Asset Risk Assessment: Gemini Dollar (GUSD)

A deep dive into the fiat-redeemable stablecoin and its suitability as a crvUSD Pegkeeper candidate

Useful Links:

Contracts: GUSD ERC20Proxy | Custodian | PrintLimiter

Markets: Curve GUSD/3CRV | Curve crvUSD/GUSD | UniV3 GUSD/USDC

Relation to Curve

Gemini Dollar (GUSD) has a long history on Curve, being one of the first proposed metapools with the GUSD/3CRV metapool deployed in October 2020. In June 2022, the GUSD/FraxBP metapool was deployed. Most recently, a crvUSD/GUSD pool was deployed in July 2023. All of these pools have been approved by DAO vote to receive CRV gauge emissions.

The focus of this report is to ascertain the risks associated with the integration of GUSD into the crvUSD Pegkeeper system. Pegkeepers play a key role in maintaining crvUSD’s peg by programmatically rebalancing crvUSD in the associated crvUSD-paired pool (ie. the crvUSD/GUSD pool). As we have covered in a previous report on the TUSD Pegkeeper, it is possible for crvUSD to depeg or accrue bad debt if its Pegkeeper pair were to lose its peg. Therefore, strong confidence is required in the solvency and stability of all Pegkeeper candidates.

As the integration of GUSD into the crvUSD PegKeeper pools is being considered, our objective is to highlight and assess the potential risks and the subsequent implications it might have on crvUSD.

Key Findings:

Regulatory Uncertainty: Gemini is facing SEC charges of an unregistered security offering in regard to the Gemini Earn program, which increases the risk to Gemini-related services, including GUSD. Importantly, GUSD reserves are isolated from Gemini’s other business operations as required by NYDFS regulations and it has not been implicated in the SEC’s case.

Reserves Management and Attestation: Gemini actively manages GUSD reserves between cash deposits and short-term U.S. Treasury Bills based on market conditions and projections of redemption demand. Gemini enhances transparency by publishing detailed monthly reserve reports and streaming allocation data on its Trust Center page.

Concentration on MakerDAO: ~80% of the total GUSD supply is deposited into MakerDAO’s Peg Stability Module (PSM). This significant reliance on MakerDAO’s ecosystem makes GUSD susceptible to MakerDAO’s governance decisions, introducing a partnership risk factor.

GUSD Overview

Gemini Trust Company, LLC (Gemini) is a fintech company and platform that primarily operates its centralized cryptocurrency exchange. It specializes in a broad array of crypto-related services with a main focus on crypto trading and custody. The services offered by the Gemini platform include the launch of the GUSD stablecoin in September 2018. GUSD is a custodial, fiat-backed stablecoin with a 1:1 reserves ratio, meaning each token is backed by at least one dollar’s worth of reserves.

User Flow

GUSD is issued exclusively through the Gemini exchange, which users can acquire by purchasing GUSD with either cash or crypto. Corresponding GUSD is minted on Ethereum when users initiate a withdrawal to an Ethereum wallet. The redemption process operates in the same manner, but in reverse: Gemini burns the ERC20 token and credits the USD to the user’s Gemini account. The general user flow is shown below:

Since GUSD is minted to Ethereum mainnet, it’s always possible to verify the amount of tokens in circulation by checking the GUSD total supply on Etherscan and comparing that with the USD holdings disclosed in monthly BPM attestations and from the Trust Center page.

Reserves Management

Gemini is a limited-purpose trust company regulated by the New York Department of Financial Services (NYDFS) and GUSD is thus subject to specific NYDFS guidance on stablecoins that governs redeemability, reserves, and attestations. The reserves portfolio is restricted to only:

U.S. T-bills with maturities of 3 months or less

Reverse repurchase agreements fully collateralized by U.S. T-bills, notes, or bonds on an overnight basis

Government money-market funds

Cash deposits in FDIC-insured U.S. state or federal banks

Therefore, all non-cash reserves backing GUSD are short-term treasury obligations with a maximum 3-month maturity period. This structure serves to reduce the duration risk that may impact the redeemability of the stablecoin in extreme circumstances.

The assets making up the reserve portfolio are not the property of Gemini and are required by NYDFS to remain segregated from the company’s proprietary assets or business accounts. The assets must be held at a depository institution or with a custodian for the benefit of GUSD tokenholders. This distinction may be significant in case Gemini faces bankruptcy, as the GUSD reserves portfolio would be isolated from the bankruptcy estate.

Gemini has partnerships with several depository institutions and custodians that custody its portfolio of cash, money market funds (invested only in U.S. Treasuries), and U.S. Treasuries. These reserves are currently held and managed in the form of cash deposits at State Street Bank and Trust Company and BNY Mellon, as well as investments in U.S. T-bills and money-market funds with Flagstar Advisors and BNY Mellon Asset Management. Flagstar Advisor is a registered broker-dealer, investment advisor, and licensed insurance agency owned by Flagstar Bank. Reserves at Flagstar are invested solely in government securities, repurchase agreements collateralized exclusively by government securities and/or cash, and cash.

Attestations Reporting

As per guidance by the NYDFS, Gemini is required to publicly publish monthly reserves attestations audited by an independent CPA that has received approval from the DFS. The attestations are required to snapshot reserves on the last day of the month and one other day during the month, including the following information:

the end-of-day market value of the reserve in aggregate and broken down by asset class,

the end-of-day outstanding quantity of GUSD,

whether GUSD was fully backed at the time of the snapshot, and

whether Gemini’s reserves met the DFS’s conditions on reserve assets.

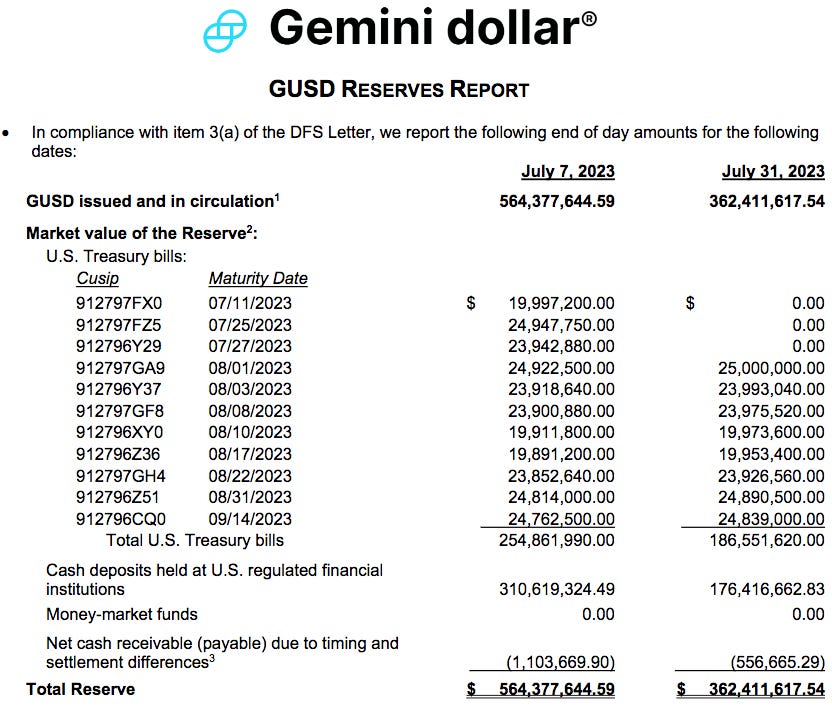

GUSD reserve attestations are provided by the accounting firm BPM, LLP on a monthly basis. As of September 2nd, the latest attestation report has been published for the month of July 2023:

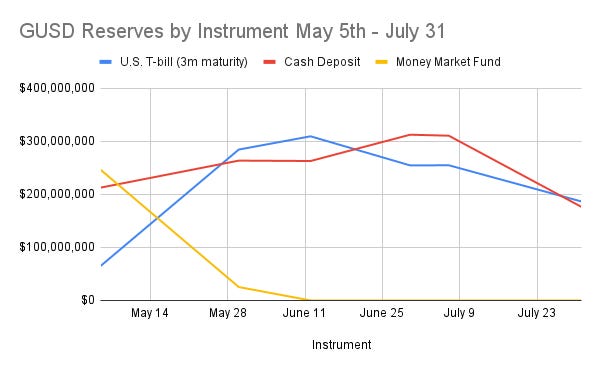

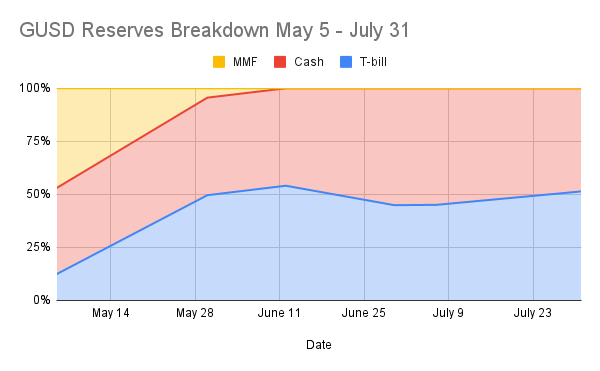

Below is a breakdown of the GUSD reserves portfolio since May, according to the monthly attestation reports. The allocation to MMFs has been removed in favor of U.S. T-bills:

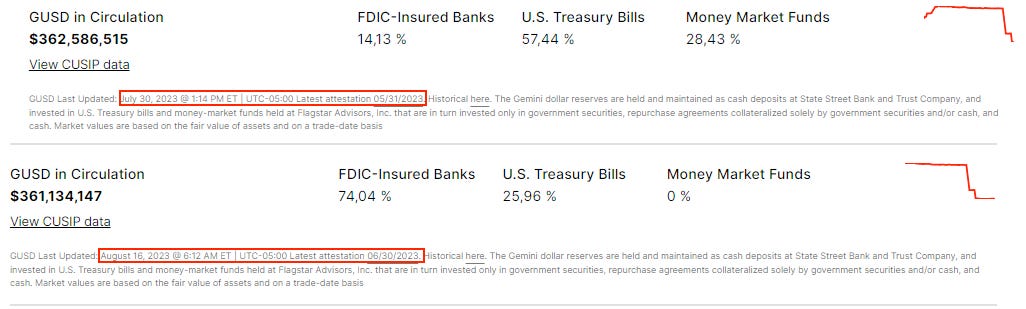

Gemini offers additional details and a more current overview of the GUSD reserves on the Gemini Trust Center page of its website. This includes a complete breakdown of the U.S. Treasury obligations backing GUSD, with specifics such as CUSIP numbers, maturity dates, weighted average maturity, and the total market value of funds. The image below shows the data related to U.S. T-bills, as updated on July 31, 2023:

The Trust Center data shows that there has been a significant reallocation of financial instruments inside the GUSD reserve portfolio between July 30th and August 16th, 2023. In the 17-day period, cash deposits held in FDIC-Insured banks were increased from 14.13% to 74.04% of the overall portfolio, U.S. T-bills were reduced from 57.44% to 25.96%, and exposure to MMFs was reduced from 28.43% to 0%.

Short-term U.S. T-bills are highly liquid and are commonly considered low risk, although cash deposits can be accessed instantly. Gemini strives to process redemptions immediately, and in cases when redemption demand is too great, withdrawals are processed T+1. By reallocating assets to FDIC-insured banks, Gemini appears to have been preparing for heightened redemption demand. This line of reasoning was confirmed by a Gemini representative who explained to us that Gemini had increased its cash allocation in anticipation of changes at MakerDAO, the platform where the majority of GUSD resides.

Contract Architecture

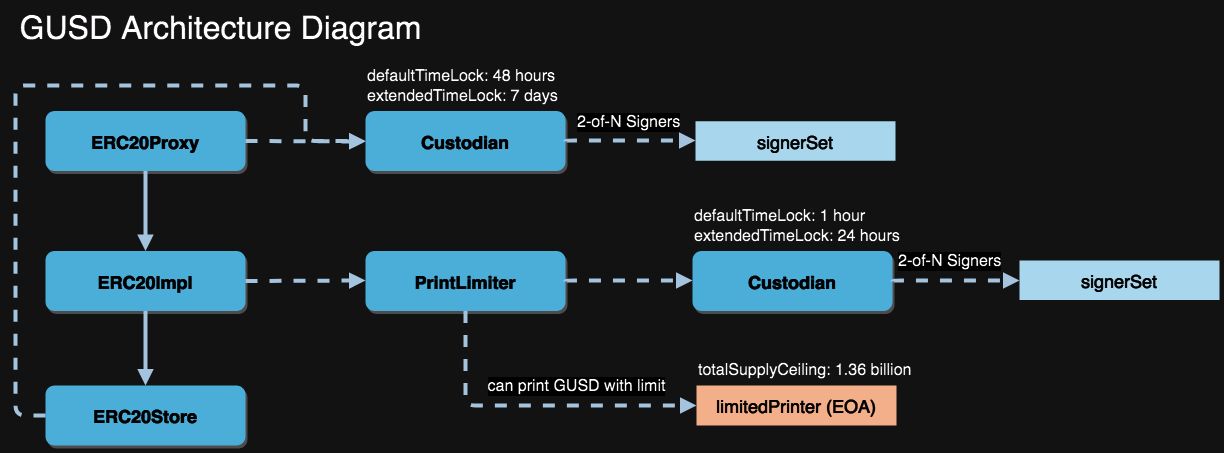

Shown below is an overview of the technical architecture for GUSD, including relationships between contracts and access control that resolves to keys custodied and operated by Gemini:

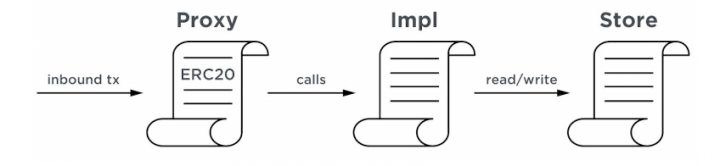

GUSD has been designed with an architecture that has three distinct smart contract layers, which allow for upgradeability through their logical separation:

Proxy Layer - ERC20Proxy is a permanent address and interface for token interactions. The Proxy contract delegates logic execution (e.g. transfers, issuance, and other core features) to the ERC20Impl contract.

Impl Layer - ERC20Impl contains the core logic that the proxy delegates to and the store is called by. ERC20Impl is upgradeable by the custodian which can update the ERC20Impl address through the proxy.

Store Layer - ERC20Store serves as storage for balances, allowances, and supply of the token. This contract is upgradeable through an upgrade of the ERC20Impl address, which defines an ERC20Store address.

Source: GUSD whitepaper

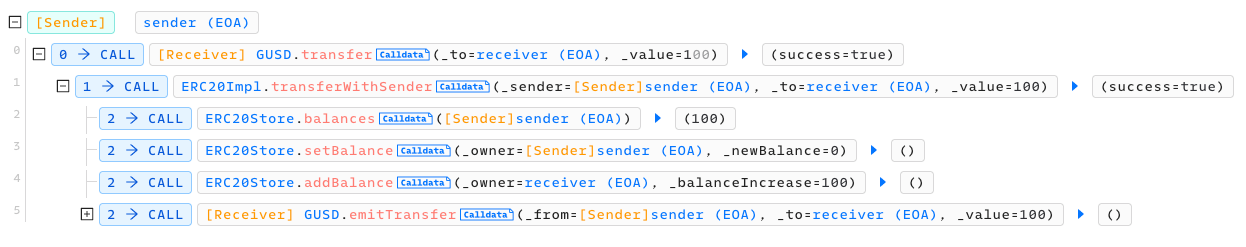

For example, calling transfer to the ERC20Proxy will call ERC20Impl.transferWithSender. ERC20Impl updates the token balances of the sender/receiver through erc20Store.setBalance and erc20Store.addBalance, and finally fires a transfer event back to the proxy through erc20Proxy.emitTransfer.

Security Features

According to the GUSD whitepaper, GUSD architecture implements the following security features:

1). Offline Keys - Offline keys approve risky actions and are stored in Gemini’s proprietary cold storage system.

2). Key Generation - Gemini uses hardware security modules (HSMs) to generate, store, and manage keys.

3). Multi-signature - Risky actions need approval from two signers with a 2-of-N scheme. Addresses are stored in the Custodian contract.

4). Time Lock - Activities that are identified as risky are timelocked prior to execution. Delay times are defined in the Custodian contract. This provides a buffer period to detect and respond to potential security breaches.

5). Revocation - Malicious or erroneous actions can be revoked before execution.

Custodians Offline Approval

As a regulated entity and stablecoin issuer, Gemini has control over all guarded functions across the three smart contract layers.

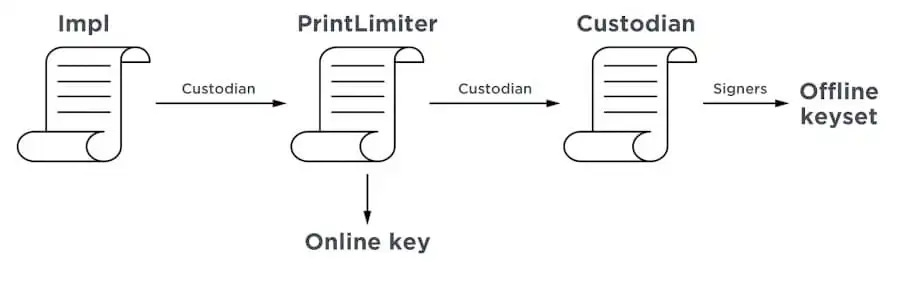

When upgrading smart contracts, there is a required approval from a custodian that is governed by an offline keyset and protected behind a timelock. The assigned custodian may be a pass-through contract that resolves to a Custodian contract governed by an offline keyset.

For instance, the ERC20Impl custodian is a PrintLimiter contract that allows an additional key to mint GUSD up to a predefined ceiling that can only be increased by the PrintLimiter’s own Custodian. The Custodian is set with a 60-minute defaultTimeLock when called by the designated Primary address (EOA), or an alternative 24-hour extendedTimeLock if called by another address. The contract requires 2-of-N members of the signerSet to approve actions that include contract upgrades and increasing the token supply.

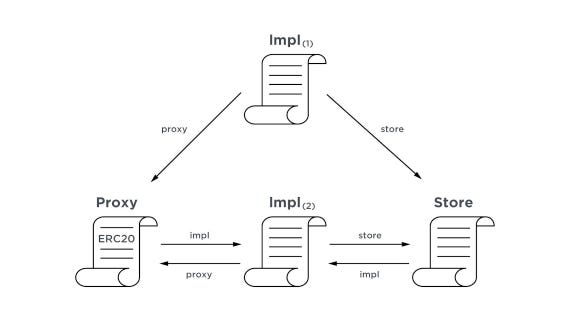

During network upgrades, the new Impl deployment is integrated, supplanting the older one. The smart contracts are migrated by delegating the proxy to the new Impl contract and instructing the Store to accept calls from the new Impl contract. The image below shows the post-migration relationships from Impl (1) to Impl (2):

Token Supply Control

Every new GUSD token minted must be backed by 1 USD in reserve. The custodian system (ie. the Gemini-controlled keyset) is fully trusted to ensure that the number of tokens in circulation never surpasses the USD balance held in reserve.

This task is managed within the Impl layer by the PrintLimiter. This contract imposes a limit on the number of GUSD tokens that can be created and assigns an address as the limitedPrinter, which has the authority to mint GUSD to any address up to the designated totalSupplyCeiling without a timelock. The assigned address is currently an EOA that is the privileged Primary address in the Custodian deployments and is an extremely active Gemini address with an over 4m tx count.

To increase the minting limit, approval must be obtained from an offline keyset (ie. the PrintLimiter’s custodian). Conversely, limit decreases can be authorized by the online key (ie. the limitedPrinter EOA). See the access control relationship between the various contract layers and privileged addresses below:

The totalSupplyCeiling within the PrintLimiter is currently set at 1.36 billion GUSD. By contrast, the current total supply is just over 300 million GUSD. In this configuration, 1 billion GUSD is at risk of being erroneously minted if the limitedMinter EOA address were compromised.

Token Distribution

As shown in the data table below, of the approximate 310 million GUSD supply, over 98% of GUSD's outstanding supply is held by 39 addresses while less than 2% is distributed across the other 9,252 addresses.

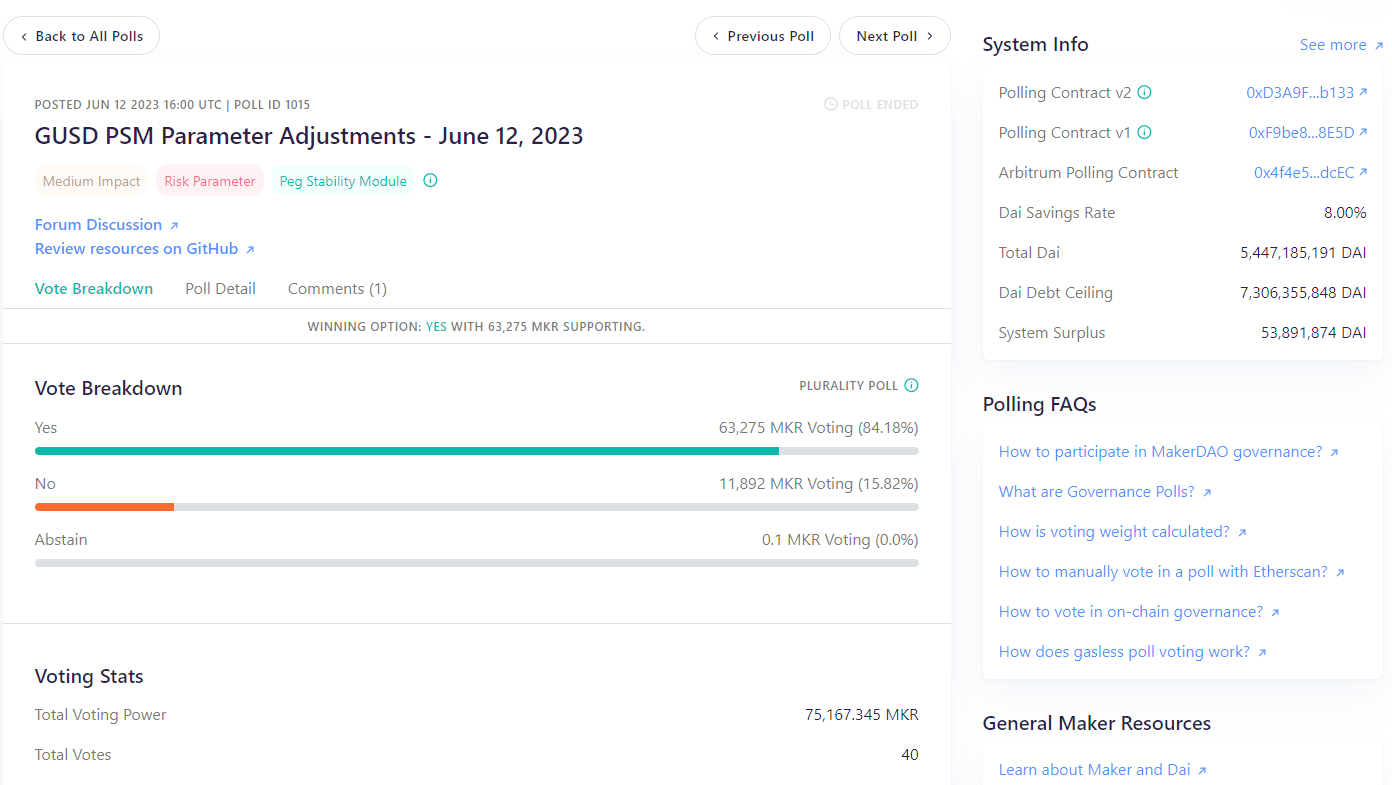

MakerDAO PSM Dominance

The distribution of GUSD is primarily concentrated in MakerDAO’s Peg Stability Module (PSM). PSMs are wrapper contracts with the same set of parameters as collateral Vault contracts, with the exception that the PSM should always have a Stability Fee of 0% and Liquidation Ratio of 100%. These contracts serve to stabilize the price of DAI by facilitating stablecoin arbitrage when DAI is trading over $1.

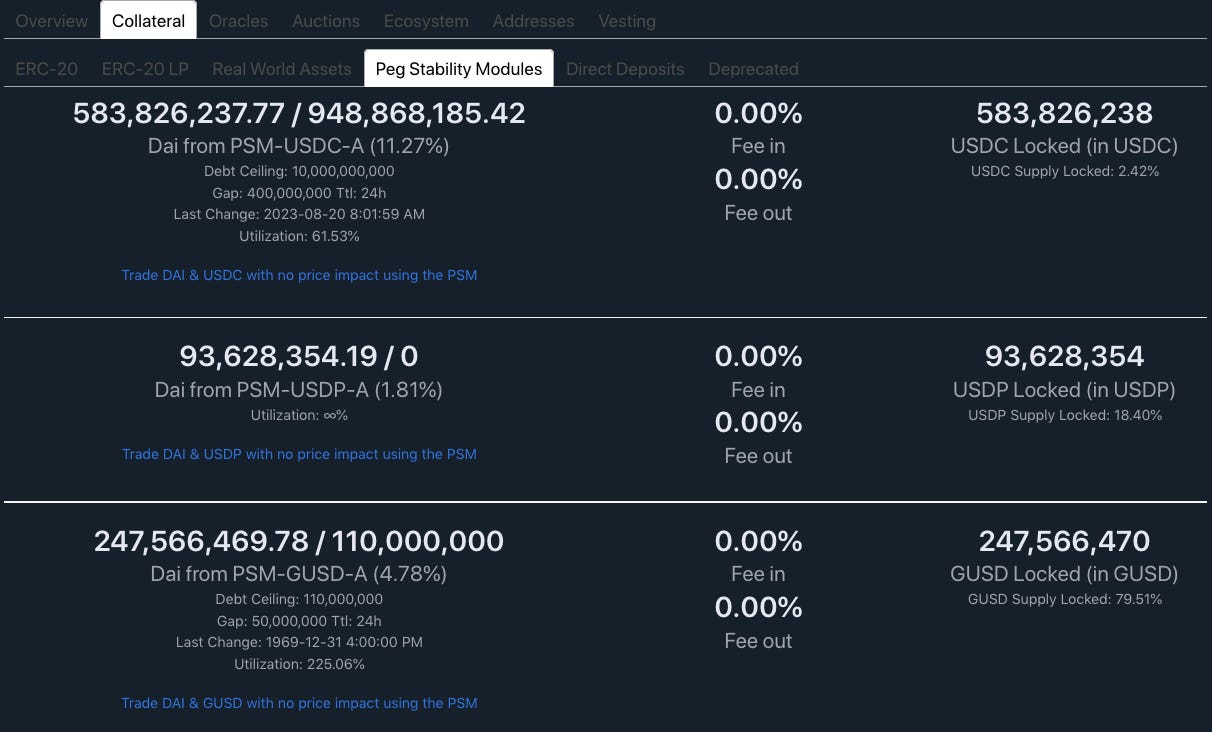

Maker has PSMs for three centralized fiat-backed stablecoins: USDC, GUSD, and USDP. The USDP PSM had its debt ceiling set to 0 in May, allowing users to only withdraw USDP in exchange for DAI. The debt ceiling for USDC is 10 billion versus only 110 million for GUSD. Note in the image below that GUSD in the PSM is also in excess of its debt ceiling, allowing only outflows of GUSD at this time.

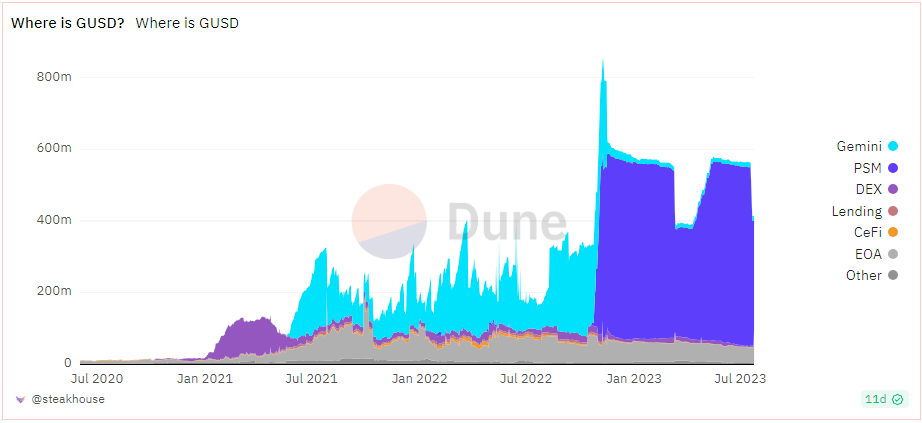

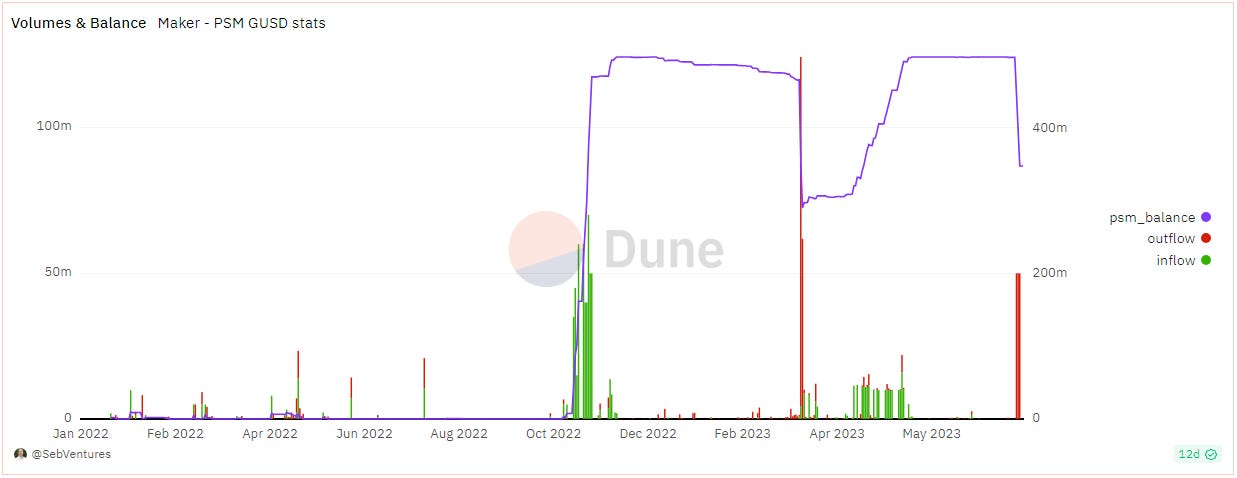

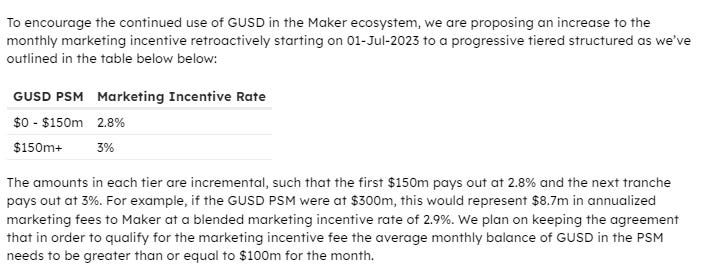

The PSM-GUSD-A became the majority holder of GUSD in November 2022 and has maintained majority status ever since. Gemini began a marketing incentive program in October 2022 that pays MakerDAO a rate based on the quantity of GUSD in the PSM. At inception, Gemini agreed to pay a rate of 1.25% monthly to MakerDAO for GUSD in the PSM, provided that the monthly average in the PSM was at least 100m GUSD. It has continued the program and periodically adjusts the rate to stay competitive. It is currently paying a maximum of 3% on GUSD deposits as of the latest update on July 18th.

GUSD Token Distribution across sectors and protocols:

A large outflow from the PSM occurred in March during the banking crisis when Gemini’s exposure to Silvergate and Signature Bank was unknown. The value in the PSM recovered by mid-May after the panic had subsided. Another major outflow in mid-June was in response to a decision by MakerDAO governance to reduce the GUSD PSM max debt ceiling from 500m to 110m.

GUSD Balance in the MakerDAO PSM over Time

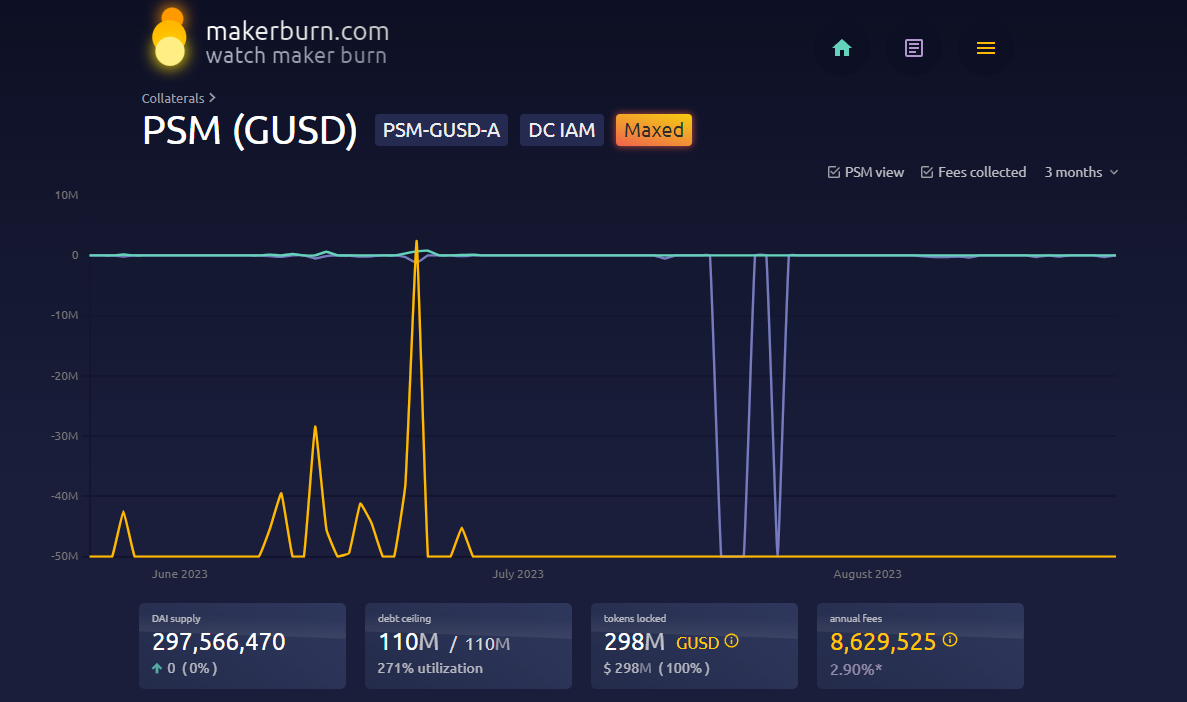

At the time of writing, 298 million GUSD are locked inside the Peg Stability Module on which Gemini is paying 2.90% annual fees to MakerDAO (which amounts to $8,629,525) per the most recent update to their partnership agreement.

It can be seen in the above screenshot that GUSD has a 271% utilization rate in relation to the max debt ceiling. This limits the PSM’s usability because it can not issue additional DAI debt; only GUSD is available in exchange for DAI deposits (one-sided trades). Gemini has indicated continued support of its partnership with MakerDAO and has expressed the opinion that the excess PSM utilization is a temporary situation.

Market Performance

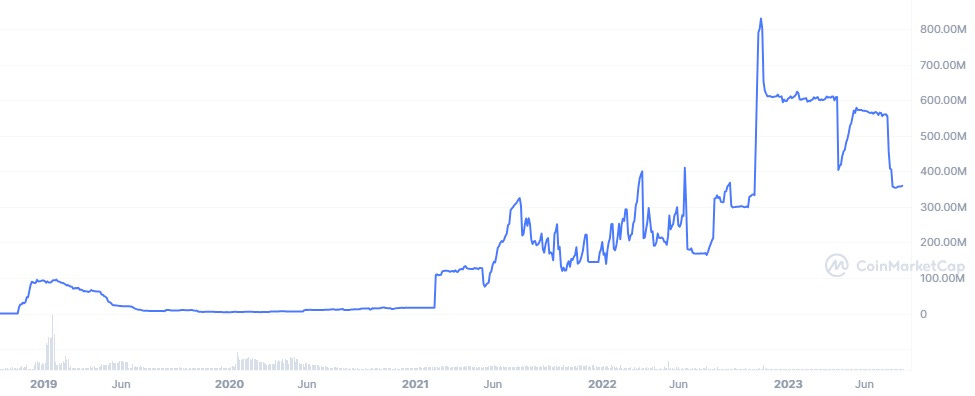

The chart below shows the GUSD market cap over time since its launch in 2018. Of note is the sharp increase upon inception of the MakerDAO partnership and the marked volatility experienced after several bank failures in March and increased uncertainty in the MakerDAO partnership:

On DefiLlama, GUSD is ranked as the 9th largest stablecoin by market cap with a 0.25% market dominance. The GUSD market cap has been decreasing in the past month compared to competitors and has experienced a max off-peg deviation of -0.74% for that period. As shown below, the off-peg deviation is significant compared to the top 10 stablecoins:

Trading Volume

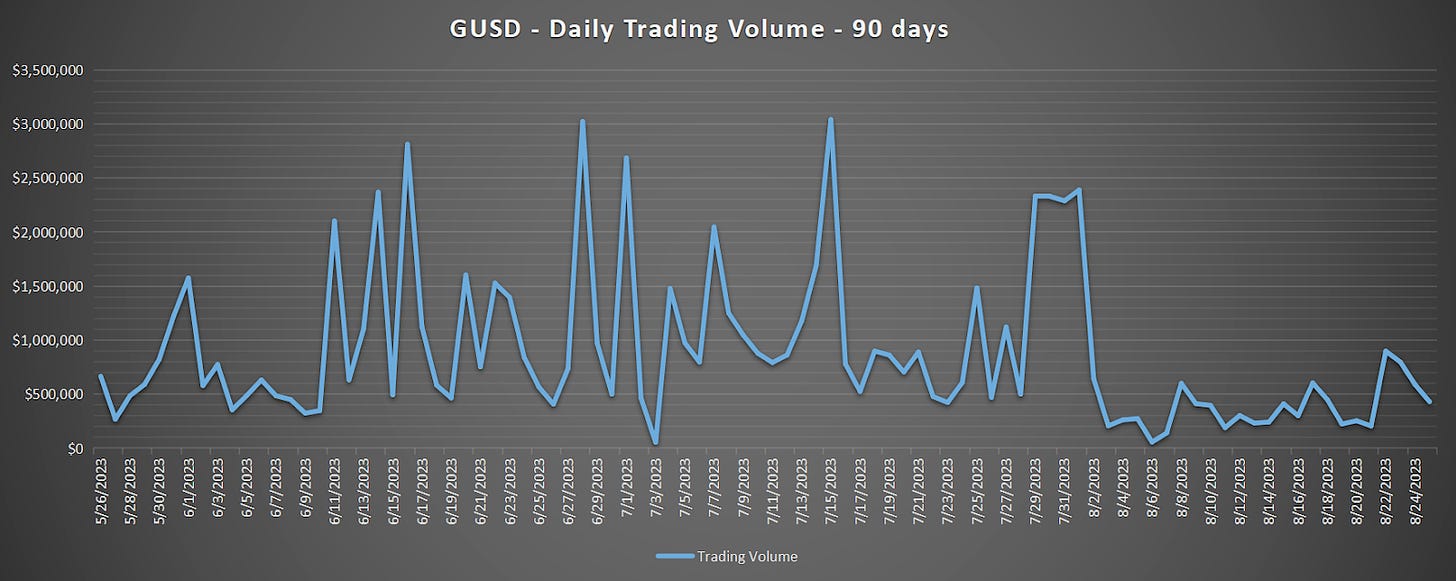

GUSD’s average daily trading volume for the last 90 days is $885,732 with a range from the lowest day of $53,791 to the highest trading volume day of $3,041,917.

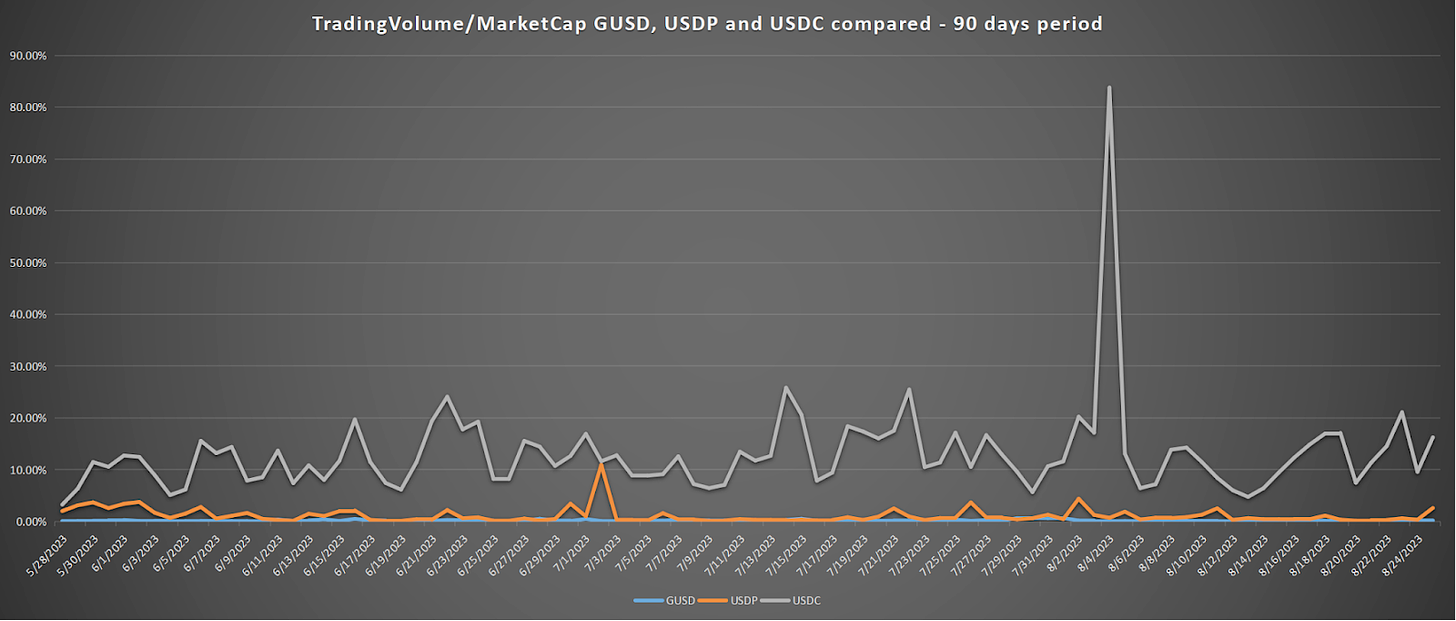

When comparing GUSD's daily volume/market cap over the 90-day period against two other stablecoins that Maker uses in its DAI PSM (USDC and USDP), we get a better picture of GUSD’s relatively low utilization:

Supported DEXs and CEXs

GUSD is listed on various CEXs, including Gemini, Coinbase, and Bitstamp. It also has DEX pools on Curve and Uniswap.

GUSD on CEX:

Gemini: GUSD/BTC, GUSD/ETH, GUSD/GBP, GUSD/SGD

Coinbase - GUSD/USD

Bitstamp - GUSD/USD

Finexbox - GUSD/BTC

FatBTC - GUSD/USDT

Tokpie - GUSD/USDT

GUSD on DEX:

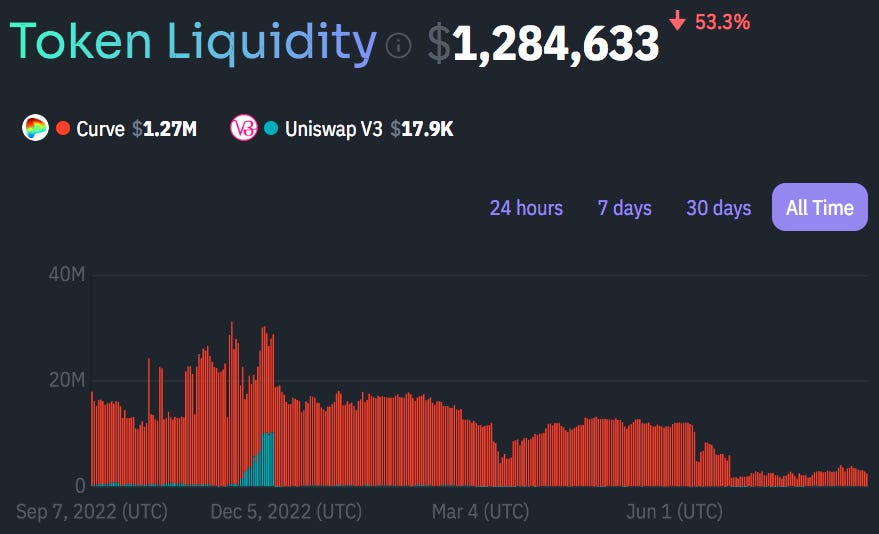

The vast majority of DEX liquidity has historically been on Curve in the GUSD/3CRV pool, GUSD/FraxBP pool, and the crvUSD/GUSD pool. DEX liquidity has declined significantly since January 2023, from around $16m to currently ~$1.2m.

Recent TVLs of the primary DEXs are as follows:

CurveFi - GUSD/3CRV: ~$3m

CurveFi - crvUSD/GUSD: ~$1.8m

CurveFi - GUSD/FraxBP: ~$59k

Uniswap - GUSD/USDC: ~$334.5k

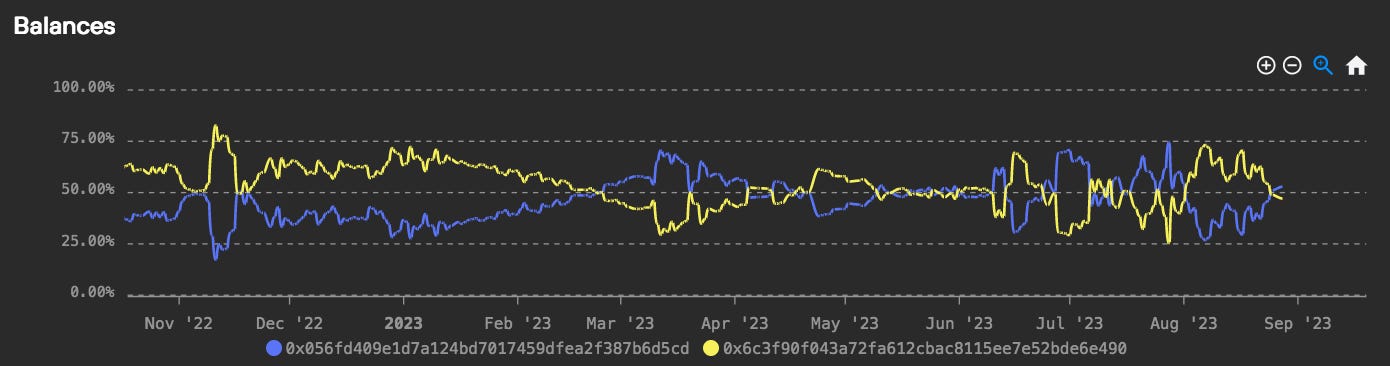

Curve Finance: GUSD/3CRV Pool

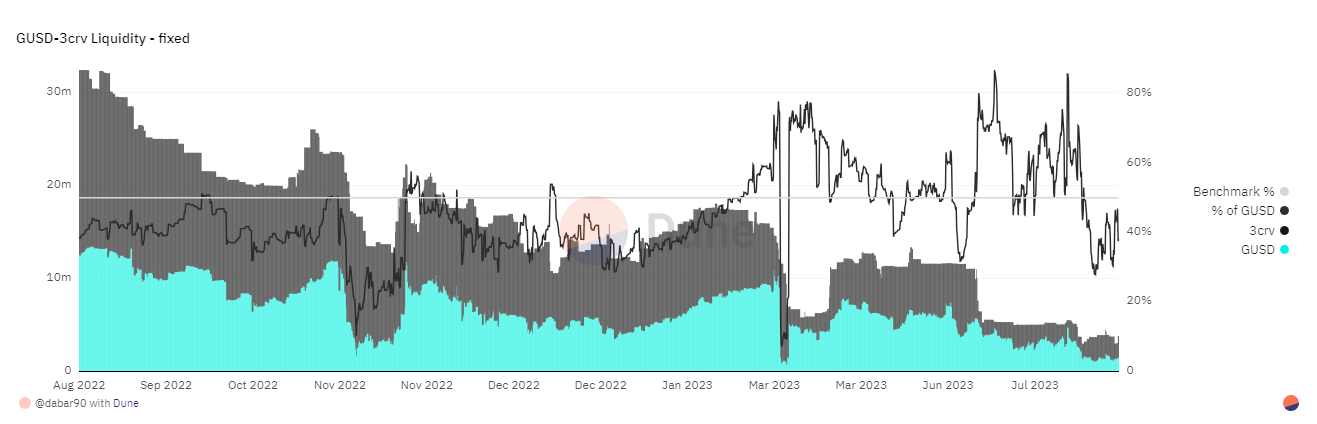

The chart below shows the historical balance between GUSD and 3CRV tokens inside the GUSD/3CRV pool, along with the trend of GUSD’s percentage share over time around a benchmark (50%).

The chart above shows a significant fluctuation in GUSD share inside the pool, which since February 2023 is mostly above the benchmark (50%). This is not unusual behavior, as the pool is set with a very high A parameter of 1000, meaning the pool balance can shift dramatically without substantially increasing the trading price. A param values this high are usually reserved for fiat redeemable stablecoins with efficient arbitrage paths.

During the USDC depeg event on March 11th, 2023, the GUSD share in the GUSD/3CRV pool decreased to 9.1% and persisted at that low level from March 11th-12th. This is attributable to confirmation that USDC was heavily exposed to Silicon Valley Bank during its collapse, and 3CRV is composed of both USDC and DAI which was affected by proxy through its PSM exposure to USDC.

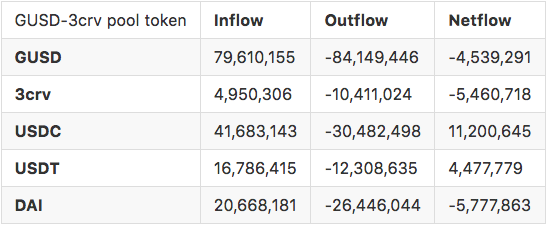

The table below compares Inflows, Outflows, and Netflows for each swappable token in the GUSD/3CRV pool in the last 6 months based on data from IntoTheBlock. Over the past six months, on-chain data reveals that only USDC and USDT maintained a positive netflow.

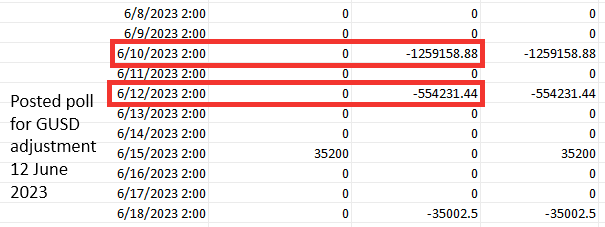

A significant outflow of 3CRV occurred on June 10th and 12th, 2023. Around the time of the outflows, a MakerDAO poll on June 12th, 2023 proposed to reduce the GUSD PSM maximum debt ceiling from 500m to 110m.

Risk Vectors

Dependence on Gemini

Gemini is the issuer of GUSD and mint/redemption is offered exclusively through its platform. There are regulations in place that isolate GUSD users from risks associated with Gemini’s other business dealings (see update from Gemini), but uncertainties remain about the continuance and stability of GUSD in the event of a Gemini bankruptcy.

In case of bankruptcy, the New York Department of Financial Services (NYDFS) would become the trustee administrating Gemini’s bankruptcy proceedings. While the reserves are strictly managed on behalf of GUSD users, there may be disruptions involved with honoring redemptions that negatively impact DeFi integrations (e.g. crvUSD Pegkeepers) which depend on the stablecoin’s stability.

This uncertainty is particularly salient in light of the distressed situation Gemini has experienced after the Gemini Earn program became insolvent in November 2022.

Gemini Earn Insolvency

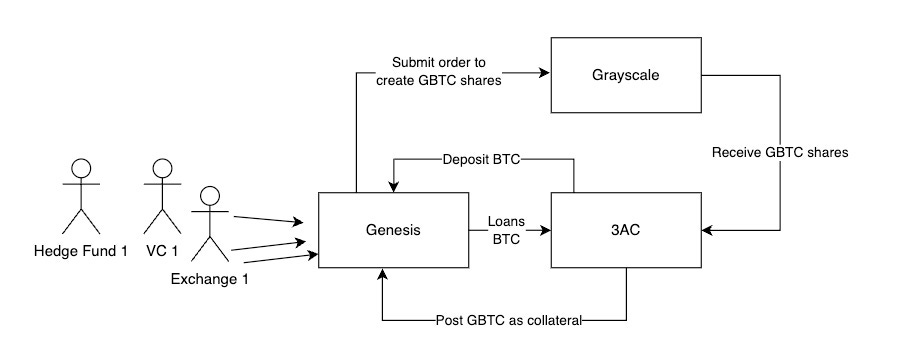

The Gemini Earn program was launched on February 1, 2021, and allowed Gemini users to lend digital assets to borrowers. Gemini partnered with Genesis (Genesis Global Capital, LLC) in offering lending services through its Gemini Earn program. Digital Currency Group (DCG) was Genesis’s parent company controlled by Barry Silbert, according to Winklevoss’s statement.

The applicable governing agreements stipulated that Earn users have principal risk directly against Genesis, with Gemini defining its role as an “Agent”. For that service, it charged an agent fee of ~4.3% from Gemini Earn investors’ returns. Gemini would lend user deposits to Genesis, and Genesis, in turn, sold loans to hedge funds like 3AC.

Collateral for those loans to 3AC were shares of Grayscale BTC Trusts (GBTC), some of them with an 80% LTV and 22% loan fee. After receiving GBTC from Grayscale from the BTC deposit, 3AC deposited GBTC again as collateral in Genesis to borrow BTC with leverage. 3AC levered up with both BTC and ETH because Grayscale’s GBTC/ETHE were trading at a premium (for every BTC deposited in the Trust, 3AC received >1 BTC worth of GBTC). After a lock-up period of 6 months, the hedge fund would sell GBTC shares for a 20% profit (making the significant assumption that the premium persisted).

As it so happened, a cascade of insolvency swept through the crypto industry in 2022. GBTC lost its premium and began trading at a discount and 3AC filed for bankruptcy on July 1st, 2022, leaving Genesis with $1.1B in uncollected debt. Ultimately, Gemini Earn announced on November 16th, 2022 that it would be halting withdrawals, as Genesis was no longer able to meet withdrawal requests.

As of January 2023, Gemini continues to be embroiled in legal proceedings with Genesis and posts regular updates for the benefit of affected Gemini Earn users on its website. As of the June 30th update, Earn users are owed $1.122 billion in assets. Gemini has emphasized that, as per the User Agreement, Gemini did not borrow or use any of the Earn users’ assets, and the principal counterparty responsible for repayment is Genesis.

Implications for GUSD

Gemini has emphasized in their public update to MakerDAO in January 2023 that, under its mandate by the NYDFS, it is required that:

the reserves backing any NYDFS regulated stablecoin be segregated from the proprietary assets of the issuing entity (e.g., Gemini) and that such reserve assets are held at depository institutions or custodians for the benefit of the holders of the stablecoin.

Gemini must keep GUSD reserves isolated in separate accounts from the rest of its business and must always have sufficient reserves to honor customer withdrawals. In a bankruptcy scenario, GUSD reserves are completely isolated from bankruptcy proceedings. Gemini, as a limited trust company, is subject to New York Banking Law (NYBL) and the NYDFS would become the trustee of the bankruptcy estate, allowing it to administrate the bankruptcy proceedings.

Therefore, regardless of the state of Gemini’s other business dealings, the regulations governing GUSD do provide strong assurances that reserves will be protected for the benefit of GUSD users.

Dependence on MakerDAO

GUSD currently has very low liquidity on both centralized and decentralized exchanges because it is primarily used in the MakerDAO PSM to help keep DAI pegged to USD. Gemini has built a relationship with MakerDAO involving the implementation of the PSM-GUSD-A and a marketing fee it pays MakerDAO to incentivize GUSD deposits into the PSM. The share of the GUSD supply in MakerDAO has consequently ballooned to over 80% of outstanding GUSD since the incentives began in October 2022.

In the aftermath of Gemini Earn’s insolvency in November 2022, and after the series of bank failures in March 2023, MakerDAO has become conflicted about its exposure to GUSD. Controversial discussions and DAO votes have since been made to remove or greatly reduce the GUSD PSM.

Timeline of Gemini’s partnership with MakerDAO:

July 23, 2020: [GUSD] MIP6 Collateral Onboarding Application - MakerDAO risk team member, Monet-supply (analyst at Block Analitica), made a proposal for GUSD collateral onboarding in July 2020.

October 22, 2021: Proposal: GUSD PSM - Gemini co-founder Tyler Winklevoss proposes the GUSD PSM with a debt ceiling of 500m DAI.

November 10, 2021: [PSM-GUSD-A] Collateral Onboarding Risk Evaluation - Risk evaluation concludes with a suggestion to set 100m max debt on the GUSD PSM.

September 22, 2022: GUSD & MakerDAO Partnership Announcement - Tyler Winklevoss introduces the Gemini marketing incentive that will pay 1.25% on all GUSD in the PSM when average monthly balances are over 100m GUSD, starting October 1st.

September 29, 2022: Change PSM-GUSD-A parameters - SebVentures proposes to increase the GUSD PSM max debt to 500m DAI. Poll here.

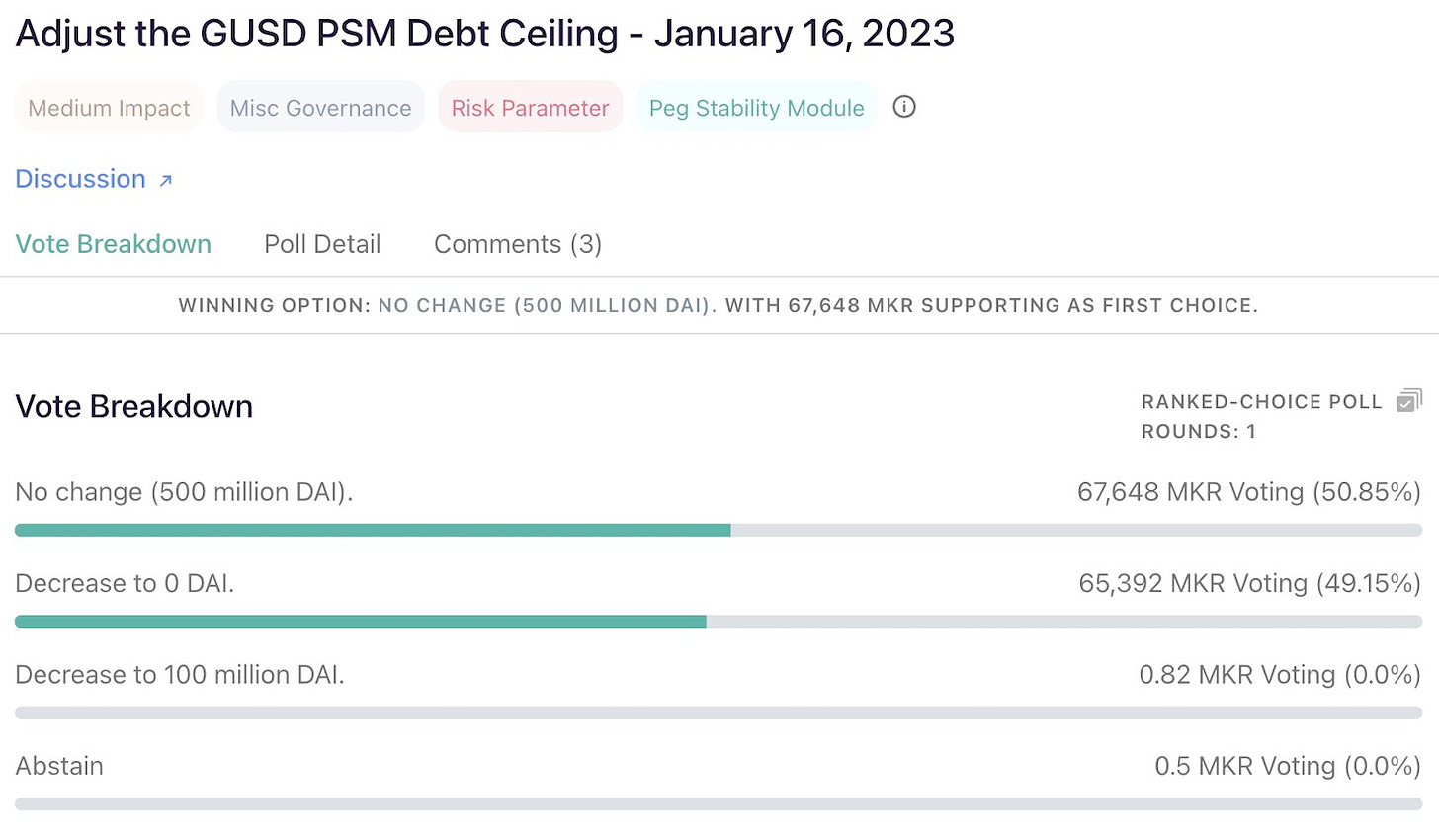

January 13, 2023: PSM-GUSD-A Parameters - In response to concerns over the possible impact of Gemini Earn insolvency on GUSD, MakerDAO initiated a proposal to reduce the GUSD PSM max debt to 0. The vote was rejected by a narrow margin. Poll here.

January 15, 2023: GUSD & MakerDAO Partnership Update - Tyler Winklevoss updates the MakerDAO community on the state of GUSD in the wake of Gemini Earn’s insolvency, reassuring them that GUSD remains completely unaffected.

March 12, 2023: [UNI-V2-GUSD-DAI] MIP6 Collateral Onboarding Application - Monet-supply proposed onboarding Uniswap v2 GUSD/DAI LP as a MakerDAO collateral. The MIP application for collateral onboarding was canceled because the liquidity in the proposed Uniswap pool had significantly decreased since the initial proposal.

June 9, 2023: Adjusting PSM-GUSD-A Parameters (Debt Ceiling and Tout) - Monet-supply proposed to reduce GUSD PSM debt ceiling from 500m to 110m, citing low GUSD utility and lower fee revenue than alternative sources. Poll here.

July 23, 2023: GUSD & MakerDAO Partnership Update - Gemini offered MakerDAO a two-tiered progressive marketing fee incentive structure for using GUSD, increasing the fee to a max of 3% and a retroactive starting date of 7/1/2023.

Of particular note is the controversial governance poll proposed to adjust the GUSD PSM debt ceiling to 0 in January 2023. The vote did not pass by a very narrow margin and it appears that ParaFi Capital, a significant VC investor in Gemini, delegated a substantial amount of MKR tokens to GFX Labs shortly before the voting deadline:

On June 9th, a proposal MakerDAO proposal was made to adjust the PSM-GUSD-A Parameters from a 500m debt ceiling to 110m. The reasoning was that GUSD has relatively less utility than USDC which limits liquidity and the rate of return was lower than USDC held in Coinbase Custody (2% vs. 2.6%).

Gemini subsequently increased its payment to MakerDAO, as explained in the GUSD & MakerDAO Partnership Update post. Gemini offered MakerDAO a new two-tiered progressive marketing fee incentive structure for using GUSD as a “Cash Stablecoin” in the PSM module with a retroactive starting date of July 1st, 2023.

As can be seen from the timeline, the trajectory of the partnership involves Gemini continuing to pay competitive rates for PSM exposure and MakerDAO exhibiting signs of hesitancy about maintaining GUSD exposure. The stability of GUSD may become a relevant risk because of GUSD’s deeply intertwined relationship with MakerDAO in conjunction with volatility in the partnership. GUSD may experience significant redemption demand resulting from the whims of MakerDAO governance. In fact, a representative from Gemini has conveyed to us that GUSD’s reserves were recently allocated heavily in cash in anticipation of expected actions by MakerDAO governance.

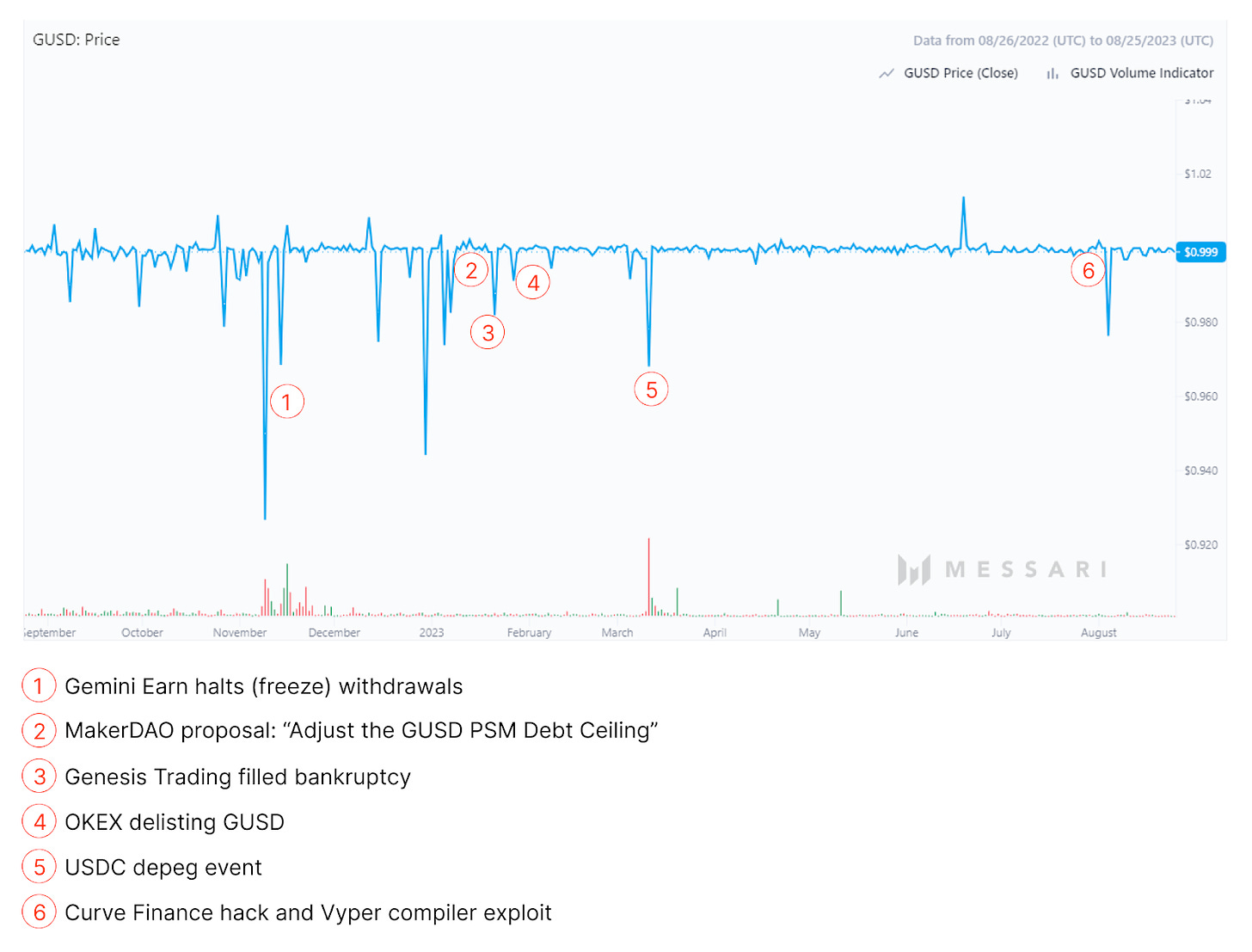

Depeg Risk

In 2022, GUSD experienced negative off-peg events multiple times. However, each GUSD depeg event was short-term, in most cases returning to peg within a day. The reason for GUSD depegs was often caused by low levels of liquidity, and the quick stabilization is evidence of an effective redemption mechanism. Gemini strives to offer immediate redemptions of GUSD with no fee, and in exceptional cases it strives to complete redemption within a T+1 timeline.

GUSD depeg event triggers:

Nov 16, 2022: Gemini halts withdrawals from “Gemini Earn”

Jan 16, 2023: MakerDAO proposal to off-board GUSD from its system. If the vote passed, it could have precipitated a massive redemption of 500 million GUSD.

Jan 20, 2023: Genesis files for bankruptcy, and reported that Gemini is its biggest creditor, with over $700m exposure.

Jan 31, 2023: OKEX delisted GUSD.

March 11, 2023: USDC depeg event due to a cascade of bank failures, most importantly it had $3.3 billion in Silicon Valley Bank. Gemini also had previously listed failed Silvergate Bank and Signature Bank as custodians for GUSD cash reserves. It later disclosed there was no exposure to these banks at the time of the collapse.

July 30, 2023: Curve Finance hack and Vyper compiler exploit. GUSD pools were unaffected.

March 11th Depeg

Of particular note is the brief depeg GUSD experienced on March 11th during a tumultuous event involving the collapse of two banks it had disclosed as custodial partners for GUSD’s reserves. In January 2023, a post on the MakerDAO forum by Gemini co-founder Tyler Winklevoss stated:

The cash portion of the GUSD reserves, which may be held at State Street Bank and Trust Company, Signature Bank, or Silvergate Bank, may be eligible for FDIC “pass-through” insurance for Gemini customers in the event that the bank holding such U.S. dollar cash deposits becomes subject to resolution or similar proceedings by the FDIC.

Silvergate Bank failed on March 8th and Signature Bank fell soon after on March 12th. Widespread panic rippled through the crypto markets as USDC’s own banking partner, Silicon Valley Bank, failed on March 10th. It was later publicly stated that Gemini had no exposure to the failed banks, although it did trade as low as $0.96 for a brief period.

The Curve GUSD/3CRV pool also became imbalanced during the March event, as the proportion of GUSD in the pool increased to >70%. The counterparty asset in the pool (composed of USDC/DAI/USDT) was notably also distressed, as USDC traded at a low of $0.9655 on the same day (per CoinGecko).

The current GUSD token distribution, GUSD market cap, and market share in the overall stablecoin supply indicate that GUSD has limited integrations and utilization in Defi protocols, and depends on MakerDAO’s PSM to maintain liquidity.

As Dex.guru shows, the on-chain liquidity for GUSD is very low. Only around 3% of the supply is available on DEXs outside of the MakerDAO PSM. Thanks to the excess of GUSD in the MakerDAO PSM, GUSD is readily accessible to arbitrageurs. However, due to low liquidity on secondary venues, the primary arbitrage path when GUSD trades below $1 is direct redemption through Gemini.

Solvency Risk

Gemini’s GUSD stablecoin operates under stringent standards set by the New York State Department of Financial Services (NYDFS). The oversight of regulators ensures that GUSD remains solvent and its value is consistently pegged to the U.S. dollar. Every GUSD issued is required to be backed by a full reserve of various liquid assets, ensuring that the market value of the reserve is at par with the units of GUSD. These reserves are segregated from Gemini Trust’s proprietary assets and are held in accounts insured by the FDIC or with DFS-approved asset custodians.

As a New York limited purpose trust company, Gemini is required by the NYBL and the NYDFS to keep reserves in excess of customer deposits and can only be held as:

Deposits in U.S. Federal Deposit Insurance Corporation (“FDIC”)-insured banks,

Money market funds, invested only in U.S. Treasury Obligations, or

U.S. Treasury Obligations.

Reserves Management

As the MakerDAO PSM contains the majority of GUSD supply and there is relatively low GUSD liquidity on other secondary markets to facilitate arbitrage, there is an additional burden on proper reserves management to facilitate GUSD redemptions. For example, the MakerDAO vote (rejected by a narrow margin) in January to reduce the GUSD PSM max debt from 500m to 0 could have resulted in a large and sudden demand to process redemptions.

A representative from Gemini has shared with us that Gemini has historically held a slightly higher allocation of cash reserves to satisfy projections of redemption requests and has done so, in part, due to the “concentration of GUSD held across market participants and the possibility of large-scale redemptions.” This strategy was validated on the weekend of 3/11/23 which saw large redemption requests that Gemini was able to honor immediately, without issue.

On reserves management strategy, the Gemini representative elaborated that:

Our in-house Finance and Treasury team actively manages GUSD Reserves in anticipation of, and in response to, changing market conditions. At times, we have shifted our allocation more heavily towards US T-Bills when the risk/reward profile of the asset class deems this prudent. For example, we shifted away from cash deposits and predominantly into short-term US T-Bills in the weeks following the US banking crisis in March 2023. We also have previously taken action in the reverse direction to reduce risk associated with US T-Bills (e.g. during the U.S. Debt Ceiling concerns in June 2023). We ensure that any impact on liquidity of our reserves will always be aligned with timeframes established in our GUSD user agreement (1-2 business days).

Gemini has also enhanced its transparency measures this year by

providing CUSIP-level detail of reserve holdings in the Monthly Reserve Report Attestation, and

streaming reserve allocation data directly to the Gemini Trust Center website.

Given the recent slew of high-profile bank failures that have resulted in increased scrutiny over the internal management of traditional assets portfolios, additional transparency measures should provide greater assurances to users. Nonetheless, continued vigilance is required with the management of reserves to ensure the seamless redeemability of GUSD in all market conditions.

Limitations of FDIC Insurance

The dedicated FDIC insurance section of the Gemini User Agreement stipulates that:

Digital Assets held in your Digital Asset account, including your Gemini Dollars, are not subject to deposit insurance protection, including but not limited to, FDIC insurance or Securities Investor Protection Corporation protections

although users may qualify for FDIC “pass-through” insurance which applies to the portion of the Gemini Dollar Reserve held as U.S. dollars in GUSD Omnibus Accounts at FDIC-insured institutions such as State Street Bank and Trust Company, JPMorgan Chase Bank, and Goldman Sachs. If the bank holding USD reserves faces FDIC resolution or similar procedures, this “pass-through” insurance may become available. However, FDIC insurance is subject to the Standard Maximum Insurance Amount per FDIC regulations, which is currently set at $250,000 per eligible Gemini Customer, along with other restrictions.

The significant condition users must be aware of is that FDIC pass-through insurance requires records that show each user’s interest in the underlying USD reserves. As such, eligible users must have a Gemini account, and FDIC pass-through insurance would apply only to GUSD held on Gemini (as Gemini would need to demonstrate each customer’s interest in the USD reserves). Thus, users holding GUSD in DeFi applications such as MakerDAO or Curve would need to transfer GUSD to their Gemini account to become eligible for FDIC pass-through insurance.

For pass-through insurance to be effective, the agency or custodial relationship must be clearly delineated on the depository bank’s records. These records, whether maintained by the bank, fiduciary, or an authorized third party, must transparently identify the actual owners of the funds and their distinct ownership stakes. Good faith record keeping is mandatory as part of standard business operations.

Furthermore, in instances with multiple fiduciary layers, all levels must be noted in the records. The agent’s relationship should be genuine, with the agreement clearly stating their role concerning deposits. Importantly, the principal, not the nominal depositor, must truly own the funds, and their terms should align with those of the bank. Splitting of interest is prohibited, and agreements shouldn’t impose independent obligations that create a debtor/creditor dynamic between the agent and principal. Finally, if all criteria are met, FDIC insurance coverage will be determined by each principal’s ownership capacity.

The majority of GUSD is currently on MakerDAO, holding over 80% of the total supply. As per a recent update on the Gemini Trust Center page, 91.96% of the reserve is held in cash deposits at State Street Bank, or $285,144,644. This equates to roughly $228 million of GUSD in the MakerDAO PSM which is potentially ineligible for FDIC pass-through insurance.

The high allocation to cash deposits combined with tenuous conditions for receiving FDIC pass-through insurance increases reliance on Gemini’s risk management procedures to avert uninsurable losses to tokenholders.

Smart Contract Risk

Audit

The smart contracts backing GUSD underwent a security audit over a one-month period in 2018 by Trail of Bits. The scope of the examination focused primarily on the ERC20 capabilities such as minting, burning, and sweeping actions, as well as the upgrade mechanism.

The audit aimed to uncover any vulnerabilities that could potentially be exploited by an attacker to carry out actions that are intended to be privileged operations by Gemini. The strategy included manual code review, static analysis, property testing, symbolic execution, prioritizing the authorization schema, upgrade system, and sweeping mechanism.

The audit identified a few issues, including two of high severity, two of medium severity, four of low severity, and one of an informational nature. Gemini promptly addressed each of these issues as they came to light, and Trail of Bits verified that all of the discovered issues were resolved during their final week of review.

The assessment outcome indicated that Gemini’s approach to developing smart contracts was effective in minimizing security risks, and the identified vulnerabilities were successfully addressed. Furthermore, the contracts have been operating on mainnet since 2018 without incident.

Access Control

Gemini operates admin functions guarded by Custodian contracts that designate privileged addresses and timelock parameters for executing functions. Contract upgrades, changes to custodians, and increases to the GUSD supply ceiling are safely protected by sufficient timelock delays and multisig authorizations.

However, there is a privileged EOA address designated as the limitedPrinter that can currently mint up to a billion GUSD to any address without a timelock. This is possible because the totalSupplyCeiling is set to 1.36 billion and the total GUSD supply is just over 300 million. This operational risk may cause losses to Curve LPs and other DeFi integrations if the EOA becomes compromised.

The access controls across GUSD contracts are listed below:

ERC20Proxy Custodian

There is a timelock on this Custodian of 1 day if initiated by the Primary address, or 7 days by any other address. The Custodian contract operates the following guarded functions:

confirmCustodianChange: Confirms a pending change of the custodian associated with the contractconfirmImplChange: Confirms a pending change of the active implementation associated with this contract.

The signerSet is composed of the following addresses, requiring 2-of-N signers for execution:

0x35d13b3e90ea179cf572945e36aab8b5443bfc69

0x3dfa83b9cb39d88c6dace9744d0f709532082296

0xcf269986da781407b0eeeac3ea79ac1c9d857d38

0xd7c14ebd217ce757041dab619a99d740cda02dc5

0xec426164c0a2f89fa70942ca2499decff306ac5a

0xf43c8e5ca6072505e4cc8f74228e4d37740d2221

ERC20Impl Custodian

There is a timelock on this Custodian of 1 hour if initiated by the Primary address, or 24 hours by any other address. The Custodian contract operates the following guarded functions:

confirmPrint: Confirms GUSD minting with a specified recipient address and amount.confirmCeilingRaise: Confirms an increase to the mint ceiling that determines how much GUSD the designated limitedPrinter can mint.

The signerSet is composed of the following addresses, requiring 2-of-N signers for execution:

0x3af7a2ff52c6e2388bac918b3776b82c99b5f268

0x6ff0408efc41b2250c9e9ff820b9fac593f50191

0xa94488c17686cefc08c1de70a4aeb6a2301599d9

limitedPrinter

The limitedPrinter is designated in the PrintLimiter contract. It provides a more convenient way for Gemini to mint GUSD, as it does not have a timelock and is operated by an EOA address. Instead, the contract enforces a totalSupplyCeiling that can only be increased by the ERC20Impl Custodian. It operates the following guarded functions:

limitedPrint: Mint any amount of GUSD to any address up to the totalSupplyCeilinglowerCeiling: Lower the totalSupplyCeiling

Regulatory Risk

Gemini, the issuer of the GUSD stablecoin, operates under the regulatory oversight of the New York Department of Financial Services (NYDFS) and adheres to specific NYDFS guidelines pertaining to stablecoins. The company has taken proactive measures to enhance transparency with regard to its GUSD reserves, providing monthly attestations by BPM, as well as daily updates on the reserve structure, including detailed information on the reserve’s financial instruments and the entities where reserves are placed.

However, the regulatory landscape surrounding Gemini is complex and marked by significant legal challenges. Most notably, Gemini, along with its partner Genesis (part of the DCG group), has been charged by the SEC over the provision of lending services through the “Gemini Earn” program. These challenges highlight the multifaceted and evolving nature of the regulatory environment in which Gemini operates, reflecting both its commitment to transparency and the scrutiny it faces from regulatory authorities.

SEC v Gemini

At the beginning of 2023, the SEC charged Genesis Global Capital, LLC and Gemini Trust Company, LLC over alleged unregistered security offerings to retail investors via the Gemini Earn crypto asset lending program. The complaint points to a contract called a Master Digital Loan Agreement (MDALA) struck among lender Genesis, Gemini, and customers in its yield-bearing Earn program. The Gemini Earn program began in February 2021, where investors reportedly loaned their crypto assets to Genesis through Gemini, which facilitated these transactions and deducted an agent fee from the returns paid to the investors by Genesis.

In November 2022, due to market volatility and insufficient liquid assets, Genesis announced that it would not permit Gemini Earn investors to withdraw their crypto assets. At this time, Genesis held approximately $900 million from 340,000 Gemini Earn investors. Although the program has since been terminated, investors are still unable to withdraw their assets.

The SEC’s complaint argues that the Gemini Earn program qualifies as an offer and sale of securities under relevant law and should have been registered accordingly with the Commission.

The Commission does not explicitly target or implicate the use of GUSD as a type of digital asset deposited into the Earn program. The regulatory body’s concern and subsequent charges primarily revolve around the unregistered securities offering conducted through the Gemini Earn program itself. SEC is not making a blanket assertion that all or certain digital assets/cryptocurrencies are securities. Instead, it is the specific contractual agreement, i.e. MDALA surrounding these digital assets that is under scrutiny.

Injunctive Relief

SEC took action to request a permanent injunction against Genesis Global Capital, LLC (“Genesis”) and Gemini Trust Company, LLC (“Gemini”), with the aim of preventing them from continuing business operations alleged to contravene federal securities laws. This injunction, if granted, would legally restrain these parties from further pursuing these purportedly unlawful activities. In addition to this preventative measure, the SEC is also seeking to compel the parties to disgorge, or surrender, all profits and benefits that were allegedly unlawfully obtained as a result of the activities in question. Lastly, the SEC is demanding that these parties pay civil penalties, which are fines imposed as punishment for their alleged violations of federal securities laws.

This action could feasibly influence Gemini’s ability to maintain the liquidity and stability of GUSD. If the platform’s operations are significantly hindered or constrained, it might affect the overall management of Gemini’s portfolio and endanger company reputation, potentially causing a decline in user trust and confidence.

Motion to dismiss the SEC’s complaint

Gemini adopts and incorporates Genesis’s arguments in support of its motion to dismiss. In seeking the dismissal of the SEC complaint, Gemini essentially posits two main arguments:

The Complaint Must Be Dismissed Because the MDALA is Not a Security

The Complaint Must Be Dismissed Because the SEC Has Not Alleged a “Sale” of or “Offer to Sell” a Security

The MDALA is neither an “investment contract” under SEC v. W.J. Howey Co., 328 U.S. 293 (1946), nor a “security note” under Reves v. Ernst & Young, 494 U.S. 56 (1990). Even if the Complaint adequately alleged that the MDALA is a security, the SEC’s sole cause of action for a violation of Securities Act Sections 5(a) and 5(c) must be dismissed because it has not alleged that Gemini or anyone else sold or offered to sell the MDALA.

Gemini’s motion to dismiss the SEC’s complaint is rooted in challenging the two fundamental premises of the SEC’s case. First, the MDALA is not an investment contract or security note that qualifies as a “security” under federal law. Accordingly, there was no requirement that any party register it with the SEC, and so there was no violation of Section 5. Second, even assuming the SEC had adequately pleaded that the MDALA is a security, it failed to make non-conclusory allegations that the MDALA was sold to anyone, or that any party offered to sell it.

If the court accepts Gemini’s arguments, the SEC’s complaint could be dismissed, effectively ending the litigation, thus alleviating the immediate threat of penalties or cease-and-desist orders.

Gemini v DCG

Gemini Complaint Against DCG and Barry Silbert, 7/7/23

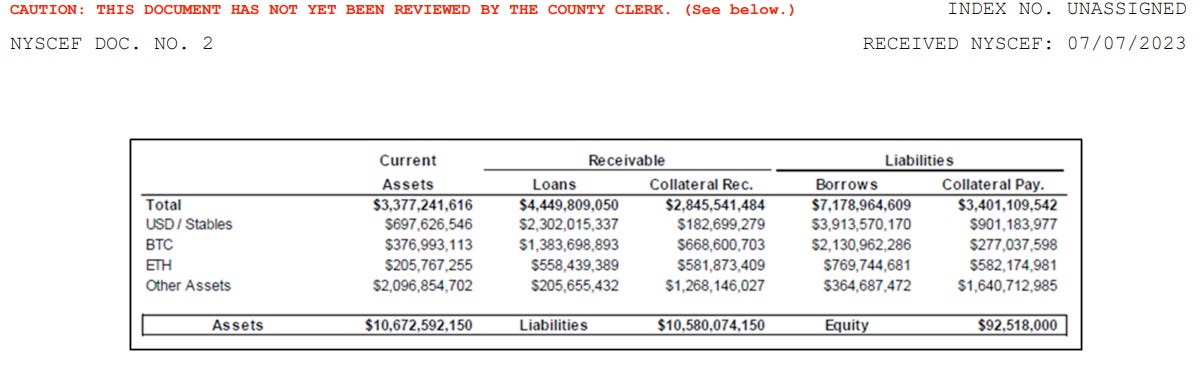

On 07/07/2023 Gemini Trust Company, LLC lodged a lawsuit against Genesis Global Capital, LLC, alleging that the defendants engaged in fraudulent conduct. The complaint asserts that the defendants provided false information about Genesis’s financial condition and the support it had received from Digital Currency Group (DCG). They knowingly deceived Gemini, intending to persuade them to maintain the Gemini Earn Program.

Gemini argues that it reasonably relied on the defendant’s misrepresentations, given its privileged position to accurately understand and articulate the support Genesis had received from DCG and its implications on Genesis’s financial health. As a result of this reliance, Gemini alleges substantial harm, including exposure to claims from Gemini Earn lenders unable to withdraw their loaned assets from Genesis, along with incurring significant legal fees and litigation costs related to the ongoing Chapter 11 proceedings of Genesis.

Furthermore, Gemini alleges a conspiracy between the defendants and Genesis to perpetrate this fraud, making them jointly liable for their harmful conduct. The severity of their fraudulent behavior, Gemini argues, was willful and egregious, thereby justifying punitive damages.

Gemini has lodged a second claim against DCG and Barry Silbert, alleging their complicity in aiding and abetting Genesis in perpetrating fraudulent behavior. The defendants are accused of knowingly assisting Genesis in making false representations about its financial status and the support it received from DCG to Gemini. The allegations further highlight the defendants’ awareness of the falsehood of the representations and their significant aid in their dissemination.

Gemini insists that this fraudulent conduct has made DCG and Silbert jointly liable for each other’s wrongful behavior directed at Gemini and for Genesis’s similar misconduct. Given the deliberate, outrageous, and reckless nature of the defendants’ fraudulent behavior, Gemini argues that punitive damages are merited and suitable.

By including the promissory note at its full-face value within the category of “Current Assets,” Genesis falsely represented that there was $1.1 billion in value on its balance sheet that could be collected in cash within one year. The promissory note is worth only a fraction of its notional value and does not mature for 10 years. The note is plainly not a current asset, but Genesis falsely presented it as one in order to lull Gemini into continuing the Gemini Earn Program.

A recent Twitter thread has drawn attention to parallels between the practices that led to the infamous Enron bankruptcy and the current situation with Gemini. These comparisons are suggestive, though they must be interpreted cautiously. In order for Gemini to successfully establish liability against DCG and Silbert, it must present sufficient evidence during the court proceedings to prove its allegations. The legal standard will require Gemini to demonstrate that DCG and Silbert had a direct role in the purportedly fraudulent actions of Genesis.

As anticipated, DCG has refuted Gemini’s allegations outright. In a statement published on Twitter, DCG maintains that “any suggestion of wrongdoing by DCG or any of its employees is baseless, defamatory, and completely false”.

Gemini Class-Action Lawsuit

Class-Action Lawsuit Against Gemini, 12/27/22

In December 2022, a class-action lawsuit was filed against Gemini Trust Company LLC and its co-founders, Cameron and Tyler Winklevoss, in the U.S. District Court for the Southern District of New York. Led by Brendan Picha and other plaintiffs, the suit claims that Gemini misled investors, concealed critical information about the program’s risks, and violated securities laws by failing to register as an exchange or broker-dealer.

On April 7, 2023, Gemini filed a Motion to Compel Arbitration. This motion was made in line with the stipulations in their User Agreement Dispute Resolution, which includes an arbitration clause and a class action waiver. An arbitration clause means that the parties involved agree to settle any disputes through arbitration rather than through the court system. As of May 15, 2023, the court’s decision regarding the enforcement of the arbitration mandate for the plaintiffs was still pending.

Regulatory Uncertainty Impact on GUSD

GUSD reserves are distinct and are not considered Gemini’s “property”, ensuring they are shielded from potential bankruptcy risks. This distinction is mandated by NYDFS under the agency’s Stablecoin Guidance. In an insolvency scenario, GUSD reserves would be outside the purview of Gemini’s bankruptcy estate. As a New York limited purpose trust company, Gemini is governed by the New York Banking Law (NYBL) and is under the supervision of the NYDFS, which would act as a trustee in any bankruptcy proceedings. While GUSD offerings align with the NYBL, and the entity has always secured prior approvals from NYDFS, the competent authority would prioritize the interests of GUSD holders. This architecture ensures that, amidst potential insolvency proceedings, user assets remain inviolate and readily accessible, distinctly partitioned from the broader bankruptcy estate of Gemini.

Furthermore, the rigor with which the NYDFS oversees Gemini’s reserve compositions is notable. The reserve must consist of the following assets: U.S. Treasury Bills the Issuer acquires three months or less from their respective maturities, reverse repurchase agreements fully collateralized by U.S. Treasury bills, U.S. Treasury notes, and/or U.S. Treasury bonds on an overnight basis, subject to DFS-approved requirements concerning overcollateralization, and deposit accounts at U.S. state or federally chartered depository institutions, subject to DFS-approved restrictions. The supervision precludes any capricious decisions concerning the taxonomy and precise allocation of underlying assets.

Risk Team Recommendation

Our findings, which are based both on publicly available data and our communications with representatives from Gemini, suggest that the perceived risk of GUSD exposure may be greater than the reality. There has been an understandable trepidation in response to the distressed state of Gemini’s business after the Gemini Earn event and ongoing legal battles. Despite the negative impact this has had on GUSD liquidity and adoption, we find that GUSD complies with regulations that provide strong assurances to tokenholders, regardless of the state of Gemini’s other business dealings. The company prioritizes transparency which should further reduce the risk to users.

As per NYDFS guidance, Gemini, as a Limited Purpose Trust Company under New York Banking Law, must meet several criteria regarding the redeemability, reserves, and attestations for GUSD. This requires an exceptionally high degree of transparency and limits the portfolio backing GUSD to highly liquid and low-volatility assets that include cash and U.S. T-bills under 3 months of maturity. Its depository institutions and custodians are all disclosed and meet the approval of the NYDFS. Furthermore, GUSD reserves are required to be isolated from Gemini’s other business accounts and held exclusively for the benefit of GUSD tokenholders, meaning that Gemini never has ownership rights over the reserves and they cannot be included as part of the bankruptcy estate in the event Gemini files for bankruptcy.

Users should be aware that GUSD is currently highly concentrated on MakerDAO, with over 80% of the supply in the PSM-GUSD-A. The partnership has experienced volatility, which at times has required Gemini to make significant changes to its reserves portfolio. GUSD occasionally maintains a cash-heavy portfolio in anticipation of MakerDAO governance decisions, introducing a partnership risk. FDIC pass-through insurance has restrictions that make pass-through insurance likely only available to GUSD tokenholders who have a Gemini account and keep their tokens on the exchange. During the slew of bank failures in March 2023, Gemini was previously partnered with two banks that eventually failed: Signature and Silvergate. Although Gemini managed to avert exposure to the crisis, the event serves as a reminder of the potential risk to a portfolio heavily weighted in cash and the significant trust placed on proper reserve management.

Although MakerDAO serves as a hub for GUSD liquidity, we believe it would benefit Gemini from the perspective of reserves management and GUSD adoption to diversify liquidity across multiple venues. Both Gemini and Curve DAO may consider an opportunity to integrate GUSD as a Curve Pegkeeper. This arrangement may help support the crvUSD peg, increase arbitrage volume for both crvUSD and GUSD and increase the on-chain adoption of GUSD. Pegkeeper parameters should be set conservatively, given limitations that make crvUSD vulnerable to depeg in the event its Pegkeeper pair depegs. Curve is working to implement an improved version of Pegkeeper that protects against this, at which point it would be appropriate to increase the max debt ceiling. An additional consideration is maintaining adequate geographical diversity of the Pegkeepers, as USDC and USDP are already domiciled in the U.S. A suitable debt ceiling at this time would be in the range of 5-10 million crvUSD.

Overall, our opinion is that GUSD has recently experienced a backlash from market participants that may be in excess of the real risks to tokenholders, and that overreaction may create an opportunity for Curve to strengthen a partnership with Gemini by attracting more GUSD liquidity to Curve.