Sturdy V2 crvUSD LP Silos Dashboards

Insights into the yvcrvUSD-LP silos included in the crvUSD Aggregator managed by LlamaRisk

Links

Sturdy App: crvUSD Aggregator | USDC Silo | USDT Silo | FRAX Silo | mkUSD Silo

Sturdy Governance: Llama Risk Proposal for crvUSD Aggregator

LlamaRisk Analytics: crvUSD Aggregator Dune Dashboard | Sturdy Silos Streamlit Analytics

Resources: Understanding the Sturdy Silos Oracle

Introduction

In February, we announced the launch of the crvUSD Aggregator on Sturdy Finance v2, managed by Llama Risk. We have continued our mission to improve transparency and understanding of the aggregator with explainers and analytics dashboards. We are pleased to share our crvUSD LP Silos Dashboard on Streamlit, which offers insights into borrower behavior, oracle behavior, and silo profitability. This post provides an overview of the analytics we have made available for users interested in the crvUSD Aggregator.

crvUSD Aggregator Refresh

The crvUSD Aggregator is a Yearn V3 vault that allocates crvUSD deposits to a set of strategies, i.e. Sturdy siloed lending pairs that use crvUSD as the borrowable asset. The aggregator redistributes crvUSD on behalf of its depositors to optimize yield and is currently incentivized with additional CRV and STRDY rewards. The aggregator manager controls additional parameters, such as allocation, minimum idle, and individual debt ceilings. Allocation during the bootstrapping phase is currently manual, with a plan to move to a keeper that derives optimal allocation via computation done on zkML.

There are four silos whitelisted in the crvUSD Aggregator, all of them using crvUSD stableswap LPs as collateral and wrapped in a Yearn vault that regularly harvests and compounds the interest on the underlying LPs. The Yearn vaults employ configurable strategies such as boosted farming with Yearn’s veCRV position, or depositing to Convex and harvesting rewards there. Sturdy allows borrowers to select their desired leverage when opening a position. The yield potential from farming the pools with leverage is substantial, but increasing leverage also comes with an increased liquidation risk. The collateral types were selected for the low volatility inherent to stableswap LPs.

This post introduces our dashboard with metrics for these silos that include the historical behavior of the price oracle, historic profitability, and exposures of individual borrow positions. We offer this tool to serve users in making well-informed decisions about participating in the crvUSD Aggregator and its constituent silos.

crvUSD Aggregator Dune Dashboard

Users interested in participating in the crvUSD LP silos on Sturdy v2 should refer to our crvUSD Aggregator Dune Dashboard, which has been publicly available since shortly after the aggregator was deployed. Users can see historical data involving the utilization of the aggregator and its constituent silos, and a collection of metrics related to the Curve LP performances and underlying stablecoin performances.

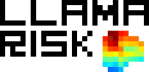

Aggregator Metrics

Our metrics track the overall crvUSD deposits into the aggregator and the utilization rates into each silo over time, as well as the idle crvUSD in the strategy. Users can also find a collection of utilization rates for individual silos.

There are two noteworthy events in the aggregator utilization history. On March 10, the allocation toward the crvUSD/FRAX silo was set to 0. This was announced on our Twitter and was due to reduced yield in the pool, which our team determined that allocations we better directed toward other silos. On March 21, a large withdrawal from the aggregator caused all strategy crvUSD in the crvUSD/USDC silo to be removed. This temporarily increased silo utilization to 100% until our strategy manager rebalanced the silos.

Silos Metrics

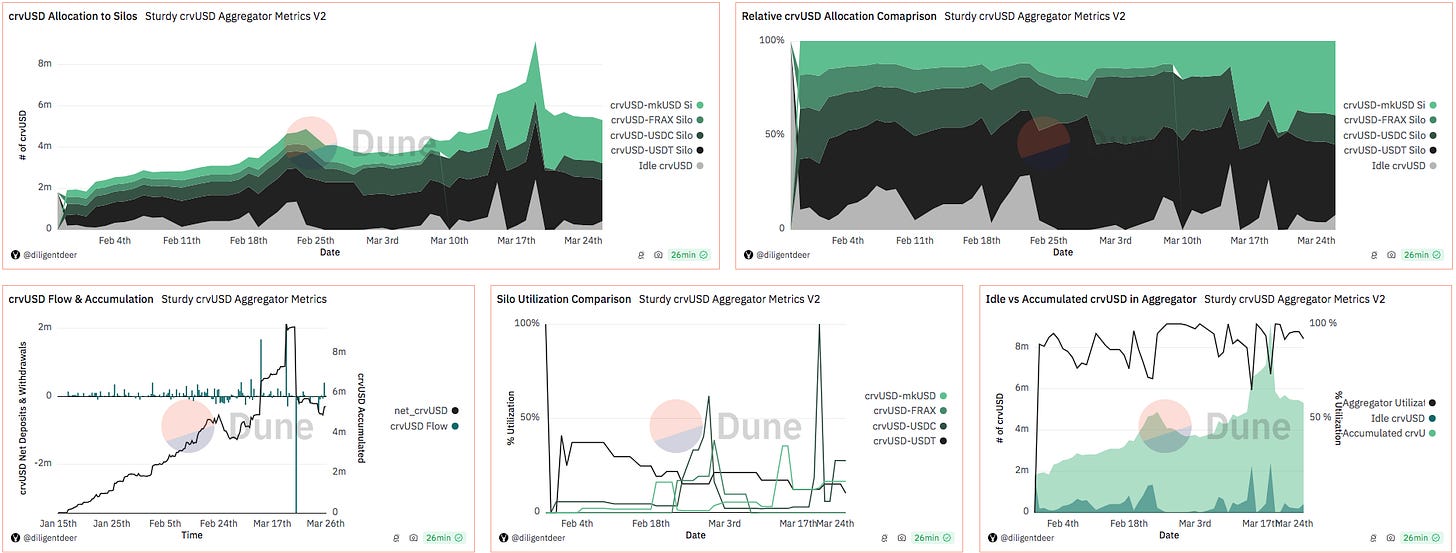

The Dune dash includes some metrics for silos that track the reserve crvUSD, available crvUSD, borrowed crvUSD, and utilization rate of the silo over time.

The image above shows the crvUSD/USDT silo. Borrow rates have been fairly stable over its lifetime, with periodic rebalancing events distributing available crvUSD across the included silos.

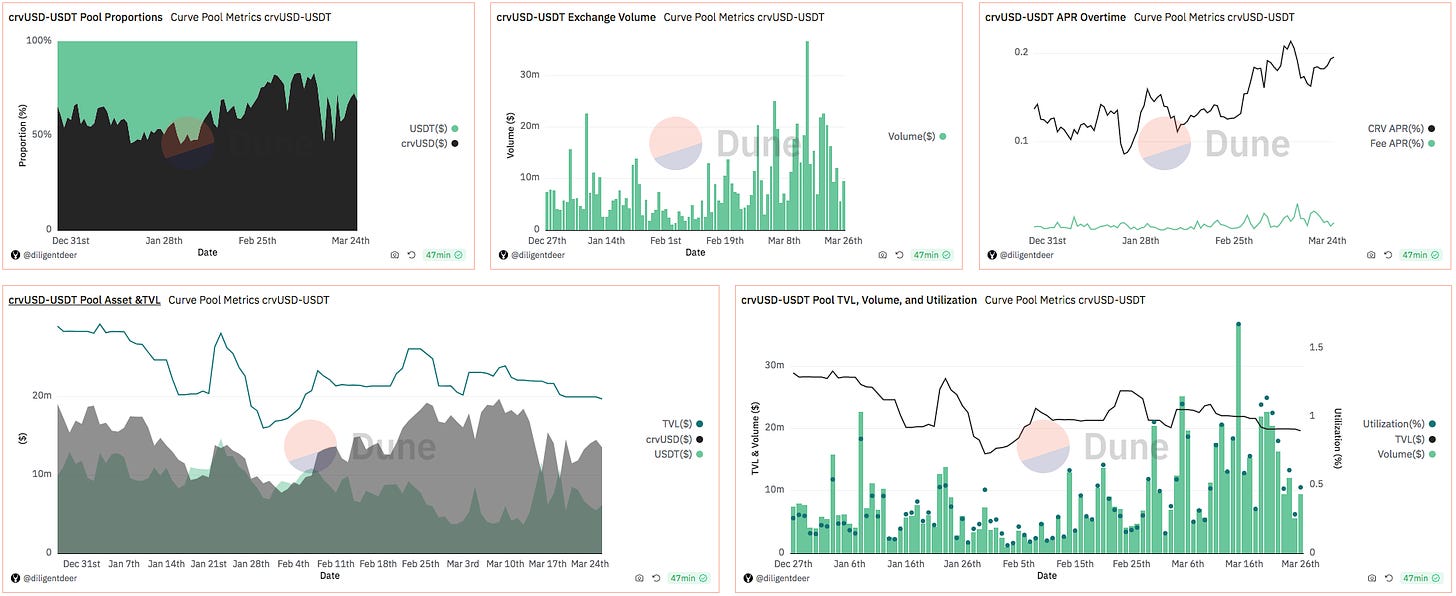

Curve LP Metrics

The Dune dashboard also shows metrics related to the Curve pool tokens serving as the underlying collateral in the Sturdy silos. This includes general metrics such as pool balances, volumes, TVL, utilization, and APR over time.

The pool shown about is the Curve crvUSD/USDT pool. This pool has shown relatively strong stability over the last 3 months. It tends towards being crvUSD-heavy in its balance, which may be attributable to recent bullish market sentiment that has increased demand for leverage and put pressure on the crvUSD peg. There has been a strong trend in pool APR, mostly in CRV incentives to the pool, which should increase the profitability of leveraged positions in the Sturdy crvUSD/USDT silo. The volumes have, likewise, shown a strong trend over the past month, likely due to arbitrage opportunities that have arisen since market sentiment has shifted.

Dune Dash Conclusion

The metrics included in the Dune Dashboard provide a good initial overview of the Sturdy crvUSD Aggregator and the components that make it up. There are limitations to the data we can source from Dune, so despite the convenience, we have been working to develop an additional dashboard that dives deeper into components of the Silos that are important for our strategy managers and users to assess the risk of the crvUSD LP silos.

Sturdy Silos Streamlit Dashboard

Today we are pleased to present the Sturdy Silos Streamlit Dashboard, which dives deeper into user interactions with the crvUSD LP silos and metrics particularly relevant to silo borrowers.

Snapshots and Silo Overview

Similar to the previous dashboard, we include an overview of the crvUSD reserves and borrows in the silo over time. We also include snapshot data, including current interest rates for borrowers, lenders, and collateral, and oracle data.

The image above shows an overview of the crvUSD/USDT silo.

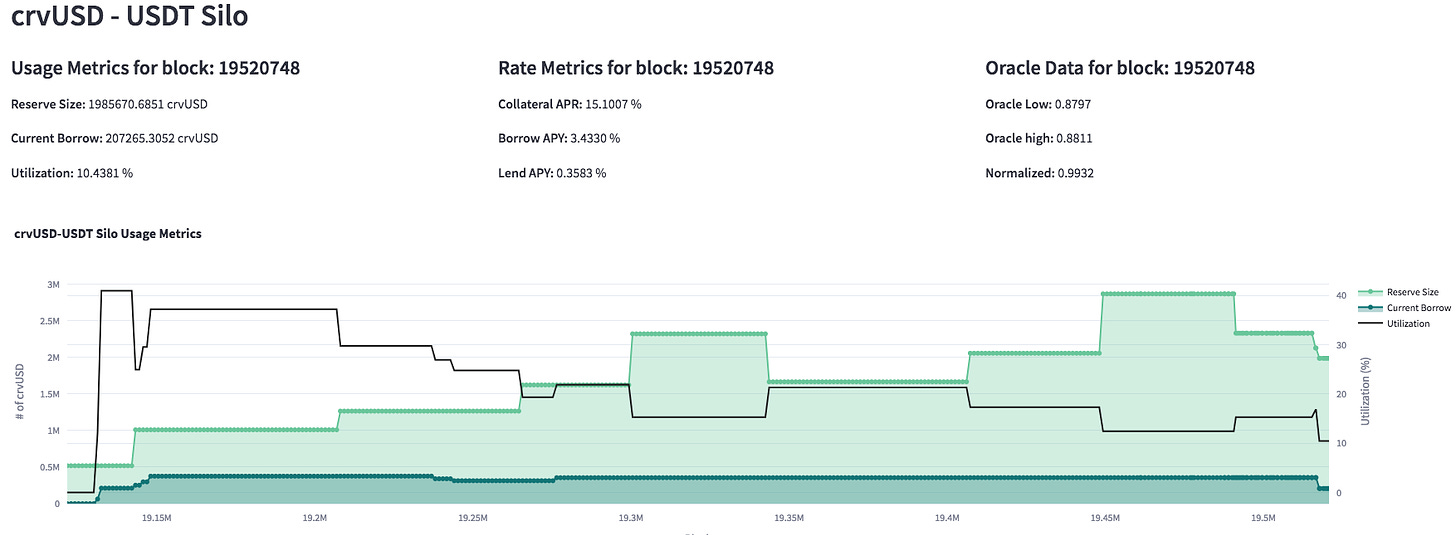

Interest Rates

Borrowers may be particularly interested in the delta between the interest earned on their yearn vault collateral versus the silo borrow rate. Whenever the collateral returns are greater than the borrowing cost, there is an opportunity for borrowers to profit from a leveraged LP position. Note that the collateral APR data is sourced from Yearn, which offers an estimate of the APR. Depending on the history of the Yearn vault and harvestings, this data may not accurately reflect the actual interest earned. Users may also consult the yields advertised by Curve directly for a sanity check on APR data.

The image above left shows the collateral returns vs. borrow rate on the Sturdy crvUSD/USDT silo. This value has always yielded a profit opportunity for borrowers, with increasing volatility recently. The image above right shows the lending returns vs. borrow rate over time in the Sturdy crvUSD/USDT silo. These values have decreased over time, likely due to aggregator incentives that have resulted in an influx of crvUSD to the silo.

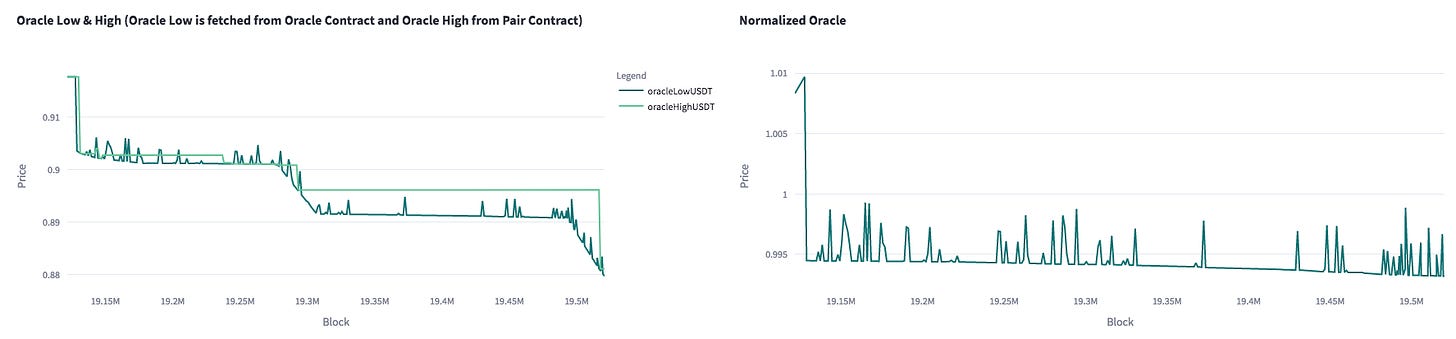

Oracle Price

The Streamlit dashboard tracks the oracle price quoted by the silo oracle and the value pushed to the silo market contract. In the image below to the left, the oracleLow value is the price fetched from the Sturdy oracle contract. The oracleHigh value is the value fetched from the silo pair contract. The oracle is inverted, representing the crvUSD price divided by the yearn vault price. As the yearn vault auto-compounds through periodic harvests, the oracle value decreases, signifying an increase in the collateral value.

The image below to the right shows the “normalized oracle”, which multiplies the oracle price by the yearn vault pricePerShare. When multiplied together, we get the price of Curve LP token denominated in crvUSD. Because the pools used are all stablecoins, the price of LP token should ideally be around $1 (provided assets are pegged). So if this normalized chart gives out highly deviated values from $1 we must check it.

In the image above, the crvUSD/USDT oracle contract shows occasional noise due to price deviations from the Chainlink and Curve oracle sources. See our post on Understanding the Oracle for more information on how this value is calculated. There are periodic rapid decreases in oracle price, which is attributable to yearn vault harvests that increase the value of the vault token. The normalized oracle shows the data without accounting for updates in the Yearn vault pricePerShare.

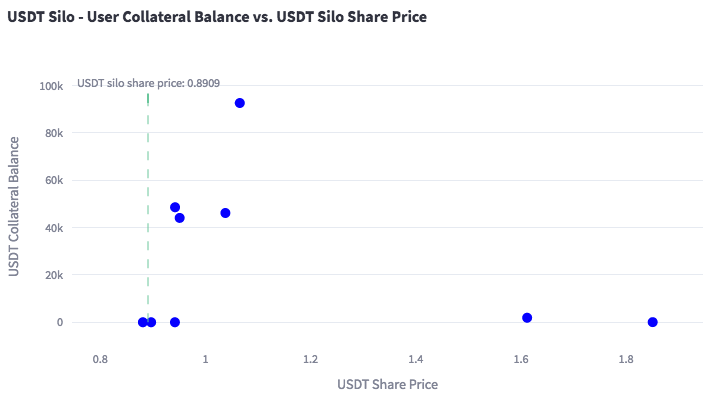

Borrow Positions

The Streamlit Dashboard shows individual borrow positions charted by the size of the borrow and against the most current oracle price. This provides insight into the relative distribution of borrow positions in the silo. The image below shows the crvUSD/USDT silo along with open borrow positions and a current oracle price of 0.8909. There is a dust position that is below the liquidation price. The largest borrow position is somewhat conservative, with a liquidation price of 1.0654.

Additionally, there is a table accompanying the chart that gives a breakdown of individual borrow positions and insight into the riskiness of the borrow position.

Conclusion

We developed these dashboards to be a resource for users interested in interacting with the Sturdy v2 crvUSD Aggregator, either as a lender or borrower. Our primary goal is transparency so that users have quality information from which they can make decisions about the crvUSD Aggregator’s suitability for their personal risk appetite. As with all DeFi products, this is an experimental product and may have bugs or other unforeseen issues that result in user loss. The analytics we make publicly available do not constitute complete due diligence of all risks involved, and users should make sure to fully understand all risk factors before interacting with the crvUSD Aggregator.

Nevertheless, we welcome any feedback about the analytics we have provided, and we strive to continue refining our metrics and including additional significant data to our analytics. If you have any comments, questions, or suggestions for improving our dashboards, please join the Llama Risk Telegram channel and let us know.