD Website

There is no further elaboration about the portfolio asset balances or the amounts held with each custodian beyond this general description. The Hong Kong account uses the nebulous phrase “other instruments”. There is no indication of the riskiness of the assets in this account and because the accounting for the purpose of attestation is disclosed “at cost”, it is possible these investments have experienced substantial depreciation that is not communicated by the attestations.

Readers are encouraged to compare the TUSD attestations (accessible from the TUSD website) with recent attestations by the primary competitors USDC (June 2023), USDT (June 2023), and USDP (June 2023). By comparison, these issuers disclose substantially more information about their custodians and their reserves portfolio.

Market Panic June 2023: Prime Trust is Shuttered

Prime Trust was a Nevada chartered trust company that provided B2B custody, escrow, compliance, fiat processing, transaction software, and other financial services. TUSD had had an ongoing relationship with Prime Trust since August 2019 when a partnership agreement was first announced. It utilized Prime Trust to make fiat transfers 24/7 for its stablecoin offerings, including TrueUSD (TUSD), TrueGBP (TGBP), TrueAUD (TAUD), and TrueCAD (TCAD).

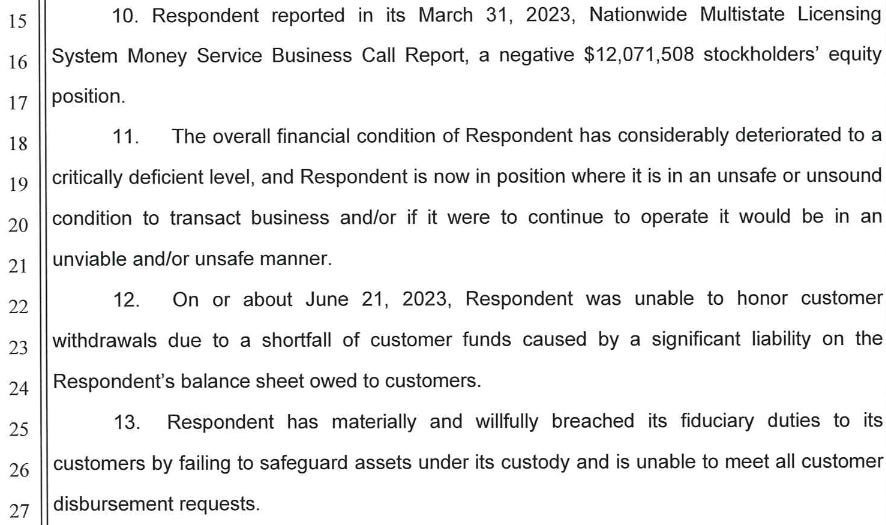

On June 21st, Prime Trust was ordered by the Nevada Department of Business and Industry FID to cease all activities as it was found to be violating state regulations. The firm’s financial condition was found to be critically deficient, leading to its inability to honor customer withdrawals and safeguard assets under its custody.

A botched upgrade to its wallet management system in 2020 apparently resulted in the discovery in December 2021 that Prime Trust had rendered funds in its legacy wallets inaccessible. It is alleged that Prime Trust began purchasing crypto with other users’ deposits to fulfill withdrawal requests. The Nevada FID found that the custodian owed its clients $85m in fiat currency while only having $3m available on hand. It claimed that Prime Trust was operating with a negative $12 million stockholder equity position and had become effectively insolvent.

TUSD Exposure to Prime Trust

Shortly before the Nevada FID’s order, rumors of TUSD insolvency were circulating in the market. TUSD announced on June 9th that it would pause minting via Prime Trust until further notice (other minting/redemption services were still available). The news triggered a relatively short-lived market panic.

TUSD subsequently experienced a sharp depeg on Binance US to a low of $0.80. This was notably not a market-wide depeg event. Binance US is distressed by battles with the SEC, trouble securing banking partners, and its own exposure to Prime Trust that have threatened reliable deposits and withdrawals from the exchange.

After the order, TUSD initially declared on June 22nd that they did not have any exposure to Prime Trust. On June 28th, following the TUSD reserves report, there was an apparent TUSD exposure of $26,000 in Prime Trust. Although the amount was negligible, there were reports of users unable to mint/redeem TUSD at the time which continued to cause panic as market participants remained on alert for possible additional undisclosed exposure. According to a representative from TUSD, the $26,000 is from random users having money in Prime Trust and the auditor put it on TUSD balance sheet- emphasizing that this balance actually has nothing to do with TUSD.

Reports on Failed Redemptions

Around the time of the Prime Trust failure in mid-June, reports began to circulate claiming that multiple users appeared unable to redeem TUSD and instead had their TUSD returned to their wallet. This was contrary to an announcement from TUSD on June 9th claimed that although mints via Prime Trust were paused, all other custodial partners were intact and there were no disruptions in minting or redemption services.

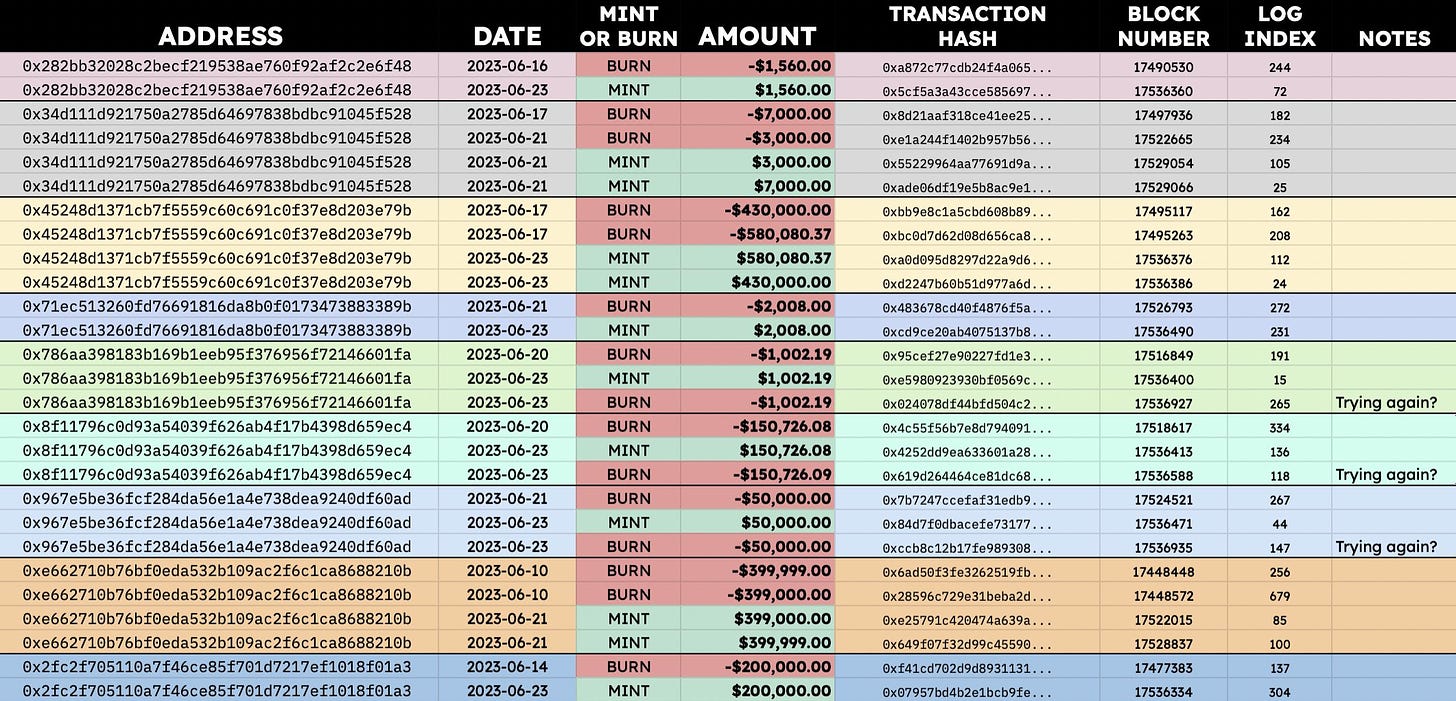

Prime Trust was shuttered on June 21st, which coincided with the reporting of redemption issues. Blockchain Analytics Firm @Chainargos and supposed former TUSD employee @willmorriss4 provided on-chain transactions of failed redemption attempts between June 10th and June 23rd:

A representative from TUSD responded that these transactions were from users attempting to send to Prime Trust, despite their public announcement that minting/redemption through Prime Trust had been suspended. They further emphasized that it continues to be possible for anyone to redeem TUSD 24/7 with no limits through its other custodial partners.

Criticism 2: Intransparent Attestations

LedgerLens Ripcord

Real-time attestations are provided by The Network Firm LLP through their LedgerLens Real-Time Reserves system. The service conducts daily queries on the total supply of TUSD across all chains (ETH, AVAX, BNB, TRON, BSC) and the total balances in accounts held by Techteryx’s custodians across several depository institutions, as shown in the following attestation report from July 28th:

Ripcord is an alerting system built into the attestation service that defines blocker conditions for automated attestation updates. They are used because occasionally the external APIs required for the attestations may be unavailable due to maintenance, downtime, or inaccuracy and ripcords automate checks on the System.

The four types of Ripcords (with emphasis on the “Balances” Ripcord) are:

Management: During the last reporting interval, Management had unacknowledged representations, assertions, or did not acknowledge the terms of the engagement.

Integrations: During the last reporting interval, the smart contract call returned an error, the exclusion of which would trigger the Balances ripcord (see below).

Pricing: Irrelevant for stablecoin attestations. Signifies an API error or non-response from the pricing source for applying a USD (or other fiat-denominated) value to collateral assets.

Balance: During the last reporting interval, responses, errors, or non-responses from third-party systems or accounts resulted in the sum total of liabilities being greater than the sum total of the assets. This may be due to normal operations such as temporary imbalances from the client opening a bank account that hasn’t been integrated. It may also be caused by an actual imbalance of liabilities and assets.

As the Prime Trust situation was unfolding, the “Management” Ripcord was triggered on June 13th, and later the “Balances” Ripcord was triggered on June 20th. TrueUSD clarified on June 22nd that the trigger was caused by a delay in adding a new banking partner’s API interface (which can be deduced to be the unnamed “Swiss depository institution”) and that attestations had returned to normal at that time. A representative from TUSD also remarked that they are only stablecoin with real-time attestation and the bank’s API was unable to reflect the amount in real time.

Earlier criticisms in March 2023 have pointed out that attestations for other stablecoin products, including TrueAUD, TrueHKD, TrueCAD, and TrueGBP have become increasingly stale, raising concerns about transparency. At the time of writing, the attestations for these stablecoins were last updated over a month ago on June 22nd and the “Management” Ripcord is currently triggered.

Chainlink PoR Integration Overview

TrueUSD utilizes Chainlink’s Proof of Reserve (PoR) technology to enhance the transparency and reliability of TUSD by regularly verifying the full collateralization of the stablecoin.

As illustrated in the figure above, the minting and redemption process depends on available reserves and involves the following steps:

The Network Firm, an independent accounting firm, initiates a request for USD-reserve data from TUSD’s escrow bank accounts using their LedgerLens attestation service.

The balance of USD reserves held in the escrow bank account is fetched by The Network Firm.

Chainlink, a decentralized oracle network, queries The Network Firm’s API off-chain.

Chainlink retrieves the USD reserve balance as reported by The Network Firm’s API.

If there is a deviation in the account balance, an on-chain transaction is performed to update the TUSD Proof of Reserve contract.

The TUSD token contract autonomously verifies the reserve on demand.

TUSD minting availability depends on reserves compared to TUSD supply:

If the TUSD supply exceeds the available reserves, the minting of new TUSD tokens is halted to ensure that the stablecoin remains fully collateralized.

If the TUSD supply is less than or equal to the reserves, the minting of TUSD tokens is permitted up to the unutilized reserves, maintaining the appropriate collateralization ratio.

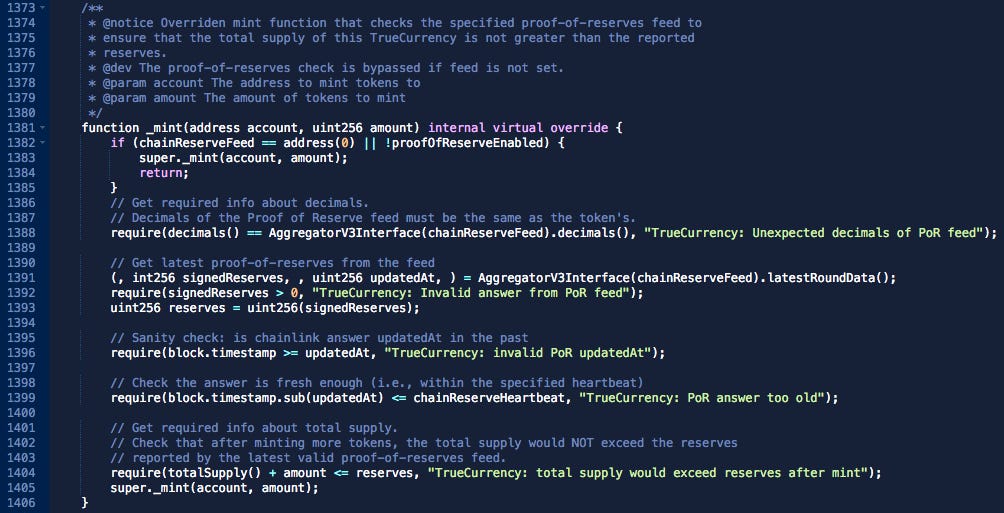

As shown below, the TUSD _mint function checks that reserve values fed from the chainReserveFeed are sufficient before allowing TUSD to be minted:

The integration with Chainlink claims to provide users with accurate and transparent information about the reserves backing TUSD, making it a more reliable form of collateral and payment across DeFi.

Stablecoin Attestation: An Incomplete Picture

The Network Firm’s reserve reports for TUSD provided through Chainlink’s PoR have limited transparency and do not disclose specific details such as:

full extent of the company's liabilities

banking relationships

backing portfolio composition

market value of reserves (reserves are calculated “at cost”)

making it difficult for users to fully assess the stability and legitimacy of the reserves.

The purpose of stablecoin attestations is to prove that the entire stablecoin supply is fully redeemable. Proof of Solvency can be achieved by proving that both reserves and liabilities have been fully accounted for.

Proof of Solvency = Proof of Reserves + Proof of Liability

While most liabilities for TUSD are available on-chain (i.e. issued TUSD), there may exist substantial off-chain liabilities. Stablecoin attestation providers, including The Network Firm (TNF), often provide reserve snapshots that do not capture the full extent of a company’s liabilities. Hidden or undisclosed liabilities can impact the availability and backing of the stablecoin, making a definitive proof of solvency a much more complex problem to solve.

As mentioned previously, the depository institutions in control of TUSD reserves are only disclosed in attestations as a Hong Kong depository institution, a Bahamian depository institution, and a Swiss depository institution. The portfolio backing TUSD is similarly vague, disclosing a portfolio containing USD cash, cash equivalents, and short-term, highly liquid investments of sufficient credit quality that are readily convertible to known amounts of cash (and the Hong Kong depository institution also invests in other instruments to generate yield).

The Network Firm LLP Trust Assumption

As disclosed in the Chainlink PoR datafeed for TUSD, the attestation data relies exclusively on The Network Firm LLP. The credibility and independence of auditors have been questioned, particularly considering The Network Firm’s association with Armanino, a firm that faced scrutiny due to its previous business relationship with FTX US.

The Network Firm issued a response to what it characterizes as “accidental or willful misrepresentations” resulting from its affiliation with Armanino. They highlight that The Network Firm is an independent CPA firm specializing in digital assets, distinct from Armanino. Many current team members were founding members of the Digital Assets Industry practice at Armanino. After FTX’s failure and controversies, Armanino decided to reduce attestation services in the digital asset space. The Network Firm LLP. was established in October 2022 with no equity interest from Armanino and only one founding member having worked on FTX US’s 2021 financial statement audit.

A representative from TUSD responded that the premise of this association amounts to FUD, as Armamino had a business relationship specifically with FTX US, which did not lose customer funds. It was also the auditor of Kraken and other large crypto platforms. Armamino stands behind its work with FTX US. Besides adverse media related to the association, there is no evidence that Armamino or The Network Firm have failed in their responsibilities or are guilty of any wrongdoing.

Final Note on PoR

While Stablecoin attestations are far from perfect and rely on trust in the auditor and stablecoin issuer to provide correct data and operate the business responsibly, they are a positive step to promote transparency and accountability. By voluntarily conducting and publishing attestations, TUSD demonstrates an effort to foster trust among users and regulators. It showcases a commitment to financial transparency and responsible practices.

On the other hand, there is some critical information that is not made public involving the custodial partners and relative exposure to each institution, the asset composition backing TUSD, and the company’s liabilities that may affect the TUSD backing. It’s important for users to grasp the trust assumptions involved when this information is not made public, and especially to appreciate the limited usefulness of a proof of reserves system like Chainlink PoR when so much remains undisclosed.

Llama Risk Recommendation

TUSD puts a remarkable amount of effort into building trust in its solvency through real-time attestations and on-chain proof of reserves. It is distinguished as being the first USD-backed stablecoin to programmatically enforce minting limits based on its off-chain reserves.

However, there are legitimate criticisms that Techteryx’s transparency policy is insufficient, as the issuer does not provide reasonable assurances regarding the solvency of the stablecoin. Compared to its competitors, TUSD offers minimal information about the state of its reserves. It does not disclose the names of its depository institutions, the balance with each custodian, or details about the contents of its portfolios. TUSD is currently the only Pegkeeper that does not disclose this information (compare recent attestations from USDC, USDT, and USDP).

The current Pegkeeper model can result in a crvUSD depeg or protocol accruing bad debt in the event of a Pegkeeper asset depeg. Given the existential significance of the Pegkeepers for the stability of crvUSD, special scrutiny must be placed on these assets and minimum requirements set. In general, prerequisites for Pegkeeper candidates include:

strong confidence in the peg from a technical, operational, and regulatory perspective and

the candidate should complement the basket of Pegkeeper assets by introducing diversity in issuers, custodians, and geographical jurisdictions.

To that end, candidates should be redeemable stablecoins with efficient arbitrage paths and should be observed to be in compliance with regulations in the jurisdiction of their operations. The overall Pegkeeper basket should not be concentrated in any single jurisdiction nor concentrated in white-label products (e.g. Paxos USDP and PYUSD) with the same underlying issuer and/or custodian.

We believe that until an upgrade to crvUSD Pegkeepers is implemented with precautions in place that mitigate the negative effects of Pegkeeper asset depegs, TUSD should not be included as a crvUSD Pegkeeper. Our reasoning is that we can not have informed confidence in the solvency of TUSD or its peg given Techteryx’s current transparency policy. The downside of reducing TUSD Pegkeeper max debt to 0 is reasonably small, as there are 3 other Pegkeepers with a total max debt of 75m. The maximum Pegkeeper debt utilized in the history of crvUSD since May has been 40.6m (on August 18th).

An argument to lower the max debt rather than reduce it to 0 may be to ensure the geographical diversity of the Pegkeepers. Increasing the proportion of Pegkeeper assets domiciled in the US may increase the risk associated with US regulation of stablecoins. If the DAO agrees with this line of reasoning, it would be advisable to set the TUSD Pegkeeper max debt to a conservative value of $5m.

Disclaimer: The facts, figures, and allegations presented in this report are derived from publicly accessible information. In accordance with our commitment to transparency and accuracy, we have reached out to TUSD team to solicit their input on the publicly available data. Upholding our policy, we neither dismiss nor favor any open-source data but aim to present findings impartially. We remain receptive to any further statements or clarifications from TUSD team and reserve the right to update sections of our report as deemed necessary.

This report is intended for informational purposes only and does not constitute financial, investment, or legal advice. The findings and conclusions drawn from the research are based on the available information at the time of analysis. Readers are encouraged to conduct their own due diligence and seek professional advice before making any financial decisions or investments based on the content provided in this report.

Thanks for this comprehensive report! I fully agree with your conclusion, as it seems to be a riskier stablecoin than the other three. But it's also important to not fully rely on the US (USDP,USDC)