Asset Risk Assessment: DAI Exposure to Real World Assets

A focus on the recent trend to radically increase RWAs on MakerDAO's balance sheet

Useful Links

Dashboards: Makerburn | Daistats | Dune (SebVentures)

Introduction

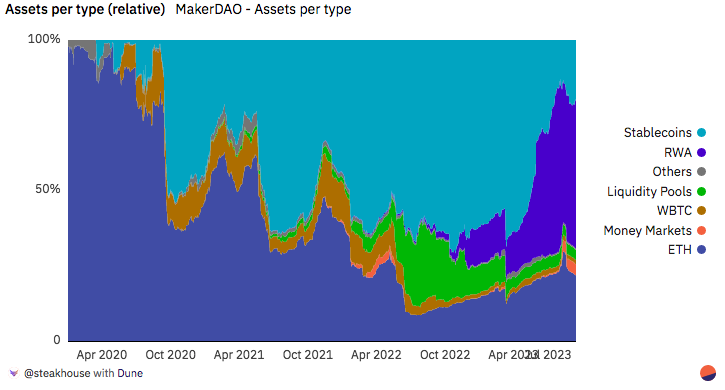

When DAI was first introduced as a decentralized stablecoin solely backed by ETH, its promise was in its simplicity and decentralized nature. However, as with any evolving digital currency, significant shifts have occurred over time. Today, less than 25% of DAI is backed by ETH, with a majority now collateralized by real-world assets (RWAs) and centralized stablecoins. MakerDAO’s exposure to RWAs has rapidly expanded over the past year from ~2% of assets on its balance sheet to nearly 40% today.

In October 2022, we highlighted potential risks to Curve Finance liquidity pools resulting from MakerDAO’s “Endgame” plan. Since then, DAI’s narrative has evolved further, emphasizing RWAs as a core component of its collateral and generating substantial revenue in the current high-interest rate environment. This shift has also allowed MakerDAO to materially raise its DAI Savings Rate (DSR) yield from 1% to 5%, influencing market dynamics for DAI and rippling through the broader DeFi sphere.

MakerDAO’s decision to back DAI with tokenized assets such as U.S. Treasuries shows its effort to balance decentralization with stable revenue generation. As this strategy develops, concerns arise regarding legal arrangements, counterparty risks, and transparency.

DAI Collateral Assessment

History

After its launch in 2017, DAI was backed entirely by ETH deposited into vaults called Collateralized Debt Positions (CDPs). However, sole reliance on ETH collateral was capital inefficient, as the CDP model involving a volatile asset required significant overcollateralization. Single collateral DAI was found to be inadequate for maintaining a $1 peg during market fluctuations.

To address this, MakerDAO introduced the USDC Peg Stability Module (PSM) in late 2020. This module enabled a 1:1 swap of USDC for newly minted DAI, significantly enhancing DAI’s stability by creating an efficient arbitrage path. By early 2023, over $2.4 billion of DAI was collateralized through the USDC PSM, and, at its peak, the MakerDAO balance sheet was comprised of 70% stablecoin assets.

Since then, DAI has significantly shifted its exposure from stablecoins to RWAs. MIP13c3-SP12 was ratified in March 2022 with the intent to invest in short-term bonds as a response to stablecoin overexposure that did not earn protocol revenue and posed a counterparty risk. This prompted proposals to put idle stablecoins to work through off-chain custodians such as in MIP81 from Coinbase Institutional to onboard PSM USDC to Coinbase Custody and earn interest for MakerDAO. The Coinbase Custody vault was approved in April 2023 and was fully onboarded with 500m DAI minted from it by June.

The USDC depeg event of March 2023 was also followed by a rapid outflow of USDC from the PSM, further expediting the transition from stablecoin to RWA backing.

Another significant portion of MakerDAO’s stablecoin holdings was previously composed of Gemini’s GUSD in the PSM-GUSD-A (see LlamaRisk’s GUSD report here). In June 2023, MakerDAO passed a vote to lower the GUSD debt ceiling from 500 million DAI to 110 million DAI due to its lack of liquidity and lower yield compared to USDC held at Coinbase Custody. The chart below shows the amount of GUSD in the PSM (aqua) vs. the DAI debt ceiling set by MakerDAO governance (blue):

This shift is part of an overall trend that MakerDAO is seeking to diversify its balance sheet by accelerating the onboarding of real-world assets.

RWA Holdings

Overall Composition

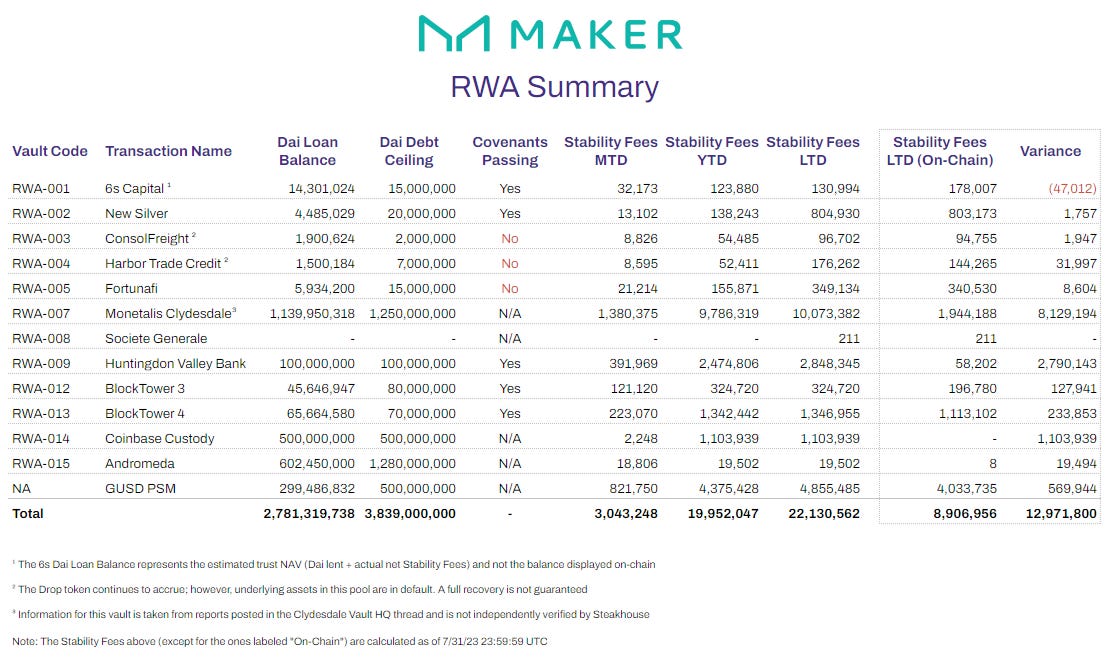

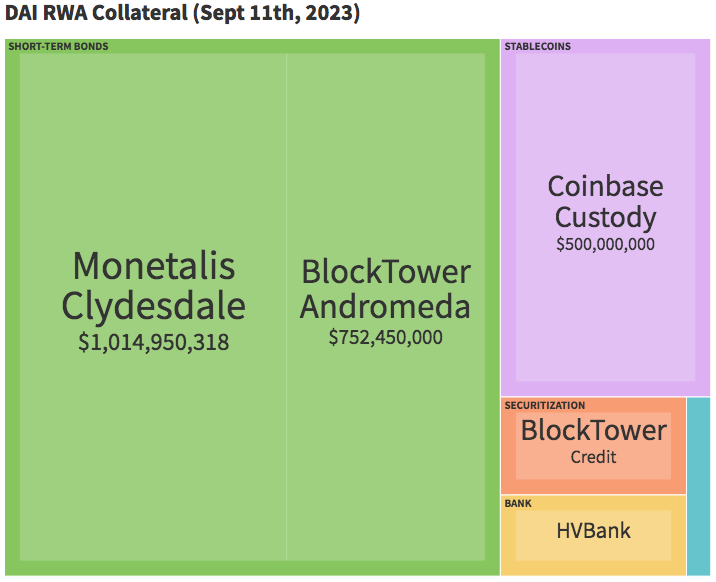

MakerDAO’s real-time RWA collateral composition can be seen on the Markerburn dashboard. Below is an overview of the DAI loan balance from RWA vaults broken down by vault:

Under the guidance of various advisors (most notably Steakhouse Financial), several legal structures, mainly for-purpose foundations, have been deployed and the allocation to RWAs has been meticulously raised.

Steakhouse also publishes monthly Real-World Asset Reports, the most recent of which was published in August. As of the most recent report covering July 2023, there were 13 active RWA vaults with a total DAI loan balance of 2.78B DAI and a debt ceiling of 3.83B DAI. Underlying assets in two vaults were in default (RWA-003 and RWA-004) and another (RWA-005) was recently approved for offboarding.

When dividing RWA exposure by category, the majority of exposure is in short-term bonds, followed by stablecoins (USDC in Coinbase Custody), and with a smaller share as private credit and bank loans.

Below, we go over DAI’s various RWA holdings used as collateral:

Monetalis Clydesdale (short-term U.S. Treasuries)

Dashboard: RWA007-A

Forum thread: Clydesdale Vault HQ

Latest report: July 31st, 2023

Composition: IB01 (0-1yr Treasury Bond ETF), IBTA (1-3yr Treasury Bond ETF), and short-term treasury bill held at Sygnum Custody.

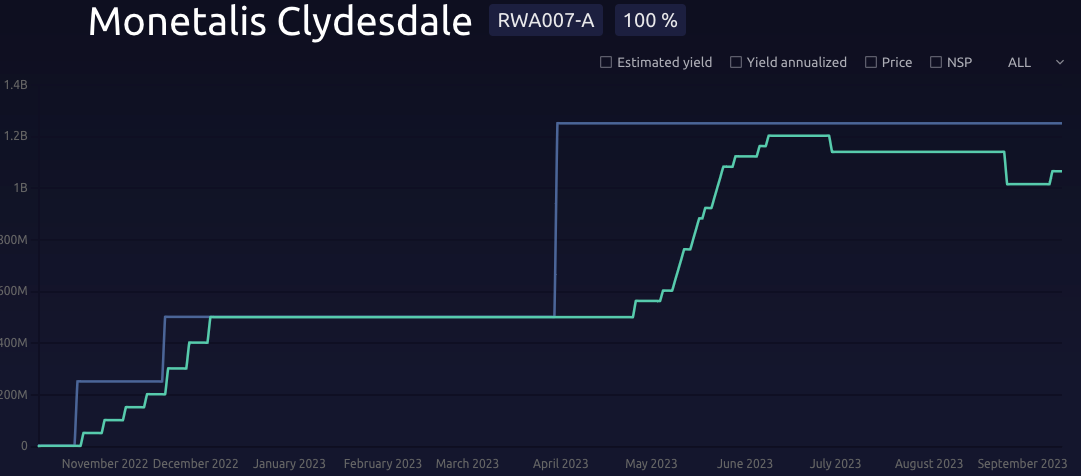

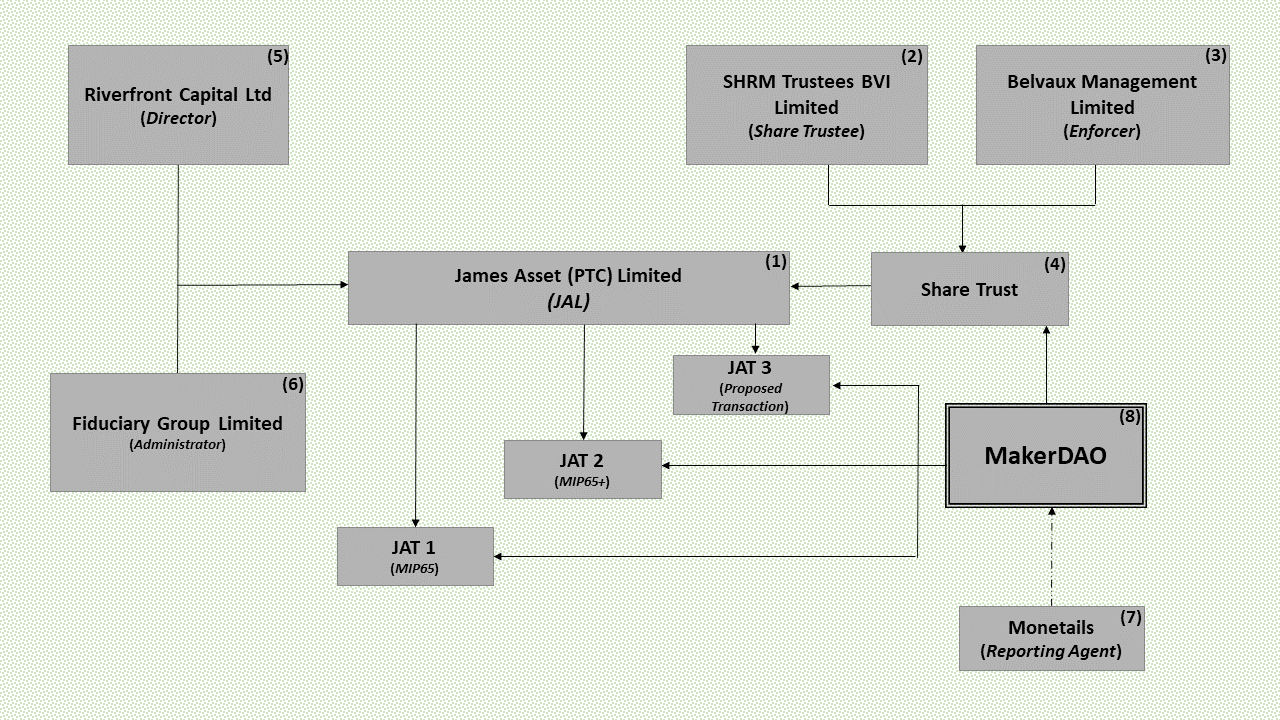

Clydesdale, devised by Monetalis, offers a pathway for MakerDAO to direct their stablecoins into liquid bond strategies, having been sanctioned through the MIP65 proposal. The James Asset Trust (JAT) is at the heart of this setup, a trust structure in the British Virgin Islands (BVI). James Asset (PTC) Limited oversees its creation and day-to-day management, with MakerDAO and DAI tokenholders as the beneficiaries.

The Maker Committee, consisting of two community members, ensures the trust’s instructions and reports are in line with governance-approved action, adding transactional and reporting oversight layers. On the operations front, MakerDAO greenlights the production of DAI from the Clydesdale vault.

MakerDAO’s governance polls are used to issue instructions to the trust. Once approved, these directions are put into motion. The vote in May 2022 approved the use of USDC from the PSM to the Clydesdale RWA vault with a DAI debt ceiling of 500M and an initially approved allocation of 80% U.S. short-term Treasuries / 20% investment grade corporate bonds. The vault became active in October 2022, although the allocation to corporate bonds never materialized. A vote approved the reallocation of corporate bonds to 0-1 year U.S. Treasuries. A vote in March 2023 approved the debt ceiling increase from 500M DAI to 1.25B DAI.

DAI swapped for USDC is sent to a trust-controlled address, converted to US dollars via Coinbase, sent to Syngum Bank in Switzerland, and invested in the ETF held in custody by Sygnum. The trust consistently reports its performance and distributes profits to MakerDAO’s surplus buffer. Provisions exist for MakerDAO to activate liquidations or discontinue the structure if the need arises. The total costs are estimated at around 25-30 bps.

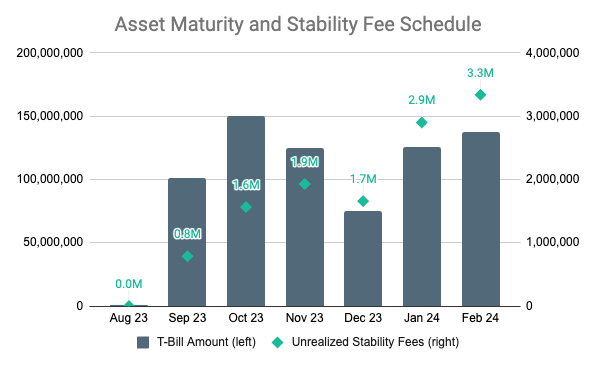

To reduce risks and fees in the current environment, the Clydesdale Trust recently started shifting its entire portfolio from bond ETFs into a 6-month U.S. Treasury bill ladder strategy, providing inherent liquidity and lower transaction costs while maintaining yield through periodic rollovers into new T-bills every two weeks (see May 2023 thread). This change demonstrates MakerDAO dynamically adjusting Clydesdale’s investment mandate to balance risk, return, and liquidity based on market conditions.

BlockTower Andromeda (short-term U.S. Treasuries)

Dashboard: RWA015-A

Forum thread: Project Andromeda: Risk & Legal Assessment

Latest report: August 31st, 2023

Composition: Short-term U.S. Treasuries (Portfolio)

Technical Assessment: [RWA015] Project Andromeda: Technical Assessment

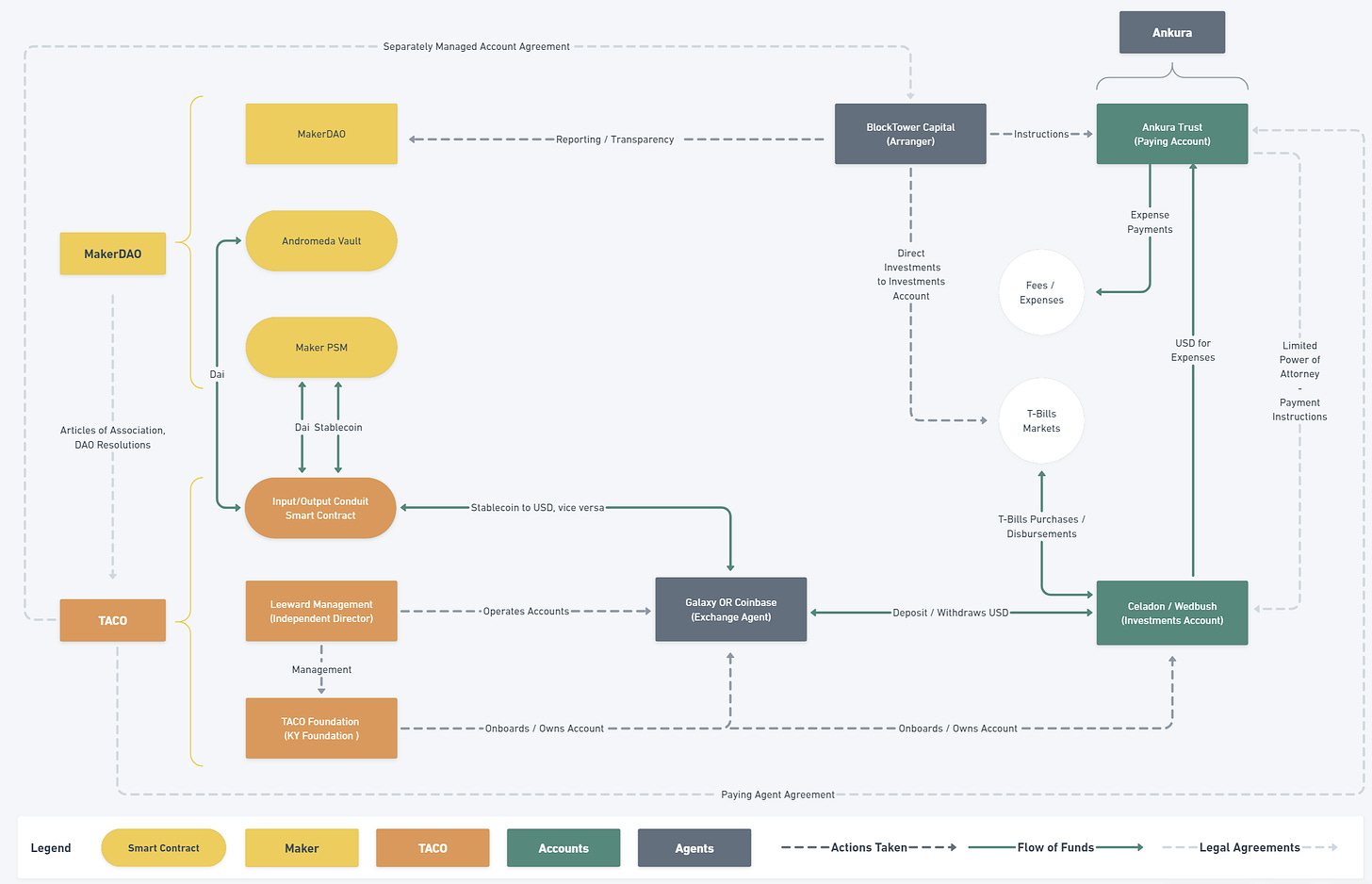

Project Andromeda is a plan by BlockTower to invest 1.28 billion DAI from MakerDAO into short-term U.S. Treasury bills to earn yield. It uses an entity called the TACO Foundation to hold the assets. TACO is a company based in the Cayman Islands that BlockTower previously set up for other deals with MakerDAO.

BlockTower directs how the money is invested based on instructions from TACO. Ankura Trust acts as the Paying Agent to handle the flow of funds and funds settlement on behalf of TACO. Wedbush acts as the custodian that keeps the Treasuries purchases in a separate account for TACO.

DAI is swapped into USDC using Maker’s PSM. Exchanges like Coinbase and Galaxy Digital facilitate exchange from USDC into USD to buy the Treasuries. The Treasuries purchased have maturities between 0-6 months. As they mature, the interest earned is sent back to MakerDAO. As of July the vault became active and has since expanded to a DAI supply of 852,450,000 out of a 1.28B DAI ceiling over the course of several months.

Coinbase Custody (stablecoin)

Dashboard: RWA014-A

Forum thread: Coinbase USDC Institutional Rewards

Latest report: July 31st, 2023

Composition: USDC held with Coinbase Prime custody

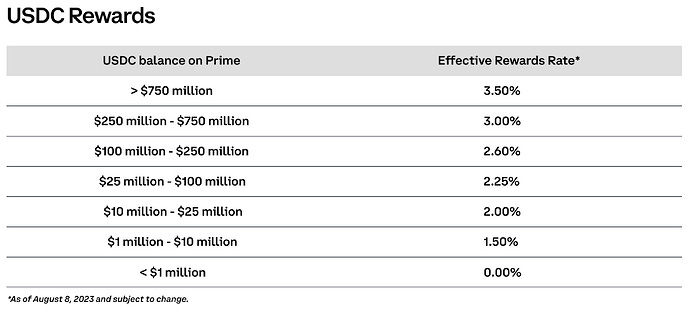

Coinbase Custody, proposed in MIP81, allows MakerDAO to earn rewards on USDC from the protocol-owned PSM by holding it with Coinbase Prime. The assets are in 6 “Cold Storage” wallets and 1 “Trading wallet.”

Where do USDC Rewards come from?

USDC Rewards is a loyalty program powered by Coinbase’s own funds. The program is designed to incentivize more of our customers to use USDC and store it with Coinbase. As a general principle, we do not lend or take any action with your assets unless you specifically instruct us to, and Coinbase has no right to use any USDC in your Coinbase account.

Source: Coinbase

A legal assessment explains the BVI private trust company James Asset (PCT) Limited (JAL) represents MakerDAO as the trustee, the same trustee as for the Clydesdale vault outlined in MIP65. SHRM Trustees (BVI) Limited holds the shares to the trust and is monitored by Belvaux Management Limited to ensure the Share Trustee is properly administering the Trust. Riverfront Capital Ltd is the sole director of the Trust with Fiduciary Group Limited acting as Administrator to ensure the actions of JAL are in accordance with the MakerDAO resolution. It should be noted that assets from JAT 1 and 2 have been commingled into one Clydesdale vault, consolidating two original vaults while preserving their legal structures. Monetalis provides reporting services to MakerDAO on its forum, such as in this post from August.

The vault became active in May 2023 and is at full capacity, having maintained its 500M DAI debt ceiling. Since August 2023, the reward rate offered by Coinbase has been increased to a maximum of 3.5% for balances > $750m:

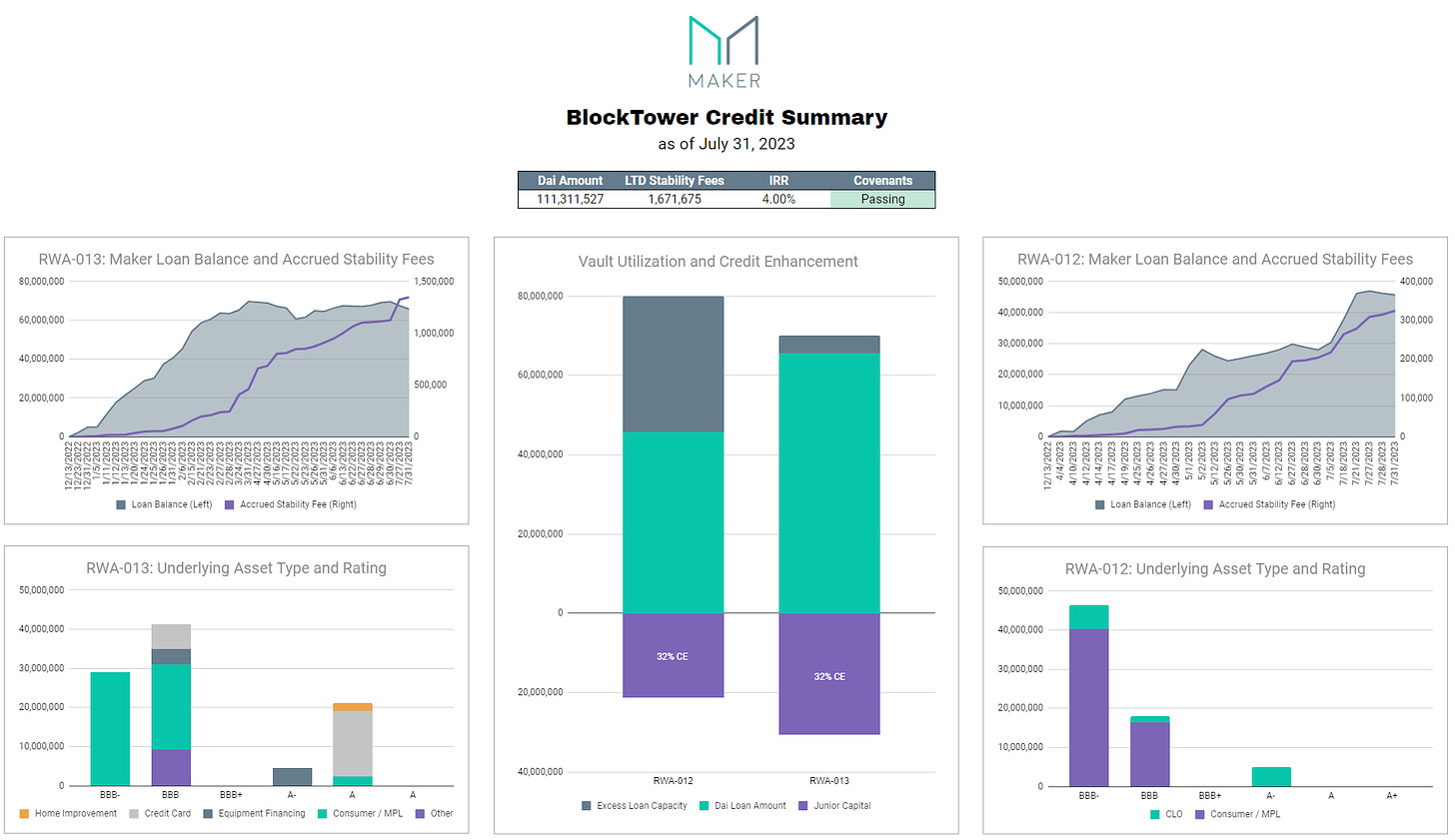

BlockTower Credit (Private Credit)

Forum thread: MIP6 Collateral Onboarding Application: BlockTower Credit (Arranger)

Latest report: July 31st, 2023

Composition: Consumer / Marketplace Lending and Collateralized Loan Obligations

BlockTower Credit has partnered with MakerDAO to integrate real-world assets. BlockTower ensures a 30% junior capital contribution on each deal to manage risk and align interests. The tokenization of assets has been facilitated using the Centrifuge protocol. A structured framework involving SPVs, trustees, and paying agents has been adopted to ensure a seamless connection between tangible assets and their on-chain counterparts. Most of these assets are short-term (1-36 months) credit lines anchored by receivables, notably invoice and trade financing.

The vaults became active in December 2022 (RWA013 in December and RWA012 later in April 2023). A vote approved an increase of the RWA012 vault from 30M DAI debt ceiling to 80M in May 2023 and reduced RWA010 and RWA011 vaults to 0, consolidating the vaults.

As of the July 2023 RWA report by Steakhouse, the BlockTower Credit vaults have been passing all performance criteria required by MakerDAO, although the debt it manages does pose a significantly higher risk of default than the previously mentioned RWA vaults and requires regular monitoring of assets in the pool.

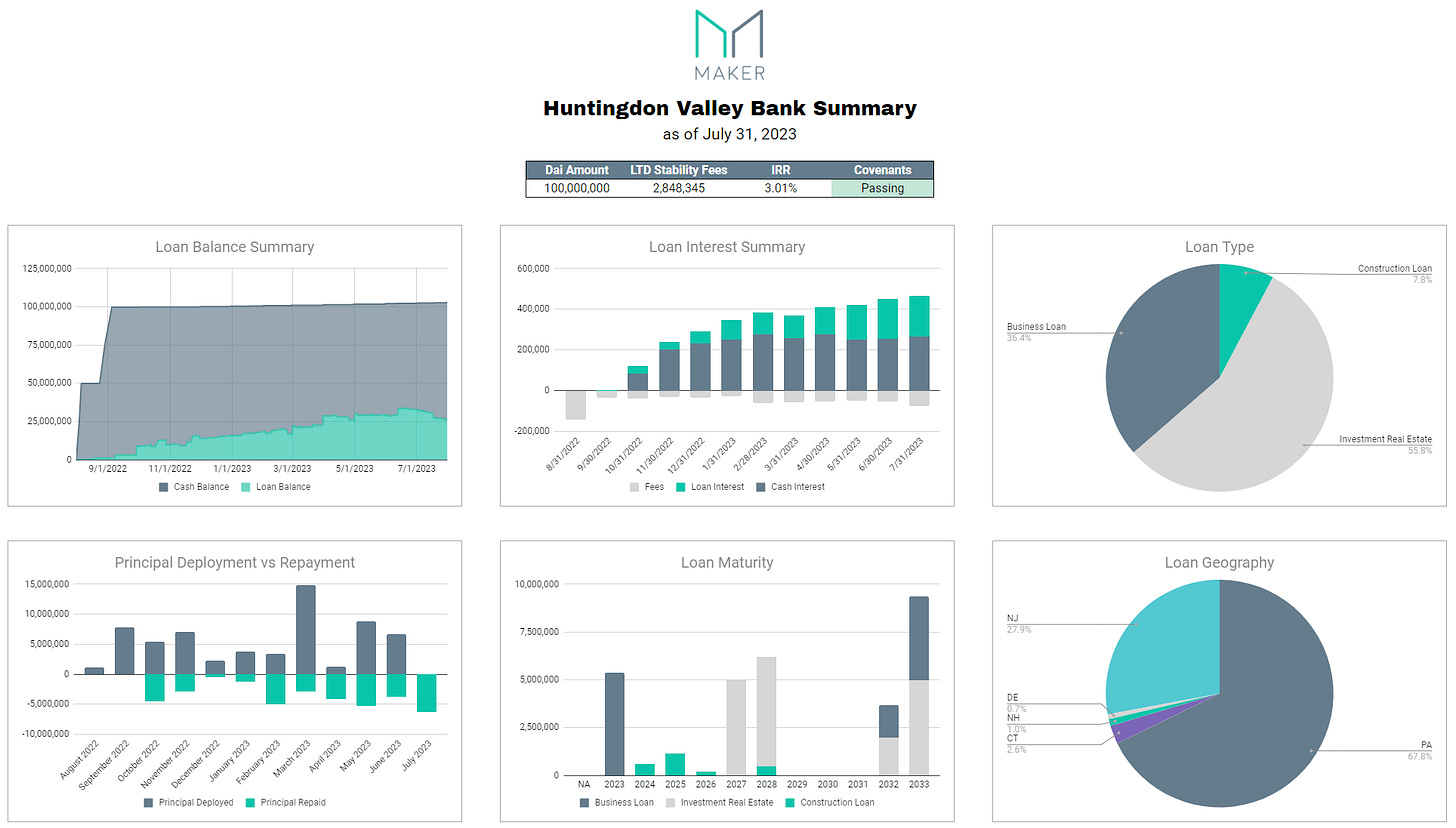

HVBank (Bank Loans)

Dashboard: RWA009-A

Forum thread: MIP6: Huntingdon Valley Bank Loan Syndication Collateral Onboarding Application

Latest report: August 31st, 2023

Composition: Huntingdon Valley Bank-originated loan

HVB loans are commercial credits offered by the Pennsylvania-based Huntingdon Valley Bank held by HV Bancorp. Inc. (HVB). These loans have terms mostly between 3-5 years and span various categories, including commercial real estate, construction, and business loans. Interest rates vary, either being fixed or floating. A unique 10-point internal risk system is used by HVB to grade these loans, requiring a minimum “Pass” rating for Maker participation. These loans, which showcase a diverse geographic distribution primarily in the Mid-Atlantic states, are integrated into a bankruptcy-protected trust structure. HVB retains at least half exposure in each loan, ensuring aligned interests, and assumes the role of a loan servicer.

In accordance with the Endgame plan to reduce RWA exposure over time, a vote in August 2023 formally mandates the termination of future purchases within the HVB Master Participation Trust and to return cash from the Trust as available.

Other RWA holdings

There are several other minor RWA vaults currently active, including:

6s Capital (RWA001-A): loans financing the construction of commercial properties

New Silver (RWA002-A): loans financing real estate investors

Fortunafi (RWA005-A): loans to SaaS and e-commerce businesses (offboarding is in progress as of this vote)

RWA Defaults and Covenant Breaches

In recent months, defaults and covenant breaches associated with a few RWA vaults have stirred discussions among stakeholders.

ConsolFreight Default (RWA-003)

ConsolFreight’s CF4-DROP vault has defaulted due to complications with their key borrowers, Hanhwa AUS Pty Ltd and Hanwha New Zealand Pty Ltd. According to a Consol representative, conditions involving failed crypto firms such as Celsius, BlockFi, 3Arrows, and FTX, as well as macro trends, had resulted in excessive liquidity outflows that led to the Australian Supreme Court issuing a freeze on pending deliveries.

Shortly thereafter, an executive vote reduced the vault to 0 and began the process to allow Centrifuge to unwind the position. This default jeopardizes the 1.8 million DAI drawn by the vault. As of the most recent update from ConsolFreight on September 1st, a claim is awaiting evaluation with the Australian Supreme Court in an attempt to recover the outstanding debt.

Harbor Trade Default (RWA-004)

With ~1.5M DAI outstanding from this vault and $2.1M in loans to a single consumer electronics company and collateralized by receivables, the loan became delinquent and defaulted in April 2023. Harbor Trade is attempting to recover the loan in part or in full and has advised MakerDAO that the effort may take 6 months or longer. Specific details have not been made public although, according to Steakhouse, they are in frequent communications with Harbor Trade. A vote was approved to decrease the RWA-004 vault debt ceiling to 0 in July 2023.

New Silver Covenant Breach (RWA-002)

New Silver’s initial deal structure demonstrated certain shortcomings, particularly allowing breaches of concentration covenants as the collateral pool dwindled. By mid-2022, monthly assessments flagged consistent breaches in state exposure covenants attributed to a diminishing portfolio. While initially dismissed as trivial, these lapses exposed vulnerabilities detrimental to senior DROP token holders, including Maker. This prompted a proposed restructuring, encompassing stringent criteria and external validation.

Fortunafi Covenant Breach (RWA-005)

The Fortunafi vault has also exhibited a covenant breach. By July 2023, Fortunafi’s debt escalated to 5.9mm DAI, mostly comprised of Revenue Financing assets. These primarily consist of loans extended to businesses, predominantly small enterprises or SaaS companies, leveraged against a segment of the business’s total revenues. A recent lapse in Fortunafi’s co-investor ratio has resulted in most non-Maker Drop holders backing out. With the “YoY Growth Rate” covenant also faltering, an August resolution suggests discontinuing this transaction, aligning with the Endgame strategy.

RWA Exposure Influence on DAI

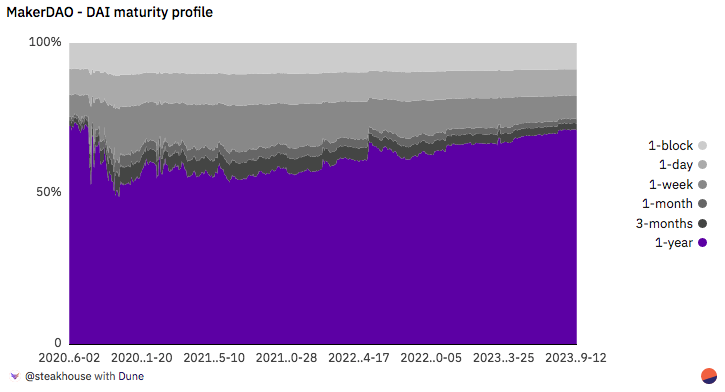

Asset maturity

The DAI maturity profile shows an increasing trend towards the 1-year maturity, with its proportion rising to over 70%. This could suggest growing trust and a longer-term outlook within the DAI ecosystem, but it is also tied to the interest rate environment. Meanwhile, despite their fluctuations, short-term maturities have maintained a substantial presence. This underscores the importance for Maker to maintain a liquid portfolio amid changing markets.

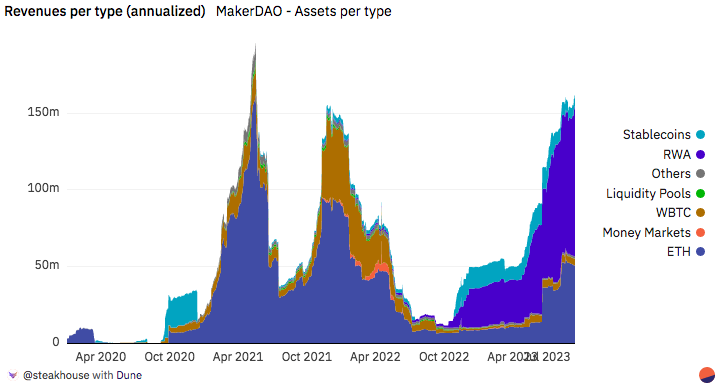

Revenue generation

MakerDAO’s real-world asset (RWA) holdings generate the lion’s share of the protocol revenues, which in September 2023 amounts to over 90m/year annualized. The increase in RWA-generated revenue in late 2022 has put MakerDAO in an excellent position to increase its saving rate.

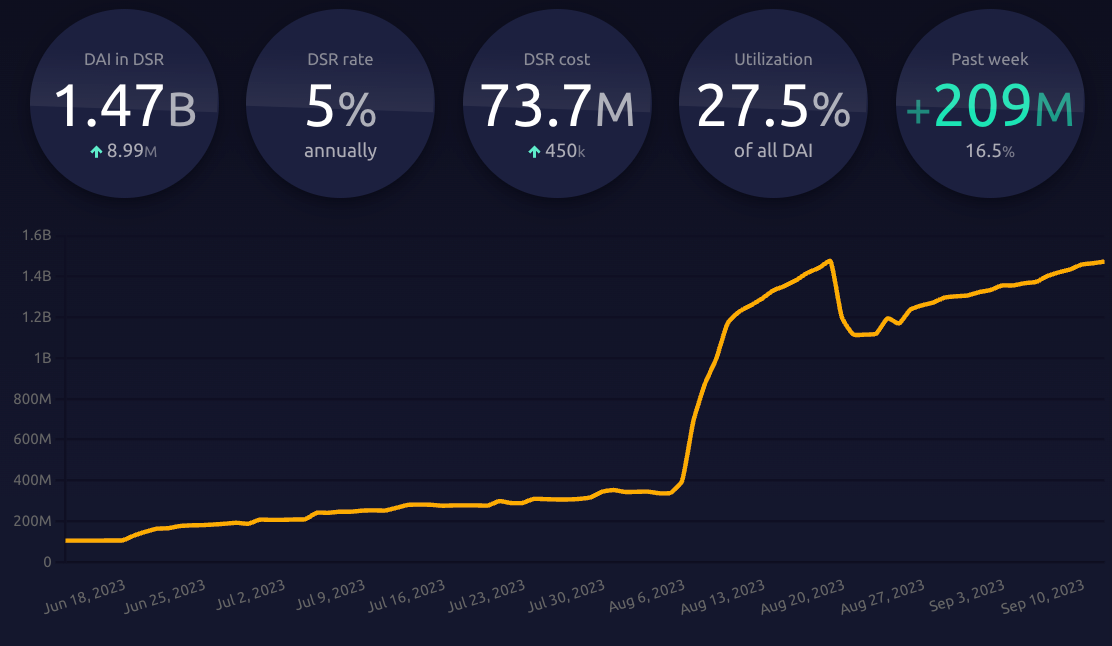

The Dai Savings Rate (DSR)

The Dai Savings Rate (DSR) is a feature within the MakerDAO system that enables DAI holders to accrue interest. By depositing DAI via the summer.fi interface, users can enjoy returns generated by MakerDAO. The current APY for September 2023 stands at 5.00%, a notable rise from its previous rate of 1%.

DSR rate changes over time:

Before December 2022: A persistent 0% DSR.

December 2022: An increase to 1%, drawing 35 million DAI to the DSR.

June 19th, 2023: A hike to 3.49% to boost DAI demand.

August 6th, 2023: A surge to 8%.

August 20th: Reduction from 8% to 5%, per Enhanced DSR (EDSR) guidelines and to harmonize DAI demand with market stability needs.

Deposits into the DSR contract augment MakerDAO’s surplus buffer, which originates from excess collateral and governance fees. These funds are strategically reinvested, with a segment of the resulting profits allocated back to users as interest. Notably, the system does not levy any lock-up periods or withdrawal fees.

The DSR is controlled by a smart contract and mirrors the function of a decentralized savings account by offering compounded returns. Adjustments to the DSR play a consequential role in shaping MakerDAO’s monetary policy, thereby wielding influence over the entire DeFi ecosystem.

For example, the raise to 3.49% was poised to usher in a significant influx of capital to DAI, especially given the backdrop of competing platforms (AAVE, Compound) providing merely 2-2.5% yields. On the other hand, lowering the DSR could lead Dai holders to seek higher yields elsewhere, reducing the demand for and circulation of DAI. This potential outcome illustrates how adjustments to the DSR can be utilized to maintain DAI’s stability and competitiveness within the fast-evolving DeFi landscape.

Risk Factors of RWA Exposure

Regulatory Risks

MakerDAO occupies a legally gray area as a decentralized finance (DeFi) protocol. While innovative, this uncharted territory poses regulatory challenges. The potential for regulatory gaps and compliance challenges has increased with the protocol pivoting towards a greater reliance on RWAs. For decentralized protocols like MakerDAO, it’s imperative that RWAs adhere to regulations across all pertinent jurisdictions. A lack of thorough vetting of legal structures and counterparties could lead to significant compliance vulnerabilities.

MakerDAO’s prominence continues rising, with its DAI stablecoin gaining traction. Given the protocol’s decentralized nature, this escalates the likelihood of regulators seeking oversight. Concerns around sanctions also reinforce the need for regulatory foresight. To get ahead of potential issues, MakerDAO has taken steps like incorporating legal entities to represent parts of the protocol. However, this centralization could undermine the ethos of an intended decentralized system. It concentrates governance power on entities that must balance decentralization with regulatory legitimacy.

Regulations remain in flux for cryptocurrencies and blockchain-based systems. Jurisdictions vary in approach, ranging from restrictive bans to embracing new frameworks. Rules could be imposed that conflict with smart contracts or tokenized securities. This may force drastic changes to maintain compliance. MakerDAO and associated issuers can face financial and operational burdens from regulatory actions. Staying abreast of policies across regions is essential yet challenging.

FATF Guidance on VASPs

A general stance on DeFi regulation has been consistently verbalized by the Financial Action Task Force (FATF). While its core function is to promote policies that combat money laundering and terrorist financing, the organization is very influential in setting standards for legislative reforms. Even though the FATF commits to technologically neutral regulation (i.e. standards shall not be applied to underlying software or technology), updated guidance outlines scenarios in which persons or entities related to a DeFi protocol may fall within the proposed VASP framework, i.e. centralization/decentralization test.

…creators, owners and operators or some other persons who maintain control or sufficient influence in the DeFi arrangements, even if those arrangements seem decentralized, may fall under the FATF definition of a VASP where they are providing or actively facilitating VASP services. This is the case, even if other parties play a role in the service or portions of the process are automated. Owners/operators can often be distinguished by their relationship to the activities being undertaken. For example, there may be control or sufficient influence over assets or over aspects of the service’s protocol, and the existence of an ongoing business relationship between themselves and users, even if this is exercised through a smart contract or in some cases voting protocols.

Since the above is not an exhaustive definition of a VASP, but only illustrates certain characteristics, national legislators may wish to consider other factors (e.g. profit incentives or ability to change parameters) to identify the owner/operator of a DeFi arrangement.

From a decentralization viewpoint, it is essential for MakerDAO to exercise vigilance during RWA tokenization processes and the potential vulnerabilities of special-purpose vehicles. These vulnerabilities should be meticulously monitored as they could serve as a plausible avenue for initiating the VASP licensing requirements.

ReedSmith Memorandum

The Maker community collectively exercises control over pivotal determinations pertaining to the tokenization of RWAs. Importantly, no specific stakeholders hold substantial or disproportionate influence over these key decisions.

The ReedSmith memorandum provides comprehensive insights into the legal setup crafted to operate in a decentralized manner. Each Declaration of Trust explicitly outlines that governance decisions are subject to the discretion of MKR token holders through the MKR voting mechanism.

The Trustee, James Asset (PTC) Limited, is mandated to effectuate the conversion of DAI into the pertinent cryptocurrency and/or fiat currency, subsequently procuring assets in strict adherence to the stipulated constraints delineated in a MakerDAO Resolution, as per the governance protocols established by MakerDAO. Furthermore, the Trustee is obligated to remit the proceeds from these assets, deducting associated costs, after their conversion into the relevant cryptocurrency, to either the James Asset Vault or the Surplus Buffer, with the primary objective of upholding the overall value stability of DAI.

The evaluation above underscores Maker’s unwavering commitment to achieving genuine decentralization by allocating roles and responsibilities among MKR holders. With the community actively shaping ongoing development, exercising substantial voting influence, and steering the course of future advancements, it is reasonable to surmise that the proposed centralization test is either implausible or, at the very least, exceptionally challenging to implement.

Collateral Risk

MakerDAO faces collateral risks from potential defaults on pledged real-world assets (RWAs), which can create shortfalls and destabilize DAI’s 1:1 USD peg. This highlights the need for prudent asset selection and ongoing risk management. Sudden significant shifts in the DAI Savings Rate (DSR) could also strain liquidity buffers if unexpectedly large amounts of DAI are minted or burned, outpacing execution capabilities. More gradual DSR adjustments are preferable to align demand changes with supply flexibility.

Many RWAs held by MakerDAO are also subject to duration risk, where the portfolio’s sensitivity to interest rate fluctuations can lead to losses if redemptions are required before maturity. For example, early savings of fixed-income investments like treasury bills can incur losses if overall liquidity is mismanaged, as observed with the EURS stablecoin. Managing the liquidity profile and duration risk of MakerDAO’s diverse RWA portfolio is crucial to ensure stability during market volatility.

Counterparty Risk

MakerDAO engages with several counterparties and is consequently vulnerable to their associated credit risks, encompassing liquidity, reputation, and settlement challenges. Key entities in this interaction include the Custodians, responsible for MakerDAO’s cash, crypto, and securities, and the Paying Account Providers.

If these parties default on their obligations, MakerDAO could face significant financial setbacks. Possible insolvency of a Custodian might hinder or block access to the underlying collateral assets, putting DAI holders at risk of instability. Moreover, MakerDAO’s exposure to the credit risk of the Paying Account Providers means that MakerDAO might be treated as an unsecured creditor in the event of insolvency.

Relying on third-party trading platforms further introduces risks. Hacks or credit events could prevent access to funds on exchange. Any disruptions with these platforms could erode the value of products, affecting both MakerDAO and DAI holders. Exchange Agents may otherwise be unable to access funds as a result of lost, stolen, or destroyed private keys during the course of their operation.

Transparency Concerns with RWAs

Onboarding more real-world assets (RWAs) as collateral decreases transparency compared to on-chain cryptoassets. There is inherently less publicly available information on RWAs. Recent covenant breaches and defaults in vaults like ConsolFreight, New Silver, and Fortunafi also raised stakeholder concerns over diminished transparency.

While RWAs expand DeFi’s access to real-world assets, dependencies persist on centralized oracles and counterparties for data. Details on the financial health and work-out processes for distressed RWAs are often limited and confidential. As noted by Steakhouse’s May 2023 report, specifics of the Harbor Trade situation have remained private since the borrower defaulted in April 2023.

RWA protocols like Maple Finance and Goldfinch have also faced opacity around borrower issues. The lack of transparency and available credit information on off-chain RWAs is a growing concern.

MakerDAO should consider minimum transparency requirements and independent audits for onboarded RWAs. Enhanced visibility into their holdings and financial details would provide greater confidence in the collateral. A unified standard and accessibility of every RWA account would be a positive step in transparency, as much of the data currently is disjointed across various forum threads. However, the inherent opacity of real-world assets poses an ongoing transparency risk compared to on-chain collateral.

MakerDAO has put forward several initiatives to retain control and visibility over the underlying assets, which is often an issue with RWAs, such as:

Instruction set: A document that provides detailed directions to a legal entity on executing transactions related to an investment strategy.

Third-party relationship: Engaging specialized external service providers to custody funds, make conversions, route transfers, and provide reporting/oversight.

Support and Development Risks

The Maker Foundation, a non-profit entity previously funded by MKR fees, supported the initial development of MakerDAO. The Foundation has since been dissolved, with support now coming directly from community members, developers, and keepers. However, concerns arise over the centralization of voting power among a few MKR holders. MakerDAO’s “Endgame” plan aims for a structural shift towards greater decentralization, transitioning DAI into a free-floating digital currency and splitting MakerDAO into “Maker Core” and “subDAOs.” Maker Core would resemble a central bank, supervising subDAOs. This move has prompted some MakerDAO team members to leave the DAO as others have entered. The challenge lies in balancing centralization with actual decentralized governance, especially with the “Endgame” plan looming, highlighting the need for meticulous navigation of these dynamics.

Conclusion

The increased reliance on centralized stablecoins and real-world assets deviates from the original vision of an ETH-backed DAI. MakerDAO’s constant evolution reveals the delicate balancing act between maintaining decentralization while also providing stability and attractive yields. DAI remains overcollateralized by a broad basket of assets despite the recent shift, and its core contracts are immutable and tested. DAI remains a comparatively sound stablecoin, and the Dai Savings Rate does not add incremental risks.

Concerning its RWA exposure, MakerDAO has strategically chosen to allocate heavily to assets like short-term U.S. Treasuries that experience low volatility and are highly liquid. It has also carefully crafted legal structures that preserve beneficial ownership and governing capability with the DAO. This strategy has helped to substantially improve protocol revenue in a rising interest rate macro environment while keeping risk to the protocol within acceptable levels.

However, for DAI to fulfill its original decentralized promise, reducing third-party reliance is an imperative long-term goal emphasized in the Endgame Plan. Close monitoring is paramount as MakerDAO transitions with this plan. Ongoing scrutiny of the collateral composition, transparency practices, risk parameters, and competitive landscape is essential. Improvements should be made to standardize transparency requirements for RWA service providers regarding collateral reporting and auditing.

Ultimately, MakerDAO must balance core values and adaptability. Its ability to strategically navigate these dynamics through persistently vigilant governance practices will determine DAI’s future role and risks as a decentralized stablecoin.

First congrats for the very interesting report!

The asset composition seems ok and luckily the protocol is reducing shitty / unclear loan exposures.

From a financial perspective, the only point not 100% clear to me is the asset-liability maturity mismatch. Most of the assets have 1 year maturity, which seems actually totally fine. But maybe a couple of simulation of stress scenarios may cast more light on it.

Nonetheless, I keep wondering if we are missing to go into enough details on the real risks of all of this (obvs this is just my opinion), which are: 1) AML-related ones and 2) opacity of the legal structures put in place.

As regards 1), DAI is using hundreds of millions of dollars to buy Treasuries and bonds. It is basically enabling a huge amount of non-KYCed money to be invested into TradFi. Super cool opportunity if you have money stuck into the crypto World for various reasons, but super risky spot for the protocol. If part of those structures are freezed, the maturity of the investment moves from 0-1 year to years. God only knows how much the SEC would love to do little, but cause a bank run and kill us.

As regards 2), it is pretty tough to understand fully so many entities in so many jurisdictions. Again, one has issue, a bank run does the rest.

Still I think we have to find a way to connect RWA returns and DeFi ones, so I am 100% for all of this, just wonder if we have to imagine some more robust legal / compliance / financial "audit" or even better, if we can kinda imagine new solution to the topic

Outstanding report, I have had such trouble seeing the full picture of the RWA exposure and this report is exactly what I needed. What a banger!