Interest Rate Model of the crvUSD MetaMorpho Vault

The AdaptiveCurve IRM and how it auto-balances for the benefit of both lenders and borrowers in crvUSD vault markets

Links

Introduction

Last week we introduced the crvUSD MetaMorpho vault, a vault managed by Llama Risk consisting of Convex-wrapped TriCrypto LP / crvUSD lending market pairs. These markets allow Curve and Convex users to gain leverage on their TriCrypto LPs and to take advantage of Curve ecosystem yield opportunities. This includes CRV + CVX gauge emissions from their Convex-wrapped collateral and a variety of crvUSD yield opportunities across various DeFi applications like Curve Lending and Sturdy Finance.

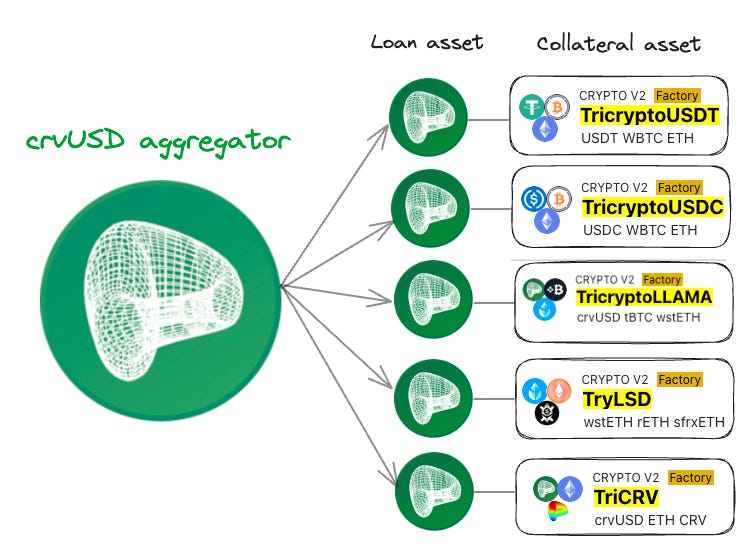

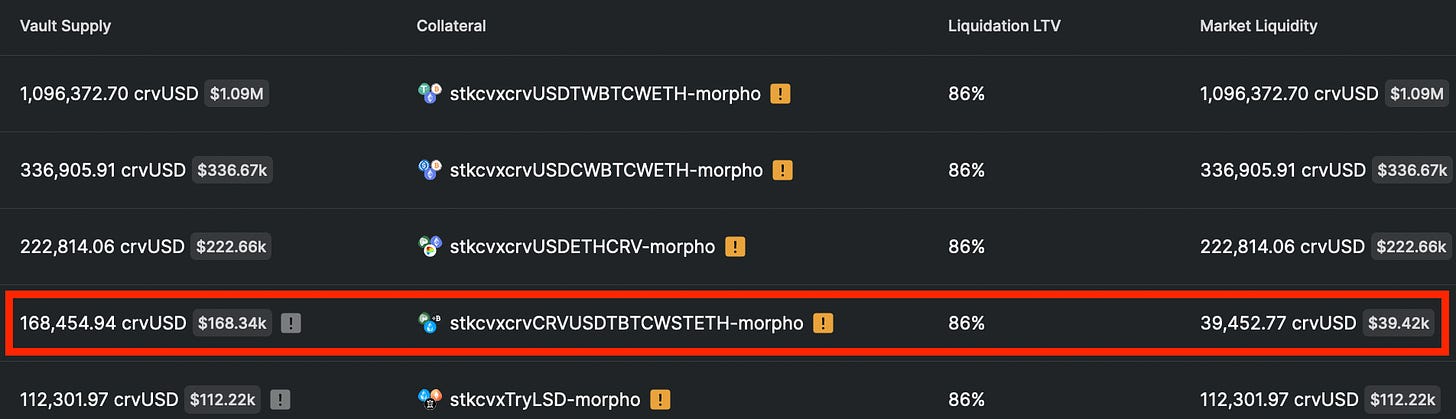

Users who wish to gain leverage on TriCrypto positions they already have may deposit to Morpho by withdrawing from the Curve or Convex gauge and depositing the vanilla LP to Morpho (It will be wrapped to Convex under the hood). Users who do not already possess TriCrypto LPs may visit the Curve Pools UI to deposit a variety of accepted tokens into Curve TriCrypto pools. For a quick recap of the whitelisted vault markets, check the image below:

This post will explain the AdaptiveCurve interest rate model (IRM) used within these markets, and how it offers an advantageous experience for borrowers, especially given that the recently deployed vault has ample crvUSD liquidity and the markets currently offer extremely low borrow rates with a gradual, time-based mechanism in response to changing borrowing behaviors.

Current Vault Market Conditions

To give an overview of the vault conditions as of this post’s publication, let’s look at the supply and utilization of each vault market. You can also look at updated data about vault markets on our crvUSD MetaMorpho Vault Dune dash.

The Vault Supply shows the total crvUSD allocated to each market while Market Liquidity shows how much crvUSD is currently available to borrow. Notice the crvUSD/tBTC/wstETH TriCrypto market is the only market that currently has open borrow interest and utilizes 76.57% of the total Vault Supply.

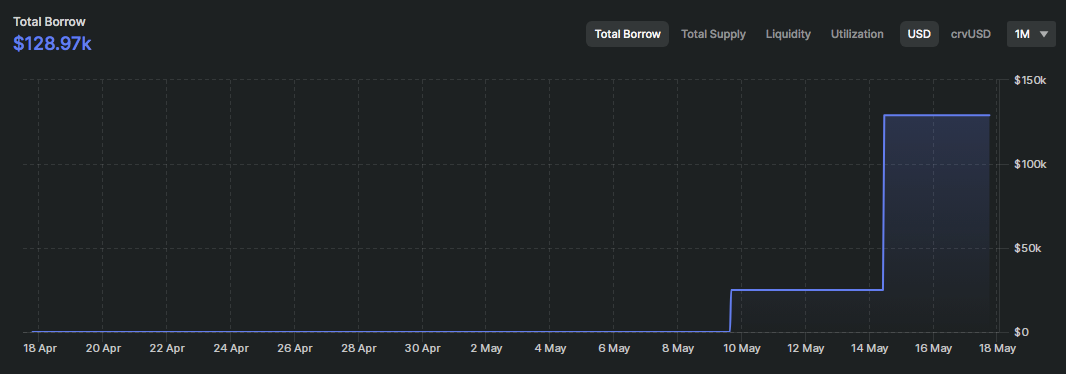

Additional information can be found on the specific market page, revealing that one user has borrowed ~129k crvUSD over several days.

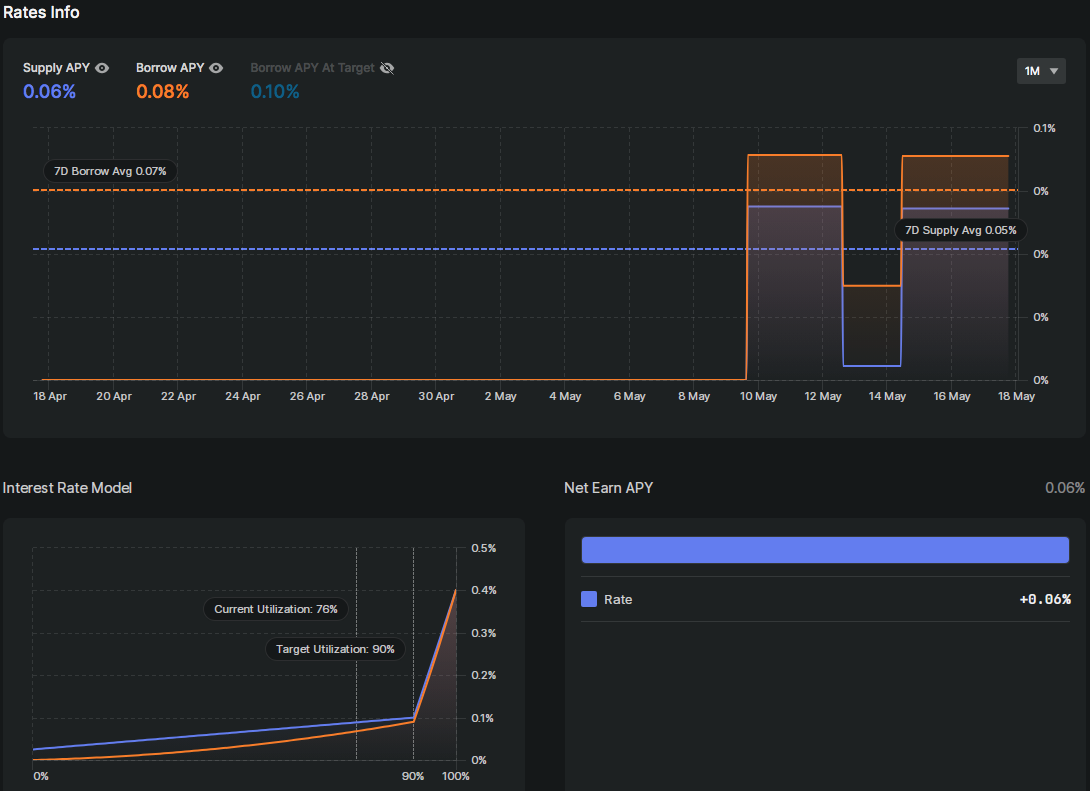

The rates info shows information about the borrowing rate over time and the target utilization, which is set at 90%. The user is currently borrowing for 0.08% APY and the market utilization is below the target rate of 90%.

This is currently a highly favor condition for borrowers, who can leverage the upside potential on tBTC/wstETH, earn Convex rewards in the form of CRV + CVX, and potentially take advantage of crvUSD yield opportunities. All at very favorable rates, even with a 76% market utilization.

This is a great situation for borrowers, but lenders may be getting a raw deal. Currently, there is a co-incentive program between Morpho and Curve to reward crvUSD lenders in the vault, but this is temporary and the vault’s viability depends on a sustainable equilibrium for both borrowers and lenders. That is why the interest rate model (IRM) is critical and leads to our discussion of how the IRM works in our vault to regulate supply and demand.

IRM: AdaptiveCurve

The crvUSD vault uses what Morpho calls an AdaptiveCurve IRM. It is designed to incentivize a market equilibrium at a target 90% utilization. The design principle requires the IRM to be fully automated with immutable parameters so it can programmatically respond to market behaviors without requiring manual intervention. This means that Llama Risk nor Morpho can make any changes to the IRM, making it ideal for permissionless MetaMorpho markets.

The MetaMorpho docs explain the two complementary mechanics, which we will also describe here.

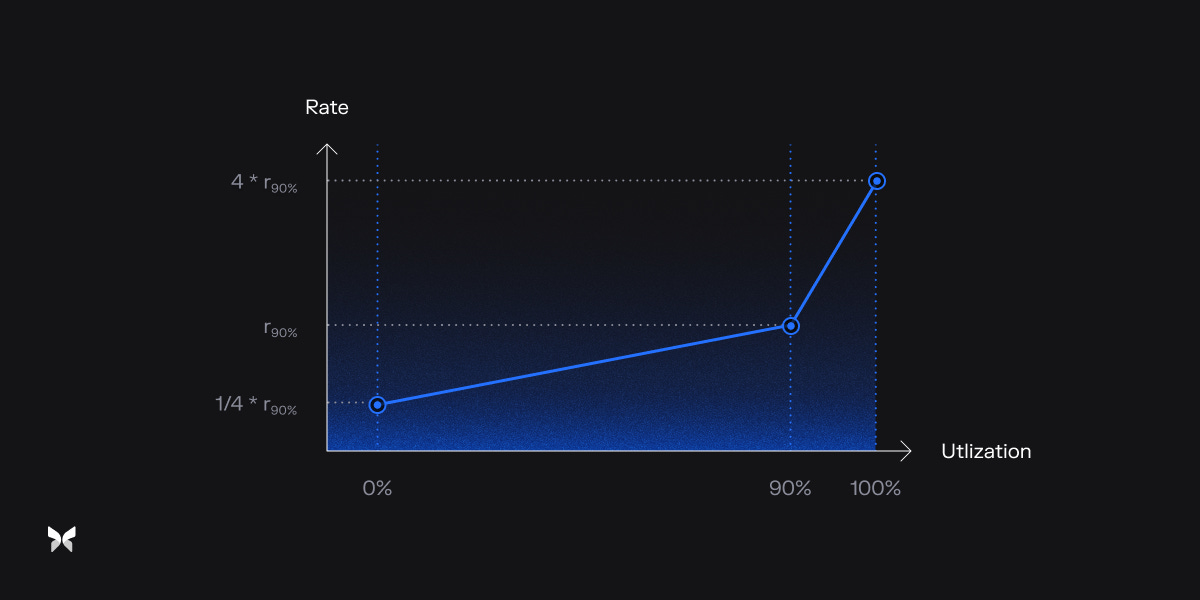

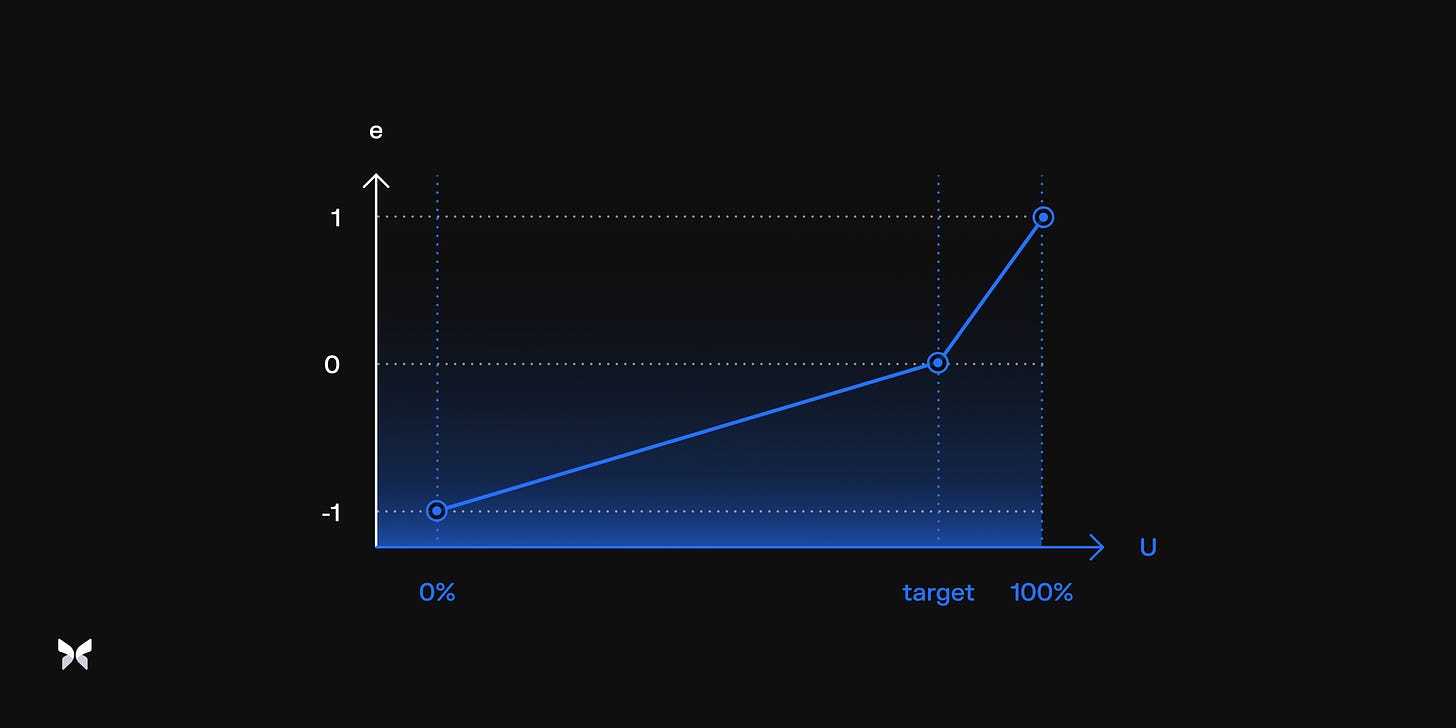

The Curve Mechanism is a standard mechanism users are likely familiar with in other pooled lending markets. The curve is designed with a gradual slope below the target utilization to accommodate borrower interest below the target. The borrowing rate at 0% utilization is 1/4 the rate at 90% with a linear increase.

At the 90% target, there is a kink that rapidly increases the borrowing rate from the target rate to 4x the target rate at 100% utilization. This incentivizes borrowers to repay their loans and/or lenders to allocate to the market.

Source: Morpho Docs This is one of our responsibilities when managing the crvUSD vault- to ensure utilizations are managed across markets to both optimize yields for vault lenders and stabilize rates for borrowers. Notice the borrow rate target listed above shows a 0.1% target rate for borrowers in the crvUSD/tBTC/wstETH market. This means a maximum rate at 100% utilization is a mere 0.4% APY. This brings us to the “Adaptive” component of the IRM design…

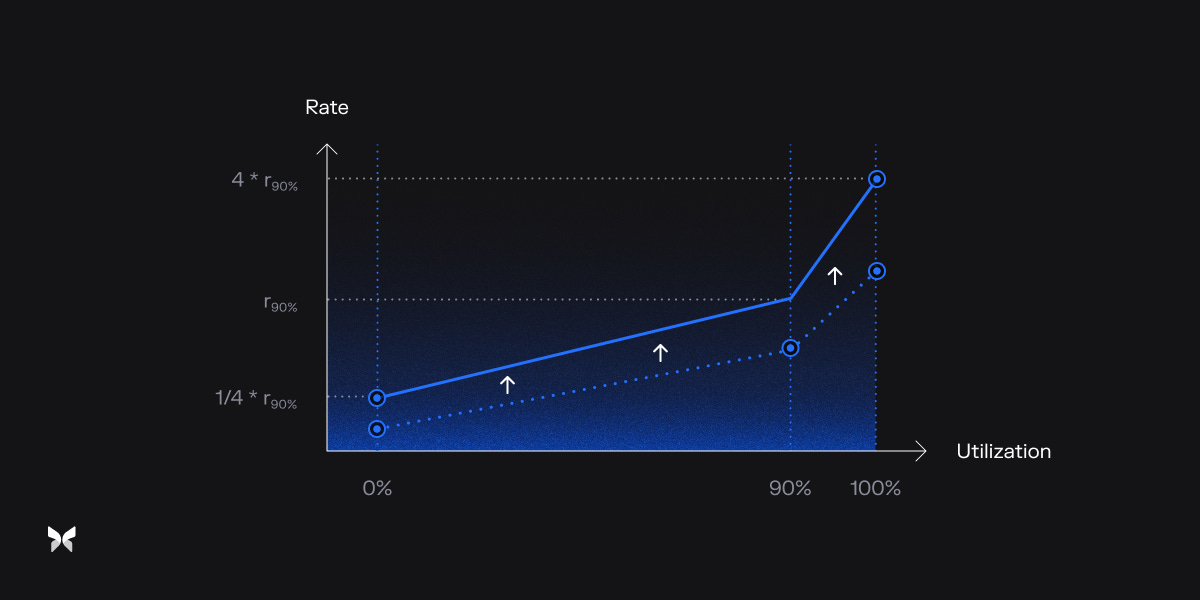

The Adaptive Mechanism makes a vertical adjustment to the overall IRM curve over time in response to changes in market behavior. The static curve on its own may not account for such changes and may result in constant 100% utilization (when rates are low compared to rates globally) or constant low utilization (when borrow demand is lower than the curve can reasonably adapt to.

When the utilization exceeds 90%, the adaptive mechanism shifts the entire curve upward. When it is below 90%, the mechanism shifts the entire curve downward. These are incremental adjustments that take place over time. The speed of the adjustment is determined by how far the utilization is from the 90% target. This timescale helps provide a superior experience for borrowers, who will not immediately be affected by dramatic changes in market behavior. It does, however, allow the IRM to explore changes in behavior and programmatically determine a new equilibrium.

Source Morpho Docs This should help elucidate the behavior observed in the current borrow rates in the crvUSD/tBTC/wstETH market. Although the max borrow rate appears to be 0.4% at 100% utilization, the max rate can increase substantially if utilizations remain above 90% for a prolonged period. The 0.4% current max effectively gates the immediate rate change that can occur as a result of market illiquidity and/or rapid change in borrower behaviors. This offers a superior experience for borrowers to respond leisurely to these possibly rapid changes.

Adaptive Mechanism Speed

An important consideration is precisely how quickly can the adaptive mechanism be expected to change. This is important for both market participants and for risk managers like Llama Risk who are expected to manage the availability of liquidity in each vault market.

First, note that the adaptive mechanism performs continuously- not just when there has been an interaction with the market. Also, as mentioned previously, the adjustment speed is determined by how far the market utilization is from 90%. From the Morpho Docs: “For example, if the utilization remains at 100% for 5 days, r90% [the borrow rate at 90% utilization] will progressively double. This is the maximum speed at which r90% can move.” To further clarify, the r90% value would double over the 5 days, while the APR at 100% utilization would be 4 * r90% (e.g. if r90% is 5% and utilization spikes to 100%, r90% would be ~10% after 5 days while the overall borrow rate would be 40% if the 100% utilization were to persist).

The IRM calculates the Error, which is the difference between the utilization and the target, divided by a normalization factor. The normalization defines a distance between utilization 0%→90%→100% as -1→0→1, and targeting an Error of 0.

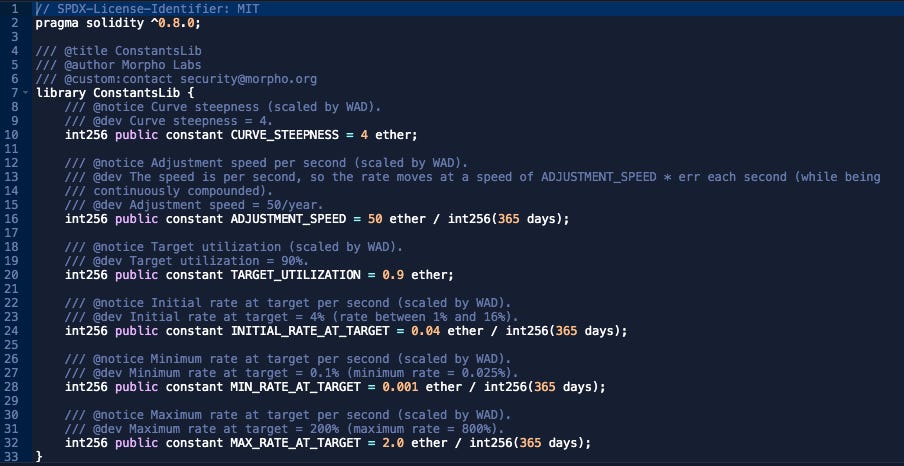

The ConstantsLib.sol stores constants relevant to the IRM calculation. Note the ADJUSTMENT_SPEED * ERROR, continuously compounded each second, defines the speed of adjustment to the curve (in seconds). Overall this gives the formula speed(t)=exp(ADJUSTMENT_SPEED * err * elapsed).

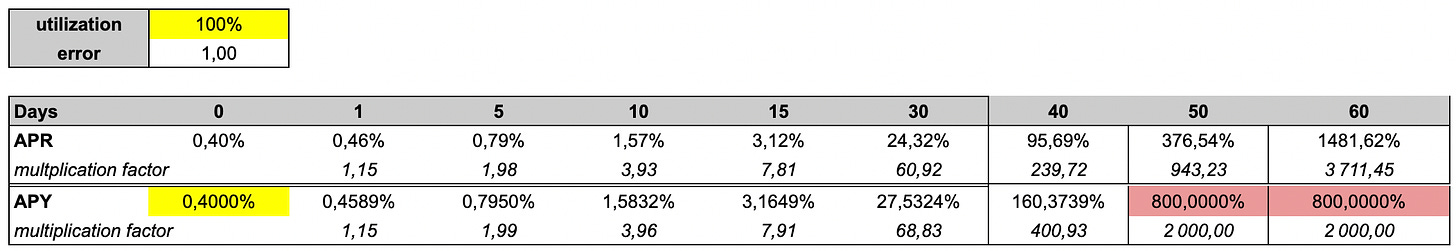

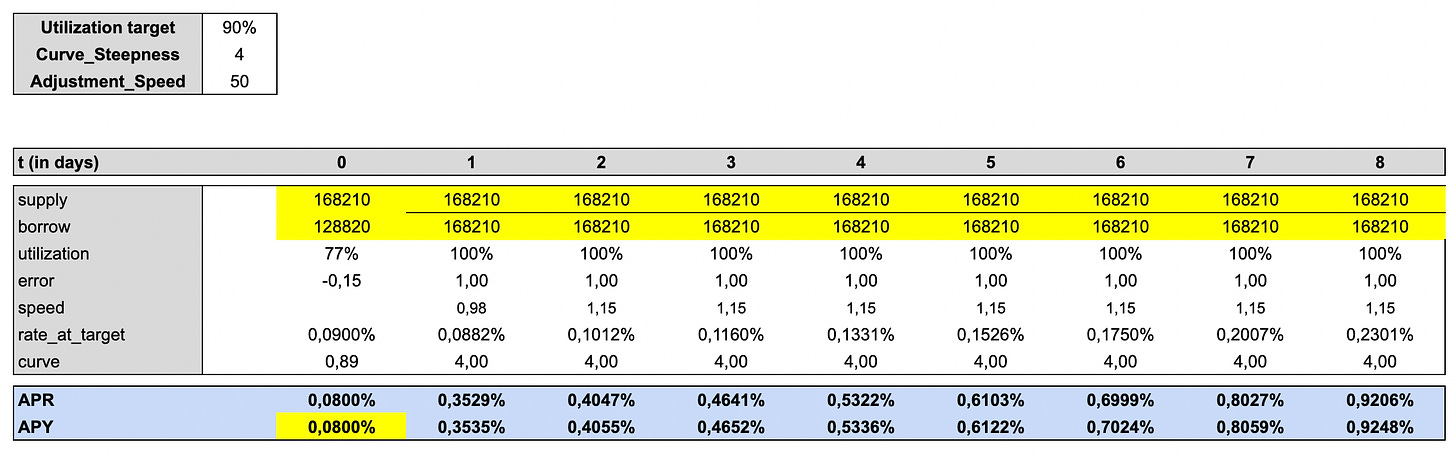

To give a tangible example of interest rate adjustments, Morpho provides a Google Sheet that can be copied and modified to demonstrate changes to the interest rate under various conditions. Below is a model of the crvUSD/tBTC/wstETH interest rate change over 8 days if utilization were to spike to 100% tomorrow:

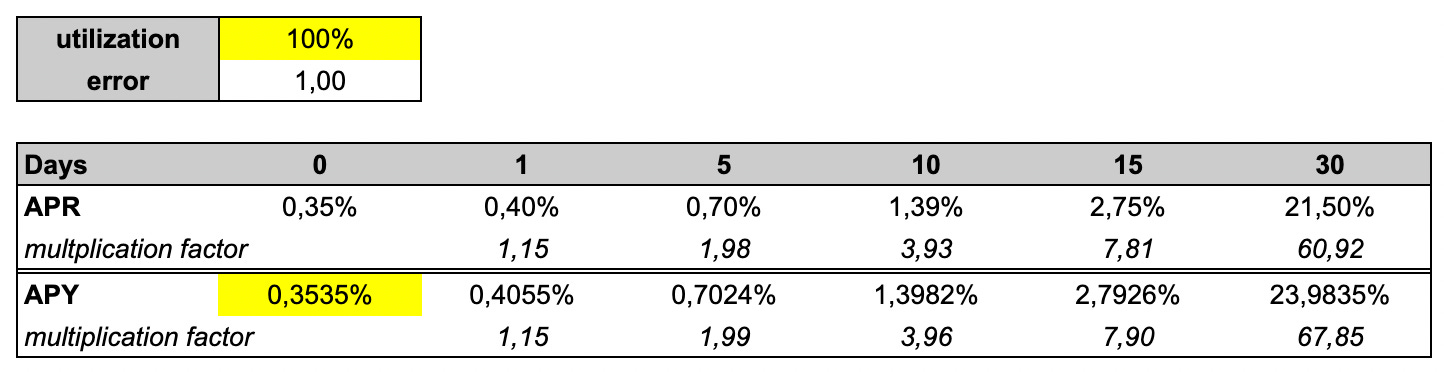

Given the current borrow APY is 0.08% and utilization spikes to 100% tomorrow, the rate_at_target (i.e. 90% utilization will progressively increase to 0.2301% over the week. The realized borrow rate at 100% utilization would be 0.9248%.

Extrapolating out over 30 days at 100% utilization, we can observe that the borrow rate would reach 23.98%. This gradual adaptive shift offers borrowers substantial time to adapt their positions in response to potentially radical shifts in market dynamics!

The remaining crvUSD vault markets currently have 0% utilization and their adaptive mechanism is reducing to the minimum allowable IR. This is defined in the constant MIN_RATE_AT_TARGET, set to 0.1%. This means the min rate at 100% utilization is 0.4%. See below how long it would take markets at the min end of the adaptive scale to increase to normal levels, assuming 100% utilization were to continuously persist.

The cells highlighted red indicate that the maximum rate of 800% (as defined in the constant MAX_RATE_AT_TARGET == 200%) has been reached. This shows that if borrowing were to immediately shift from 0 to 100, it would take at least ~30 days before rates increase enough that borrowers may be required to close their positions. This demonstrates the highly accommodative IRM that gives borrowers ample time to respond to changing market dynamics.

Conclusion

Llama Risk has recently deployed the crvUSD vault and the constituent markets composed of Convex-wrapped TriCrypto LP collateral types. A substantial amount of crvUSD has been allocated to these markets thanks to a co-incentive program conducted by Morpho and Curve. Most markets have not yet experienced borrow demand, creating an opportunity for borrowers to gain leveraged exposure to their TriCrypto LPs at extremely low rates with a highly accommodative, time-based IRM model. Prospective users of the crvUSD vault are recommended to play with the Google Sheet created by Morpho to test the behavior of the AdaptiveCurve IRM.

Disclaimer:

LlamaRisk provides the review of the MetaMorpho vault for informational purposes only, and such provision does not constitute financial, investment, legal, or professional advice. In the context of MetaMorpho, LlamaRisk does not take custody, control, or influence over user funds or investment choices and expressly disclaims any liability or responsibility for losses, damages, or other issues that may arise from users' investment decisions.

The content provided by LlamaRisk, including any reports or overviews, is intended as a general guide and should not be relied upon as definitive or comprehensive advice. Users are advised not to act upon this information without seeking appropriate professional counsel specific to their situation.