Overview - Bitcoin on Ethereum

This Overview is a supplement to the "BTC on Ethereum Detailed Dashboard" created by @DiligentDeer in cooperation with LlamaRisk.

LINK: BTC on Ethereum Detailed Dashboard

Index

BTC and Bridged-BTC Supply

Only ~1% of the BTC supply is bridged to Ethereum and almost 98% of that is WBTC. The utility of BTC on Ethereum and perceived risk of pegged assets influences the amount of BTC bridged.

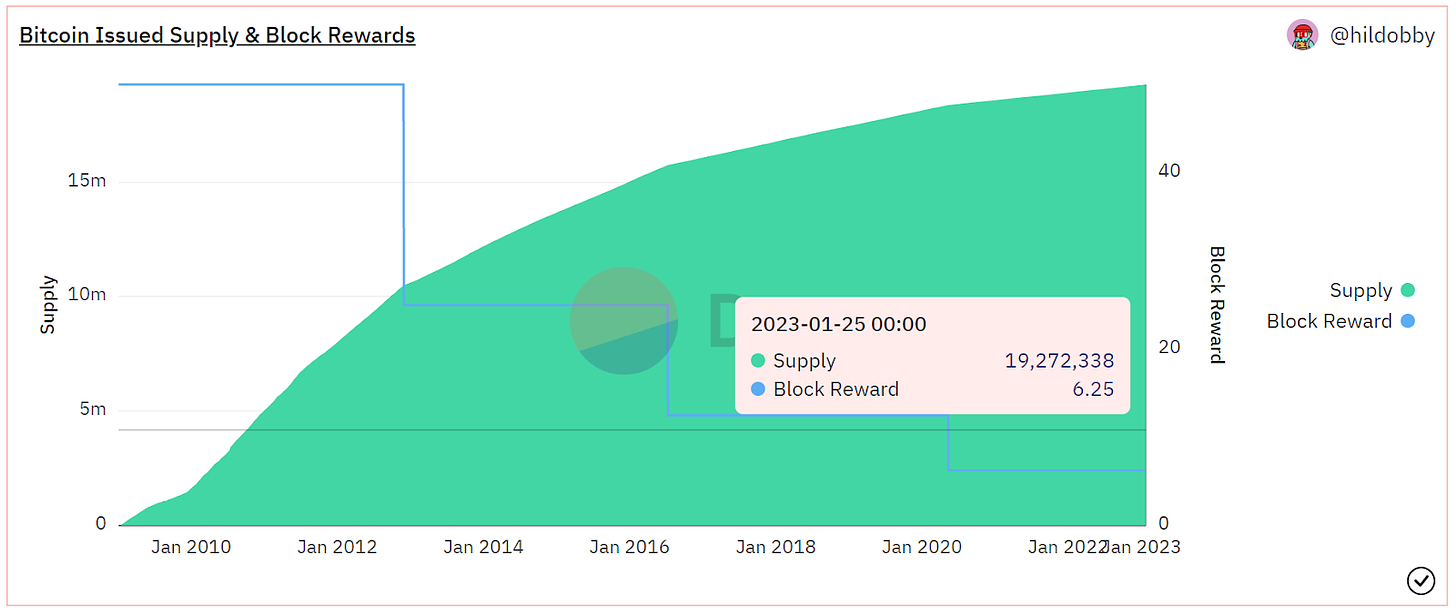

The current supply of BTC as of 25th January 2023 is 19,272,338 and the current BTC supply on Ethereum (WBTC, HBTC, bBTC, sBTC, renBTC, multiBTC, pBTC, tBTC, tBTC2, imBTC, oBTC) is almost 194,607 which is 1% of the total BTC supply. The proportion of bridged BTC to Ethereum peaked in mid-May 2022 at 1.8%.

The only reason to bridge BTC from Bitcoin network to Ethereum network is utility, whetehr it be earning yield in liquidity pools, leveraging as collateral in lending platforms, or depositing it to bridge to other chains.

Centralized vs Decentralized variants of bridged BTC

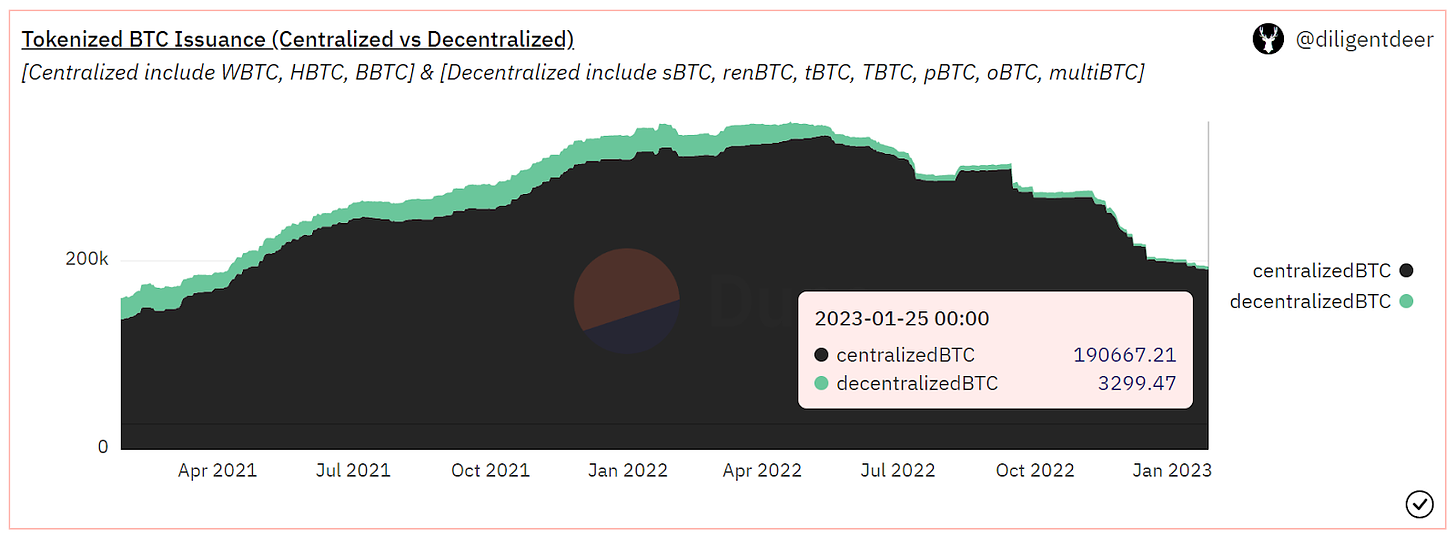

Every negatively impacting event in DeFi after the Terra collapse has caused a reduction in the supply of bridged BTC, causing users to migrate towards centralized entities that provide bridge services.

We consider whitelisted and custodial exchange tokens (WBTC, HBTC, BBTC) as centralized and crypto-backed or permissionless bridge tokens (sBTC, renBTC, tBTC, TBTC, pBTC, oBTC, multiBTC) as decentralized. The proportion increased from almost 92% centralized to 98.3% centralized between mid-May 2022 and January 2023. In the same period, the overall bridged BTC supply dropped 44%.

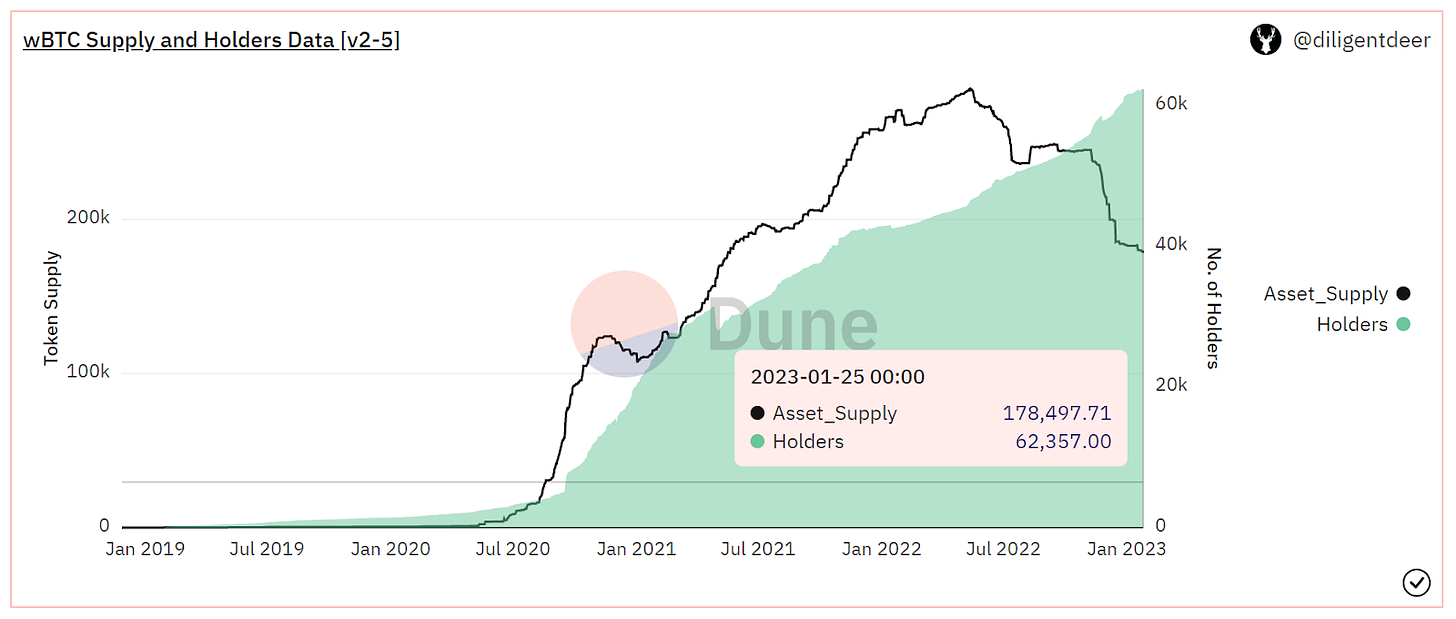

WBTC

WBTC supply peaked before the Terra collapse and at that time made up almost 83% of all the bridged BTC on Ethereum. It is 92.2% as of January 25th, 2023. Following the collapse of FTX in November 2022, FUD began circulating about BitGo's exposure to FTX and possible insolvency. Although BitGo provides proof of reserves, this led to rapid WBTC redemptions and a temporary depeg.

The decreasing WBTC supply coincides with increasing WBTC holders, so it can be inferred that exposure is shifting towards smaller holders of WBTC. Subsequently, it can be said that whales have shown less engagement after May 2022 (Terra collapse) and November 2022 (FTX collapse).

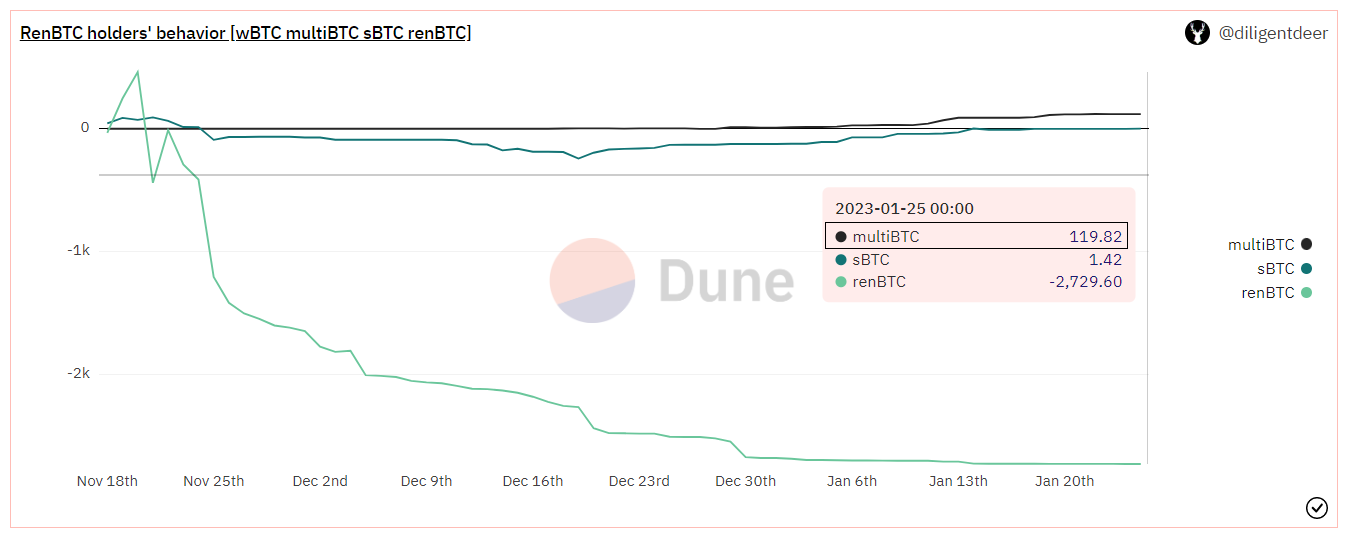

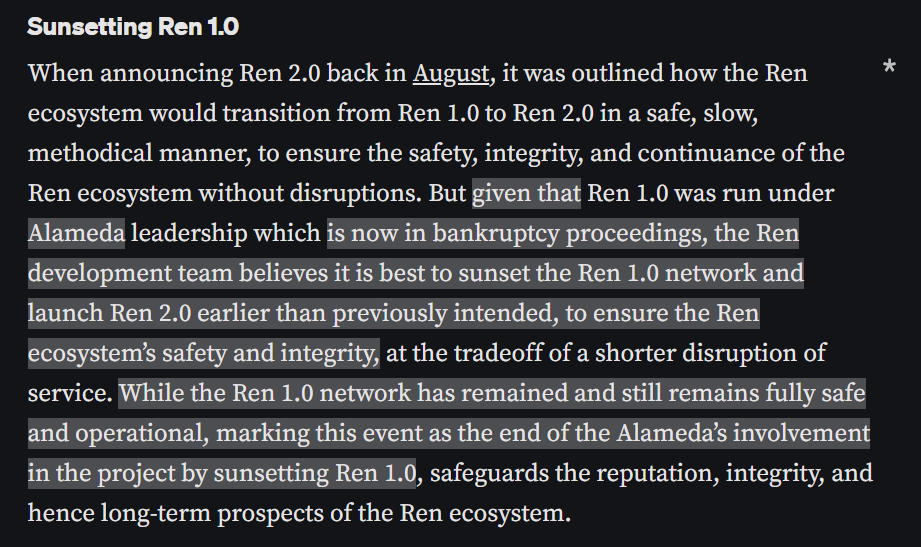

Ren sun setting

Ren team announced on November 19th, 2022 to sunset Ren 1.0 network as a result of the Alameda bankruptcy. They are asking all renBTC holders to redeem their BTC at Ren bridge, as the bridge will soon cease operations.

Before the announcement, renBTC supply was almost 2400 (18th November 2022). Since November 18th, 2729.6 renBTC have been burned (bridged back) and 421 renBTC are yet to be burned.

One of the OG LlamaRisk team members, @wormholeoracle, has proposed to kill gauges for all metapools containing renBTC.

TL;DR of the proposal:

Kill all metapool gauges containing renBTC, as Ren Protocol will be shutting down soon. This includes pBTC1, pBTC2, ibBTC, oBTC, tBTC2, and BBTC.

pBTC has a new metapool with sBTC2.

Threshold Network (tBTC) has a new metapool with sBTC2.

BoringDAO failed to respond to get a new metapool.

Binance team is not motivated to support the BBTC product.

BadgerDAO is in the process of deprecating the ibBTC product.

Most importantly, LlamaRisk members would like to assist teams with an existing BTC gauge on pool migration.

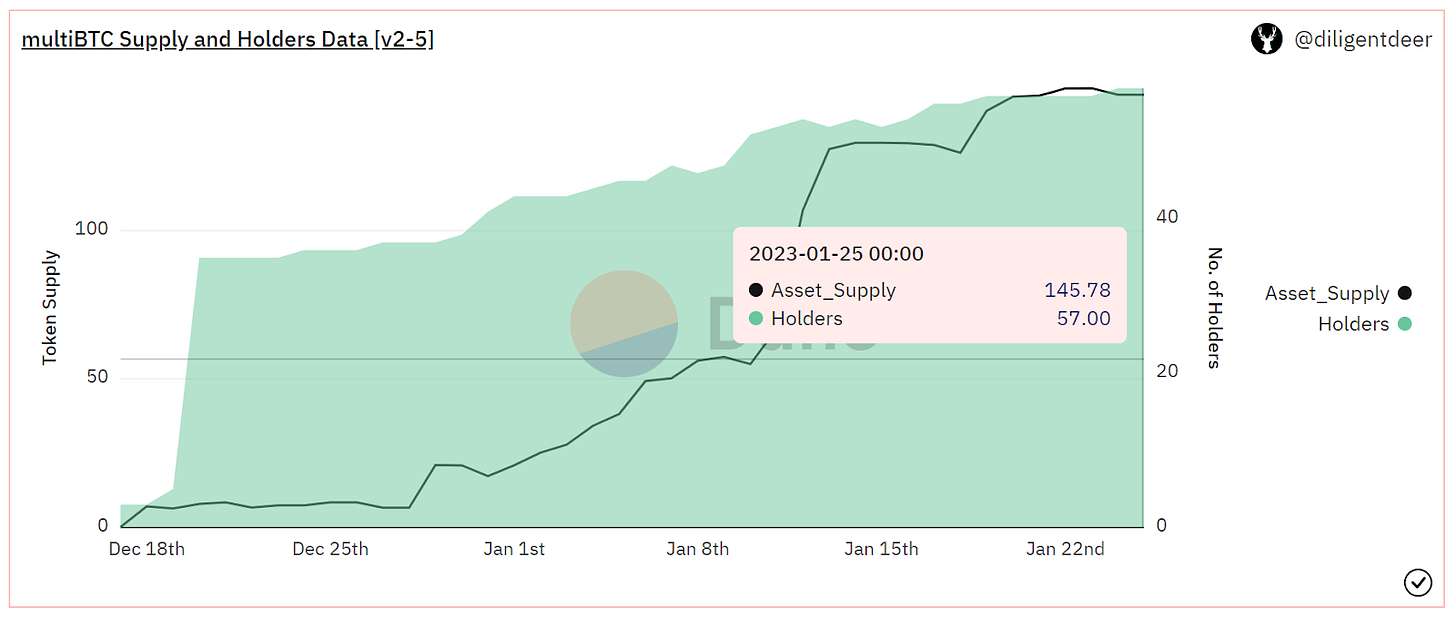

MultiBTC

MultiBTC was created on December 16th, 2022 and the multiBTC-sBTC2 pool was successfully voted to add to the gauge controller (Vote). Multichain's multiBTC is trying to capture demand for permisisonless BTC bridging that was created due to the deprecation of the Ren network.

In light of the upcoming sunset of renBTC, we want to deploy a metapool that consists of 50% sBTC2 and 50% multiBTC. multiBTC is a derivative of BTC that is fully backed with BTC and can be redeemed on the Bitcoin Mainchain in a decentralized and trustless way, even if the wrapping function is deprecated.

Source: Proposal to add multibtc3CRV (multiBTC-sbtc2) to the Gauge Controller

High CRV rewards have recently attracted an influx of liquidity to the multiBTC-sBTC2 pool. With additional incentives, renBTC holders have shifted to using multiBTC. Almost 82% of multiBTC supply is held by previous renBTC holders.

Source: RenBTC holders' behavior [WBTC multiBTC sBTC renBTC]

Source: RenBTC holders' behavior [WBTC multiBTC sBTC renBTC]

Liquidity Provisioning of bridged BTC on Curve

One of the largest liquidity pools on Curve Finance holding bridged BTC is tricrypto2 (WBTC-wETH-USDC). Providing liquidity in such a pool can be considered as an index token with proportional exposure to the prices of the underlying tokens. Liquidity providers additionally receive CRV emissions and swap fees as yield.

It is recommended to check the past performance and the peg of the bridged BTC in the liquidity pool before providing liquidity. By providing liquidity to any liquidity pool, the LP is exposed to the risks of every asset included in the pool.

Using the Dashboard

Dashboard: BTC on Ethereum Detailed Dash by LlamaRisk Team

Token liquidity pool-specific sections show:

Liquidity pool asset TVL overtime.

Liquidity pool asset proportion over time.

Pool activity for participating tokens.

Top depositors and withdrawals with amounts in the last 1 month.

Token-specific sections show:

The distribution and top holding based on wallet type (contract/wallet).

Minting and Burning activity for the last 1 year.

Top minters and burners for the last 1 month.

Overall token holding in contracts vs wallet over time.

There is also a small section showing the behavior of renBTC holders which can be used to check how much of the demand got filled by other bridged BTC tokens after the Ren network deprecation.