CRV Collateral Risk in DeFi Markets

Analyzing CRV lending markets before and after the July 30th liquidity crisis

Introduction

CRV is listed as a collateral type on a number of DeFi lending platforms including Aave, Abracadabra, Fraxlend, Silo, FiRM, and Cream. There had previously been concerns raised in various governance forums about the risk of CRV overexposure since the on-chain liquidity has historically been far less than CRV supplied as collateral.

The hypothetical concerns became a reality when several Curve pools were hacked on July 30th, rendering the primary on-chain liquidity hub for CRV (the CRV/ETH pool) inoperable. Immediate actions were taken by several DeFi lending platforms that realized their platform may not have liquidity available to process potential liquidations. The responses by these lending protocols and the state of CRV as a collateral asset after the liquidity crisis are the subject of this report.

Curve Pool Hack

On July 30th, Curve Finance experienced a significant exploit that affected several pools due to a vulnerability in some versions of the Vyper programming language. This resulted in losses to Curve pool LPs totaling over $70 million. A small subset of pools were affected by the exploit, including Alchemix’s alETH/ETH pool, JPEGd’s pETH/ETH pool, and Metronome’s msETH/ETH pool. Most significant for the purpose of this report is the CRV/ETH pool exploit, which held the vast majority of on-chain CRV liquidity. crvUSD contracts and associated pools were notably not affected by the attack.

The exploit was attributed to a reentrancy vulnerability in Vyper versions 0.2.15, 0.2.16, and 0.3.0 that affected Curve pools paired with ETH (WETH-paired pools were not affected). Reentrancy attacks can drain all funds from a contract when multiple functions are called recursively. In Curve’s case, the exploit was able to recursively supply and withdraw liquidity to the pool before burning the LP tokens, allowing it to infinitely mint LP tokens and extract assets from the pool. For a postmortem analysis of the Vyper hack's effect on Curve pools, refer to the Llama Risk Curve Pool Reentrancy Exploit Postmortem July 30th, 2023.

Liquidity on Curve had been on a downtrend in the months preceding the hack. During the event, overall TVL dropped from $3.24B to a low of $1.68B, or a 48% decline. Many protocols and users withdrew liquidity as a derisking measure, and the TVL has since been relatively stable with a slight decline.

In response to the exploit, the DeFi community initiated a rescue operation involving white hat hackers to recover as many stolen funds as possible. To date, all pools except the CRV/ETH pool have fully recovered stolen funds, although the affected pools consequently suffered additional MEV losses as the pools were not fully drained and were left imbalanced from the hack. In some cases, such as Alchemix and Metronome, a Coinbase validator was tipped hundreds of ETH that was extracted as MEV from LPs (570 ETH from Alchemix and 247 ETH from Metronome). Coinbase has refused to return funds to the affected LPs, and it is likely impossible to completely recover MEV losses. Curve is compiling a full list of affected LPs and intends to fill the hole by vesting CRV over 1 year to LPs for the value of funds lost.

Impact on CRV

The incident caused panic across the DeFi ecosystem and led to a decline in Curve DAO’s CRV price by over 30% in the period immediately following the exploit, dropping from $0.73 to $0.503 within a day. The loss of the CRV/ETH pool had severe consequences on CRV liquidity, as it was the primary venue for on-chain CRV liquidity. This combination of factors created a potentially dire situation for DeFi lending markets that listed CRV as collateral. The declining price with low liquidity greatly increased the risk that lending protocols could not liquidate in a timely manner and may assume significant amounts of bad debt.

On-chain liquidity is crucial for lending markets primarily (among other reasons) for liquidations. In DeFi lending platforms, loans are over-collateralized, meaning borrowers must provide collateral worth more than the borrowed amount. If the value of the collateral falls (relative to the borrowed asset), it may be liquidated to ensure the loan’s integrity. Adequate liquidity ensures that these liquidation events can occur smoothly without significantly impacting the market price.

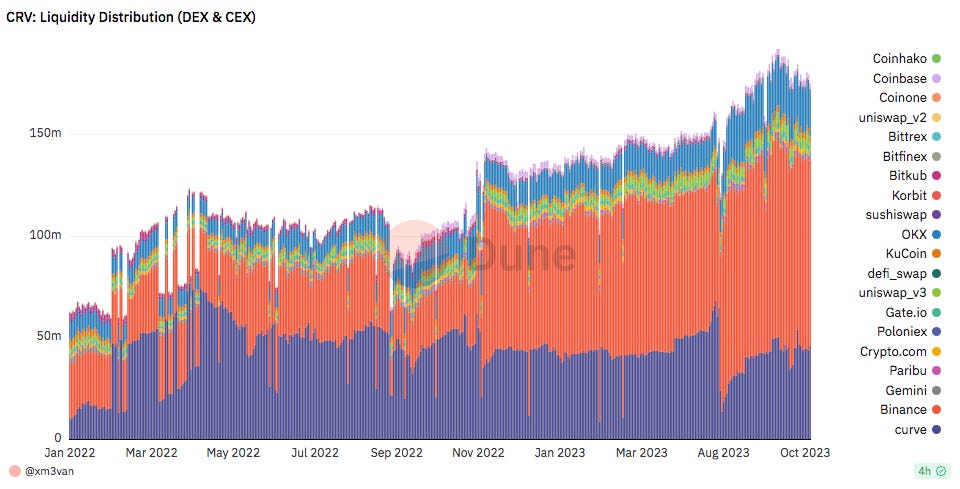

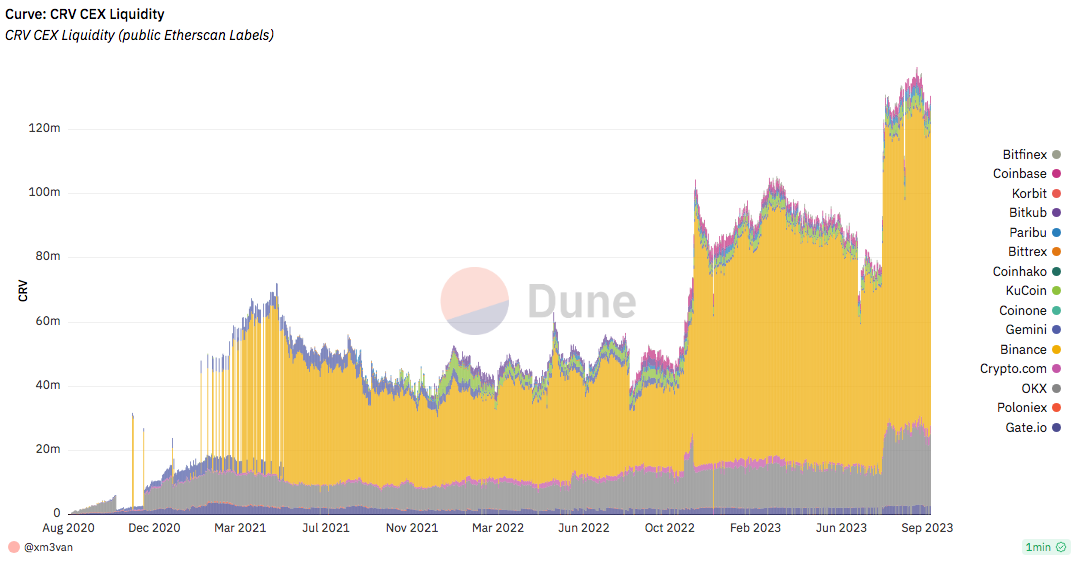

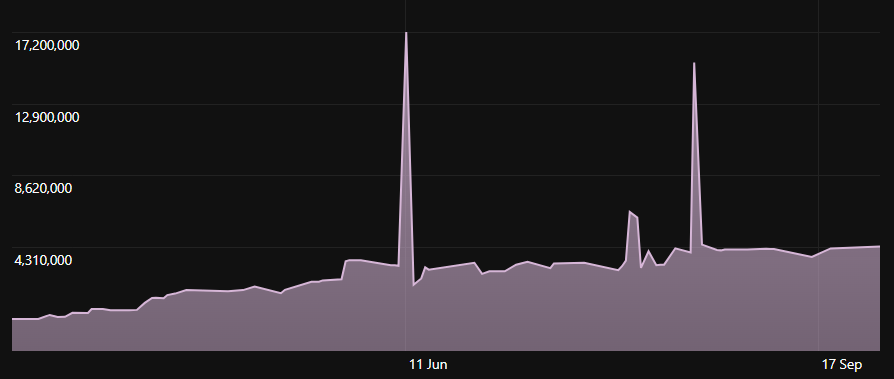

The overall distribution of CRV on exchanges is shown below to have a high concentration on CEXs like Binance and OKX, and the concentration on CEX has greatly expanded since the Curve pool hack:

Note: The distribution is based on publically labelled exchanges addresses available on Etherscan

This price drop put pressure on Curve founder Michael Egorov’s outstanding CRV-backed loans to various DeFi protocols. He began taking action to prevent the potential liquidation of his DeFi loan positions, which had the potential to cause bad debt for multiple projects due to the limited on-chain liquidity of CRV liquidity on Ethereum.

Concerns were raised across the DeFi industry, particularly from Aave, given that Aave’s Safety Module relied on a Balancer pool and staked AAVE as a source of funds in case of a shortfall event. Forced liquidation of CRV could trigger market declines in both AAVE and CRV, leading to a cascade of liquidations and bad debt across platforms using either token as collateral.

On-chain evidence indicated that Egorov engaged in a series of over-the-counter (OTC) transactions to secure his positions. He sold 106 Million CRV tokens by August 3rd to over a dozen OTC buyers at a rate of $0.40 per token for a total of $42.41 million. Egorov’s OTC transactions helped him pay down his stablecoin loans, improving the health of his positions across multiple protocols.

The impact of the hack and the resulting awareness of liquidity risks and a concentration of borrowers led to a reevaluation of CRV as a collateral asset across lending protocols. This research aims to assess the impact and consequences of the event for DeFi lending markets and CRV’s role as a collateral type.

Impact on CRV On-Chain Liquidity

For this analysis, we focus on the largest DEX pools that do not involve veCRV derivatives such as cvxCRV, sdCRV, or yCRV. In the event of liquidation, protocols require a path to exit CRV exposure, which is not offered by liquid veCRV pools.

See below the distribution of CRV across DEX pools. Pairs with cxvCRV, sdCRV, and yCRV have been removed from the chart to show the high concentration of on-chain CRV liquidity in pools paired with veCRV derivatives:

Before July 29th, 2023

Prior to the Vyper hack, the primary liquidity venue to enter/exit CRV exposure on Ethereum was the Curve CRV/ETH pool, which has been deprecated since the pool exploit on the 30th of July.

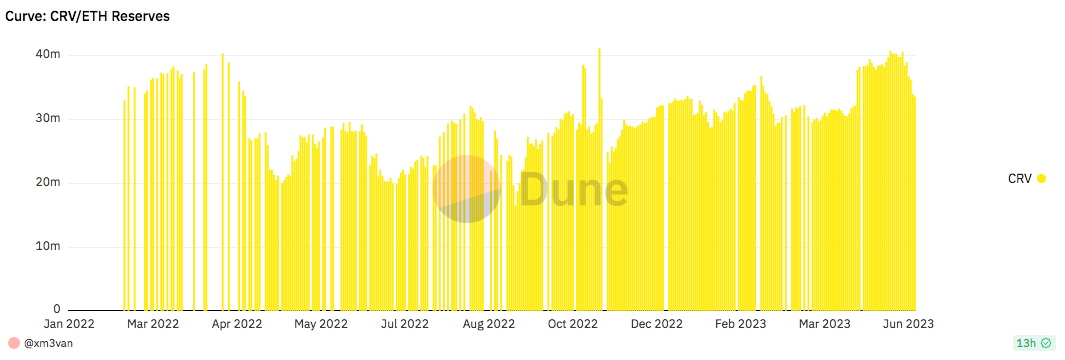

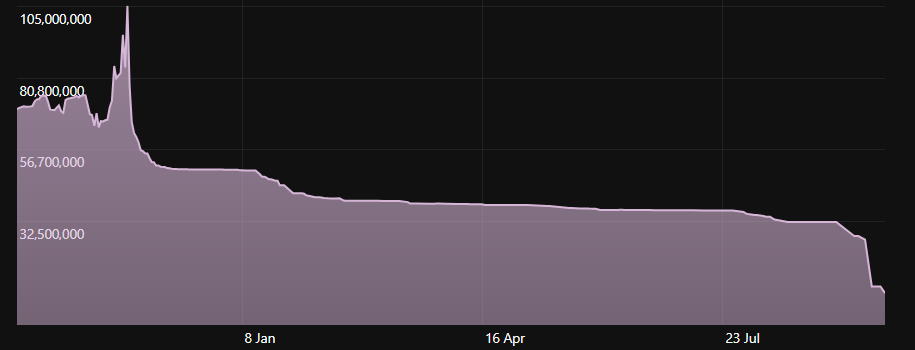

Reserves

Prior to the hack, the CRV/ETH Curve pool had reserve balances of 14,515.37 ETH and 33,606,598.50 CRV.

CRV/ETH ETH Reserves

CRV/ETH CRV Reserves

Note: The gaps in reserves result from the data retrival technique, caused by calling call_balances.

CRV/ETH TVL

The USD-denominated TVL was ~$50 Million before the hack.

After July 30th, 2023

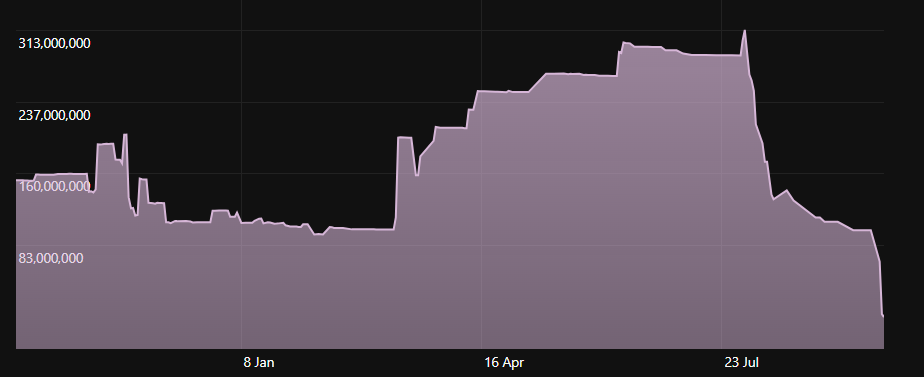

After the hack, a new pool gained traction as the primary liquidity venue on Ethereum. This is the TriCRV pool composed of CRV, WETH, and crvUSD.

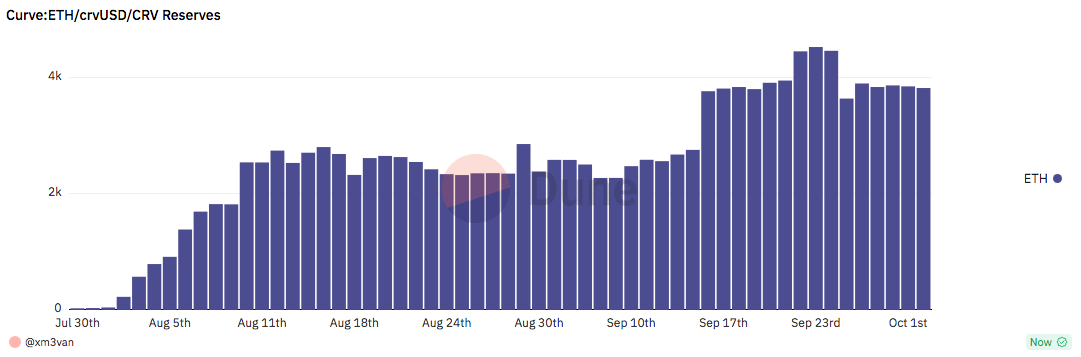

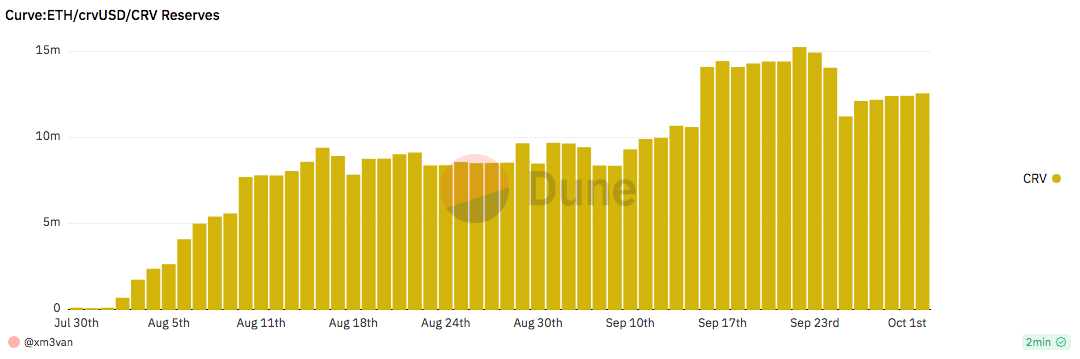

Reserves

The TriCRV pool saw a steady increase in nominal units of the respective assets since its inception on the 30th of July as it replaced the deprecated CRV/ETH Pool.

TriCRV WETH Reserves

TriCRV CRV Reserves

TriCRV crvUSD Reserves

As of September 23, 2023, the pool contains 4,517.99 ETH, 14,942,429.41 CRV, and 7,208,009.79 crvUSD. While not entirely congruous to compare nominal units to the previous CRV/ETH pool due to the difference in pool structure, ETH assets in the pool are ~30% of the pre-hack quantity and CRV ~44%.

TriCRV TVL

The TriCRV pool, at the time of writing, has $21.3m USD in TVL and thus has approximately regained 40% of the previous CRV/ETH Curve pool TVL.

Overall, the dominant liquidity venue for users needing to enter/exit CRV exposure has shifted from the CRV/ETH pool to the TriCRV pool. It has shown a strong trajectory to begin recouping a similar liquidity dominance as the previous pool.

Impact on Curve CEX Liquidity

In order to determine CEX liquidity, we filtered known exchange addresses from the top 1000 Holders on Etherscan and accounted for their CRV balances over time. While not a perfect metric for the liquidity of CRV on exchanges, it gives a general idea as exchange addresses usually custody user funds.

Before the Hack

According to our chart, CRV liquidity on centralized exchanges is concentrated on Binance (~75%) and OKX (~15%). This seems consistent over time even even as the overall quantity on exchanges dramatically increased after the Curve hack.

During and After the Hack

On the 30th of July, the day of the hack, we saw a substantial increase in CRV tokens flowing into known exchange addresses. Notice that the distribution of CRV tokens across exchanges remained largely the same with OKX (~20%) and Binance (~70%) redistributing slightly.

A likely explanation for this behavior is that since the primary on-chain liquidity venue had failed (the hacked CRV-ETH Pool), liquidity fled to exchanges to manage the risk and trade volatility that the CRV token was experiencing.

Response from DeFi Lending Platforms

At the time of writing, DefiLlama lists 6 protocols that offer lending markets for CRV. These include Aave, Silo Finance, Fraxlend, Inverse Finance (FiRM), QiDAO, and Abracadabra. Each platform took swift action in the wake of CRV’s liquidity crisis. Responses to the hack and in regard to CRV as a collateral asset have varied across the ecosystem, ranging from aggressive offboarding as a derisking measure to onboarding and expanding market share.

Aave

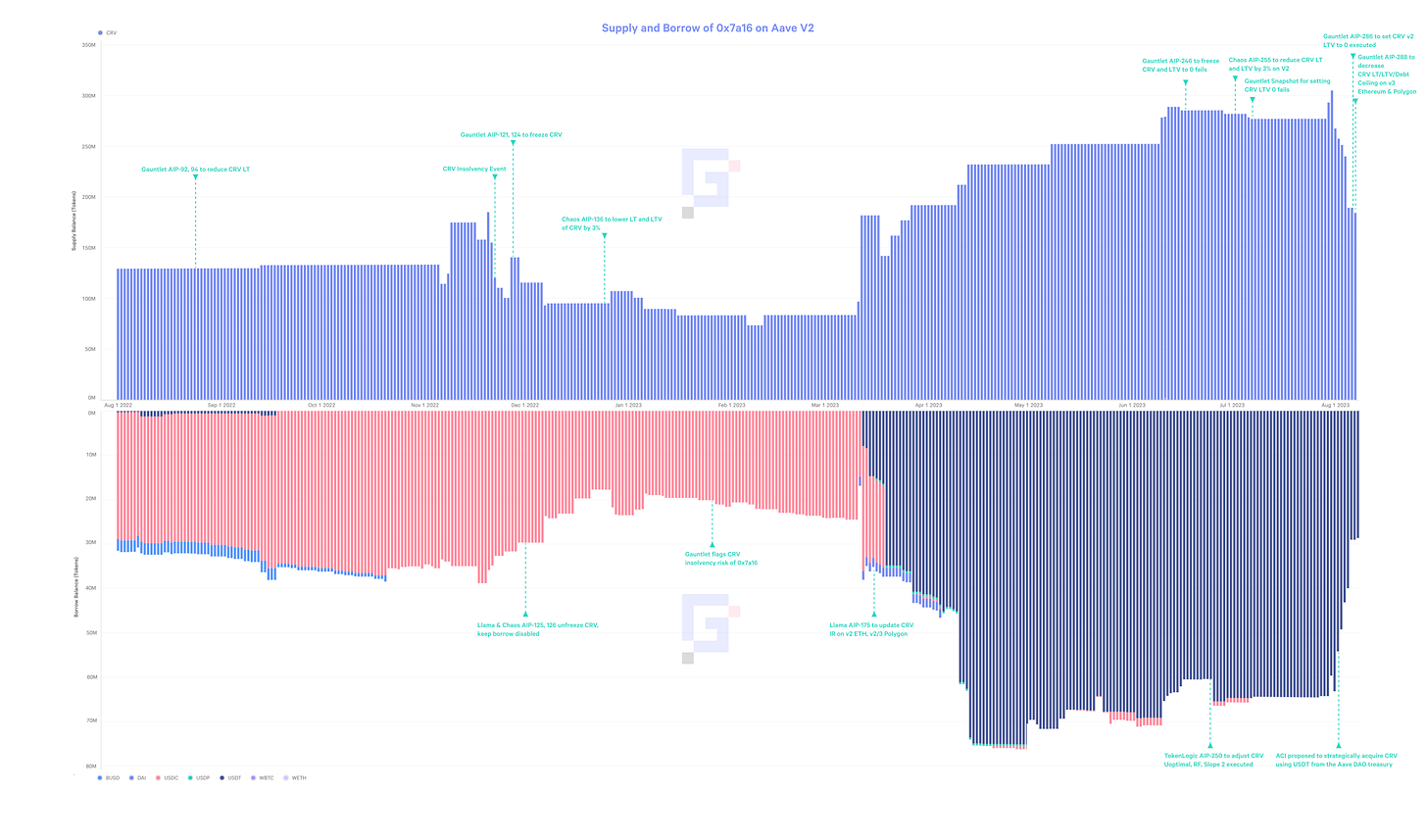

Aave had previously been subjected to a CRV short attack by Avi Eisenberg in November 2022 that threatened to saddle Aave with bad debt due to insufficient CRV liquidity. The target was a CRV-backed loan on Aave that Avi attempted to force into liquidation, the magnitude of which would have exceeded Aave’s ability to process liquidation. This instigated substantial debate around the risk management of CRV within the Aave governance forum. A full timeline of recommendations from risk management firms Gauntlet and Chaos Labs, and actions taken on the platform regarding CRV, show that there has been debate to reduce protocol exposure to CRV since August 2022.

Central to the debate was a position by Curve founder Michael Egorov, which had borrowed up to $67.7m in stablecoins against $185m worth of CRV by June 2023, with an HF of 1.66. The highly concentrated position, at the time, had been rapidly expanding, causing trepidation from Gauntlet that prompted recommendations to freeze the CRV market and reduce protocol exposure. Despite prolonged debate on the subject, there were unfortunately minimal mitigating actions to reduce protocol exposure until after the CRV liquidity crisis on July 30th.

An overview of the largest CRV-backed position on Aave over time:

Initial Attempts to Reduce CRV Exposure Prior to Vyper Hack

Throughout 2023, there was an ongoing discussion and debate between risk analyst firms Gauntlet/Chaos Labs and the Aave community regarding the best approach to manage CRV risk on the Aave platform. The major events and changes that materialized within the protocol prior to the Vyper hack can be summarized as follows:

November 22, 2022: Aave CRV Market short attack leaves the protocol with $1.7m in bad debt.

November 27/28, 2022: Gauntlet executed AIP-121 and AIP-124, freezing CRV on V2 Ethereum and V2 Polygon.

November 30, 2022: Chaos Labs and Llama proposal overturned AIP-121 with AIP-125, resulting in the unfreezing of CRV (with CRV collateral deposits still enabled). However, CRV borrowing remained disabled on V2 Ethereum.

June 15, 2023: Chaos Labs proposed a 3% reduction in LT and LTV for CRV on Aave V2. This proposal was executed in AIP-255 on July 3, 2023.

June 18, 2023: Gauntlet published AIP-246 to freeze CRV and set CRV LTV to 0, which failed with 423,695 AAVE against.

July 9, 2023: Chaos Labs proposal AIP-264 is executed, reducing CRV LT/LTV by 5% on V3 Polygon.

July 10, 2023: Chaos Labs proposal AIP-266 is executed to increase the CRV reserve factor by 5% (making interest rates for lenders less favorable).

July 21, 2023: Chaos and Gauntlet increased the supply cap of CRV on Polygon V3 via the Risk Steward process.

Before the Vyper hack, community consensus on how to deal with Aave’s CRV Market was divided, with some proposals undoing previously approved AIPs. Risk management and the threat of CRV illiquidity were perceived with less urgency, despite frequent recommendations put forward by Aave’s risk management service providers.

Sentiment Shift After Vyper Hack

Community consensus shifted radically after the Vyper hack that resulted in severe liquidity issues and price volatility for CRV, threatening Aave with unserviceable liquidations and the potential for significant bad debt to the protocol. The following events took place:

August 6, 2023: AIP-286 is executed, setting CRV LTV to 0 (removing the ability to open or increase borrow positions using CRV collateral).

August 9, 2023: AIP-288 is executed, reducing CRV LT from 61% to 41% (reducing the liquidation threshold in this case did not result in any accounts becoming liquidatable), LTV from 55% to 35%, and debt ceiling from $20m to $5m on V3 Ethereum. It also reduced CRV LT from 75% to 65% and LTV from 70% to 35% on V3 Polygon.

August 14, 2023: Chaos Labs proposal AIP-293 is executed to disable CRV borrowing for Ethereum and Polygon V3. Gauntlet and Chaos Labs align on bi-weekly CRV LT reductions and execute AIP-292 to reduce CRV LT by 6% to 49%.

August 19, 2023: Gauntlet proposal AIP-297 is executed to freeze the CRV market on Aave V2 Ethereum. This prevents new CRV borrowing and supply but doesn’t prevent users from increasing their borrowing against existing CRV collateral up to the CRV Liquidation Threshold.

August 28, 2023: AIP-305 is executed, reducing CRV LT by 2% to 47%.

September 5, 2023: Gauntlet and Chaos Labs recommend no change to CRV LT.

September 13, 2023: Gauntlet and Chaos Labs recommend no change to CRV LT.

September 27, 2023: AIP-326 is executed, reducing CRV LT by 2% to 45.

The overall strategy for reducing exposure has involved using the LTV, LT, and market freeze levers. Measures were taken to halt additional exposure by setting LTV to 0, freezing the market, and periodically decreasing the LT over time. LT adjustments are potentially destabilizing, as adjustments can make loans eligible for liquidation. Analysis has been done on a weekly basis to ensure volatility and other market conditions allow Aave to safely reduce LT.

Interestingly, a governance vote passed with a relatively narrow margin that approved to use of 2m aUSDT from the Aave treasury to purchase 5m aCRV as part of the OTC deal with Michael to put toward paying down his loan. On September 27th, Michael, whose Aave position was central to the debate over protocol CRV exposure, completely unwound his loan by repaying $11m USDT.

Impact to CRV on Aave

Borrow of CRV - AAVE V2

Borrow of CRV - AAVE V3

The amount borrowed has been in decline on Aave V2 since the attack by Avi and has been continuously decreasing. Given the deprecation plan for CRV on Aave V2 and the overall trend to incentivize migration to Aave V3, this trend can be expected to continue. The plan gradually phases out CRV by decreasing the Liquidation Threshold, which is a parameter indicating when a user’s borrow position might be liquidated if the collateral value falls below a certain percentage relative to the loan.

Borrowing on Aave V3 has not seen significant demand and the market has a more conservative 41% LT, 35% LTV, and a $5m debt ceiling. With the successful AIP-288 that reduced market parameters, the trend is likely to continue. The AIP reduced the CRV Liquidation Threshold from 61% to 41% for Ethereum and 75% to 65% for Polygon, effectively making it “easier” to be liquidated. In addition, the Loan-to-Value ratio decreased from 55% to 35% on Ethereum and 70% to 35% on Polygon, allowing a user to borrow less from CRV collateral. The overall debt ceiling also fell from $20m to $5m on V3 Ethereum.

CRV Deposits - Aave v2

CRV Deposits - Aave v3

Declining patterns can be seen in the amount deposited into V2. Notice especially from 9/24 to 9/26 that the CRV supplied dropped precipitously from over 100m to under 20m. Shortly after the Vyper hack, the LTV was set to 0. This effectively means new positions cannot be opened that utilize CRV as collateral. Aave V3 deposits have gained adoption as a functional alternative for a CRV market, although deposits have stagnated since the Vyper hack.

The series of Aave governance proposals after the Vyper hack on July 30th has led to a reduction in CRV supply and its use as collateral on the platform. Since the Vyper hack, the CRV market underwent a freeze and a reduction in its Loan-to-Value (LTV) ratios, which affected its utility as collateral and borrowing capacity. Additionally, governance discussions have explored various options for managing CRV, including its deprecation schedule. These developments signal an effort to restrict protocol exposure to CRV in a regulated manner. As a result, CRV’s role in the Aave ecosystem has been substantially reduced over the course of recent months.

Fraxlend

Contrary to Aave’s mitigation strategy, the Frax Community did not debate the adjustment to the protocol risk parameters. This can be largely explained in that the Fraxlend model, which involves siloed pairs governed by market forces, seemingly does not require active DAO intervention.

Fraxlend, as explained by its developer Drake Evans, is a lending protocol with isolated lending pairs, providing several unique features to protect both lenders and borrowers. These features include:

Isolated Lending Pairs: Fraxlend’s pools are isolated lending pairs, meaning issues with collateral or bad loans are contained within individual pairs. This isolation reduces risk for all participants.

Non-Borrowable Collateral: Collateral within Fraxlend pools cannot be borrowed, further enhancing security for lenders and borrowers.

Interest Rate Control: Fraxlend uses a PID controller for interest rates, allowing rates to respond to market dynamics without requiring governance intervention. This ensures that interest rates adjust according to supply and demand.

Dynamic Debt Restructuring: In case of bad debt, Fraxlend adjusts the virtual price of fTokens immediately. This mechanism helps maintain pool functionality and prevents panic in the market.

Socializing Losses: Instead of triggering an exodus of lenders during bad debt events, Fraxlend socializes losses across all lenders.

Incentivized Liquidations: Liquidators receive an extra 1% fee for making clean liquidations, where the liquidation results in a borrower’s collateral balance reaching zero. This incentivizes liquidators to protect the protocol.

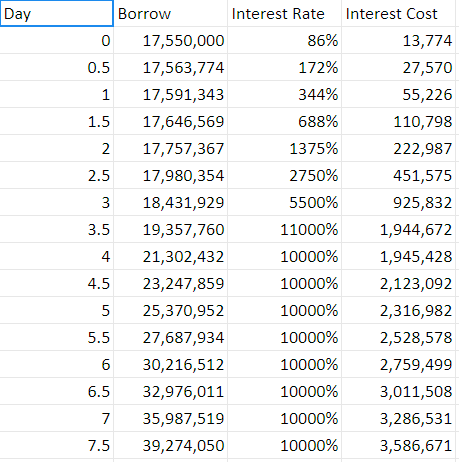

Fraxlend’s use of a PID controller for interest rates played a pivotal role in prioritizing its debt repayment over other lending protocols. This controller gradually escalates interest rates for borrowers, motivating them to make partial repayments and effectively reducing the utilization rate and interest rate.

Fraxlend Response

Thanks to a highly aggressive interest rate policy, borrowers are incentivized to repay their Fraxlend loan before any other venues. At 100% utilization (as it was during the liquidity crisis), the interest rate would double every 12 hours to a max of 10,000% over 3.5 days. Michael’s loan on Aave was charging 4% interest on July 31st, while the Fraxlend loan was charging 81%. Left unattended, the position could have reached liquidation in under 5 days.

Loan repayments were quickly initiated. Users began withdrawing liquidity as soon as it was repaid, causing initial issues with managing the rate. As a measure to stabilize liquidity, a fFRAX/crvUSD Curve pool was created with a Curve gauge added on August 8th. The pool would incentivize LPs to maintain positions on Fraxlend, allowing the interest rate to stabilize.

Ultimately, the interest rate spike was short-lived. Below is the borrow APY of the CRV Fraxlend market, showing the brief interest rate spike that has since stabilized around 12% APY:

The Frax Community was not required to intervene during the event, but it did take the opportunity to acquire discounted CRV tokens, approved by a Snapshot vote. Through an OTC transaction, 1 million FRAX from the Frax DAO treasury was approved to purchase 2.5m CRV. The acquired CRV tokens will be staked in veCRV (via Frax’s authorized locker) and/or cvxCRV to boost Frax’s presence in the Curve ecosystem for future growth.

Impact to CRV on Fraxlend

CRV Collateral

CRV Collateral dipped briefly on the 30th but subsequently rebounded and is supplied at higher levels than before the hack.

FRAX Borrow Amount

Frax borrowing against CRV experienced a sharp decline after the 30th of July, suggesting the rapid repayment of loans. However, since August 6th, borrowing has expanded and is relatively stable, suggesting no further impact or changes for the CRV Market on Fraxlend.

Note: When looking at the Fraxlend CRV market, it is easier to determine the borrowing against CRV collateral, as we are dealing with an isolated lending market. In contrast, Aave allows positions backed by a basket of multiple assets.

Fraxlend, with its unique features and governance by market forces, stands out from other lending protocols like Aave. Its mechanisms, such as isolated lending pairs, non-borrowable collateral, and the use of a PID controller for interest rates, make it adaptive and resilient against market shocks. Despite minor perturbations observed in the CRV collateral and the FRAX borrow amount around the end of July, the CRV market on Fraxlend remains generally unaffected.

Silo Finance

Silo’s platform has many similar design characteristics as Fraxlend and has, in fact, pioneered some of the significant features adopted by Fraxlend. These include isolated lending markets routed through a bridging asset, user control of whether their collateral is borrowable, and a dynamic interest rate model first introduced in June 2022.

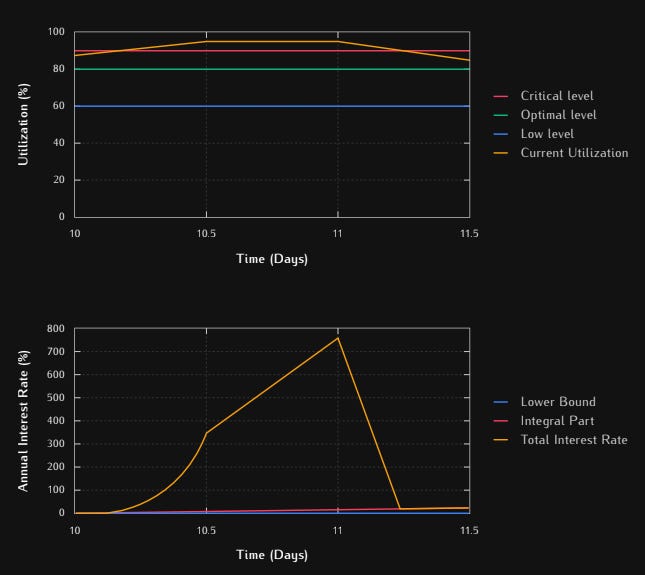

The Silo interest rate model is designed to sharply increase APR once a specified critical utilization rate threshold is breached, to continuously increase the APR for the duration it remains above the critical range, and to quickly return to baseline after dropping below the critical range. This model would perform much like Fraxlend was observed to have performed during the CRV liquidity crisis.

crvUSD is assigned an interest rate model stableHighCap as described in the Silopedia Interest Rate Model Configurations. With this config, a utilization of over 90% constitutes critical utilization (ucrit). The APR will exponentially increase for each percentage point utilization increases above ucrit and will continue to linearly increase for the duration that utilization remains above ucrit.

Impact to CRV on Silo

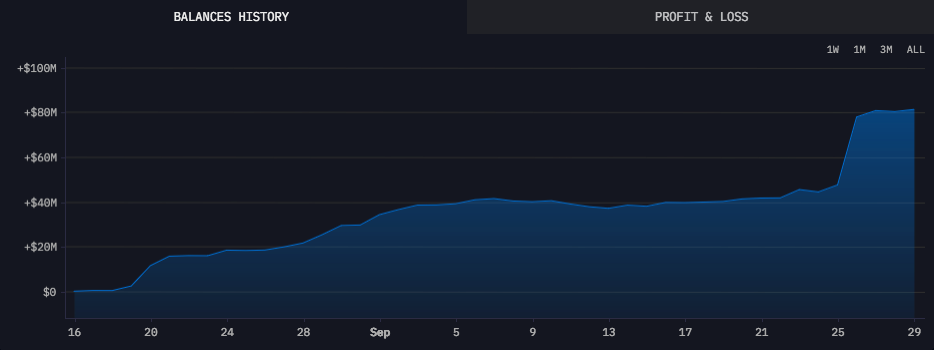

Silo Finance has substantially increased its exposure to CRV as other platforms like Aave and Abracadabra have been aggressively offboarding it. The platform has 2 markets supporting CRV as a collateral type: the mainnet silo paired with ETH and XAI and the LLAMA silo paired with crvUSD. As the former is a legacy product that no longer needs support, a proposal and subsequent vote were made to burn available XAI in that silo. The vote was executed on August 27th.

The LLAMA market is a fork of the original Silo protocol that makes use of crvUSD as the bridge asset. Its launch was announced on August 18th. There is a substantial amount of CRV that has since migrated to the CRV LLAMA silo with over 143m CRV deposited as of 9/29/23. The high level of adoption may be attributable to the platform’s preferential treatment toward Curve, pairs with crvUSD, and the relatively favorable market parameters compared to other platforms (50% max LTV/65% LT). There are also additional incentives for supplying crvUSD liquidity.

Shown below is the growth of the CRV LLAMA silo since inception, which currently contains 141.4m CRV and 9.54m crvUSD:

Silo has overtaken Aave as the primary venue for CRV as collateral. Whereas Aave had maximum exposure to CRV in June with around 300m CRV, it now contains less than 20m.

Abracadabra

Abracadabra introduced the CRV cauldron on December 1st, 2022 enabling users to borrow against CRV as collateral. The market set out with an interest rate of 18%, no borrowing fee, a Minimum Collateral Ratio (MCR) of 75%, and a liquidation fee of 10%. It started out with an initial debt ceiling of 10 million MIM. Shortly after introduction, the interest rate was reduced to 11% for whitelisted users and the mint limit of the CRV cauldron was increased from the initial 10m MIM to 15m MIM. In April 2023, the debt ceiling was again increased to the CRV Caldron to 20 Million MIM.

On June 27th, 0xthespaniard highlighted on the governance forum that CRV's illiquidity at the time could not withstand “6M liquidation before everything spirals down”, resulting in cascading liquidations. Although there was recognition from the community that this was a viable concern, no action was taken.

Abracadabra Response

On August 1st, shortly after the exploit, AIP 13.4 titled ‘Emergency Freeze of the CRV Market Liquidation’ was the initial community response. Romy, an Abracadabra contributor, proposed to authorize Abracadabra DAO to swiftly switch the CRV pricing oracle to prevent accidental token sales during market turbulence, ensuring the safety of CRV tokens and minimizing associated risks.

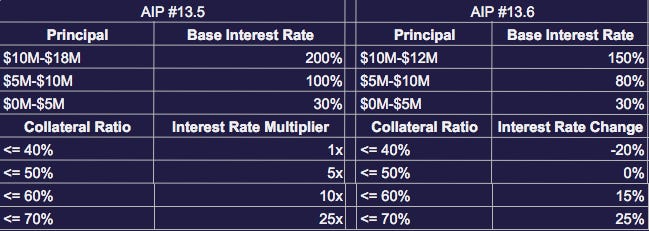

Later that day, Romy followed up with a second proposal aimed at reducing the risk exposure of the Abracadabra protocol to CRV. AIP 13.5 proposed a dramatic interest rate increase on the CRV cauldron with an amendment in AIP 13.6 that proposed less extreme (although still highly aggressive) parameter changes.

A side-by-side comparison of proposed interest rate models in AIP 13.5 and 13.6 is shown below:

The proposal introduced a tiered interest rate structure based on the combined outstanding principal of both CRV cauldrons. The key objective was to prevent unnecessary compounding of principal interest, a move intended to reduce negative externalities associated with these positions compared to a straightforward interest rate hike.

The collateral-based interest mechanism behaves such that interest will be charged directly on the cauldron’s collateral. This interest would then immediately flow into the protocol’s treasury, bolstering the reserve factor of the DAO. Once in the treasury, the collateral can be converted into MIM through on-chain transactions or with the help of off-chain partners.

The initial version of the proposal (AIP 13.5) did not immediately pass and was slightly amended with a less aggressive Base Interest Rate and Interest Rate Multiplier. AIP 13.6 suggested applying discounts based on factors such as principal size, position health, and on-chain liquidity. For instance, the collateral ratio and on-chain liquidity conditions would determine further adjustments to the base interest rate. The response of the community largely expressed support for this proposal. The proposal passed on August 05, 2023.

Impact on CRV Cauldron

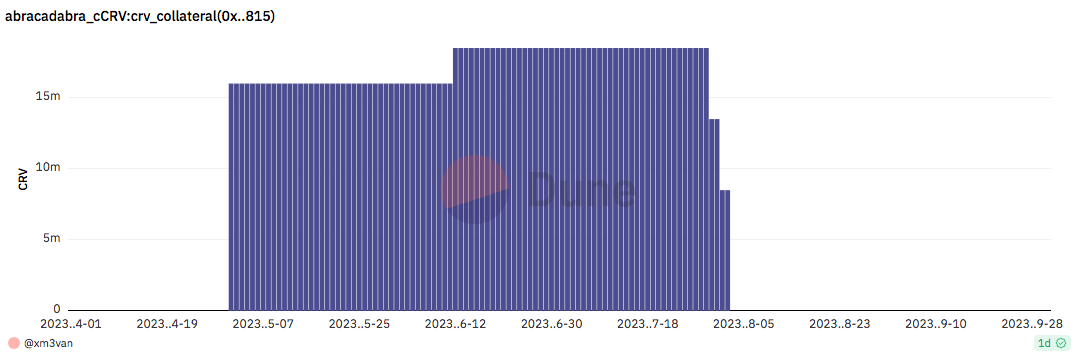

CRV Collateral

The CRV cauldron reached a peak in mid-June 2023 with nearly 80m CRV deposited. On July 30th, MIM debt was quickly repaid and all CRV was withdrawn from the system within a week. This was just one day after Abra governance completed its vote to substantially increase the interest rate on the cauldron.

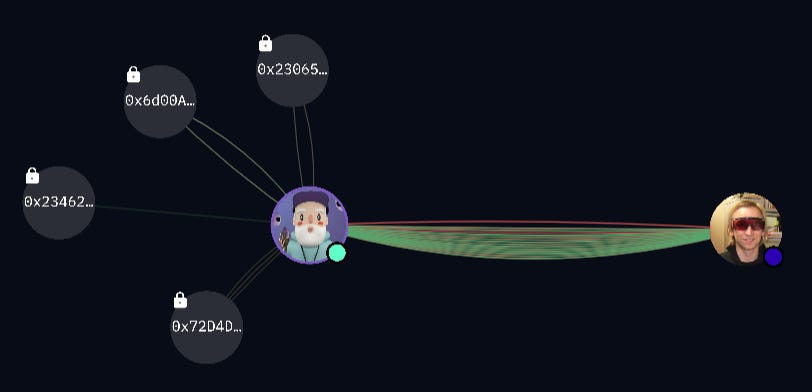

Shown below are interactions involving CRV and the Abracadabra platform. Nearly all deposits and interactions with the CRV cauldron have historically been from Curve founder, Michael Egorov:

In summary, the proposed changes introduce a tiered interest rate structure based on the outstanding principal of CRV assets within the protocol. The parameter changes were exorbitant, apparently made with the intention to encourage the sole user to quickly exit the platform. Although the approved interest rate hike apparently did not come into effect (all CRV was withdrawn before the execution of the proposed changes), the highly aggressive publicized intention seems to have effectively nullified Abracadabra’s CRV market.

Inverse Finance (FiRM)

On August 10th, an initial forum post by edo on behalf of nour proposed to adjust parameters within the FiRM protocol to reduce exposure to CRV and CRV-derivative collateral, to mitigate the risk of cascading liquidations, and to incentivize borrowers to repay their FiRM loans, thus reallocating their DOLAs (FiRM’s stablecoin) to AMM Feds.

To achieve these objectives, the proposal suggested the following changes:

Pausing new borrows on CRV, cvxCVV, and st-yCRV markets to prevent additional loans backed by these collaterals.

Reducing the liquidation factor of these markets to 20%, limiting the extent of collateral seized during liquidations.

Reducing the maximum DBR (Debt to Borrow Ratio) streaming rate from 20 million/year to 12 million/year, turning DBR supply deflationary until FiRM’s global debt reaches $12 million/year.

Community members provided mixed feedback on the proposal. The proposal was ultimately put up for vote on August 18, 2023, and executed on August 23 with the changes proposed in the initial proposal.

Impact on CRV FiRM Markets

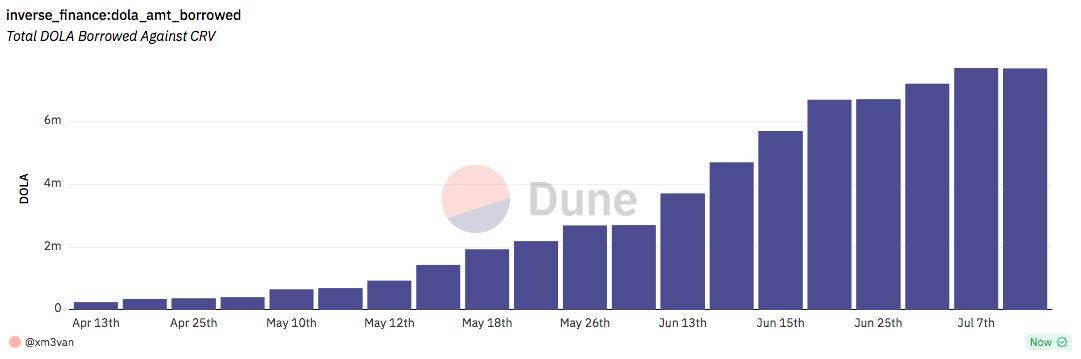

DOLA Borrow Amount

The DOLA amount borrowed did not seem to be affected by changes made in the August 23rd governance vote. However, in theory, reducing the maximum DBR will limit the amount of DOLA that can be minted by collateralizing CRV and therefore reduce utility.

CRV Collateral

The CRV collateral provided has not been affected by changes made in the August 23rd governance vote. However, preventing new borrows against CRV collateral should limit the utility of CRV.

The proposal in theory should reduce protocol exposure to CRV. However, empirically there have been no observed changes in DOLA borrows or CRV use as collateral.

Cream Finance

In direct contrast with other lending platforms that sought to minimize CRV exposure during the liquidity crisis, Cream announced on August 5th that it had added Ethereum markets with CRV as a central collateral asset. The announcement claimed the move was motivated to support Curve. No community discussion was found other than the Twitter announcement.

This surprising announcement may have been related to a backroom agreement made with Jeffrey Huang, aka Machi Big Brother, who has ties to Cream and had acquired 3.75M $CRV OTC from Curve Founder Michael Egorov. Cream Finance also purchased 2.5m CRV OTC.

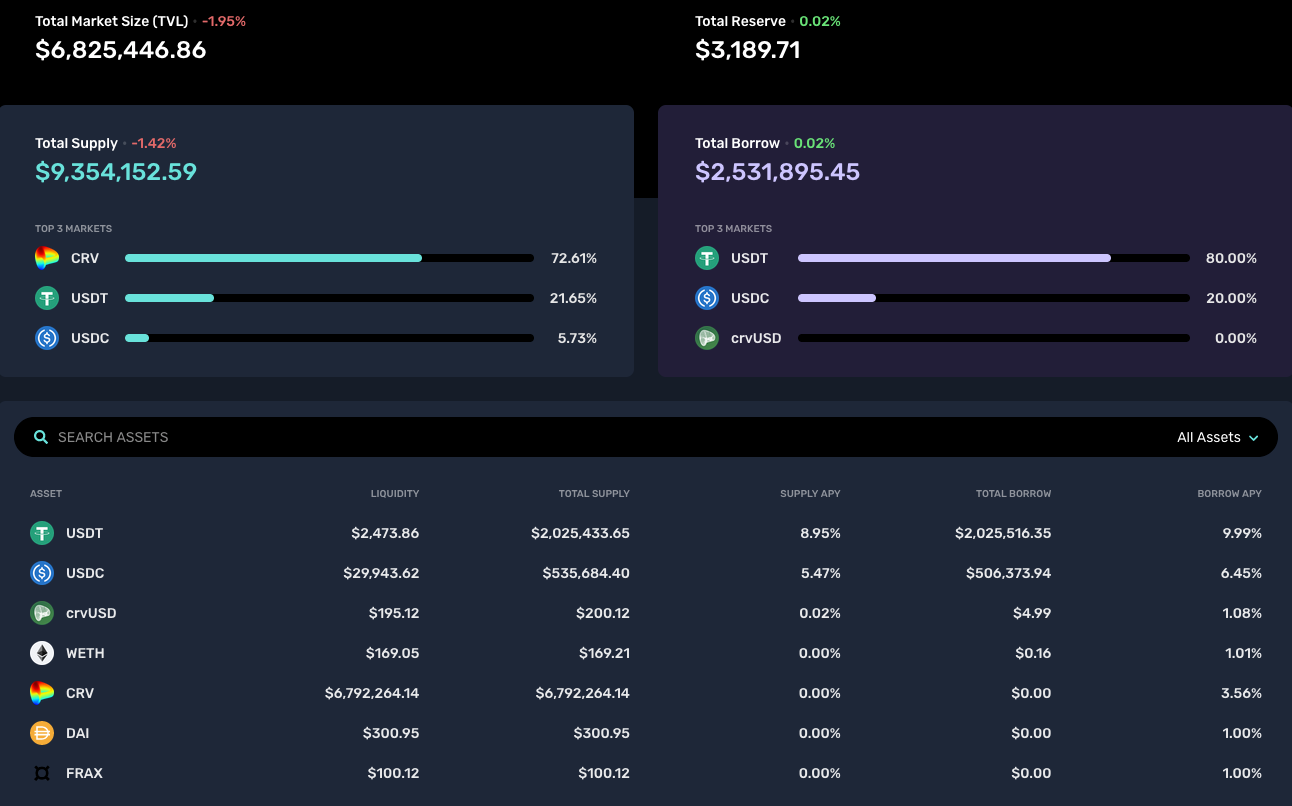

CRV is currently the market’s single active collateral type, with 13m CRV supplied. The position has borrowed ~$2.5m of USDT and USDC. Although technically a DeFi market with permissionless access, the market appears to behave more as a personal line of credit. There is a single position of any substance and it has withdrawn nearly all the borrowable liquidity. Likely the market was deployed to help alleviate pressure from other platforms like Abracadabra and Frax that posed a risk of unsustainable interest rates on their CRV markets.

Conclusion

Analyzing the repercussions of the Curve controversies on various platforms offers a panoramic view of the DeFi ecosystem’s resilience and adaptability. If nothing else, the CRV liquidity crisis serves as an excellent case study for risk management and good design practices for DeFi lending markets.

There have been radically different responses across platforms depending on both technical features of the protocols and governance decisions of the respective communities. The most notable players are Aave, Abracadabra, Fraxlend, and the LLAMA Silo.

Aave’s long-drawn governance debates and adjustments to CRV markets underline the challenges associated with managing such assets in the ever-evolving DeFi landscape. Abracadabra similarly required governance action to handle the crisis, to which its community reacted with a highly aggressive offboarding strategy. By contrast, Fraxlend’s unique interest rate mechanism showcased a protocol design that could autonomously limit exposure to assets during a crisis. Other protocols like Silo have chosen to embrace CRV as a collateral type, creating the most favorable conditions that have precipitated a migration to the platform and making it the primary venue for CRV lending today.

While the initial shockwaves of the Curve exploit led to significant on-chain liquidity reductions for CRV, there were signs of recovery in the weeks that followed. The shift from the CRV/ETH pool to TriCRV as the dominant liquidity venue has managed to recoup approximately 30% of the ETH and 50% of the CRV that became unavailable on-chain immediately after the incident.

While liquidity on-chain remains quite low, lending platforms are advised to take a measured approach to onboarding CRV as collateral to avoid similar pitfalls in the future. To attain status as a quality collateral type, CRV markets should continue to be fostered on Curve as well as on alternative venues, paired with assets that facilitate liquidations (ie. less concentration of liquidity paired with veCRV derivatives).

Glossary

1. LTV (Loan-To-Value): This is the ratio of the value of the debt over the value of the borrower’s col- lateral.

2. LT (Liquidiation Threshold): This is maximum collateralization ratio over specific assets. If a user exceeds the liquidation threshold, then they are available to be liquidated