On Abracadabra Degenbox Strategies, dwindling Anchor Protocol Yield Reserves, and risk to Curve liquidity providers

This article examines potential risks that declining yields on Anchor Protocol (on Terra) may have on Curve liquidity pools containing wrapped UST.

Useful links:

Agora discussion on Abracadabra Degenbox strategies and UST peg

Anchor Protocol Discussion on the growing gap between deposits and borrows

Abracadabra is a leveraged yield farming protocol that allows users to farm outsized yields on stables by taking on risk and leverage. Their recent Degenbox launch with its unique cross-chain strategy has been an enormous success, bringing lots of fees for UST liquidity providers in Curve. The only catch here is: yield is not risk-free. This article examines potential risks that UST liquidity providers on Curve are taking on, following developments around UST. The approach here involves a bit of chain-checking, some imaginative thinking, and a whole lot of parsing through tweets.

First, let’s try to understand the magic behind the Degenbox UST strategy.

Abracadabra Degenbox UST Strategy

The strategy allows users to deposit wrapped UST into Abracadabra cauldrons to mint MIM, which can then be sold on the MIM-UST pool to increase one’s liquidity position via leverage.

The oracle contracts for UST degenbox (deployed by Abracadabra):

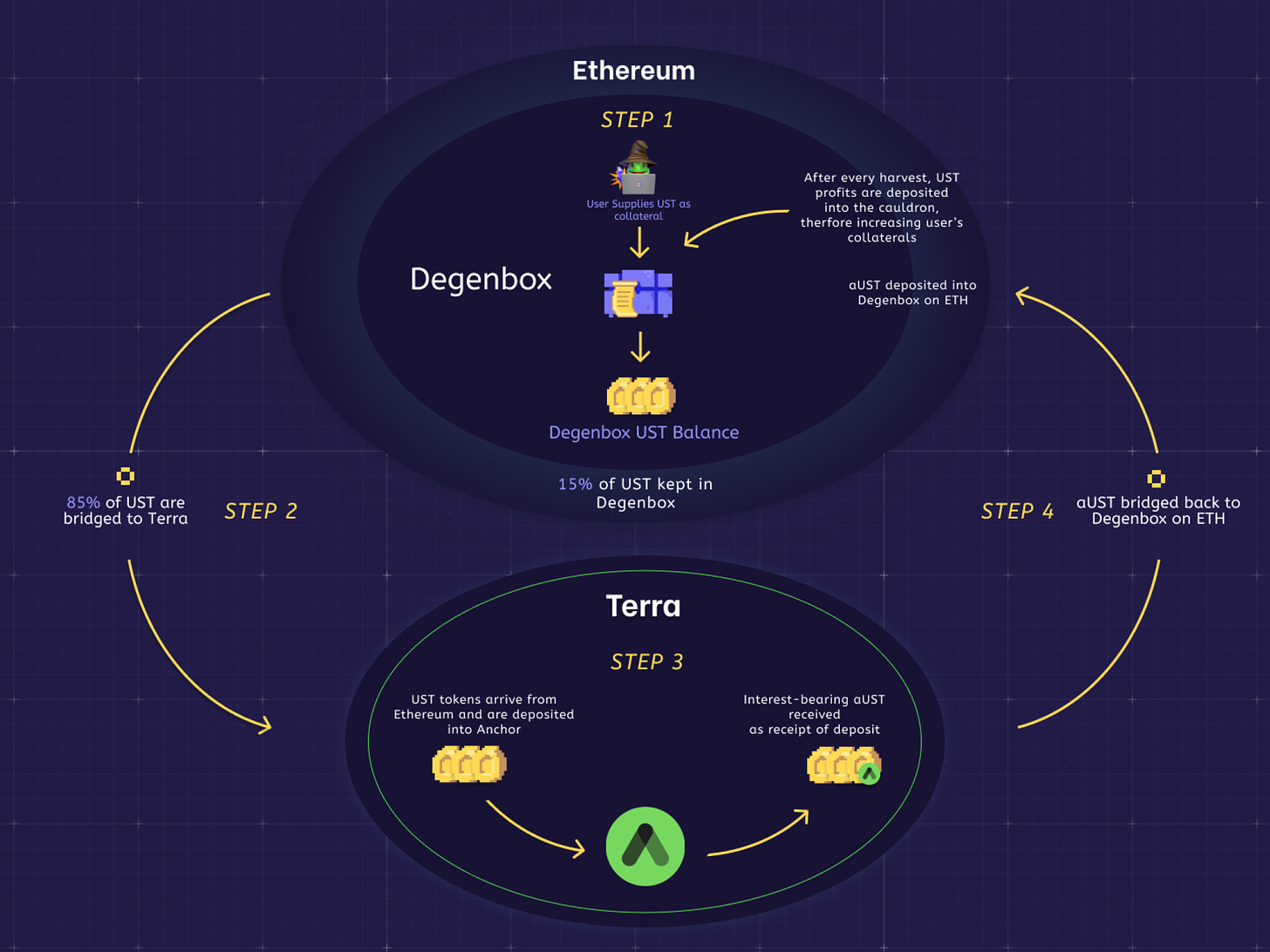

The following infographic outlines the strategy:

The deposit steps are (unrelated example transactions):

Deposit wrapped UST into UST Degenbox contract. The UST strategy contract gets to work from here onwards.

10% of UST is deposited into Degenbox (this makes vault withdraws easier).

The rest of the wrapped UST is then bridged onto Terra, for example, tx.

Deposit UST into Anchor in return for aUST. Abracadabra uses EthAnchor for this.

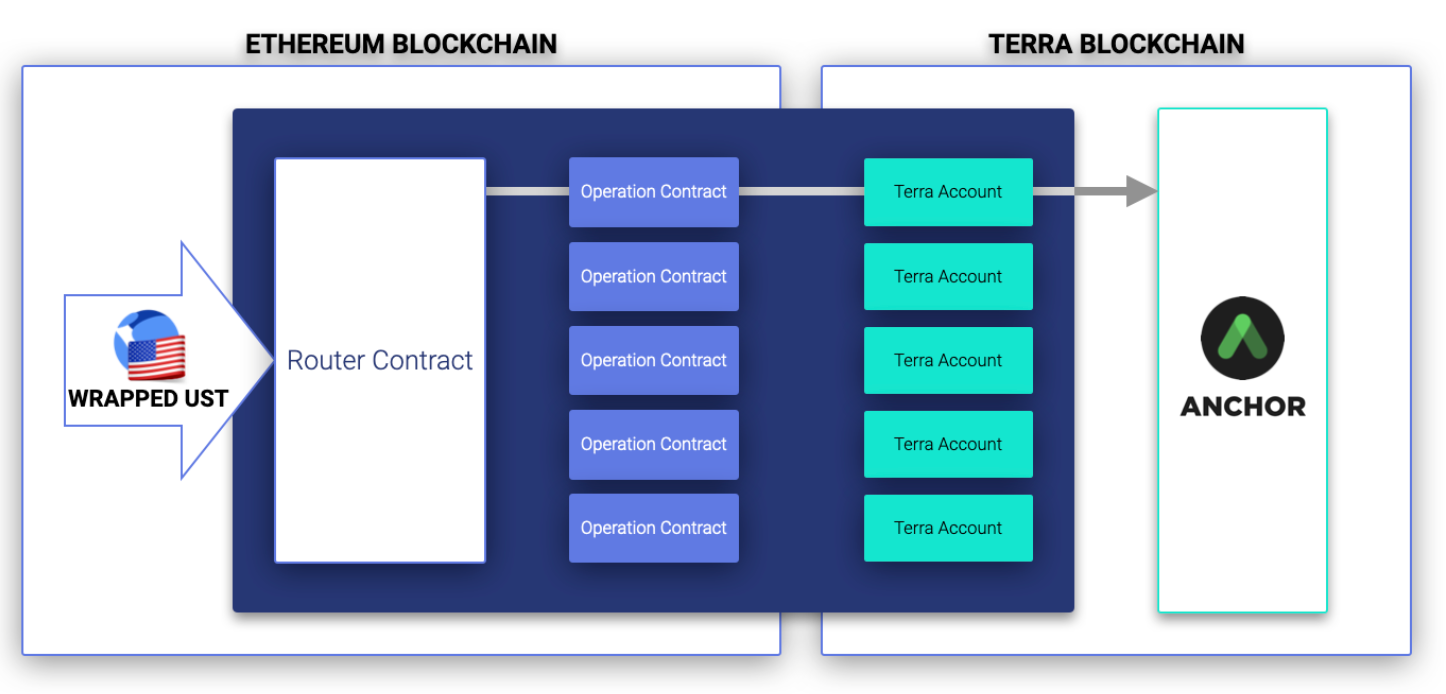

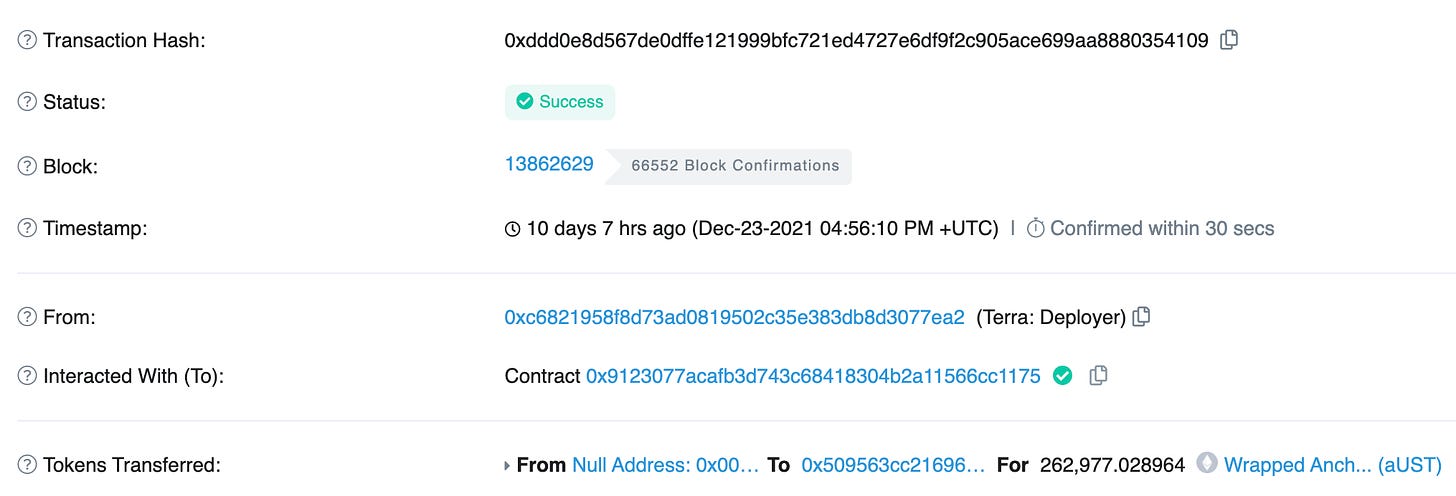

EthAnchor Router contract for depositing wrapped UST to Anchor on Terra. Image taken from Anchor Protocol docs. Bridge back aUST to Ethereum: example tx. The receiver contract is the Anchor generated Operation contract for Abracadabra.

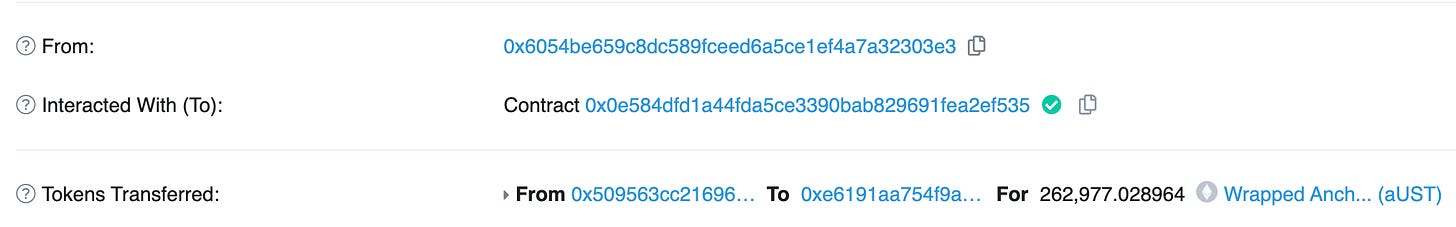

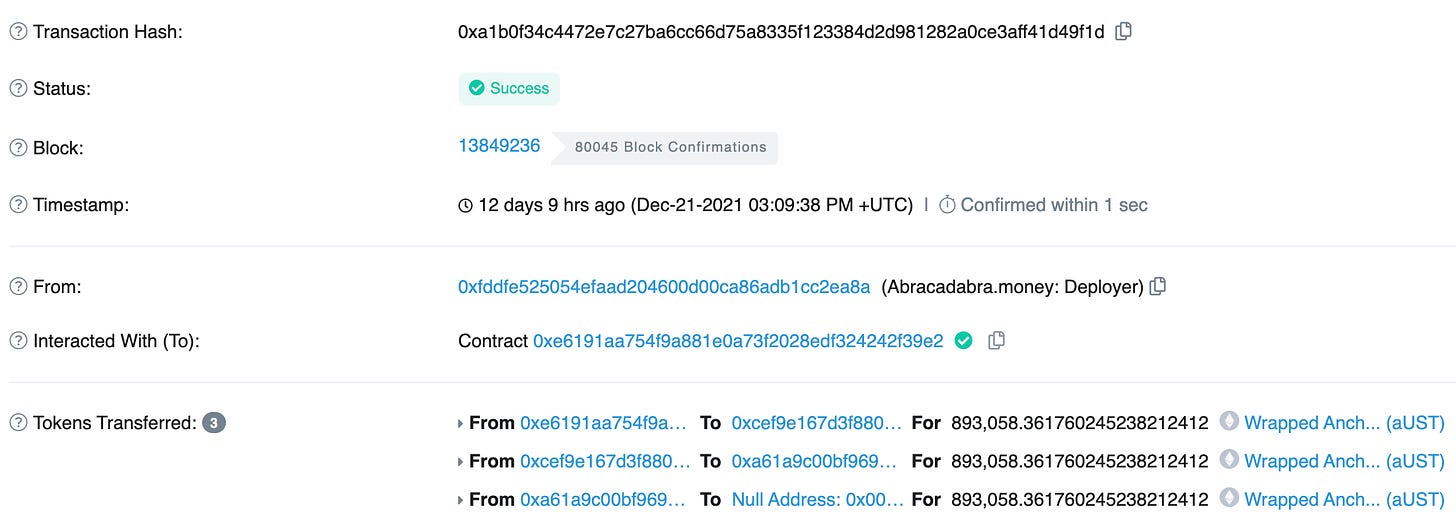

Deposit aUST into Degenbox contract: example tx. The deposit side strategy ends with the

finish(address)method.

Harvest steps are:

Withdraw aUST from degenbox and bridge to Terra: example tx.

Deposit aUST in Anchor and withdraw UST + interest (from Anchor yield reserves) using EthAnchor.

Bridge UST back to Ethereum.

Add to user’s collateral.

The exciting aspect of this strategy is that it uses a non-interest-bearing asset wrapped UST and runs a strategy that swaps a portion of it for an interest-bearing strategy, allowing users to earn leveraged yield from Anchor borrowers.

Market Reception

UST being the stablecoin with some of the most amounts of on-chain liquidity, the strategy has attracted a lot of liquidity to Curve MIM-UST pool, as users drove up leverage in their liquidity positions:

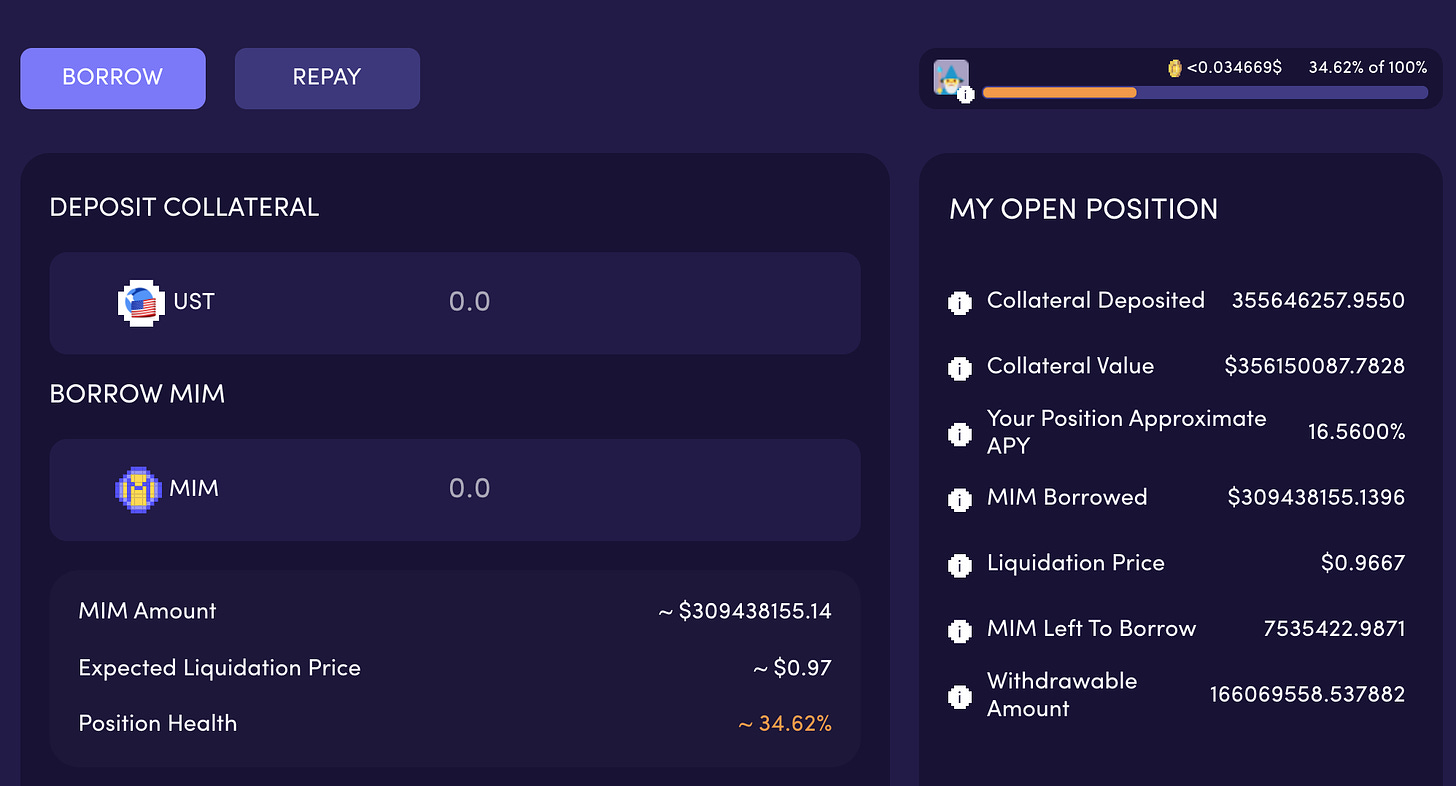

Exciting is the following leveraged LP position by Wonderland DAO who’s liquidity position as of writing this article gets them liquidated if UST price falls to 0.97 USD:

The nature of this Abracadabra Degenbox has perfect synergy with Curve since the first step after depositing into the collateral is to swap it to UST.

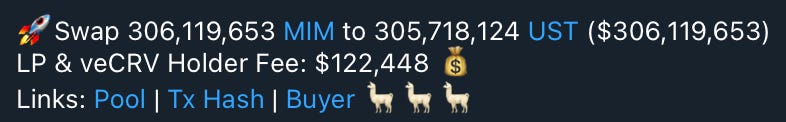

This has been quite profitable for Curve liquidity providers, who earned approximately 120k USD from that ape alone.

Knowing this, it is worthwhile to answer the question: where does the yield come from?

Anchor Protocol Yield Reserves

Useful links

One of the attractive features of Anchor is its high APY for depositors, which is currently offering an APY of 19.49%: this is the target rate (called Anchor rate) set by governance consensus. The yield comes from two sources:

Borrowers paying interest to lenders

Deposited collateral (such as LUNA and ETH) earning staking rewards for participating in PoS consensus.

Yield deficit

Useful links:

The two collateral assets currently being staked by Anchor in PoS consensus protocols to harvest yield are LUNA and ETH, with ETH staked on Lido. The stETH oracle used by Anchor takes ETH price and a ratio of ETH vs stETH.

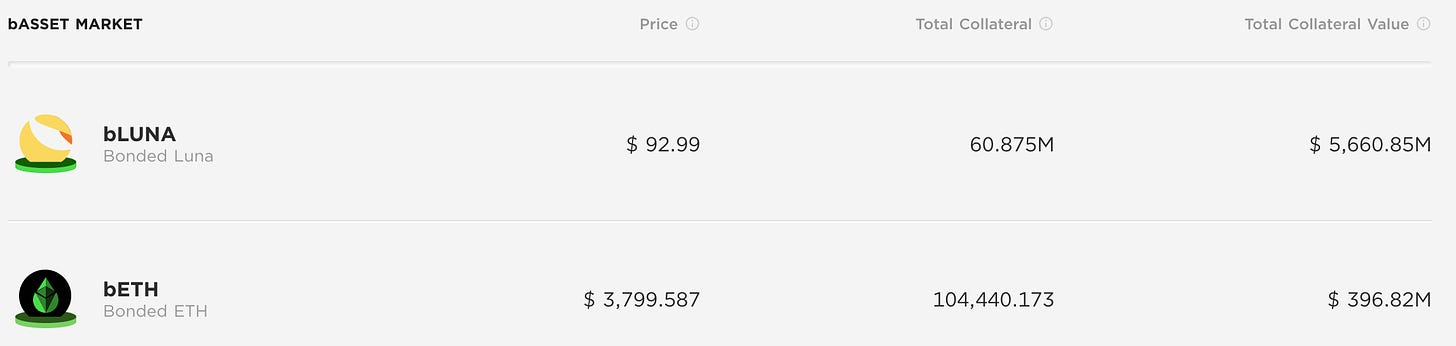

As of writing this report, the total bAsset collateralised is $ 5.6 billion for bLUNA and $ 396 million for bETH.

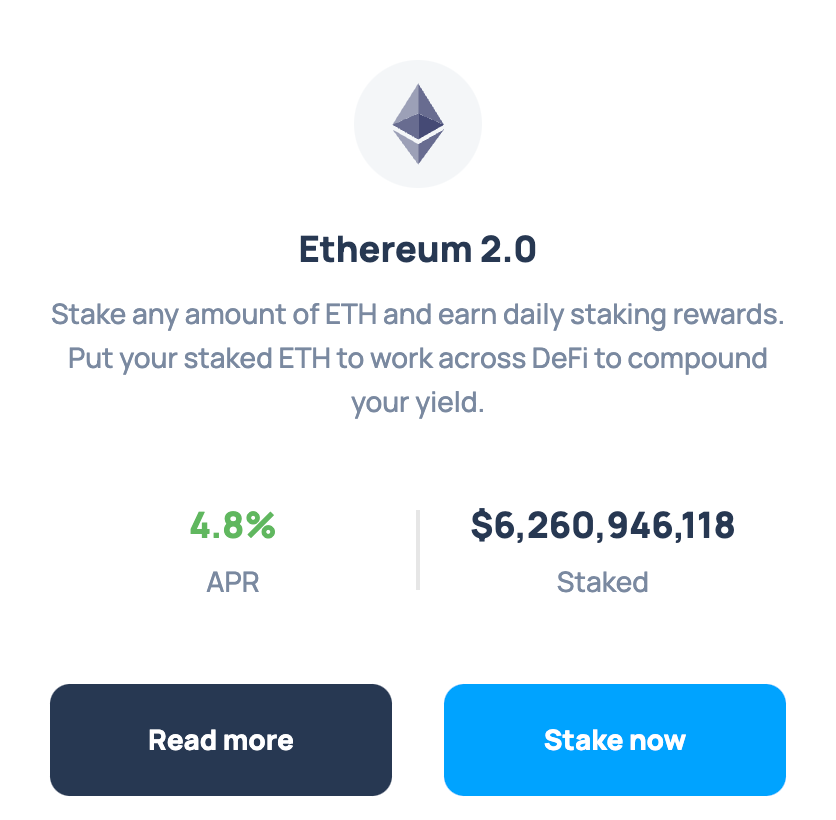

The staked ETH collateral earns approximately 4.8% APY, which amounts to $ 19 million in Ethereum 2.0 staking yield annualised.

All in all, the expense/earning breakdown is provided in the following. Lending and borrowing data is derived from the Anchor protocol dashboard.

$5.27 billion UST deposited earning 19.5%: $1.027 billion to be paid to lenders.

$5.56 billion bLUNA earning 6.63% in staking yields: $0.35 billion of yields.

$0.387 billion bETH earning 4.8% in stETH staking yields on Lido: $0.0187 billion in yields.

$2.064 billion borrowed UST at 17.51% interest rate: $0.36 billion in yields. (it is cheaper to borrow than lend currently: which has implications of its own).

The total yield earned: $0.73 billion in yields earned.

Deficit: $0.298 billion in yield deficit to hit the golden 19.5% earned interest rate.

From Anchor Protocol Docs:

If actual yield > Anchor Rate, the excess yield is stored in a UST denominated “yield reserve”. ANC incentives to borrowers drop by 15% every week.

If actual yield < Anchor Rate, the yield shortfall is drawn down from the yield reserve until depleted. Additionally, ANC incentives to borrowers increase by 50% every week until the actual yield converges to the Anchor Rate.

Interestingly, the protocol incentivises (at the time of writing this article) borrowing over lending. However, there is still a lend and borrow deficit: too many lenders and too few borrowers.

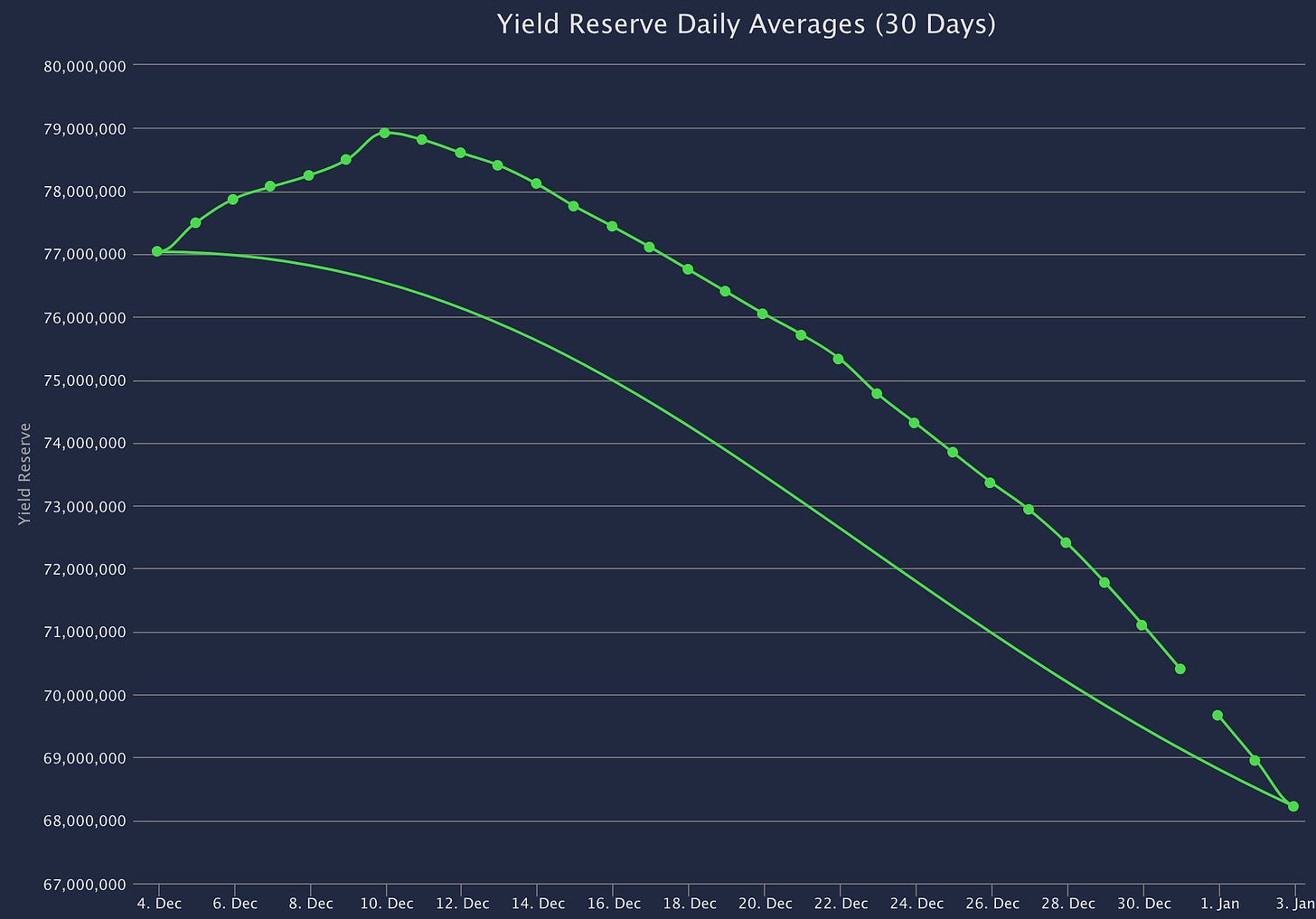

This brings us to Anchor Protocol yield reserves, which have observed a steep decline over time:

This begs the question: how does Anchor’s steep drop in its yield reserves impact the UST peg? And how does this affect Curve liquidity pools with UST synths?

Impact of declining Anchor yield reserves on UST/USD peg

Impact on UST peg

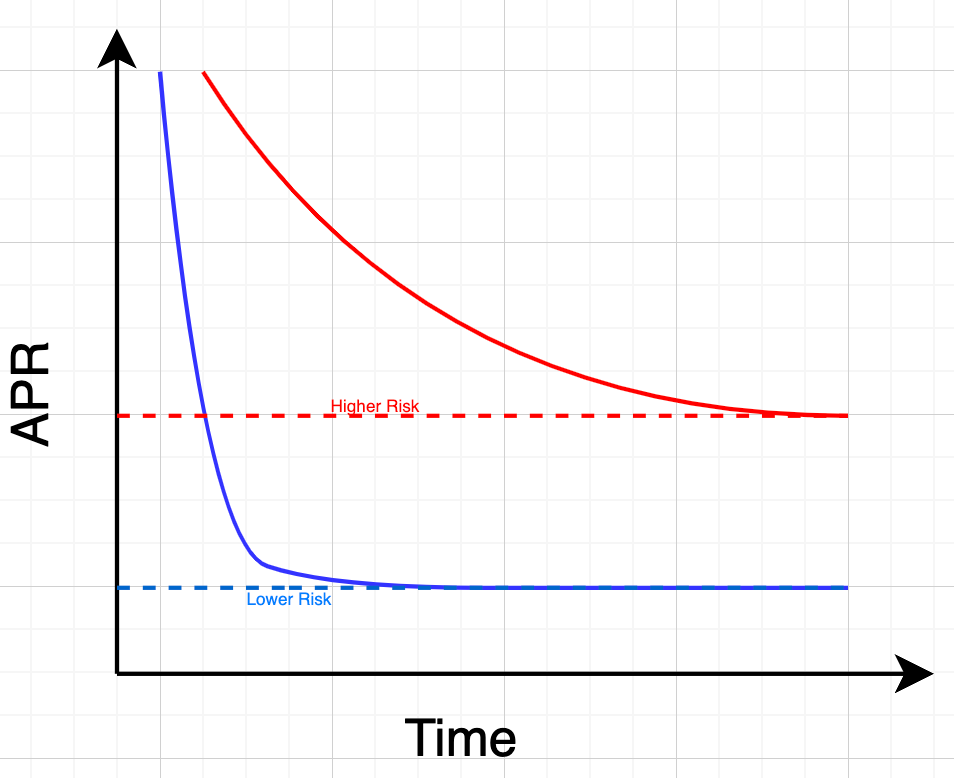

If an asset offers a high yield, it’s most likely a riskier asset. Lower risk yield attracts liquidity, causing the APR to decline.

There are three scenarios with varying levels of optimism around dropping Anchor yields. Bear in mind that these scenarios can only occur if the Anchor protocol yield reserves are entirely depleted: until they aren’t exhausted, the market has no incentive to price risk.

The (hyper)optimistic scenario

The market considers UST low risk: it is still acceptable even if yields drop as low as 1-3% APR and sustain those levels. No liquidity flees from Anchor.

The realistic scenario

UST's market prices risk at about x% to y% APR (say 8-12%). If yield drops to (say) 8% APR, large accounts will close their lending positions. The fleeing liquidity would result in the total deposited collateral to reduce, thereby increasing borrow yield. The APR would climb to (say) 12%, and more liquidity would come back in, dropping the yield to 8%. There would be an oscillation around an equilibrium APR N%.

In hindsight, this is optimistic.

The pessimistic scenario

The market considers UST risky: if yield drops below some APR threshold N, the risk-reward is too skewed towards risk. Liquidity flees Anchor.

Fleeing UST liquidity has a few places to go:

Hold UST: but why would pessimistic market participants hold a risky asset that they’ve taken steps to de-risk away from?

Sell UST for USD on the open market: affects UST peg,

threatening liquidations of Abracadabra Degenbox users, which has other cascading effects, or

threatening LUNA sell pressure, as cheaper UST can be bought off the market, burnt into LUNA at parity (excluding spread), and the LUNA sold for USD.

De-risk: Burn UST, mint LUNA and sell LUNA in the open market. Assuming that the volume of UST being de-risked is maximally 20% over a few weeks:

If the market is not volatile, centralised exchanges can absorb de-risking. But this may lead to cascading liquidation events as LUNA supply increases and its price falls.

If the market is volatile, de-risking can get turbocharged and result in strong liquidation cascades.

Historically, liquidation cascades in LUNA have led to UST de-pegs, which has implications for Degenbox positions. This is discussed further ahead.

Impact of declining Anchor yield reserves on Curve LP positions

Considering strategies like Abracadabra Degenbox’s Viking Attack and potentially other products will eventually deplete Anchor yields, risk-reward will likely be skewed more towards the risk side. In the case of a de-risking event, the MIM-UST pool has very high chances of de-pegging via the following mechanisms.

Cheaper UST bought on the open market, bridged to Ethereum, swapped into MIM or 3CRV at 1:1 parity is one example of arbitrage.

Degenbox liquidation events result in large UST swaps into MIM.

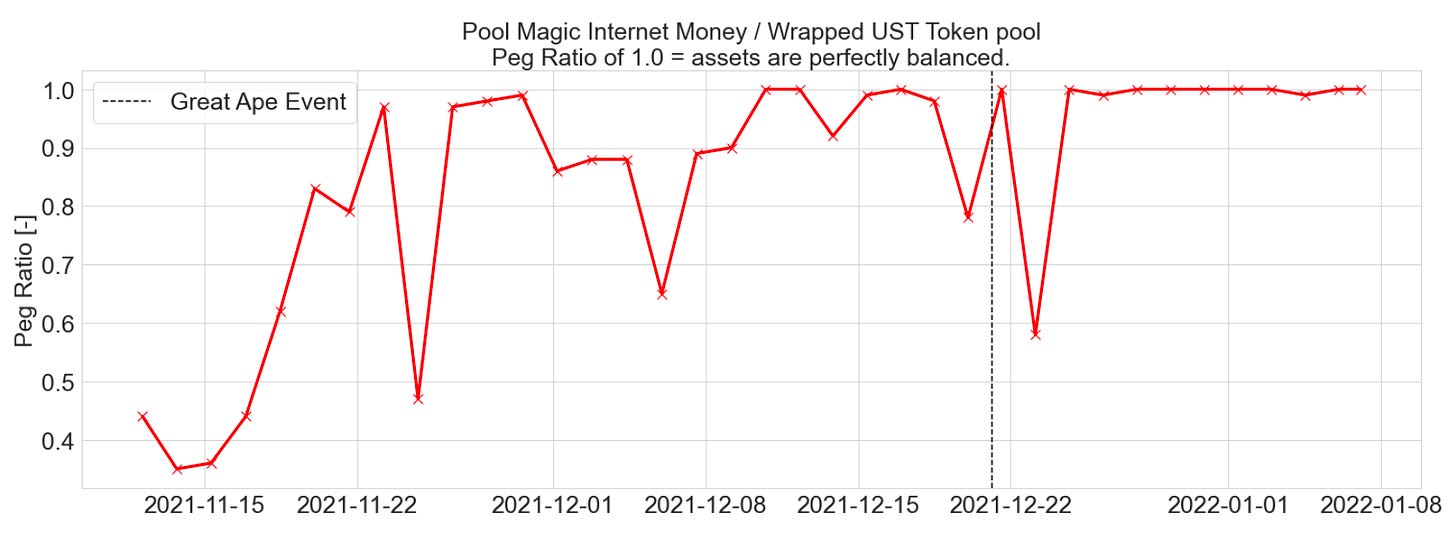

Historically, the MIM-UST pool has seen a lopsided token distribution due to the great Wonderland DAO ape event:

The MIM-UST and UST-3CRV pools have good chances of getting de-pegged in a liquidation event, as a large quantity swap will make these pools UST overweight. To quote Naga king:

The MIM-UST pool has ~1B in it, and there is about 950m MIM collateralised by UST. If that 950m is withdrawn as UST and then exchanged for MIM in the MIM-UST pool, the pool would become >90% UST regardless of A. For A = 1 (lowest possible), that trade would lead to 93% UST.

This would result in discounted UST swaps, resulting in the following arbitrage.

Get discounted UST from Curve pools.

Bridge to Terra via the shuttle bridge.

Burnt UST and mint LUNA at 1:1 parity.

Sell LUNA in the open market to complete the arbitrage.

This arbitrage adds sell pressure to LUNA price but re-pegs the pool as more MIM (now backed by less UST) or 3CRV gets swapped into the pools for UST. An interesting note here: with a high amplification factor of 1000, large de-pegs get re-pegged slower: there’s more liquidity at each step of the re-pegging process. The general rule here is:

Lower pool amplification factor (A) increases the velocity of the de-peg and re-peg. Higher values decreases it (unless the balances are closer to the shoulder of the invariant curve: the de-peg is definitely non-linear.

Abracadabra Degenbox introduces a cauldron withdrawal cap, which may delay/limit liquidity exodus. This directly impacts the peg: it suggests that the de-peg may never happen, and at worst, the pool may suffer a short-lived imbalance.

Apart from not-so-obvious market risks of holding or interacting with UST, it looks like there exist several arbitrage mechanisms that can help balance the pool after de-peg events (but not prevent it).

Summary - for wUST LPs in Curve.

The article hypothesises several scenarios following the impact of the Abracadabra Degenbox strategy on depleting Anchor yields and its implications for Curve liquidity providers for pools containing UST synths. There are a few expectations:

Due to Degenbox, LPs in MIM-UST can expect moments of significant liquidity events that can imbalance the pool. This pool imbalance may be slowed down by the high A parameter of the MIM-UST pool (1000).

De-peg events are likely, owing to the high-risk nature of UST. Currently, the market is pressuring Anchor UST lending yields at a downwards trajectory. Considering yields are correlated with risk, this is likely to result in risk-discovery, akin to price-discovery.

Suppose UST pools de-peg, specific arbitrage routes exist that incentivise re-pegging of the pool (if the pool is UST-heavy). This suggests that while LPs can expect moments of pool imbalance, the likelihood of the pool re-pegging over time is also high. The time it takes to re-peg depends on the pool’s amplification and re-pegging volumes (generally takes lower UST to MIM swap volumes to re-peg if A is low compared to high A values).

Lastly, nobody is without flaws. This analysis may be flawed or incorrect. If you agree or disagree, we would like to hear it! Do have your voice heard in the comments below.

Thank you kindly for the investigation, how do you get paid for doing this work? Or what is your incentive to do this work?

This one aged well.