Asset Risk Assessment: Accumulated Finance (stACME)

A look into the Accumulate network, the Accumulate bridge, and the liquid staking platform built on Ethereum: Accumulated Finance

This research was spearheaded by xm3van.eth

General:

Proposal: https://gov.curve.fi/t/proposal-to-add-wacme-frxeth-and-stacme-wacme-to-the-gauge-controller/9148

Analyst Spreadsheet: https://docs.google.com/spreadsheets/d/1wqXqaz74Y_SCg6GezSMuwuArHIfY9nEM5n0Z8_jLBk4/edit?usp=sharing

Accumulate Network (LINK TO RISK SECTION)

Webpage: https://accumulatenetwork.io/

Whitepaper: https://accumulatenetwork.io/Accumulate-Whitepaper-4-12-22.pdf

Block explorer: https://explorer.accumulatenetwork.io/

Twitter: https://twitter.com/accumulatehq

Telegram: https://t.me/accumulatenetwork

Audit: https://fairyproof.com/doc/Accumulate-Blockchain-Audit-Report-091622.pdf

Accumulate Bridge (LINK TO RISK SECTION)

Docs: https://docs.accumulatenetwork.io/accumulate/tutorials/bridge

WACME Analytics: https://dune.com/sigrlami/wacme-accumulate

Audit: https://fairyproof.com/doc/AccumulateBridge-Audit-Report-092822.pdf

Accumulated Finance (LINK TO RISK SECTION)

Website: https://accumulated.finance/

Twitter: https://twitter.com/AccumulatedFi

Relation to Curve

A gauge proposal has been put forward by Accumulated Finance for the WACME/frxETH and stACME/WACME Curve pools. The goal is to create deep on-chain liquidity for the WACME token and exit liquidity for its stACME liquid staking derivative (LSD). Accumulated Finance has been incentivizing both pools with their WACME token since April 15th and claims they will transition incentives to Votium/Votemarket after a successful gauge vote. Gauge votes for both pools have recently passed on April 30th, 2023, and May 1st, 2023.

Introduction to Accumulate Ecosystem

Project History

Accumulate Network has a long project history that began as the Factom Protocol founded by Paul Snow and David Johnston in 2014. Factom was conceived as an enterprise blockchain that would enable companies and organizations to keep transparent, high-integrity data records. It was a grant recipient from the US Department of Homeland Security and partnered with the Bill and Melinda Gates Foundation.

The Factom protocol improved Bitcoin's verification process by utilizing a unique chain-of-chains architecture that linked specific data chains for faster indexing and reduced computational costs. Factom also introduced innovations for more efficient scaling, such as the separation of token transactions and computation from the data layer, which allowed for continuous and real-time securing of data demanded by enterprise customers. With its competitive speeds, Factom forged several successful partnerships in both the public and private sectors. Accumulate Protocol was born out of the desire to preserve Factom's unique aspects while improving ease of use, mass appeal, and scalability.

The protocol announced its intention to rebrand and upgrade to the Accumulate Network in November 2021 and officially activated its mainnet the following year. A timeline of significant events is as follows:

2014: Factom is founded by Paul Snow and David Johnston in Austin, Texas.

April 2015: Factom has one of the first blockchain token sales and raises 579 Bitcoin, worth $140,000 at the time.

Summer 2021: Inveniam Capital Partners acquires Factom's 40 blockchain patents and key engineers Paul Snow and Jay Smith. It also forms the DeFi Devs subsidiary as a developer community for its projects.

November 2021: Factom Authority Node Operators (ANOs) unanimously vote to rebrand and upgrade the Factom blockchain to the Accumulate blockchain.

April 2022: Accumulate whitepaper is released.

November 2022: The Accumulate mainnet is officially activated.

Team

Development of Accumulate is headed by Factom lead engineers Paul Snow and Jay Smith through the community development organizations. Dennis Bunfield and Ethan Reesor are team members who have played a significant role in Accumulate Network development. There are a number of organizations that can be considered core maintainers of the Accumulate Ecosystem, most notably:

DeFi Devs is a community development organization for Accumulate Protocol. They are one of the primary contributors to the project, which is developed through open participation from the developer community.

De Facto is a company that provides blockchain development and advisory services to startups. Their goal is to help startups navigate the complexities of blockchain technology and bring their solutions to market quickly and efficiently. De Facto can be considered core maintainers of Accumulate Network, and are also the core development team behind Accumulated Finance.

Accumulate displays on its website a number of additional organizations that contribute to its development.

Brief Ecosystem Overview

The Accumulate network is a delegated proof-of-stake blockchain network organized around digital identities called Accumulate Digital Identifiers (ADIs). Other key features include a multi-chain architecture through the use of sub-chains, human-readable addresses, and user-assignable key hierarchies for customizable security settings.

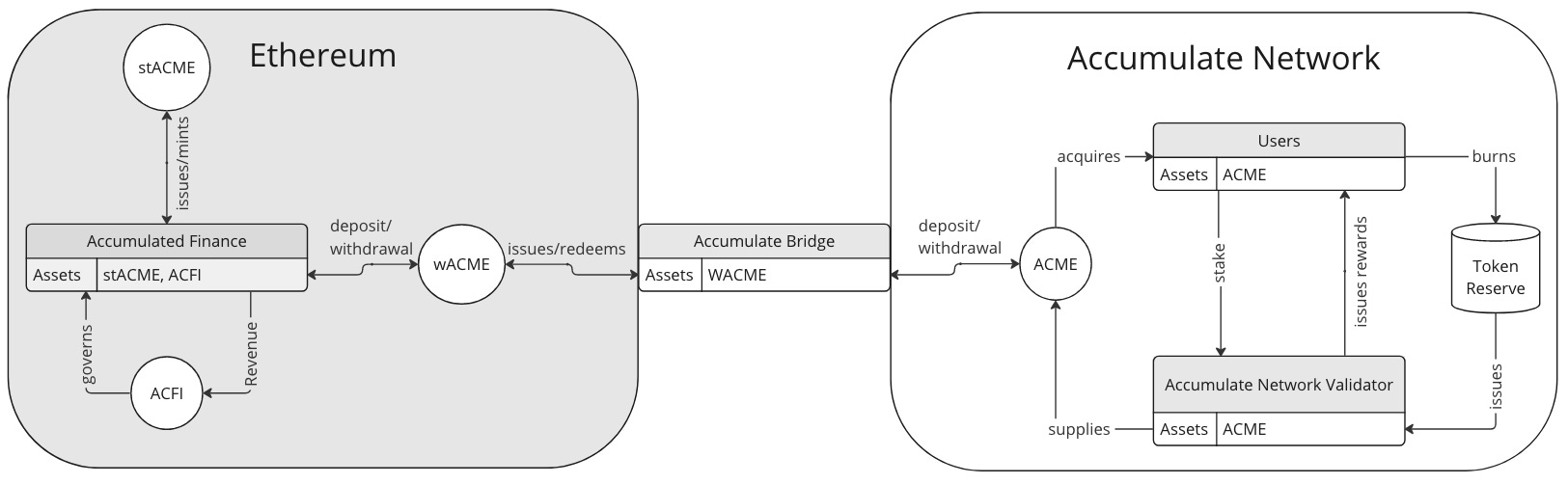

ACME is its native asset (similar to ETH). Users can acquire ACME on the open market or earn it from staking. Usage burns the token and adds it to the token reserve where it can be issued again as staking rewards. The Accumulate Bridge enables users to bridge ACME from Accumulate to Ethereum where it is represented as the WACME ERC-20 token.

Accumulated Finance is a DeFi application on Ethereum for staking WACME which allows the user to stake for stACME and earn yield. This allows users to reap the benefits of staking ACME without leaving Ethereum. Staking is liquid through the stACME/WACME and WACME/frxETH Curve pools, so users can enter or exit the Accumulate ecosystem at any time.

The following diagram shows an overview of the relationship between the three main components: Accumulate network, Accumulate bridge, and Accumulated Finance:

Assets

The assets relevant to this report can be summarized as follows:

ACME | ACME is the native token of the Accumulate Network. It is used to pay for transactions and services on the network, and it can be staked for network security and governance.

WACME | WACME is an ERC-20 token that is pegged 1:1 to ACME and can be minted by depositing ACME on the Accumulate Bridge, which is a bridge that allows users to transfer ACME and other Accumulate tokens between Ethereum and Accumulate.

stACME | stACME is an ERC-20 derivative token of ACME that represents staked ACME tokens on the Accumulate Network. It allows users to earn staking rewards while retaining the ability to use their staked tokens as collateral for other DeFi applications.

ACFI | ACFI is the (currently unreleased) governance token of Accumulated Finance, a platform that allows users to participate in liquid staking and other DeFi services for the Accumulate protocol.

FraxETH | Frax Ether is a liquid ETH staking derivative designed to uniquely leverage the Frax Finance ecosystem to maximize staking yield and smoothen the Ethereum staking process for a simplified, secure, and DeFi-native way to earn interest on ETH.

Risk Assessment Scope and Specification

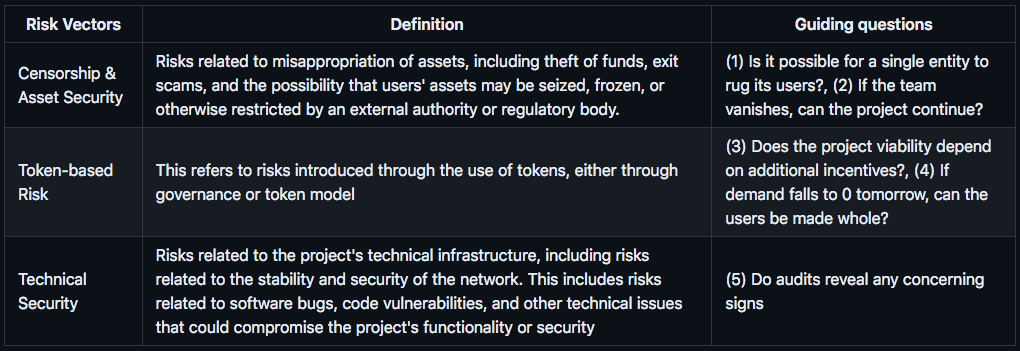

For the purpose of this report, we categorize risk into three risk vectors:

While this report is primarily focused on the proposal put forward by Accumulated Finance for the WACME/frxETH and stACME/WACME pools, the dependency on Accumulate Network requires a wider scope for our investigation.

We will first cover risks associated with Accumulate Network, as it underlies the stACME and WACME pools put forward in the proposal. Secondly, the report will look at Accumulate Bridge, which is responsible for issuing WACME. Finally, we will take a look at Accumulated Finance, the issuer of stACME.

Risk Analysis: Accumulate Network

Product Introduction

The Accumulate Protocol is an identity-based blockchain that aims to address the trilemma of security, scalability, and decentralization through a chain-of-chains architecture. Digital identities called Accumulate Digital Identifiers (ADIs) are treated as independent blockchains, and each possesses a hierarchical set of keys with different priority levels. The protocol uses a two-token system to provide predictable costs for enterprise users, and all transactions are anchored to Layer-1 blockchains for enhanced security. The goal is to power the digital economy through interoperability with Layer-1 blockchains, integrations with enterprise tech stacks, and interfacing with web APIs.

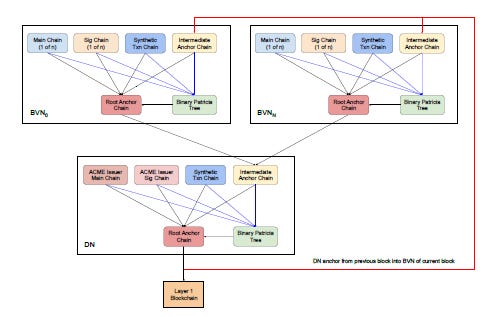

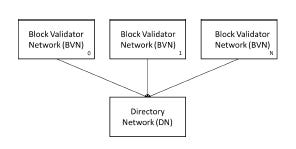

Block Validator Networks and Anchoring

The Accumulate protocol is designed to optimize parallel processing, linear scaling, and state efficiency. To achieve parallel processing, the network is partitioned into multiple validator networks, called Block Validator Networks (BVNs), that process transactions for a fraction of accounts. Each account is assigned to a particular BVN, and each BVN can process transactions for thousands of accounts. Additional BVNs can be added to linearly scale the network as usage increases.

The efficiency of the state is realized through Accumulate’s chain-of-chains architecture that organizes transactions into hierarchies of summary hashes. This enables users to validate transactions on low-capacity devices such as mobile phones. In a traditional blockchain, transactions are hashed using cryptographic algorithms like SHA-256 and organized into a data structure called a Merkle tree. The Merkle tree is stored within a block and connected to other blocks in the network by including the hash of the previous block in the current block header. This data structure creates a block ‘chain’ that maintains the history of the network.

In contrast, the Accumulate protocol treats each account as an independent chain and manages it as a continuously growing Merkle tree. Blocks are treated as synchronization points for all chains in the network. The indexing of these points allows Accumulate to provide 1-second blocks for finalization and 12-hour blocks for synchronization of the historical ledger.

Block Validator Network Nodes (BVNNs) validate transactions for an account. Root hashes from each BVN are fed into a larger network of nodes called the Directory Network (DN), which produces a final root hash that can be ‘anchored’ into another blockchain. DN root hashes will be regularly anchored into Layer-1 blockchains like Bitcoin and Ethereum.

Additionally, each BVN and the DN have Synthetic Transaction Chains, Root Anchor Chains, and one or more Intermediate Anchor Chains. Every chain is anchored into the Root Anchor Chain, creating a chain-of-chains architecture where every chain within a BVN or the DN can be considered a side chain of its respective BVN/DN Root Anchor Chain.

Accounts and Key Hierarchy

Each account is uniquely identified by a URL and is uniquely identified by its own Signature Chain and Main Chain. Accumulate accounts are designed to improve the user experience, efficiently organize data, and integrate with web apps, mobile devices, and enterprise tech stacks. Accumulate supports several types of accounts, including Lite Token Account, Lite Data Account, Accumulate Digital Identifier (ADI), Key Book, Key Page, ADI Token Account, ADI Data Account, and Scratch Account.

The protocol has a hierarchical key management structure where Key Books contain Key Pages and Key Pages contain keys that are authorized to sign transactions. Each Key Page specifies m of n where m is the number of unique, authorized signatures required to approve transactions (i.e., the signature threshold) and n is the total number of keys on the page. Accounts are linked at creation to a Main Key Book and an optional Manager Key Book. A signature is authorized only if the signing key corresponds to a key in one of the pages of either the Main Key Book or the Manager Key Book (if specified).

More information on the tech stack is available in the Accumulate Whitepaper.

Risk Vector 1: Censorship & User Assets Security

This section revolves around the security of user funds on Accumulate. For this, we based our analysis on metrics from this Consensys research piece to determine the level of network decentralization and therefore to assess the "rug-ability" (i.e. the extent of censorship resistance).

Consensus Algorithm

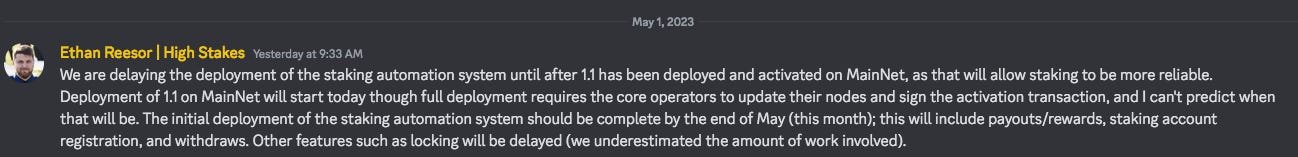

Note: As of this writing, Accumulate has not fully implemented its consensus algorithm as outlined in the whitepaper. The network currently operates as a hybrid proof of stake/proof of authority chain. Validators on the network are whitelisted and all 44 validators have equal weight in achieving consensus. There is an early version of staking and stake delegation, but there is not yet an automated process for slashing. Stakers can not unstake until an upgrade that is planned for the end of May.

Accumulate Network is building a Delegated Proof of Stake System. In essence, this means that tokenholders delegate their ACME to specific validators which propose new blocks and validate transactions. Each Validator runs the Tendermint Consensus Algorithm. Tendermint is a Byzantine Fault Tolerant (BFT) consensus algorithm designed by Jae Kwon (2014) to provide a high degree of security and consistency in a decentralized network. At a high level, the Tendermint algorithm works as follows:

Validators are responsible for proposing new blocks and verifying transactions. A set of validators is selected through a Byzantine fault-tolerant consensus algorithm that ensures a certain level of decentralization and security.

A new block is proposed by one of the validators, who must then broadcast the proposal to the rest of the validators.

Validators then vote on the proposed block. They can vote to approve, reject, or abstain.

If more than two-thirds of the validators approve the proposed block, it is added to the blockchain. Otherwise, the block is rejected.

Once a block has been added to the blockchain, the validators move on to the next block proposal and voting process.

It also supports finality, which means that once a block has been added to the blockchain, it cannot be reversed. The most popular and original use case is part of the Cosmos SDK. Purely on an empirical basis, this suggests a degree of establishment and robustness. Thus far, it has been successfully running with a large amount of capital on the respective chain, suggesting a trustworthy and efficient consensus algorithm.

Due to the absence of more granular analytics provided by the Accumulate Network, the author is unable to assess stability beyond a heuristical reference to Tendermint.

Client Diversity

Based on the information provided, it seems there is a lack of available information on the client diversity of the Accumulate Network. Therefore, it is difficult to draw any definitive conclusions about the extent of client diversity. However, the limited information available suggests that there may only be one client available for the network.

Network Usage

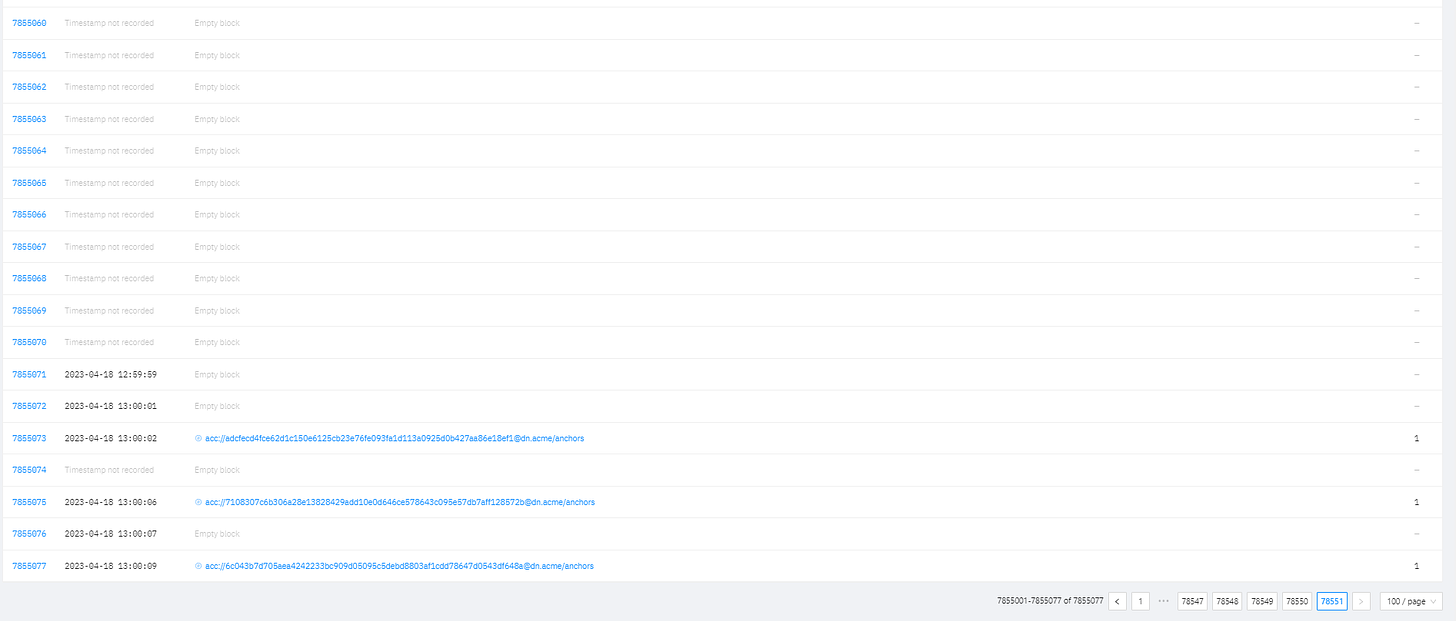

The absolute figures are unclear. It is not uncommon to see empty blocks, although it should be noted that the network operates on a 1-second block time.

Another measure of actual usage is the transaction volume of the native ACME token. The number of transactions of the token can be found on the token page. As of this writing, the ACME token page displays 23191 transactions associated with it. Given that the Accumulate Network generated its Genesis block on 2022-10-31 20:11:52 (see Block 1), it has operated for approximately 6 months, which averages to (23191/6) = 3865 transactions involving ACME per month or 128 transactions per day. Relative to other blockchains, the activity is notably sparse (compare to this Chain Comparison Dashboard).

User traction

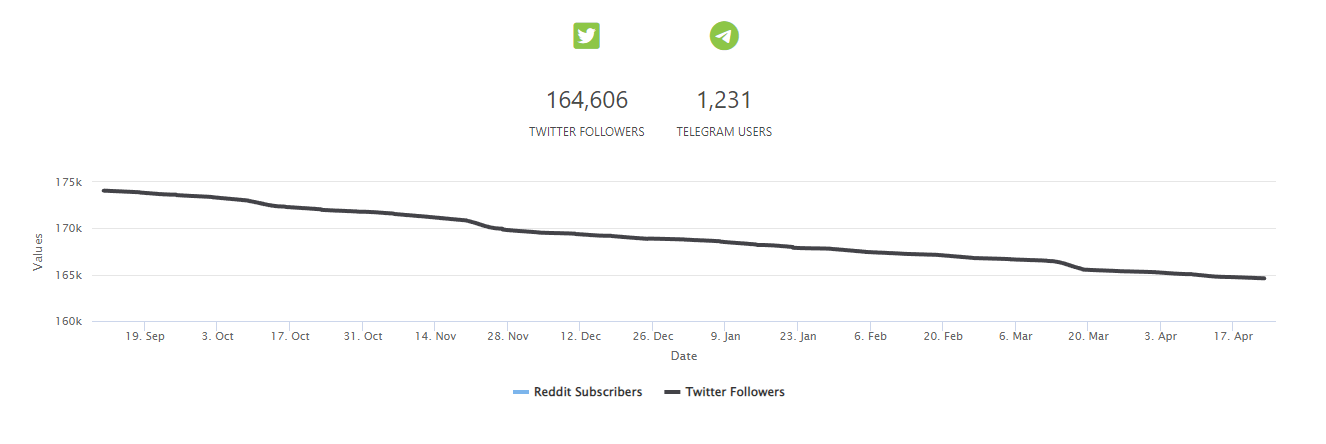

While social metrics are not great tools for examining real user traction (as they can be easily manipulated), we nevertheless will consider them. Due to a lack of meaningful analytics, we will use this metric as a proxy to analyze the general interest of users in Accumulate.

As illustrated in the chart from Coingecko, we can observe a decline of ~6% of Twitter followers (from ~175,000 to 165,000 since listing on the 10th of September, 2022 until the 6th of April, 2023).

Developer Activity

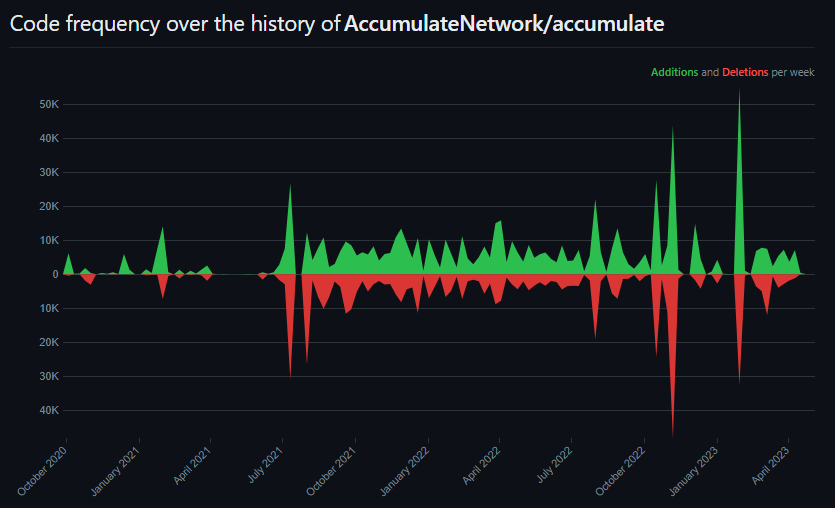

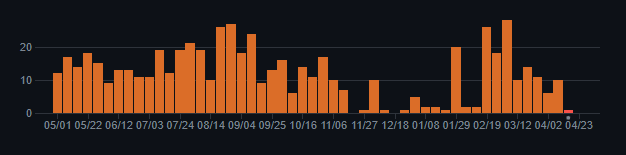

Developer activity refers to the level of contribution and engagement of developers in a software project. It can be measured by various metrics such as code commits, pull requests, bug fixes, and code reviews. Developer activity is a critical factor in the success and sustainability of software projects, as it drives faster development cycles, improved collaboration, and better quality software. In open-source projects, developer activity is particularly important, as it fosters community participation and collaboration, and helps drive the project's success. The reader should note that the main development of the Accumulate Network takes place on GitLab and GitHub acts as a mirror.

The developer activity for the main repo on GitHub is relatively consistent, suggesting sustained effort and sustainability of the project.

Commits for this repo range somewhere between 5 to 10 commits per week. On a relative basis, this puts Accumulate on par with projects ranked 727 - 1001 in terms of weekly commits on the Artemis Developer Activity Dashboard.

Funding

A substantial ecosystem fund is crucial for the success of a layer 1 blockchain. It provides resources to support growth and development, incentivizes participation, and covers costs when there are low adoption rates. Without such a fund, the network may not be able to pay transaction fees or support dApps. In addition, a large ecosystem fund attracts investors and developers, signaling a commitment to long-term success. It can also incentivize early adoption and provide grants for projects that contribute to the ecosystem's growth. Thus the aspect of funding is key.

Factom raised 579 Bitcoin in 2015. Relative to major recent launches, this is tiny. For instance, Sui raised 336,000,000 USD in Series A and B, Avalanche raised 248,000,000 USD across funding rounds and Solana raised 334,000,000 USD. While Accumulate Network allocated a 60M ACME Grant block (~0.04x60,000,000 = 2,400,000 USD), the minimal funding is a concern as bootstrapping a layer 1 protocol is expensive.

Inveniam purchased all the patents and invested several million dollars into Accumulate's development. An exact figure is not known. It's unlikely that the amount compares to the funding of other layer 1 protocols.

Governance Processes

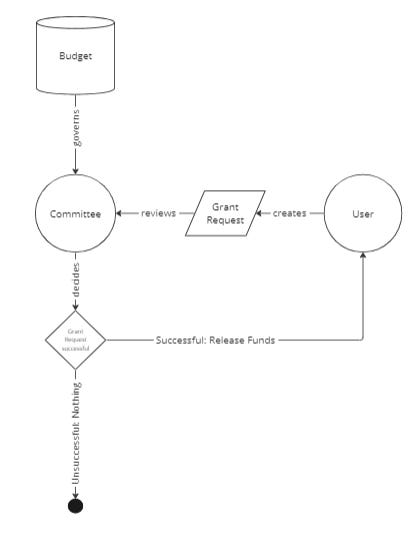

Accumulate's governance process is centered around committees that manage critical workflows in the ecosystem. Committee members are selected by stakers and validators. There are four committees called the Governance Committee, the Core Development Committee, the Ecosystem Committee, and the Business Committee. Each is assigned a budget in ACME tokens to carry out operations. The committees manage tasks such as code development, managing the protocol, managing staking services, coordinating integrations with other communities, negotiating with exchanges, providing liquidity, and organizing marketing activities such as conferences and hackathons.

The grant request process is initiated by an applicant who submits a proposal to the appropriate committee. The committee evaluates the proposal and approves or rejects it. Stakeholder voting is required for all grant proposals, and decisions by the committee cannot be appealed. The committee may appoint independent consultants to monitor the execution of awarded grants. The initial Accumulate Grant Pool is allocated 60 million ACME tokens.

In general, the standard process can be summarized below:

While Governance is fairly centralized, it is effective and well-documented, and seems appropriate given the current growth stage of the Accumulate Network. Initially, a core committee of individuals with technical expertise will make decisions about the protocol's implementation, but over time, node operators and delegators will have greater input in decision-making. Accumulate has plans to move towards a 100% on-chain governance model over the next 2-5 years, with all decisions being made by all staking parties. The community will eventually be able to vote on Accumulate Improvement Proposals and Grants for application/solution development. The move towards full decentralization is expected to be slower than the implementation of layer 2 grant proposal voting.

Risk Vector 2: Token-based Risk

ACME Tokenomics

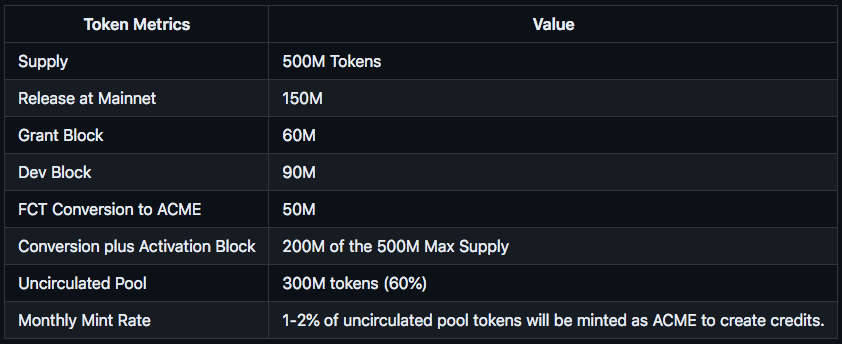

As outlined in the whitepaper, Accumulate's ACME token is designed to follow a Burn and Mint Equilibrium (BME) model. The token is used as a means of exchanging value within the Accumulate network, with Credits being used to pay for blockchain services. The Credits are fixed to the USD value, allowing enterprise users to budget their data use long-term without worrying about market conditions.

The BME model is designed to be deflationary, which incentivizes network use and staking. Periodically, ACME tokens are minted and distributed to stakers and validators as a reward for securing the network. At the same time, a portion of the circulating supply of ACME tokens is burned to create Credits, which are used to pay for blockchain services. Burned ACME tokens are returned to an unissued pool to be reissued in future blocks, creating a deflationary model that further incentivizes network use and staking. Initially, the unissued pool contains 300 million ACME tokens, which is 60% of the max supply.

Furthermore, every month, 1-2% of the tokens in the unissued pool will be minted as ACME is burned to create Credits. This ensures a steady supply of tokens for stakers and validators while maintaining the deflationary nature of the BME model.

In the first year, 100% of minted ACME tokens will be delivered to stakers and validators as a reward for securing the network. Later on, some of the minted ACME tokens will be added to the Grant Pool to support partnerships and development.

The staking process in Accumulate aims to lower token velocity and increase predictability, with a goal of 60%-80% of the circulating supply being staked. There are two staking methods: undelegated staking, which has no penalties or bonding, and delegated staking, which has higher rewards but with warm-up and cool-down periods and penalties for poor performance. One can choose to delegate stake between 3 months and 24 months. The longer you stake the higher the rewards percentage will be. There will be short-term and long-term lockup implementation, and delegators and operators can be slashed if the operator is not performing or acting maliciously. To incentivize the robustness of the network in its early days, operators may operate multiple active core validators, but this is a temporary measure that may be discontinued in the future.

Initial Token Distribution of ACME

The initial token distribution of ACME is outlined in this article:

The Grant Block will be given to community members for improving the protocol.

Governance | 30M

Core Development | 15M

Ecosystem Development | 6M

Business Development | 9M

The Developer Block will be allocated directly or indirectly to shareholders, advisors, protocol contributors, and team members.

DeFi Devs | 79,200,000

Unpaid Work Compensation | 3,600,000

Advisors | 1,800,000

External Contributors | 3,600,000

Miscellaneous Expenses | 1,800,000

The initial allocation seems to be equitable in our opinion. In this distribution, DeFi Devs and Advisors can be considered protocol insiders, putting the insider allocation to approximately 41%. On a relative basis, we consider this reasonable.

Staking Rewards

Validators are nodes that are responsible for verifying and validating transactions, and adding them to the blockchain. According to the whitepaper (p. 21), stakers and validators are compensated with freshly minted ACME:

"Every year, 16% of tokens in the unissued pool will be minted at intervals of approximately 1 week to compensate stakers and validators in the absence of a transaction fee"

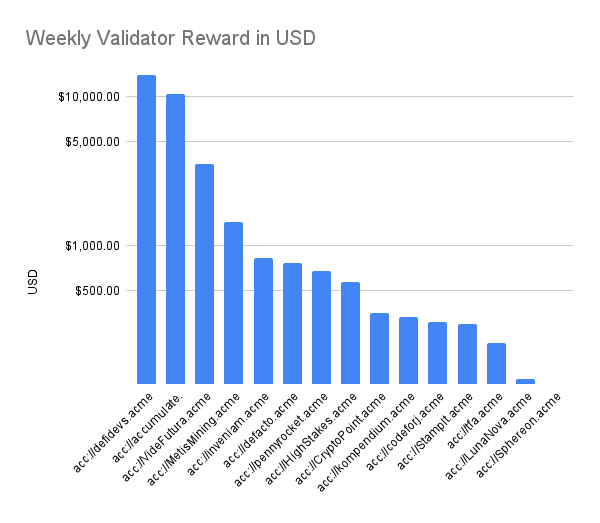

When a staker delegates to an Accumulate validator, the validator earns 10% of the delegated stake. Therefore an approximate cost calculation for the security budget for a respective validator can be expressed as:

Weekly Validator Reward = (16% * Total Unissued Tokens / 52) * (Validator Stake / Total Staked)

By doing a simple analysis using recent figures of ACME self-staked by validators and delegated stake, we can approximate the weekly staking rewards earned by each validator. Only 4 validators are earning >$1000 per week. De Facto, the validator run by the Accumulated Finance team and to which its ACME is delegated, has the 6th highest stake in the network and earns ~$800 per week.

While this may seem like a low-security budget, it may be sufficient in the context of network activity, as Accumulate is essentially a new project. Given that ACME is relatively illiquid, an attacker will be unable to meaningfully cash out on a consensus-level attack. This limits the risk at present, although additional liquidity in the Curve pools may increase this risk.

Stake Diversity & Growth

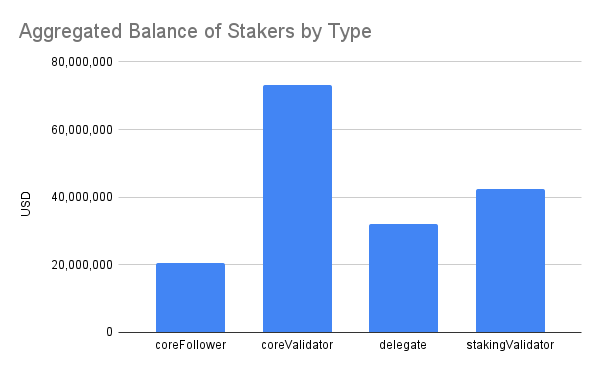

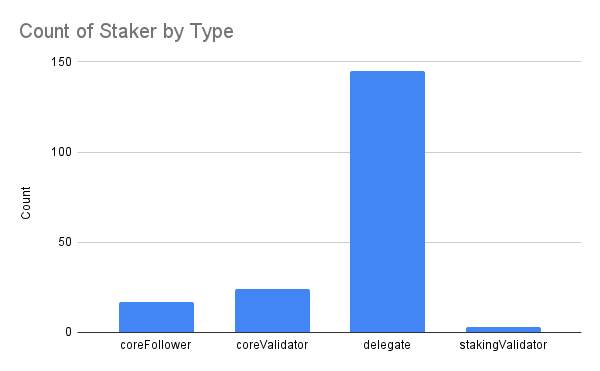

There are different types of agents listed as staking and validation participants. They are defined as follows:

CoreValidator: A validator node that is responsible for proposing new blocks and validating transactions on the Accumulate Network. CoreValidators are selected through a consensus algorithm and have a significant role in maintaining the security and integrity of the network.

StakingValidator: A validator node that participates in the consensus process by validating transactions and adding them to the blockchain. Unlike CoreValidators, StakingValidators do not participate in block proposals, but they do earn rewards for their participation in the network.

CoreFollower: A node that follows a CoreValidator in the network. These nodes are responsible for replicating data and participating in the consensus process.

Delegate: An individual who holds tokens and delegates them to a validator in exchange for a share of the validator's rewards. Delegators do not participate directly in the consensus process, but they play an important role in securing the network by choosing trustworthy validators.

There are 17 coreFollowers, 24 coreValidators, 145 delegates, and 3 stakingValidators.

CoreFollowers hold the lowest number of tokens, at 20,496,467, while the coreValidators hold the largest amount at 73,088,162 tokens. Delegates hold 32,159,501 tokens, and stakingValidators hold 42,458,526 tokens.

This shows a nearly inverse relationship that likely indicates the relative token distribution between insiders and retail. Insiders are likely to be operating validators and retail users are likely to be delegates.

Due to a lack of available analytics about Accumulate Network, limited insight on node distribution can be provided. The author encourages similar infrastructure to Etherscan Node Tracker to be deployed by Accumulate Network.

Note: In the current iteration of Accumulate consensus, all validator types (CoreValidator, StakingValidator, and CoreFollower) are whitelisted, and have equal weight in achieving consensus with a total of 44 validators. Weighting proportional to stake will be introduced in a later upgrade.

Token Ownership

In Delegated Proof of Stake (DPoS), the delegated tokens play a crucial role in curating the validator selection process. DPoS networks are designed such that token holders can vote for delegates who will validate transactions and maintain the blockchain. In DPoS, the token holders' voting power is proportional to the number of tokens they hold or control through delegation. This means that token holders with a larger token balance or more delegated tokens have a greater say in the election of validators and hence the ordering of transactions and block construction. In addition, validators are rewarded with newly minted tokens and transaction fees for their efforts.

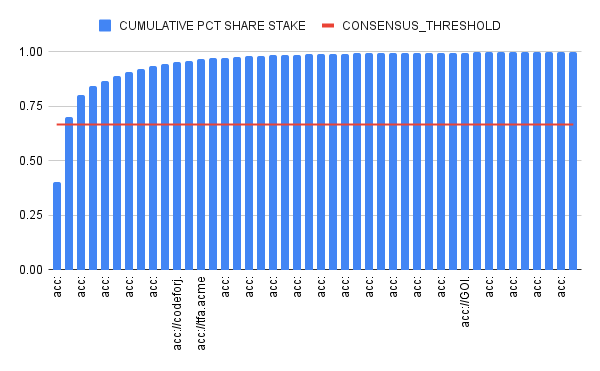

In essence, whoever controls more than 2/3 of the token stake effectively controls transaction validation and block construction in a Tendermint DPoS System.

From the chart, we can see that essentially two validators & their delegates controlled by 1) the DeFi Devs team (acc://defidevs.acme) and 2) the Accumulate Foundation (acc://accumulate.acme) effectively control the network (if the network were DPoS today). While not unusual for an early-stage protocol, this represents a concerning level of centralization and a greater distribution of the token is needed.

The staking mechanism has a positive feedback loop (assuming no slashing for technical failures of a given validator, etc.) that increases the balances of large token holders, as they are disproportionally more often selected for block validation and construction. It is likely to observe a circular effect of further entrenching the influence of early insiders, which may stifle future growth.

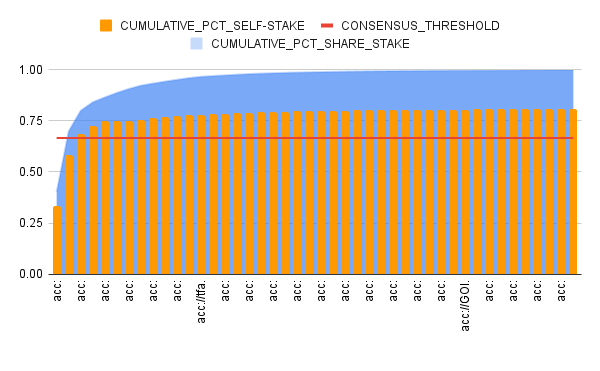

In the interest of decentralizing the influence of validators, stakers might reconsider the current distribution and delegate to a wider pool of validators. However, this may not be effective in adequately distributing vote power, as the majority of validator stake in both cases is self-staked (56,193,658 ACME and 42,000,000 ACME respectively). As shown below, when excluding delegation, the 2/3 threshold would be met by only 3 entities.

We recommend ideating about possible modifications to the validation mechanism. For instance, an option for balancing power more effectively for Accumulate Network might be achieved by implementing Quadratic Voting. For an example see Axelar Network.

Furthermore, as only 45% of the total supply has been issued at present, it may be worth considering an alternative distribution mechanism to distribute to a larger token holder base.

Note: Decentralization is always a means to an end and not a goal in itself (i.e. most commonly blockchain systems are used to achieve the property of censorship resistance). Given this, the LP should ask him or herself whether the degree of decentralization is sufficient for them in the context of Accumulate Network.

Risk Vector 3: Technical Security Risk

A series of 9 testnet releases were deployed between November 2021 (when the upgrade to Accumulate was confirmed) and November 2022 (when the Accumulate mainnet was activated).

An audit report by Fairyproof has been conducted between July 7, 2022 - Sep 13, 2022. We will highlight the most important issues raised by Fairyproof.

Consensus mechanisms are not fully implemented: [FP-1] DPoS Algorithm Not Implemented, [FP-2] No Slashing for Tendermint Validators

The Accumulate Network has not implemented the DPoS algorithm. This changes the security properties of Accumlate and poses a potential risk to the network's security and integrity. At the time of the audit, the network seems to have been running on pure PoS.

Additionally, the network's lack of a slashing mechanism poses a risk to users. If a validator engages in misconduct, there is currently no way to penalize them. However, the Accumulate team has acknowledged this issue and plans to implement a slashing mechanism to penalize such validators in future upgrades. Once implemented, evidence will be recorded on a data chain, and a layer 2 staking system will be responsible for discovering evidence and punishing misbehaving validators.

After inquiring with the team, it was clarified that the DPoS and slashing will go live in May 2023.

Unresolved Attack Vectors: [FP-6] Potential Malicious BVN, [FP-15] Inappropriate Validator Power

The Accumulate Network has a potential security vulnerability in its consensus algorithm. When 2/3 of the validators in a single BVN are malicious, that BVN could become malicious and could potentially attack normal BVNs. This is particularly concerning when the number of validators in a BVN is small, as it could be easily manipulated and used to attack the entire system.

To address this issue, the recommendation is to ensure that each BVN has at least a certain number of validators and to use a well-designed algorithm to randomly allocate validators for each BVN. At launch, each BVN will have at least 10 validators, spread across different mainnet participants. The Accumulate team plans to implement a more robust solution, including randomization, in version 1.1.

In addition, the power of newly added validators is always set to 1 in Accumulate Network's EndBlock function, which could pose a security risk. The recommendation is to implement a DPoS algorithm to calculate the actual power of the validator. The Accumulate team has acknowledged the issue, but no update has been provided yet. With the upgrade to DPoS in May 2023, the validator weight should change.

[FP-18] Reinforcing Token Security

The potential issue identified is that Accumulate's token design may have some issues. Currently, a token issuer only keeps its token's metadata in the BVN it belongs to and not the balance of the token holder's account. This implementation leads to issues such as the balance of a sender being verified only in the sender's BVN, but the receiver BVN cannot verify the sender's balance.

The recommendation given is to consider implementing the logic in a way that a token issuer's BVN keeps all token holders' account balances, and when a token transfer is initiated, the token issuer's BVN will act as a relayer and verify the transaction.

The Accumulate team has responded that the state of the BVN can only be compromised by Tendermint authorities, which will be shuffled automatically in a subsequent update. Also, each account is auditable independently, without needing to involve the entire blockchain for audit purposes, and along with the ability to keep cryptographic fraud proofs small, this makes the protocol harder to compromise. They believe this makes the blockchain more decentralized. They plan to launch with a small set of trusted operators and randomly shuffle BVN assignments and active validator assignments in PoS v2 to make it harder for a cabal to gain control of a BVN.

Risk Analysis: Accumulate Bridge

Product Introduction

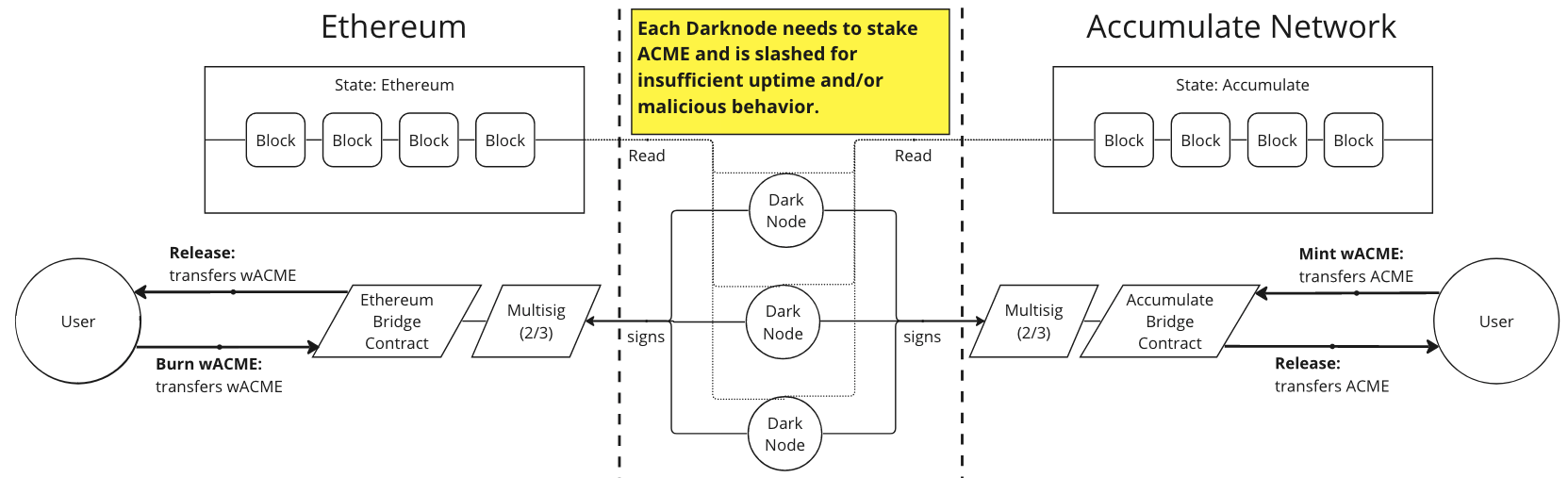

The Accumulate Bridge is a decentralized bridge that allows users to transfer Accumulate tokens, including ACME, between Ethereum and the Accumulate blockchain. It uses a technology based on renBridge Darknodes, which act as gatekeepers between different blockchain networks to facilitate cross-chain transfers. At present there is no slashing implemented for bridge operators, meaning it run by a trusted set of nodes (i.e. PoA). Bridge transactions can be paused if misbehavior by any of the nodes is detected. Each bridge node operator has staked over 1.5 million ACME each, which is significant in relation to the total token supply of 200 million, although less so in dollar terms (~$60k USD).

The bridge software consists of the bridge node, bridge front end, and smart contracts. The bridge node is a Golang backend application that integrates with the Accumulate blockchain and Ethereum. Bridge node operators set up multi-sig token accounts on both sides of the bridge that can only hold one type of token.

Users can initiate a transfer of Accumulate tokens from one blockchain network to another by sending their tokens to the bridge multi-sig token account. The memo field of the transaction is used to store the destination address for wrapped tokens on the destination blockchain network.

Once the transfer request is validated, the Accumulate Darknodes verify the transaction on both the source and destination blockchain networks. If the transaction is valid, the Darknodes sign a multi-sig contract to trigger the minting of wrapped tokens on the destination blockchain network.

On the Ethereum network, bridge operators parse burn transactions made by users, which releases native ACME tokens from the multi-sig token account on the Accumulate blockchain. Bridge operators mint wrapped tokens on the Ethereum network by generating and signing multi-sig mint transactions using the Gnosis Safe API.

The bridge also includes a fee module, which charges a flat fee without ACME price oracles. The fees collected are accumulated into Accumulate multi-sig token accounts.

Users can interact with the bridge via the bridge front end, which allows them to initiate transfers of Accumulate tokens between Ethereum and Accumulate. The bridge node, bridge smart contracts, and the bridge frontend are open-source and released under the MIT license.

Risk Vector 1: User Assets Security

At present, a 2-of-3 multi-sig governs the Accumulate bridge and is required to initiate cross-chain transfers. While the validator set is small, they are not anonymous and are operated by companies.

The node operator addresses are listed below:

0xCaD2fddb5009608Fa1ab042d643A61550A7dA63F

0x9aB9c0d6741EaA6d6FDAf44c6EE80A2F9F59A8dB

0x348975426678c0C0fCeD637b7Aa25C2900db986D

MHz125tGb22fZtxjkViSDLmV5xeDmWRDgvZf39qbWMfbnDkYnJ8LLHT

MHz126MJiCCPe4XSiS4byx5ydc5dk3aM4JAjU4odXvhpF9pwubvBqnU

MHz1277ixNm9EZcLbCBpbw8SDYRddWfzHbXmHcEgbAShLY2mWp5N8xw

While the companies behind the bridge signers are not posted publicly, the Accumulate Team has stated that they can be inferred on-chain. Based on this, the Bridge Operators are DeFacto, HighStakes, and Kompendium.

Risk Vector 2: Token-based Risk

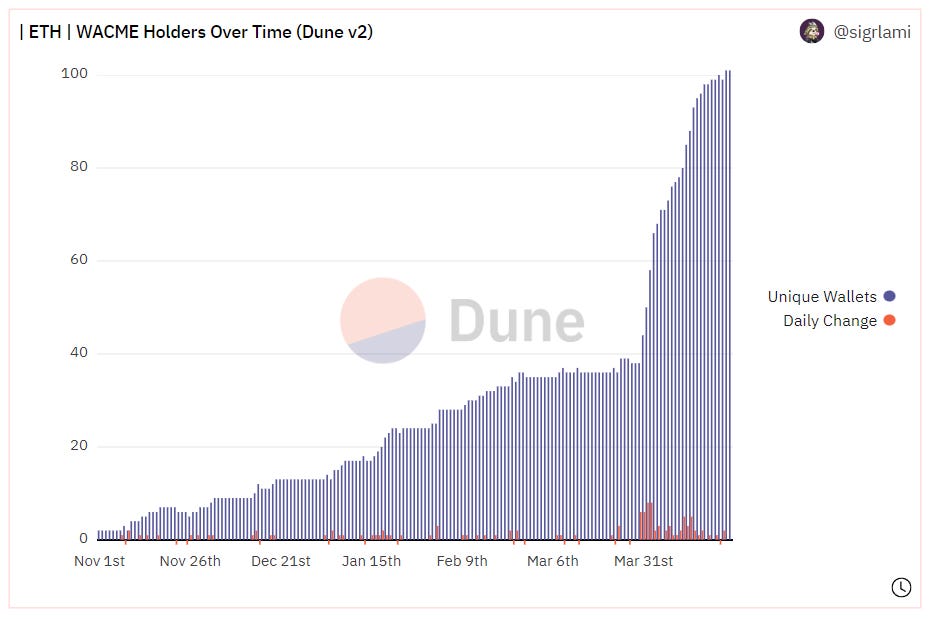

WACME Adoption

The bridge has received modest usage since its launch. WACME holders apparently consist mostly of the existing ACME holder base, rather than users onboarding from Ethereum. This may change as incentives to the WACME/frxETH pool grow WACME liquidity. The number of unique WACME holders has expanded since March, but as of this writing, adoption remains very low.

Potential WACME Depeg

A user can lose funds even after bridging their asset if the underlying token is stolen. This is because the synthetic ERC-20 WACME token derives its value from the underlying ACME locked on the Accumulate network. If the underlying ACME token is stolen or compromised, the value of WACME will be affected, and depending on the severity of the compromise can potentially render it worthless. Therefore the wrapped ACME is entirely dependent on the integrity of its native network.

Risk Vector 3: Technical Security

The Accumlate Bridge Infrastructure (i.e. bridge frontend and bridge contracts) have be audited by Fairyproof. The audit does not show any meaningful unresolved security issues.

However, it is worth highlighting a recommendation mentioned in the report: under the current implementation bridge validators complete a cross-chain transaction by using private keys stored locally in configuration files, which is not the best security practice. Compromise of the private keys could cause losses to WACME holders and LPs in the associated Curve pools.

To improve security, it is recommended to use Clef for signing transactions on an EVM chain and Walletd for signing transactions on the Accumulate network. These are programs that enable the signing of transactions without exposing private keys to the Internet. Clef and Walletd should be deployed independently from the bridge nodes, and access control should be managed by different individuals. This may increase maintenance costs, but it greatly enhances overall security by reducing the risk of private key compromise.

Risk Analysis: Accumulated Finance

Product introduction

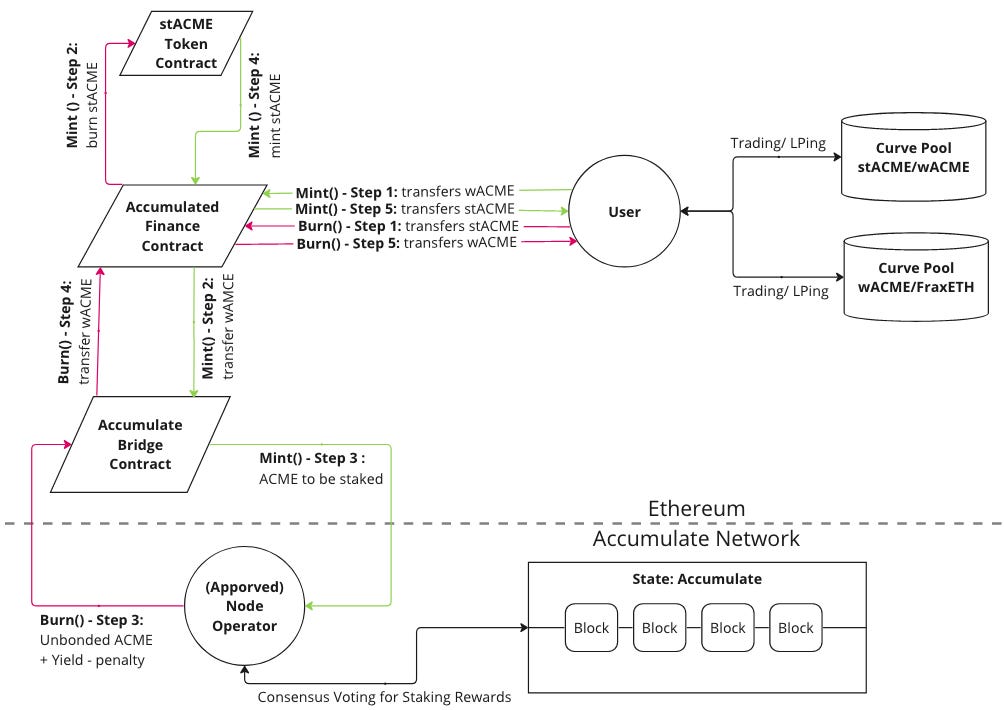

Accumulated Finance is a platform that enables users to participate in liquid staking for the Accumulate protocol, similar to Lido for Ethereum. Users can easily stake any amount without worrying about the challenges and risks of managing staking infrastructure. Stakers receive stACME assets, which are liquid, tokenized staking derivatives representing their claim on the underlying stake pool and its yield. This allows users to stake their ACME tokens on the Accumulate protocol without leaving the Ethereum ecosystem.

Accumulated Finance plans to use deeply liquid Curve pools to provide liquidity for WACME, the wrapped version of ACME on the Ethereum network. A pool paired with frxETH onboards Ethereum users to WACME and a pool paired with stACME gives users access to ACME staking rewards.

Node operators are added to Accumulated Finance through the multi-sig and are responsible for actual staking, maintaining the underlying infrastructure, and ensuring the security of the staked assets. Given that there is a token planned for Accumulated Finance ($ACFI), it is likely that Governance over changes to the Node Operator configuration will eventually be subject to token voting, similar to Lido.

Note: Image above shows unstaking ACME. Currently unstaking is not possible. When Accumulate network supports unstaking, Accumulated Finance say they will support stACME redemptions.

When a user deposits WACME into the ACME Liquid Staking, deposits are then moved to Accumulate Bridge. From there, they are transferred to the burn address. The Bridge releases the ACME on Accumulate Network where it is staked by whitelisted node operators, and the user is issued stACME in return. A withdrawal event executes the process in reverse, as seen in the figure.

Risk Vector 1: User Assets Security

Unstaking ACME:

Users should be aware that, as of early May when this report is being released, it is not possible to unstake ACME (similar to ETH staking before the Shanghai upgrade). The Accumulate team has announced on Discord their plan to allow staking withdrawals by end of May. The Accumulated Finance team has also reported to us that they will allow stACME redemptions following this network upgrade. For now, the only way users can exit stACME is through the stACME/WACME Curve pool.

Access Control:

The ACME liquid staking contracts are owned by a 2-of-3 multi-sig wallet composed of Accumulated Finance/Accumulate network team members. The signers include Anton Ilzheev, who represents Accumulated Finance, Paul Snow, the Chief Blockchain Scientist of Accumulate Protocol, and Ethan Reesor, a Core Developer of Accumulate Protocol. These individuals are responsible for managing the multi-sig wallet and have specific admin rights, including ACME Liquid Staking contract ownership, the ability to set staking accounts for deposits, and mint stACME. All relevant contracts are non-upgradeable and there are no timelocks on admin functions.

Below is an overview of Accumulated Finance's liquid staked ACME contracts, contract ownership, and privileged functions:

ACMELiquidStaking Contract - Handles the logic of accepting WACME deposits, transferring to Accumulate Bridge, and minting stACME to users.

Owner is Accumulated Finance multi-sig

approve_bridge()- approve bridge address for the WACME tokenmint_stACME()- mint stACME to an addressrenounceOwnership()- renounce ownership to ACMELiquidStakingrenounce_stACME_ownership()- renounce ownership to stACMEset_stakingAccount()- set Accumulate staking accounttransferOwnership()- transfer ownership to another addresstransfer_stACME_ownership()- transfer stACME ownership to another address

stakedACME Contract - The stACME token contract.

Owner is ACMELiquidStaking contract (which is owned by Accumulated Finance multi-sig)

Function calls are made through the LiquidStaking Contract

pause()- This function cannot be called, as the LiquidStaking contract doesn’t support this function call. Either the LiquidStaking contract would need to be upgraded or stakedACME ownership transferred to use this function.

StakingRewards Contract - Users can stake their stACME and earn staking rewards.

Owner is Accumulated Finance: Deployer (EOA)

setRewardsDuration()- set the duration of rewards to be paid out (in seconds)notifyRewardAmount()- set the reward amount for the next reward period

Fees:

Accumulated Finance charges a 20% fee from ACME staking rewards and an 8% fee on the distribution of WACME/frxETH incentives. The breakdown of fees and their funding source is as follows:

Liquid Staking

ACME is staked at acc://accumulated.acme/staking, it delegates its stake to acc://defacto.acme (a validator run by the Accumulated team), and rewards are claimed by acc://accumulated.acme/staking-rewards. The fee is taken from the staking rewards and the remainder is compounded for the benefit of stACME holders.

4% to Accumulated Finance Treasury on Accumulate Network

8% to veACFI stakers (since the token is not currently live, this fee is directed to the above treasury for now).

8% to Accumulated Finance Incentives on Accumulate Network, to be used to incentivize LPs in the stACME/WACME Curve pool.

Distribution of WACME/frxETH incentives

Funds for these incentives are from 2 Accumulate accounts (acc://defidevs.acme and acc://wacme-lp-incentives.acme) that direct their ACME staking rewards to the Accumulated WACME LP incentives account. An on-chain motion references this resolution to transfer staking rewards from the Accumulate Business Committee.

4% fee on the distribution of these incentives to cover associated gas fees to Accumulated Finance Treasury.

4% to veACFI stakers (since the token is not currently live, this fee is directed to the above treasury for now).

The Accumulated team processes fee distribution on the Accumulate network using this script. Fee handling is a manual process so users must trust the Accumulated team to honestly and responsibly process fees and rewards.

Risk Vector 2: Token-based Risk

Governance currently seems to be undefined for Accumulated Finance. However, the fee page suggests that a veModel will be utilized.

Based on the information provided on that page, one can imagine a potential veTokenomic model for Accumulated Finance could involve the use of veACFI staking to incentivize participation in the platform. Users who stake their ACFI tokens could earn a portion of the fees generated by the platform, including the 8% fee from the ACME Liquid Staking Fee Structure and the 4% fee from the WACME LP Incentives Fee Structure. The amount of the staking reward, as well as the decision-making power, will most likely be determined by the lock-up to which the user commits.

Inquiry with the team made it clear that they are not in a rush to launch a token and will only do so if it makes sense. Their stated intention is to have sound utility for any governance token, and not simply launch a token for farming purposes.

Initial Token Distribution of ACFI

To date, there is not much information available on the token apart from (1) ACFI token holders will be entitled to 50% of the protocol revenue (2) 1% of the total ACFI supply will be distributed to early adopters through several rounds of distribution. Early bird liquid staking users who deposit ACME or WACME to the liquid staking before 9 March 23:59, 2023, will be able to participate. The ACFI distribution will be based on a pro-rata basis, determined by the amount and duration of the deposit. A retroactive allocation will be given to early stACME/WACME Curve pool liquidity providers at a later stage.

Risk Vector 3: Technical Security

The code has not been audited. They plan to conduct an audit when releasing their ACFI token. The system is composed of only a few contracts that are forked from previously audited projects.

Llama Risk Gauge Criteria

1. Is it possible for a single entity to rug its users?

Yes. There are a number of points of trust in the system, including Accumulated Finance Deployer, Accumulated Finance 2-of-3 multi-sig on Ethereum, Accumulated Finance 4-of-6 multi-sig on Accumulate, and Accumulate bridge 2-of-3 multi-sig. In all cases, trust is in core members of the Accumulate team whose identities are known.

2. If the team vanishes, can the project continue?

No. The team is required to stake and process rewards for users. stACME does not have any utility without active efforts by the team.

3. Does the project viability depend on additional incentives?

No. Accumulated can support the project through native staking rewards on Accumulate. Additional CRV emissions merely provide additional bootstrapping support.

4. If demand falls to 0 tomorrow, can the users be made whole?

No. Until staking withdrawals are activated, users who wish to exit stACME must do so through the Curve pool. Users may experience slippage if the Curve pool becomes imbalanced.

5. Do audits reveal any concerning signs?

Accumulated Finance is a small project in its early stage. It has not undergone an audit, although its system is quite simple and makes use of previously audited contracts. The team plan to have an audit when releasing their ACFI token.

Llama Risk Recommendation

As with many early-stage DeFi projects, Accumulated Finance requires a significant amount of trust in the honest and reliable performance of its core team. It is given greater credibility by its direct ties with core developers of the Accumulate network and that the team's identities are known. Accumulate itself is an early-stage layer 1 protocol and has yet to implement core features of its consensus algorithm, including a true proof of stake consensus with slashing, performance traction, and staking withdrawals. The Accumulate Bridge additionally presents a single point of failure, and its private key management strategy poses a risk of loss to WACME holders.

Although there are significant trust assumptions that warrant caution, the movement of funds is all auditable on-chain and both staking reward revenue streams and fees have been clearly defined. Users always have a way to publicly verify the proper operation of the Accumulated Finance staking system. For that reason, we are comfortable with the request for gauges to the stACME/WACME and WACME/frxETH pools.

Contract glossary

Accumulated Finance | Gnosis Safe Multi-sig Admin | 0xaBaEBBd34E7F79352F55B0Acea9516F6CDB94BB5

The Gnosis Safe 2-of-3 Multi-sig is used by Accumulated Finance to manage smart contracts for the platform. Specifically, this contract owns the liquid staking and stACME contracts.

Accumulated Finance | Accumulate Deployer | 0x5e95454F33F9C88C9a967531CD48192dEb2Fd4fd

Accumulate Deployer is used to deploy and manage smart contracts on the Ethereum network. In particular, it manages stACME staking rewards.

Accumulated Finance | stACME | 0x7AC168c81F4F3820Fa3F22603ce5864D6aB3C547

stACME is a liquid staking derivative token of WACME, representing staked ACME in a liquid form.

Accumulated Finance | ACME Liquid Staking (Deposits) | 0xcf1a40eff1a4d4c56dc4042a1ae93013d13c3217

The ACME Liquid Staking (Deposits) contract is used by Accumulated Finance to manage the staking of ACME tokens in a way that allows them to be used for other purposes while still earning rewards.

Accumulated Finance | ACME Liquid Staking (Rewards) | 0xe194d30aFDbae89b3118b8b7bc7B331Cc3333b88

The ACME Liquid Staking (Rewards) contract is used by Accumulated Finance to distribute rewards to users who stake their WACME tokens in the liquid staking pool managed by the platform.

Accumulated Finance | Accumulated Account | accumulated.acme

Accumulated.acme is the parent account for all Accumulated Finance addresses on Accumulate Network.

Accumulated Finance | ACME Staking Account | accumulated.acme/staking

The ACME Staking Account is a smart contract used by Accumulate Network to manage staking of ACME tokens.

Accumulated Finance | Staking Rewards | accumulated.acme/staking-rewards

The Staking Rewards contract is used by Accumulate Network to distribute rewards to users who stake their ACME tokens on the platform.

Accumulated Finance | Incentives | accumulated.acme/incentives

The Incentives contract is used by Accumulate Network to incentivize users to provide liquidity to different pools on the platform.

Accumulated Finance | Treasury | accumulated.acme/treasury

The Treasury is a public address used by Accumulate Network for various functions, including receiving a portion of the protocol fees.

Accumulate Bridge | Accumulate Bridge Multi-sig | 0x76b1E2d258CC4297e7708345E5d99e8ECa967BB1

The Accumulate Bridge 2-of-3 Multi-sig authorizes cross-chain token transfers and generally manages the bridge.

Accumulate Bridge | Wrapped ACME (WACME) |0xDF4Ef6EE483953fE3B84ABd08C6A060445c01170

Wrapped ACME (WACME) is a token that represents ACME on the Ethereum blockchain, allowing it to be used in decentralized finance (DeFi) applications.

Accumulate Bridge | Accumulate Bridge Contract | 0xbA050938970C8eAeDA3e970B571a6fe463Db7d0e

The Accumulate Bridge Contract is a smart contract that enables cross-chain transfers of ACME tokens between Ethereum and Accumulate blockchains.

Curve | stACME/WACME | 0x4424b4A37ba0088D8a718b8fc2aB7952C7e695F5

The stACME/WACME contract is used by Accumulated Finance to incentivize liquidity providers in the stACME/WACME pool. Users who provide liquidity to this pool can earn rewards in the form of stACME or other tokens.

Curve | WACME/frxETH | 0x7bbE7a17E501BB6542e975D8A163950149487fa3

The WACME/frxETH contract is used by Accumulated Finance to manage the exchange of WACME and frxETH tokens. Users can trade between these tokens through this contract, which enables them to take advantage of different features and benefits associated with each token.